MasterTrust Review, Brokerage Charges, Demat A/C, Platforms & more

Last Updated Date: Jan 16, 2023Mastertrust Capital is one of the top financial services company in the country. They have been into the business for over two decades now and have been able to successfully manage relationship with over 150,000 clients building their portfolios and shaping their businesses.

In today’s article, we will do a deep dive into this financial conglomerate and try to see whether the various factors of its promise to the customers is really something they offer or is it just a hoax.

We will look into their Brokerage charges, the other transaction or administrative charges that they charge the customers, the various products and services that they boast of and the offers that they lure the customers with.

We would also analyze how effective are their trading portals and what value added services would you get using these portals.

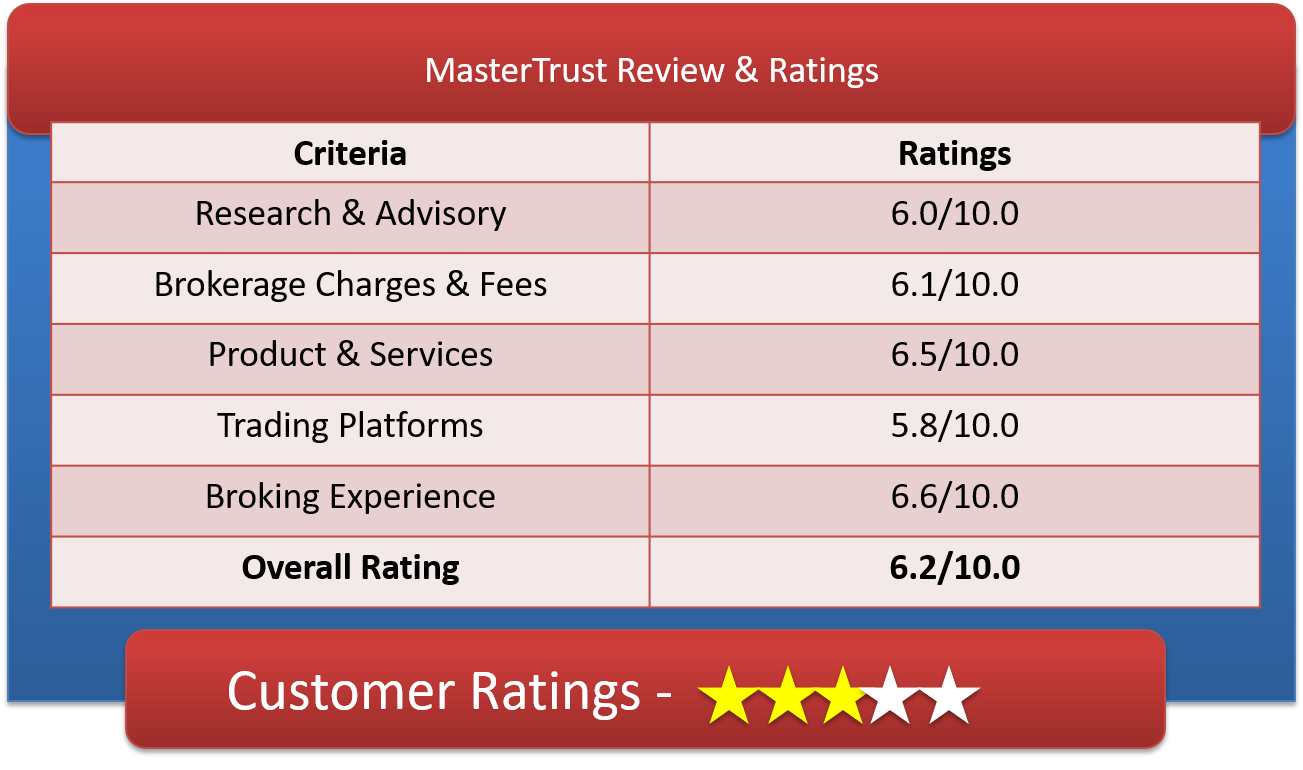

MasterTrust Ratings & Review by Top10StockBroker

About MasterTrust

| Overview | |

| Company Type | Private |

| Broker Type | Full Service Broker |

| Headquarters | Mumbai, Maharashtra |

| Founder | Harjeet Singh Arora & R.K.Singhania |

| Established Year | 1994 |

Mastertrust Capital was a conglomerate formed by the merger of two companies Master Capital Services Ltd and Arora Financial Consultants Ltd in the year 1994 in Mumbai, Maharashtra.

It acquired membership of NSE in 1994 and thereafter year on year it got into the membership of various exchanges and Depository service providers like NSDL & CSDL.

The company truly lives its motto “Master Minds Trusted Hands” by virtue of managing customer expectations with utmost sincerity and dedication.

Getting associated with Mastertrust Capital will open avenues for you to trade in both NSE & BSE for Equity trade, NCDEX & MCX for Commodities trading and MCX-SX & NSE for Currency Derivatives as well.

Moreover, Mastertrust Capital also provides services under the Mutual Fund and Insurance domains as well. In a nutshell, this company is a one stop destination for all your financial requirements from Trading to Mutual Funds, from SIP to Insurance.

Apart from this, the company is known for its customer centric approach and its extensive Research team who works round the clock to provide accurate information to traders and investors.

Get a Call Back from MasterTrust. Fill up this Form.

MasterTrust Brokerage Charges

| Brokerage Charge & Fees | |

| Equity Delivery | Rs 0 (Free) |

| Equity Intraday | Rs 20 per executed order |

| Equity Futures | Rs 20 per executed order |

| Equity Options | Rs 20 per executed order |

| Currency Futures | Rs 20 per executed order |

| Currency Options | Rs 20 per executed order |

| Commodity | Rs 20 per executed order |

| Minimum Brokerage | Rs.20 per executed order |

| Demat AMC Charges | Rs.300 per Annum |

| Trading AMC Charges | Free |

| Margin Money | 75% Margin |

| Brokerage Calculator | Mastertrust Brokerage Calculator |

As an investor or a trader, you are entitled to know the exact charges and fees you would be charged when you are getting into a trading assignment with any Broking house.

Hence this table has been positioned herein to give you a clear picture of what you are getting into incase you associate yourself with Mastertrust Capital.

If you compare the brokerage charges of Mastertrust Capital with other players of the industry, its rates are much better than the other competitors.

For Equity Delivery Trading, they charge a brokerage of Rs 0 per executed order of the total transaction amount; for Equity Intraday, for Equity Futures and for Currency Futures as well, they have a standard charge of Rs 20 per executed order brokerage.

Even for their Options trading like Commodity options & Currency Options, they charge only Rs 20 per executed order per lot respectively; moreover this lot could be of any amount and size.

The company demands a minimum security deposit amount of 75% Margin as a Margin Money.

Mastertrust Other Brokerage Plans

| Brokerage Charge & Fees | 20:20 | My Plan |

| Equity Delivery Trading | Free | 25% off |

| Equity Intraday Trading | Rs 20 per executed order | 25% off |

| Commodity Options Trading | Rs 20 per executed order | 25% off |

| Equity Futures Trading | Rs 20 per executed order | 25% off |

| Equity Options Trading | Rs 20 per executed order | 25% off |

| Currency Futures Trading | Rs 20 per executed order | 25% off |

| Currency Options Trading | Rs 20 per executed order | 25% off |

Mastertrust 20:20 Brokerage Plan

This plan is especially for the online traders, who are in a watch out for discount brokerage services, or anything likewise, a flat rate brokerage for instance.

This brokerage plan is free for the equity delivery segment, and charges Rs 20 per executed order for any other segment. The stock broker house refers it to a DIY trader, who trades online.

Here, the greatest advantage provided is of free 5th executed order.

Mastertrust My Plan

This plan is exclusive for traders who choose to remain active and trade quite often. This plan deems to provide 25% off on any active plan traders hold with other brokers.

Compare Stock Brokers

Find brokerage charges of other Full Service Brokers

| Sharekhan | Edelweiss | Indiabulls Ventures | Kotak Securities |

| Angel Broking | HDFC Securities | India Indoline / IIFL | Motilal Oswal |

| Axis Direct | ICICI Direct | Karvy | Upstox |

MasterTrust Charges

| Other Charges | |

| SEBI Turnover Charges | 0.00005% (Rs.5/Crore) |

| STT | Equity Delivery: 0.1% on both Buy and Sell Equity Intraday: 0.025% on the Sell Side Equity Futures: 0.01% on Sell Side Equity Options: 0.05% on Sell Side(on Premium) Commodity Futures: 0.01% on sell side (Non-Agri) Commodity Options: 0.05% on sell side Currency F&O: No STT On Exercise transaction: 0.125% Right to entitlement: 0.05% on sell side |

| Stamp Duty | (On buy side only) Delivery: 0.015%, Intraday: 0.002%, Equity Futures: 0.002%, Equity Options: 0.002%, and Currency F&O: 0.0001%.Commodity Futures: 0.002%, Commodity Options: 0.002% (MCX) |

| GST | 18% on (Brokerage + Transaction Charge + SEBI Fee) |

| Margin Funding Charges | NA |

| Reactivation Charges | Rs 75 per instruction |

| Account Closure Charges | NIL |

| Dematerialisation Charges | Rs 20 per DRF plus Rs 2 per certificate |

| Pledge Creation |

0.02% of the value of transaction, subject to a minimum of Rs 50 + Depository charges at actual

|

| Pledge Invocation |

0.02% of the value of transaction, subject to a minimum of Rs 50 + Depository charges at actual

|

| Margin Pledge/Unpledge/ Pledge closure |

0.02% of the value of transaction, subject to a minimum of Rs 50 + Depository charges at actual

|

| Margin Repledge |

0.02% of the value of transaction, subject to a minimum of Rs 50 + Depository charges at actual

|

Every Broking house would add some other charges apart from the brokerage amount to every trading transaction as a part of the administrative or legislative charges. Some of these charges are a mandate which are been levied by the central government or the SEBI as well.

In this case, Mastertrust Capital charges 0.00289% of the value of the Total turnover as Transaction charges. It charges 0.0126% of the value of the total Turnover amount as Securities Transactions Tax and a nominal 0.00005% of the Total Turnover value as the SEBI Turnover charges.

Apart from these charges, there is the GST (Goods & Sales Tax) which is a standard 18% of the sum of the brokerage amount and the Transaction charge and it also charges a Stamp Duty which is again very nominal amount and depends on state to state.

While all these charges look like a mammoth addition to your pocket, when you actually calculate all these in your trade cost, they compute a very nominal charge; hence you may be rest assured that this company is not charging anything extra or unnecessary from you as a trader.

Mastertrust Other Charges

- Dematerialization – Availing for this service, you will have to pay Rs 20 per DRF plus Rs 3 per certificate.

- Rematerialization – Remat services charge is also stated by the company and it is Rs 25 per certificate or 0.05% of the value of the transaction whichever is higher + Depository charges at actual.

- Pledge – The pledge charges are same for all the activities, i.e. creation, invocation and closure. Charges, as fixed by the broker are 0.02% of the value of transaction, subject to a minimum of Rs 50 + Depository charges at actual.

- Transaction Charges – This charge is for the debit transaction, both within DP and outside DP. They are Rs 15 within DP / Rs 25 Outside DP.

MasterTrust Demat Account Opening Fees

| Demat Services | |

| Trading Charges [One Time] | Rs 100 |

| Trading AMC [Yearly] | NIL |

| Demat Charges [One Time] | NIL |

| Demat AMC [Yearly] | Rs. 300 per annum |

| Margin Money | 75% Margin |

| Offline to Online | Yes |

Mastertrust Capital is a trusted Depository partner with both NSDL & CDSL, hence it is authorized to provide trading services as well as share holding services. This company, over the last two decades, has been embracing traders and investors to join them and trade through them.

One can very easily get enrolled as a trader with them and get their trading career started. They have a one-time Account Opening charge of Rs. 100/- and they also charge an annual maintenance charge for the Demat of Rs. 300/- per year, whereas the Trading Account maintenance is absolutely free.

The minimum margin money required to get started as a trader with Mastertrust Capital is 75% Margin.

MasterTrust Offers

| Offers | |

| Free Demat Account | No |

| Free Trading Account | Yes |

| Discount on Brokerage | Yes |

| Trading Happy Hours | No |

| Flexible Brokerage Plans | Yes |

| 1 Month Brokerage Free | No |

| Holiday Offers | Yes |

| Referral Offers | Yes |

| Zero Brokerage for Loss Making Trades | No |

The above table illustrates the various offers that Mastertrust Capital launches time and again for its customers. They do come up with periodic offers like Holiday Offers and Referral Bonanza Offers so that the traders can take advantage from that.

Apart from that the trading account anyways come free of charge for them, they need to bare the AMC charges though. For regular traders and high value traders, they also have customized and flexible Brokerage plans so that they save on their brokerage fees.

Find Offers from other Broking Houses

| SBI Smart | Aditya Birla Money | Asit C Mehta Investment | Bonanza Portfolio |

| Narnolia Securities | Alice Blue Online | Astha Trade | Choice Broking |

| Zerodha | Anand Rathi | BMA Wealth Creators | Geojit Finance |

How to open Demat Account with MasterTrust?

With Mastertrust Capital you can open up types of account:

- DP Account (Depository Participant)

- Trading Cum DP Account.

This basically means that you can either choose to only open up your Demat Account with them or open up a Trading cum Demat Account wherein you can trade from instantly.

The Account Opening procedure is very simple and hassle free with Mastertrust Capital:

- You can download the account opening form through their official website or visit any of their branches to collect the Trading Account opening form.

- Ensure all the fields are filled accurately like Name, contact details, address and mobile number and email id etc.

- Ensure the spelling of your name is exactly as mentioned in your bank account as the Trading account will further be linked to your bank account only and if there is a spelling mismatch, then the payments would get stuck

- You also need to enter your bank account details very accurately. Details like account number, MICR Code and IFSC code etc needs to be very minutely entered.

- You need to then submit this duly filled form along with all your KYC documents at any of our nearby centers and within 48 hours the account will be opened.

- Once the account is opened, you will receive an account opening kit which would have all login credentials and details on how to login to the portal and get started.

Get a Call Back from MasterTrust

Why Open MasterTrust Trading Account?

A Trading Account and a Demat Account go hand-in-hand if one has to deal with shares and also wants to trade in them.

While Demat Account is just a depository tool for your shares, if you ever want to purchase new shares or even sell the existing ones, you will need to have a Trading Account for that.

However, if we look at in specific to Mastertrust Capital and deep dive as to why one should open up a Trading Account with them, then there are quite few reasons why one would make that choice:

- You get an array of options for Trade with ranging from NSE, BSE, NCDEX and MCX as well

- You get a customized brokerage plan, despite the fact that their general brokerage rates are also very competitive.

- The Trading Account would enable you to trade online from anywhere by the click of a button

- You would get access to unlimited research and analysis data which will help you build a strong portfolio in stocks

MasterTrust Products & Services

List of products & services provided to its clients

MasterTrust Products:

| Products | |

| Equity Trading | Yes |

| Commodity Trading | Yes |

| Currency Trading | Yes |

| Options | Yes |

| Futures | Yes |

| Mutual Funds | No |

| Forex | No |

| Banking | No |

| SIP | No |

| Insurance | No |

Mastertrust Capital offers a plethora of products to its customers who then, get fixated with them for a lifetime without the need for exploring outside.

The above table illustrates very clearly that they offer Equity trading options, Commodity Trading facility, Currency trading and Options & Futures trading as well.

They are also a registered member of the AMFI for offering Mutual Fund solutions and they also deal with Insurance policies for investment purposes. With a company offering all these and much more, why would someone feel the need to hunt outside for options?

MasterTrust Services:

| Services | |

| Demat Services | Yes |

| Trading Services | Yes |

| 3 in 1 Acount | No |

| Intraday Services | Yes |

| IPO Services | Yes |

| Stock Recommendations | Yes |

| Robo Advisory | No |

| PMS | No |

| Trading Institution | No |

| Trading Exposure | Upto 5x |

Being a Full Service broker, Mastertrust Capital offers services like Trading & Demat Services, Intraday services and IPO services as well. Moreover, the online tool would also provide detailed Stock recommendations and market updates on a real-time basis.

MasterTrust Research, Advisory & Stock Tips

| Research & Advisory | |

| Fundamental Reports | Yes |

| Research Reports | Yes |

| Company Reports | No |

| Annual Reports | No |

| Company Stock Review | No |

| Free Stock Tips | Yes |

| IPO Reports | Yes |

| Top Picks | Yes |

| Daily Market Review | Yes |

| Monthly Reports | No |

| Weekly Reports | Yes |

| Offline Advisory | Yes |

| Relationship Manager | Yes |

Mastertrust Capital has deployed robust research and analytics team whose core job is to cull out data of various segments of the industry, study their trends and provide recommendations to invest and when.

This team sends our regular reports to customers in the form of Weekly, Daily and Monthly reports. These reports are quite exhaustive and give you a complete understanding of the overall behavior of the industry.

They provide Fundamental report, research reports, IPO reports and various other reports like free stock tips, Top picks etc.

MasterTrust Exposure or Leverage

| Exposure / Leverage | |

| Equity Delivery | 1x |

| Equity Intraday | Upto 5x |

| Equity Futures | 1x |

| Equity Options | 1x |

| Currency Futures | 1x |

| Currency Options | 1x |

| Commodities Future | 1x |

| Commodities Option | 1x |

| Margin Calculator | Mastertrust Margin Calculator |

The above mentioned table indicates that the company wants to promote people to come and join them and hence they offer some lucrative exposures and leverages so that they can operate freely even if they have exhausted their limit.

For intraday purchases, you can leverage upto 5 times of the average trade amount. For Equity Futures and Options as well the leverage if up to 1 times.

As for the Delivery segment, the leverage provided is basically 1x. As for the 20:20 plan, there is a slight variation in the delivery segment precisely, where the stock broker provide 1x exposure.

Check Margin or Exposure of other stock brokers

| IDBI Direct | KIFS Trade Capital | Nirmal Bang | Prabhudas Lilladher |

| Jhaveri Securities | 5Paisa | NJ Wealth | Profitmart |

| JM Financial | Monarch Networth Capital | Paytm Money | Reliance Securities |

MasterTrust Trading Platforms

| Trading Platforms | |

| Desktop Platform – Windows | Yes |

| Desktop Platform – Mac | Yes |

| Desktop Browser Platform | Yes |

| Mobile Site Platform | No |

| Android App Platform | Yes |

| iOS App Platform | Yes |

| Windows App Platform | No |

| Other Mobile OS Platform | No |

| Real time Updates | Yes |

| Portfolio Details | Yes |

| Online MF Buy | No |

| News Flash | Yes |

| Research Reports | No |

| Easy Installation | Yes |

| Global Indices | Yes |

| Stock Tips | Yes |

| Personalized Advisory | No |

| Interactive Charts | Yes |

| Live Markets | Yes |

| SMS Alerts | Yes |

| Email Alerts | Yes |

| Multi Account Management | No |

Mastertrust Capital has launched two Trading Platforms one for Desktop and Laptop users which is a Web based portal and the other is a Mobile App wherein you can access your entire trade cycle on your Mobile itself.

Let’s look at some of the features of each of the Platforms:

Web based Desktop Platform – Master Swift –

Master Swift is by complete virtue a Next Generation trading platform which can work wonders for you in the trading field. Below are some of the key features of Master Swift:

- Live Streaming and a market watch profile across indices and exchanges in India

- Easy and simple Cash Trading features which can enable smooth transactions and inflow of funds as well.

- Place Order seamlessly across various exchanges, all at one screen view

- Interactive and Exhaustive charts on Market trends and recommendations

- Maintenance of your Order Book without the need to manually maintain any records

- Live Candlestick charts are published for advanced technical analysis

- Collateral valuation is also done on a realtime basis and displayed on screen

Mastertrust Capital Mobile Trading App –

This Mobile app has further enabled trade and eased out the pressure from traders to have a compulsory work day to be able to carry out trades; now they can trade while traveling as well and on the go. Key Features:

- Custom made Market Watch list is published at periodic intervals

- Trade across segments and exchanges all on the go

- High Speed connectivity even in Low bandwidth internet connection

- Customized reports – like order book, net position, trade book and funds view etc.

- Tracks your individual portfolio and sends relevant notifications as well

- Realtime live streaming of market quotes and easy order placement

MasterTrust Customer Support

| Customer Support | |

| Dedicated Dealer | Yes |

| Offline Trading | Yes |

| Online Trading | Yes |

| 24*7 Support | No |

| Email Support | Yes |

| Chat Support | No |

| Toll Free Number | No |

| Branches | 35 |

Mastertrust Capital has overall 12 branches across the country and provides customer support to their customers through various channels like Online and Offline and email support as well.

You can also chose to immediately get in touch with any of the Business Associates of Mastertrust Capital and they would assist in case of any queries at any given time.

MasterTrust Complaints & Feedback

| Complaints (Current Year) | |

| Lodged in BSE | 56 |

| Resolvd in BSE | 53 |

| Lodged in NSE | 112 |

| Resolved in NSE | 105 |

Every company, no matter how big they are, would have some percentage of customers complaining about their services and products. Similarly, Mastertrust Capital also had a few complaints in their basket; however they have seemed to resolve most of them.

MasterTrust Disadvantages

Although Mastertrust Capital tops the charts in their Brokerage rates, Trading apps and platforms and various other services that they offer, but there are a few elements that they could work upon to enhance their overall performance:

- They provide very less Exposure or Leverage to customers; should look at increasing that

- The account that they offer is a 2 in 1 account and not a 3-in-1 account like other brokers

MasterTrust Conclusion

Mastertrust Capital has been a strong entity in the financial services space and has been able to make a mark in the customers’ lives with its unique approach and technology interventions.

They just need to look at some minor customer feedbacks and work on those areas to make the company a better one.

Mastertrust Review – FAQs

Ques – Is Mastertrust safe for trading?

Answer – Yes, Mastertrust is safe for trading. It is a top financial services company in the country. Having been in business for over two decades and served more than 150,000 clients, the company lives up to its motto of “Master Minds Trusted Hands”.

Ques – What is the brokerage of Mastertrust?

Answer – Matertrust is a full service broker company. Maximum brokerage charges are set at Rs 0 for Equity Delivery Trading and minimum at Rs 20 per executed order for Equity Intraday Trading, Commodity Options Trading, Equity Futures Trading and Currency Futures Trading.

Ques – How to open Mastertrustdemat online?

Answer – Customers can open either a Demat Account or a Trading cum Demat Account. They can click on “Open Demat Account” button, fill all the fields, and submit the form along with the KYC documents. Within 48 hours, an account will be formed.

Ques – Can I invest in IPO via Mastertrust?

Answer – Mastertrust doesn’t offer IPO application services. However, Mastertrust customers can apply in an IPO using ASBA facility offered by the banks.

Ques – What Leverage does Mastertrust provide?

Answer – Even if people have exhausted their limits, Mastertrust offers leverage ranging from as high as 5x in Equity Intraday and as low as 1X in Commodities so that people can operate freely.

Ques – Does Mastertrust have trading App?

Answer – Yes, Mastertrust has a Mastertrust Capital mobile trading app for trading on the go. Available for both Android and iOS users, the app offers attractive features like customized reports, tracking of individual portfolios, real time streaming of market quotes etc.

Ques – How to contact Mastertrust customer care?

Answer – Mastertrust provides customer care for both offline as well as online trading. In-person support can be received at all 35 of its branches located throughout the nation, whereas online support can be acquired through email. In addition to this, the company also provides a dedicated dealer. Customers can also immediately get in touch with any of the business associates of Mastertrust Capital.

Ques – Does Mastertrust provide Research?

Answer – Mastertrust Capital has a hands-on research and analytics team with a ton of expertise, who analyse data of various segments of the industry, study their trends and provide recommendations on investment opportunities. They provide regular research and fundamental reports to the customers.

Ques – Is Mastertrust good for Beginners?

Answer – Yes, Mastertrust is good for beginners. Even if you have little to no experience in trading, you will find that the company, armed with its exhaustive daily, weekly and monthly reports help customers get a complete understanding of the overall behavior of the industry. The company also provides top picks, stock and advisory tips etc.

Ques – Who Founded Mastertrust?

Answer – Mastertrust Capital was a conglomerate formed by the merger of two companies Master Capital Services Ltd and Arora Financial Consultants Ltd in the year 1994 in Mumbai, Maharashtra, making Mr. Harjeet Singh Arora and Mr. RK Singhania its proud co-founders.

Get a Call Back from MasterTrust

Find Reviews of other Stock Brokers

| Religare Securities | Shri Parasram Holdings | Sushil Finance | Ventura Securities |

| SAMCO | Shriram Insight | Swastika Investmart | Way2Wealth |

| SAS Online | SMC Global | Tradebulls | Yes Securities |

Most Read Articles