IDBI Direct Review, Brokerage Charges, Demat A/C, Platforms & more

Last Updated Date: Jan 05, 2024IDBI Direct, also known as IDBI Capital Markets & Securities Ltd., is a wholly-owned subsidiary of IDBI Bank Ltd.

The fully integrated financial service brokerage house has made a gigantic reputation for itself within the Indian trading and brokerage industry by providing its respective clients with personalized support.

However, in today’s article, we will verify if everything that has been acknowledged as a generalized perception of the company is at all true.

In simple words, we will commence proper research regarding every aspect of the firm with regards to their range of products, extensive, regular or occasional offers, all their service offerings, the kind of brokerage they charge, and the type of taxes they impose on their respective traders and investors.

Also, the effectiveness of the research and advisory-based materials they have to offer, the number of complaints they have received within the BSE and the NSE over the past year and of course the significance, efficiency and user-friendliness of all the remote trading platforms they have to provide.

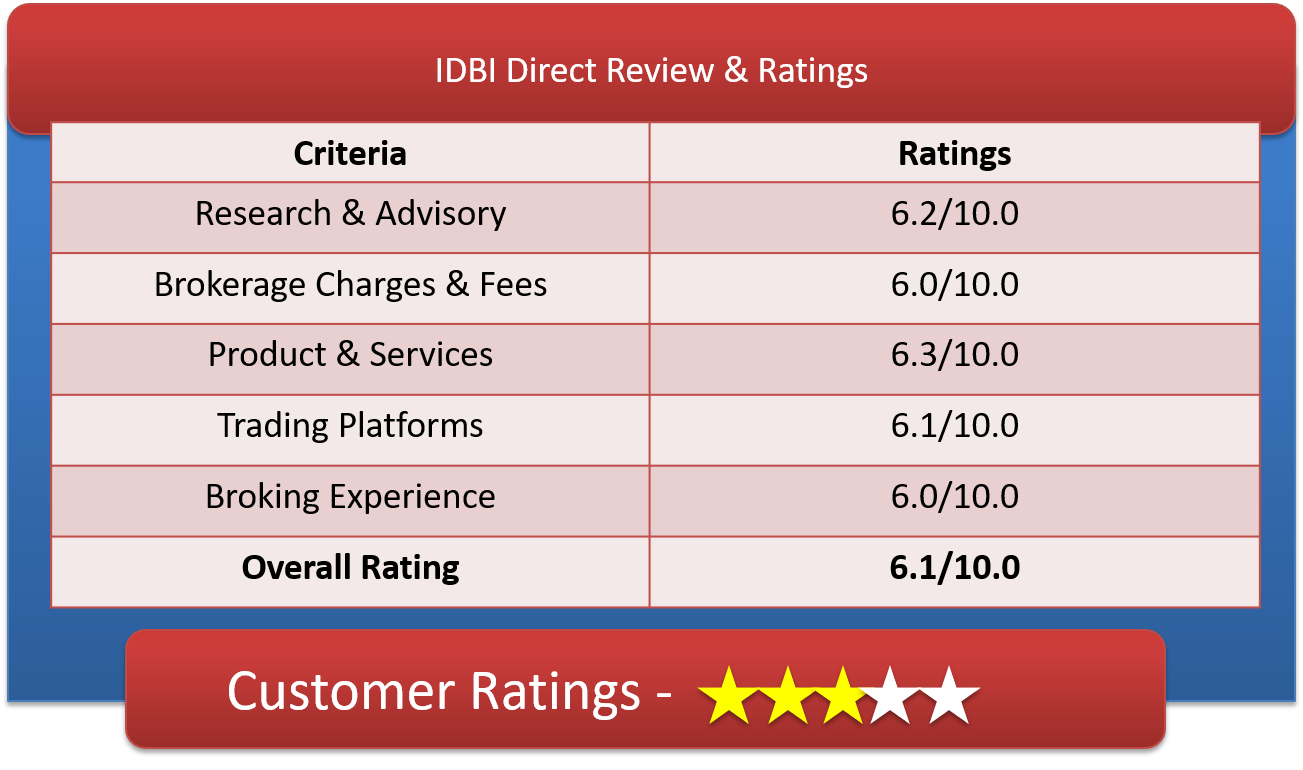

IDBI Direct Ratings & Review by Top10StockBroker

About IDBI Direct

| Overview | |

| Company Type | Public |

| Broker Type | Full-Service Broker |

| Headquarters | Mumbai, Maharashtra |

| Founder | Shri. Nagaraj Garla |

| Established Year | 1993 |

IDBI Direct was established as a fully integrated financial service provider and brokerage firm by the founder Shri. Nagaraj Garla in the year 1993 within the judiciary premises of Mumbai, Maharashtra.

The company, as of today has a net worth of three billion rupees and a total of two hundred employees located across fourteen distinct branches in fourteen different cities around the nation.

IDBI Direct, as a retail broking division of the India-centric financial services, provides giant offers, and remote-based trading through the help of the internet across all the major financial trading segments like Mutual Funds, Initial Public Offerings, Equities and F&O.

The company typically boasts about their respective online portal providing a plethora of features in order to help the respective registered traders as well as the investors of the company to better, informed and swift investment-related decisions.

Get a Call Back from IDBI Direct. Fill up this Form.

IDBI Direct Brokerage Charges

| Brokerage Charges & Fees | |

| Equity Delivery | 0.50% |

| Equity Intraday | 0.05% |

| Equity Futures | 0.05% |

| Equity Options | Rs 100 per lot |

| Currency Futures | NA |

| Currency Options | NA |

| Commodity | NA |

| Minimum Brokerage | Rs.100 per executed order |

| Demat AMC Charges | Rs.450 |

| Trading AMC Charges | Free |

| Margin Money | 75% Margin |

| Brokerage Calculator | |

The table of contents as mentioned above shows the exact details of the brokerage charges as imposed on the respective registered traders and investors by IDBI Direct.

Taking a short glimpse at the chart above will give you a proper hint about the company’s policies with regard to their respective brokerage charges.

As you can see in the aforementioned table of contents, the company imposes a brokerage charge of 0.05 % on Equity Intraday Trading, a brokerage charge of 0.05 % on Equity Futures Trading, a brokerage charge of NA on Commodity Options Trading, a brokerage charge of NA on Currency Futures Trading, a brokerage charge of 0.50 % on Equity Delivery Trading, a brokerage charge of Rs. 100 per lot on Equity Options Trading, a brokerage charge of a minimum of Rs.100 per executed order, and an annual maintenance charge of Rs.350 for the sake of maintaining a Demat Account.

Furthermore, the company also seeks their respective clients to have a minimum balance of 75% Margin in terms of Margin Money in order to be able to execute trading smoothly without any interference.

Nevertheless, the company does not ask their respective traders to pay any sort of annual maintenance whatsoever.

Compare Stock Brokers

Find brokerage charges of other Full Service Brokers

| Sharekhan | Edelweiss | Indiabulls Ventures | Kotak Securities |

| Angel Broking | HDFC Securities | India Indoline / IIFL | Motilal Oswal |

| Axis Direct | ICICI Direct | Karvy | Upstox |

IDBI Direct Charges

| Other Charges | |

| SEBI Turnover Charges | 0.00005% (Rs.5/Crore) |

| STT | Equity Delivery: 0.1% on both Buy and Sell Equity Intraday: 0.025% on the Sell Side *Equity Futures: 0.01% on Sell Side Equity Options: 0.05% on Sell Side(on Premium) Commodity Futures: 0.01% on sell-side (Non-Agri) Commodity Options: 0.05% on sell-side Currency F&O: No STT On Exercise transaction: 0.125% Right to entitlement: 0.05% on sell-side |

| Stamp Duty | (On buy-side only) Delivery: 0.015%, Intraday: 0.002%, Equity Futures: 0.002%, Equity Options: 0.002%, and Currency F&O: 0.0001%.Commodity Futures: 0.002%, Commodity Options: 0.002% (MCX) |

| GST | 18% on (Brokerage + Transaction Charge + SEBI Fee) |

| Margin Funding Charges | 18% |

| Reactivation Charges | Rs 50 per instruction |

| Account Closure Charges | Rs 35 per instruction |

| Dematerialisation Charges | Flat Rs 5 per certificate |

| Pledge Creation | 0.02% of the value of the scrip (Min Rs 25) |

| Pledge Invocation | 0.15% of the value of the scrip (Min Rs 25) |

| Margin Pledge/Unpledge/ Pledge closure | 0.02% of the value of the scrip (Min Rs 25) |

| Margin Repledge | 0.02% of the value of the scrip (Min Rs 25) |

If you take a proper look at the above-mentioned table, then you will be able to speculate that IDBI Direct, charges a total of 0.00005 % of the total turnover value with regards to SEBI Turnover Charges, a total of 0.0126 % of the total turnover value with regards to Securities Transaction Taxes, a total of 0.00312 % of the total turnover value with regards to Transaction Charges, a total of 18 % on the overall value of the sum of brokerage and transaction charges with regards to GST and variable (but minimal) amount with regards to Stamp Duty in accordance to the laws of the respective State judiciary.

IDBI Direct Demat Account Opening Fees

| Demat Services | |

| Trading Charges [One Time] | Rs 500 |

| Trading AMC [Yearly] | NIL |

| Demat Charges [One Time] | NIL |

| Demat AMC [Yearly] | Rs 450 |

| Margin Money | 75% Margin |

| Offline to Online | Yes |

IDBI Direct has been generous in terms of accepting the requests they receive with regard to new accounts being opened with the company throughout the country.

In fact, people from across the country who are interested in joining the well-reputed and fully integrated financial services providing firm can register themselves for free with a Trading or even a Demat Account.

Nevertheless, once a person becomes a part of the company by joining them through opening up a Demat Account, then the company requires them to pay an amount of Rs. 450 every year in terms of annual maintenance charges and maintain a minimum balance of 75% Margin in terms of Margin Money so as to be able to execute the trades without getting interfered with. All the transactions can be made through NSDL and CDSL.

IDBI Direct Offers

| Offers | |

| Free Demat Account | No |

| Free Trading Account | Yes |

| Discount on Brokerage | Yes |

| Trading Happy Hours | No |

| Flexible Brokerage Plans | Yes |

| 1 Month Brokerage Free | No |

| Holiday Offers | Yes |

| Referral Offers | No |

| Zero Brokerage for Loss-Making Trades | No |

The aforementioned chart of contents has been deliberately positioned and drafted in the most simplistic way possible so as to give you a detailed understanding of IDBI Direct’s provisions with respect to regular or occasional offers.

If you take a moment to look at the chart, you will be amazed to see that the fully integrated financial service providing brokerage firm has exclusive offers with regards to Free Demat Accounts, Discount On Brokerage, Free Trading Accounts, Holiday Offers and Flexible Brokerage Plans.

However, you must also consider the fact that they do not let out any offers whatsoever with regards to Referral Offers, provision for charging zero brokerage for the loss-making trades or even trading happy hours.

Find Offers from other Broking Houses

| SBI Smart | Aditya Birla Money | Asit C Mehta Investment | Bonanza Portfolio |

| Narnolia Securities | Alice Blue Online | Astha Trade | Choice Broking |

| Zerodha | Anand Rathi | BMA Wealth Creators | Geojit Finance |

How to open a Demat Account with IDBI Direct?

IDBI Direct does not have any particular set of criteria to be followed when it comes to people who are interested to join the firm as traders or as investors send them registration requests.

So, if you too happen to be interested in joining them as a trader or as an investor, then it is the right time and the right place for you to learn what you need to do:-

- Just click on the green-coloured button reading ‘Open Demat Account’ that can be found underneath this particular section.

- Clicking on the button will pop up a completely new window on your computer screen with a set of details that are needed to be filled up.

- Go through the entire form, reading carefully each line, sentence, and paragraph carefully.

- Fill in all the required details within the form that pops up correctly.

- Proceed with the KYC procedure as soon as you get done with submitting the popped-up form.

- You must have your Aadhar Card, PAN Card, and a photograph with you and upload them to the website in order to verify your age, identity and address respectively and therefore complete the KYC procedure.

- Once you have finished the KYC verification, you can expect a call from an authorized representative of the firm to contact you and take care of the final few set of verifications.

- You may expect to be granted full access to your new Trading or Demat Account within a couple of hours once you have completed all the aforementioned procedures.

Get a Call Back from IDBI Direct

Why Open IDBI Direct Trading Account?

There is no other alternative for the people residing within the Indian constituency and wanting to execute equity or derivative-based trades across the Indian Stock Trading Industry other than having a Demat or a Trading Account.

Nevertheless, that is not the sole compelling reason for you to consider in order joining IDBI Direct:-

- They have gained a positive reputation for themselves within the past few years.

- They have been recognized many times for their tremendously satisfying customer care services by the maestros of the domain.

- Their remote trading platforms are considered to be some of the best in the entire domain of equity and derivative-based trading.

IDBI Direct Products & Services

List of products & services provided to its clients

IDBI Direct Products:

| Products | |

| Equity Trading | Yes |

| Commodity Trading | Yes |

| Currency Trading | Yes |

| Options | Yes |

| Futures | Yes |

| Mutual Funds | Yes |

| Forex | No |

| Banking | Yes |

| SIP | Yes |

| Insurance | No |

By taking a few moments to look into the aforementioned chart of contents, you will be able to easily understand everything about IDBI Direct’s chain of financial products.

As a matter of fact, it can be easily concluded that the financial service and brokerage providing giant has financial products across Systematic Investment Plans, Banking, Equity Delivery Trading, Commodity Trading, Mutual Funds, Futures Trading, Options Trading and Currency Trading.

However, you must also have been able to understand that the brokerage house does not have any financial products with regard to Forex Trading or Insurance.

IDBI Direct Services:

| Services | |

| Demat Services | Yes |

| Trading Services | Yes |

| 3 in 1 Account | Yes |

| Intraday Services | Yes |

| IPO Services | Yes |

| Stock Recommendations | Yes |

| Robo Advisory | No |

| PMS | No |

| Trading Institution | No |

| Trading Exposure | Upto 5x |

designed with a simplistic format, will give you a proper idea about the company’s take on providing exclusive services to their respective registered traders as well as investors.

You can clearly see that the company provides services with regards to 3 in 1 Account, Demat Services, Trading Services, Initial Public Offering Services, Stock Recommendations and Intraday Services with up to 5 times the average exposure on trading.

Nonetheless, this is also a considerable fact that the company seems to have no interest in providing services with regard to Robo Advisory, Portfolio Management Services or Trading institutions.

IDBI Direct Research, Advisory & Stock Tips

| Research & Advisory | |

| Fundamental Reports | Yes |

| Research Reports | Yes |

| Company Reports | No |

| Annual Reports | No |

| Company Stock Review | Yes |

| Free Stock Tips | Yes |

| IPO Reports | Yes |

| Top Picks | Yes |

| Daily Market Review | Yes |

| Monthly Reports | No |

| Weekly Reports | Yes |

| Offline Advisory | Yes |

| Relationship Manager | Yes |

It can be easily speculated after taking a basic look at the aforementioned table of contents that IDBI Direct does take the provision for their Research and Advisory services seriously.

As a matter of fact, they provide almost all the services related to the Research and Advisory of financial services including Research Reports, Fundamental Reports, Relationship Managers, Weekly Reports, Offline Advisory, Daily Market Reports, Top Picks, Initial Public Offerings Reports, Company Stock Overview and Free Stock Tips.

However, they do not have any provision to provide any support related to Monthly Reports, Company Reports or even Annual Reports.

IDBI Direct Exposure or Leverage

| Exposure / Leverage | |

| Equity Delivery | 1x |

| Equity Intraday | Upto 5x |

| Equity Futures | 1x |

| Equity Options | 1x |

| Currency Futures | 1x |

| Currency Options | 1x |

| Commodities Future | 1x |

| Commodities Option | 1x |

| Margin Calculator | |

If you consider looking at the above-mentioned table of contents, you will be amazed to notice that IDBI Direct provides additional leverage on all the major asset classes.

They typically provide, an additional trading exposure of up to 1 time on Commodities Trading, an additional trading exposure of up to 1 time on Equity Delivery Trading, an additional trading exposure of up to 1 time on Currency Options Trading, an additional trading exposure of up to 1 time on Currency Futures Trading, an additional trading exposure of up to 1 time on Equity Options Trading, an additional trading exposure of up to three 1 on Equity Futures Trading, an additional trading exposure of up to 5 times on Equity Intraday Trading.

Check the Margin or Exposure of other stock brokers

| 5Paisa | KIFS Trade Capital | Nirmal Bang | Prabhudas Lilladher |

| Jhaveri Securities | Mastertrust Capital | Groww | Profitmart |

| JM Financial | Monarch Networth Capital | Paytm Money | Reliance Securities |

IDBI Direct Trading Platforms

| Trading Platforms | |

| Desktop Platform – Windows | Yes |

| Desktop Platform – Mac | Yes |

| Desktop Browser Platform | Yes |

| Mobile Site Platform | No |

| Android App Platform | Yes |

| iOS App Platform | Yes |

| Windows App Platform | No |

| Other Mobile OS Platforms | No |

| Real-time Updates | Yes |

| Portfolio Details | Yes |

| Online MF Buy | Yes |

| News Flash | Yes |

| Research Reports | No |

| Easy Installation | Yes |

| Global Indices | Yes |

| Stock Tips | No |

| Personalized Advisory | No |

| Interactive Charts | Yes |

| Live Markets | Yes |

| SMS Alerts | No |

| Email Alerts | Yes |

| Multi-Account Management | No |

IDBI Direct has developed a plethora of remote trading platforms to offer to their respective registered traders and investors throughout the nation.

What’s fascinating about them is that they have developed their respective platforms in accordance with the categories of their respective users. Here is a list of all the platforms they have developed so far:-

IDBI Direct Trading Terminal:

IDBI Direct has an in-house team of proficient technocrats who have designed a brilliant terminal-based trading platform for the company’s respective registered traders as well as investors.

This particular platform can be installed with one’s computer with a minimum configuration of Windows 98 / Windows 2000 / Windows XP / Windows 7 / Windows 8 / Windows 10, Pentium 4 Processor or higher, RAM of 512 MB or more and an internet speed of 56 kbps or more. It comes with the following features:-

- The software has been developed so as to enable the users to set audio and visual-based alerts along with a set of specific conditions allocated to specific stocks.

- The software comes integrated with a functionality that enables the respective traders as well as investors to keep a track of any and all of their placed orders in real time.

- The software has been developed in a particular manner so as to grant the respective registered investors as well as traders the ability to monitor a set of specific scrips across several industries through personalized market watch lists.

- The software comes equipped with a variety of charting options that enable the respective investors as well as the traders registered with the company to analyze their certain stocks in accordance with their preferred style of display.

- The software has been developed in a manner to be able to access many of the company’s research and advisory reports including research reports, stock recommendations and tips across fundamental as well as technical levels, thereby empowering the investors as well as the traders registered with the company to take informed financial decisions.

IDBI Direct Web Trading Platform

IDBI Direct’s team of proactive technical professionals have been able to develop a web browser-based platform known as the IDBI Power Streaming that can be directly accessed through a web browser.

This particular remote trading platform is apt to be used by frequent investors pertaining of the fact that the numbers of features that have been integrated within the software are not as exhaustive as compared to the IDBI Power PRO. It comes integrated with the following features:-

- The web-based app has been created in a manner so as to enable the respective investors as well as the traders who have registered with the brokerage house to create up to seven customizable market watch lists with the ability to create upto 50 different scrips in each market watch list.

- The web-based platform has been developed in a way to enable the respective investors and traders who are registered with the company to place their particular orders with a single click in a hassle-free environment.

More on Web Trading Platform

- The web-based app comes integrated with a feature that enables the respective users to access real-time charting options that are further optimized with colour-coded price movements to give away a swift sneak peek at the real-time momentum of any particular or group of stocks, sector or even the entire market.

- Web-based software has been integrated with an in-built functionality known as the ‘Hotkey’. This particular feature enables the respective users registered as investors or as traders with the brokerage house to take swift decisions during times of stock price change with quick analysis, order placement and feature browsing actions.

- The web-based remote trading platform has been integrated with a functionality that enables the respective users who are registered with the brokerage house as investors or as traders to get a detailed view of the top 5 bids available at a certain point in time.

IDBI Direct Mobile Trading App:

IDBI Direct have yet another set of remote trading platform suited for every kind of user ranging from frequent traders to the seldom investors who have registered themselves with the well-acclaimed brokerage house.

This particular app can be found in Google’s Play Store by the name of IDBI Direct Mobile and comes loaded with the following features:-

- The mobile-based app enables the respective users who have been registered with the brokerage firm either as investors or as traders to create multiple customizable watch lists in accordance with their own preferences.

- The app can be used to get instant access to real-time market streaming across several exchanges as well as indices by the respective users registered with the brokerage firm either as traders or as investors.

- The respective users who have already registered themselves with the well-acknowledged brokerage house can get access to a variety of charts that the app comes integrated with for in-depth market analyses at fundamental as well as technical levels.

IDBI Power Classic:

IDBI Power Classic is another remote trading platform developed by the in-house team of technical maestros at IDBI Direct.

This particular software has been brought to existence keeping in mind the people who are new to the entire trading or investing business within the Indian stock trading industry.

The software has been designed with a rather simplistic interface and comes equipped with the following set of features:-

- The software enables users to get instant access to the live rates of stocks directly from the National Stock Exchange as well as the Bombay Stock Exchange.

- The software enables the respective users to add, update or cancel ongoing orders from within the platform with a series of simple commands.

- Also, the software comes integrated with a set of ledgers, contract notes and account notes for a better understanding of the overall market.

IDBI Direct Customer Support

| Customer Support | |

| Dedicated Dealer | Yes |

| Offline Trading | Yes |

| Online Trading | Yes |

| 24*7 Support | No |

| Email Support | Yes |

| Chat Support | No |

| Toll-Free Number | No |

| Branches | 225 |

Taking some time to look into the above-mentioned chart of content will give you a proper hint about the brokerage firm’s customer care support.

As you can see from the table above, IDBI Direct extends exclusive support for their respective clients in the form of a Dedicated Dealer, Email Support, Offline Trading and Online Trading through a network of their two hundred and twenty-five branches set across the nation.

However, this is also clear that they do not have any support with regards to 24 * 7 Support, Chat Support or even a Toll-Free Number.

IDBI Direct Complaints & Feedback

| Complaints (Current Year) | |

| Lodged in BSE | 46 |

| Resolved in BSE | 42 |

| Lodged in NSE | 65 |

| Resolved in NSE | 59 |

IDBI Direct, as a full-service brokerage firm, received a total of forty-six complaints against them in the BSE and sixty-five complaints within the NSE last year, out of which, a total of forty-two and fifty-nine complaints against them were resolved within the respective segments.

This shows how dedicatedly the company serves their respective clients.

IDBI Direct Disadvantages

IDBI Direct is definitely a big shot in the Indian stock trading industry. However, they still need to look after some important factors that may seem to be disadvantageous for their respective customers or the one who is willing to join them in the near future:-

- They still do not have any toll-free number for their respective customers to reach out to.

- Their mobile app has time and again received a lot of negative criticism with respect to features like slow update speed.

IDBI Direct Conclusion

IDBI Direct has definitely evolved as a fully integrated financial services provider and brokerage firm in the past few years.

However, this has not let them overlook certain factors that may cause their respective investors or traders to face difficulties.

As a matter of fact, the total number of complaints received against them in the National Stock Exchange or the Bombay Stock Exchange last year was a lot less as compared to their respective competitors.

IDBI Direct Review FAQs

Check out various FAQs related to IDBI Direct:

Is IDBI Direct safe for trading?

Of course, it is a flag bearer of one of the most stable financial organizations. The brand significance is a thing, and this stock broker has the trust and reliability obtained as a result of the same, being a subsidiary of IDBI Bank.

What is the brokerage of IDBI Direct?

The brokerage IDBI Direct charges range and vary from one segment to another. The first group is Intraday, Commodity, Futures, and currency futures where the brokerage is NA. Brokerage for delivery is 0.50%, options are Rs.100 per lot and Currency Options are NA.

How to open IDBI Direct demat online?

We provide you with the most seamless process in which you can invest in the stock market, via this chosen stockbroker. So, starting with the process, click on “Open Demat Account” and fill up the quick pop-up that appears. Now, the company will follow up with you accordingly.

Can I invest in an IPO via IDBI Direct?

Yes, IPO investment is highly possible through IDBI Direct. They have an offline presence including a significant digital presence. You can choose the offline or online investment route as per your feasibility and avail of the IPO service.

What Leverage does IDBI Direct provide?

Speaking in terms of the leverage provided, there is a margin facility you can avail of. The highest margin is extended in the intraday segment, as it was done by the majority of stock brokers, i.e. 5x. The rates vary as per the segment and are provided in the article.

Does IDBI Direct have a trading App?

Yes, IDBI does provide a trading app for the convenience of its clients. This is a major step taken as per the present prevailing market demand. This stock broking house has as well catered for their clients and provides investment on the go.

How to contact IDBI Direct customer care?

If you are in need of connecting with the customer support team of this stock broking house, then you have multiple ways via which you can connect with them. You can opt for the offline mode, i.e. via the branches, or choose the email support way.

Does IDBI Direct provide Research?

Yes, being a full-service stock broker, they have an excellent team, consisting of all the industry experts. This team is inclined towards providing research and advisory service for the investors who are in need of it in a way or two.

Is IDBI Direct good for Beginners?

Yes, this stock broking firm is one of the right places to start with. We would say so as this stock broking house provides research and advisory services which is one of the most important aspects needed by a beginner to begin their trading journey.

Who Founded IDBI Direct?

This stockbroker was first launched in the year 1993 and is a wholly-owned subsidiary of IDBI Bank. Situated in the city of Mumbai, this stock broking house has acquired a lot of significance in the market presently, serving the need of a lot of investors.

Get a Call Back from IDBI Direct

Find Reviews of other Stock Brokers

| Religare Securities | Shri Parasram Holdings | Sushil Finance | Ventura Securities |

| SAMCO | Shriram Insight | Swastika Investmart | Way2Wealth |

| SAS Online | SMC Global | Tradebulls | Yes Securities |

Most Read Articles