Fyers Review, Brokerage Charges, Demat A/C, Platforms & more

Last Updated Date: Jan 15, 2024Fyers Securities has a team of enthusiastic young business people with profound trading and security industry experience.

They have associated with IL&FS broker Securities Services Limited for Demat and for online trading, demat and mutual fund service.

This stock broker introduced a new method for investment in the stock called ‘ themed investment, ‘ with the ability to invest in the same category of stocks, instead of trading in any individual stocks. The purpose of ‘Theme investment’ is to invest in similar structure are collected together. It also resembles investment in the mutual fund.

In this article you will get to know all detail about Fyers on bases of charges, fee, brokerages etc. This article will help you as guideline to take decision to move forward with Fyers security broker.

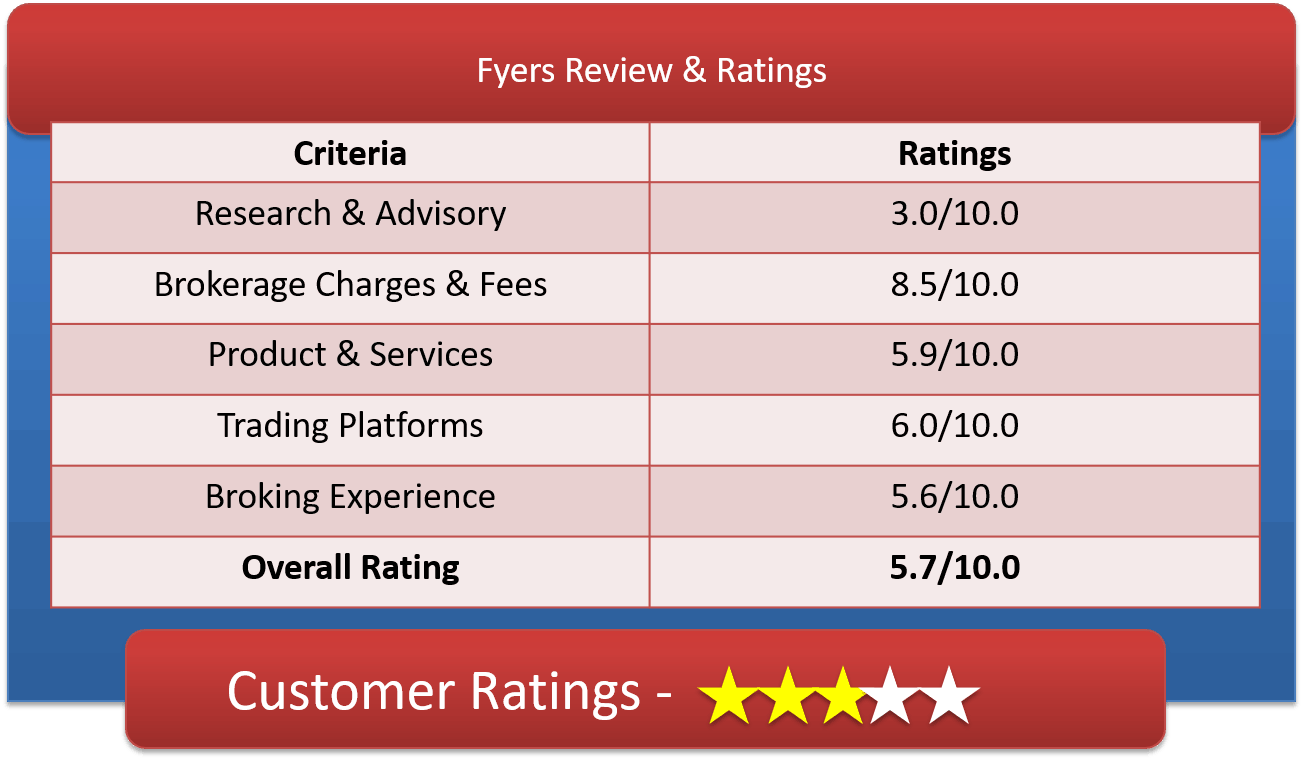

Fyers Customer Ratings & Review

About Fyers Securities

| Overview | |

| Company Type | Private |

| Broker Type | Discount Broker |

| Headquarters | Bangalore, Karnataka |

| Founder | Tejas Khoday, Shreyas Khodey & Yashas Khodey |

| Established Year | 2015 |

Fyers broking firm was launched in 2015 in less time it has become one of best India’s discount brokers. It is founded by Tejas Khoday, Shreyas Khodey & Yashas Khodey. This broker firm is centered in Bangalore, Karnataka.

They offer financial segments to trade and invest in NSE Equity, NSE Futures & options and NSE Currency Derivatives with its broking services. Fyers offers its customers all online platform services for trade at no extra cost.

it offer in-house online platform for trading that includes desktop trading terminal, and phone app. it assert to provide trading platforms with the feature for best online trading experience.

They commit to offer:

- Online trading account.

- Various investment option at free of charge.

- They offer ‘30 Day dare’ to give confidence to trader.

- Provide highest historical data in trading platform.

- They charge the lowest brokerage amount for trading in the market.

- They charge the lowest brokerage for commodity.

Get a Call Back from Fyers Securities. Fill up this Form.

Fyers Securities Brokerage Charges

| Brokerage Charge & Fees | |

| Equity Delivery Trading | Free |

| Equity Intraday Trading | Rs.20 per executed order or 0.03% (Whichever is lower) |

| Commodity Options Trading | Rs.20 per executed order |

| Equity Futures Trading | Rs.20 per executed order or 0.03% (Whichever is lower) |

| Equity Options Trading | Rs.20 per executed order |

| Currency Futures Trading | Rs.20 per executed order or 0.03% (Whichever is lower) |

| Currency Options Trading | Rs.20 per executed order |

| Minimum Brokerage | Rs.20 per executed order |

| Demat AMC Charges | Free for 1st year & Rs.300 |

| Trading AMC Charges | Free |

| Margin Money | Zero Margin |

| Brokerage Calculator | Fyers Brokerage Calculator |

- For trading in equity intraday, brokerage of Rs.20 per executed order or 0.03% (Whichever is lower) is levied.

- Brokerage for trading in Equity Futures with Fyers is Rs.20 per executed order or 0.03% (Whichever is lower).

- Trading on delivery basis stock in equity is free from brokerage.

- Brokerage for trading in Equity Options is flat Rs.20 per trade.

- For Currency F&O Brokerage with Fyers is lowest of Rs.20 per executed order or 0.03%.

- Charges for trading are Rs.20 per executed order and organization charges for Square Off of your position are Rs.20 per executed order

- The minimum marginal money to maintain in Demat account is zero.

- The charges for Thematic investment is Free for buy order. Rs.100 or 2% (Whichever is lower) is the charge for Sell/Exit, Re-balance, Modify, any of the activities individually.

Compare Stock Brokers

Find brokerage charges of other Full Service Brokers

| SBICap Securities | Aditya Birla Money | Asit C Mehta Investment | Bonanza Portfolio |

| 5Paisa | Alice Blue Online | Astha Trade | Choice Broking |

| Zerodha | Anand Rathi | BMA Wealth Creators | Geojit Finance |

Fyers Securities Charges

| Other Charges | |

| Transaction Charges | 0.00275% of Total Turnover |

| STT | 0.0126% of Total Turnover |

| SEBI Turnover Charges | 0.0002% of Total Turnover |

| Stamp Duty | Depends on State (very minimal) |

| GST | 18% of (Brokerage + Transaction Charges) |

Additional charges are charged in accordance with the pricing policy of Fyers are listed below:

- Transaction Charges for every executed trading order placed is 00275% of total turnover charges.

- Securities Transaction charges are charged over total turnover are 0126%.

- Valid Taxes levied by the state Government depends on state of trading is performed. Duty of stamp at the state level shall be charged as applicable

- SEBI Fees are charged on 0002% of total turnover.

- GST on trading is the 18% of total brokerage and Transaction Charge.

Fyers Other Charges

- Pledge Charges – If you wish to avail this service, you will have to pay Rs 50 + Rs 12 per scrip (CDSL Charges) for pledge or unpledge request. As for the Pledge Invocation request, the charge is Rs.50.

- Dematerialization – For availing this service in particular, you will be charged, Rs 100 per certificate.

- Rematerialization – There is also a charge applicable for converting electronic certificates into physical form and they are Rs 100 per certificate + CDSL Charges).

Fyers Securities Demat Account Opening Fees

| Demat Services | |

| Depository Source | CDSL & NSDL |

| Account Opening Charges | Free |

| Demat AMC Charges | 1st Year Free & Rs.300 per Annum |

| Trading AMC Charges | Free |

| Margin Money | Zero Margin |

| Offline to Online | Yes |

- The source of depository for Fyers is both CDSL and NSDL.

- For Account opening one-time fee are charged by any stock broker when your DEMAT account is opened. They open account of free of cost.

- AMC fees are the yearly payment charged to retain your account by each broker. Even if you do not trade for the full year, AMC is debited from your account.

- Maintenance charge for Demat is free for first year and Rs 300 will be charged for upcoming years.

- Marginal money for trading in the security amount trader need to maintain for trading. The maintenance amount is Zero.

Fyers Securities Offers

| Offers | |

| Free Demat Account | Yes |

| Free Trading Account | Yes |

| Discount on Brokerage | Yes |

| Trading Happy Hours | No |

| Flexible Brokerage Plans | No |

| 1 Month Brokerage Free | No |

| Holiday Offers | No |

| Referral Offers | No |

| Zero Brokerage for Loss Making Trades | No |

- If you want to save brokerage on trading and other additional costs than Fyers is the perfect solution, as Equity and Derivatives trading accounts are provided free of charge.

- Equity & Derivatives Trading Account:Fyers provides an online trading account with no choice of offline equity trading. The trader can trade by the means of a browser-supported platform, software- supported platform or cellular phone supported application. They also facilitate to utilize the trading.

- Equity Demat Account:Account of Equity Demat is a must open account if you’d like to trade in stock market. This is a digital record to maintain your stocks. All traders generally charge an open fee for their one-time account. On the other hand, Fyers offer Demat account at no cost and charge only AMC.

- Discount on Brokerage is available on many conditions to customers to carries out buy and sell orders at a reduced commission rate.

Find Offers from other Broking Houses

How to open Demat Account with Fyers Securities?

To trade online with the Fyer, trader has to open 2-in-1 account i.e. Trading and Demat account. To open Demat account with Fyers need to follow very simple steps.Following are the methods to open an account to trade:

- Visit Fyers website and select tab “Open Demat account”.

- Fill the form displayed with all required detailed like name and contact details.

- A representative will visit your place after taking appointment.

- The representative will collect all required documents.

- Soon within few days your Demat account will be opened.

Get a Call Back from Fyers Securities

Why Open Fyers Securities Trading Account?

- Fyers give the option of flat brokerage of Rs 20/- per trading order.

- Detailed study and offer significant data for choice making.

- The unique attribute of Fyers is thematic investing.

- The traders are provided with updated technology trading online platforms.

- They provide more than above customer care support, they also provide a recommendation program which is worth to invest your precious time.

- Offer a range of researching tools for comparing for margin, brokerage evaluation calculator and option tactic.

Fyers Securities Products & Services

List of products & services provided by to its clients

Fyers Securities Products:

| Products | |

| Equity Trading | Yes |

| Commodity Trading | Yes |

| Currency Trading | Yes |

| Options | Yes |

| Futures | Yes |

| Mutual Funds | Yes |

| Forex | No |

| Banking | No |

| SIP | Yes |

| Insurance | No |

Fyers security brokers provide a large range of financial product to customers for trading.

- The Trader can trade in Equity on intraday and delivery bases.

- Provide a platform to trade in the commodity in both MCX and NCDEX.

- Currency trading can be performed with Fyers security.

- Trading in derivative equity in option and future can be performed.

- They provide opportunity to invest in important financial instruments like SIP and mutual funds.

- Fyers provides innovative tool for calculating margin and brokerage for trading in all different segment in security market.

Fyers Securities Services:

| Services | |

| Demat Services | Yes |

| Trading Services | Yes |

| 3 in 1 Account | No |

| Intraday Services | Yes |

| IPO Services | Yes |

| Stock Recommendations | No |

| Robo Advisory | No |

| PMS | No |

| Trading Institution | No |

| Trading Exposure | Upto 16X |

Fyers provide important financial service to customers. The trader are provided with every services required for Demat account.

- Trading Services to trade in financial market NSE, BSE, and Commodity are offered.

- They provide services based on intraday trading if stock is square off on same day.

- Reports and trading based on IPO are offered.

- They provide maximum exposure of 16 times to their customers.

Fyers Securities Research, Advisory & Stock Tips

| Research & Advisory | |

| Fundamental Reports | No |

| Research Reports | No |

| Company Reports | No |

| Annual Reports | No |

| Company Stock Review | No |

| Free Stock Tips | Yes |

| IPO Reports | No |

| Top Picks | No |

| Daily Market Review | No |

| Monthly Reports | No |

| Weekly Reports | No |

| Offline Advisory | No |

| Relationship Manager | No |

- Fyers brokers provide trading tips to trade in the different stock market.

- The trading tips are free of cost.

- The trading level provided has good accuracy maintenance with proper entry level, exit level and stop loss for trading.

- They do not provide any fundamental and research report to customers to analyze market.

- They offer stock review, IPO reports on daily and monthly based.

- Unlike other they do not appoint any personal representative, so it becomes difficult for traders resolve problem at one call and it is time taking also.

Fyers Securities Exposure or Leverage

| Exposure / Leverage | |

| Equity Delivery | Upto 1X |

| Equity Intraday | Up to 16x (based on the stock) |

| Equity Futures | Intraday – 4 Times, Carry forward – 100%(1x) of Total margin (Span+ Exposure) |

| Equity Options | Intraday Sell 4x, Intraday Buy with CO 1.3x, Intraday Buy without CO 1x, Carry forward – 1x |

| Currency Futures | Intraday – 40% (2.5x), Carry forward – 100%(1x) of Total margin (Span+ Exposure) |

| Currency Options | Intraday – 40% (2.5x), Carry forward – 100%(1x) of Total margin (Span+ Exposure) (Options selling) |

| Commodities | NA |

| Margin Calculator | Fyers Margin Calculator |

Market exposure represents the value of money or the ratio of an investment, decided to invest for trading, market segment or industry, normally presented as a proportion of the total stocks of portfolios.

- Taking leverage from broker can give you large return but in also if position faces loss you will get huge loss. It is always advised to not trade on taking exposure.

- Fyers broker offers maximum exposure of 16 times to trade in intraday.

- For trading in Derivative Equity future different level of exposure is provided for different type of orders.

- Trading in equity derivative in option market they provide up to 4 times of exposure in Intraday sell.

- Currency trading in future and option maximum of 40% (2.5x) is offered for intraday.

Check Margin or Exposure of other stock brokers

| ISE Securities | Lakshmishree Investment | Marfatia Stock Broking | Indbank Online |

| JK Securities | LFS Broking | Indianivesh Securities | India Advantage |

| Joindre Capital | LKP Securities | Maverick Brokers |

Fyers Securities Trading Platforms

| Trading Platforms | |

| Desktop Platform – Windows | Yes |

| Desktop Platform – Mac | Yes |

| Desktop Browser Platform | Yes |

| Mobile Site Platform | Yes |

| Android App Platform | Yes |

| iOS App Platform | Yes |

| Windows App Platform | No |

| Other Mobile OS Platform | No |

| Real time Updates | Yes |

| Portfolio Details | Yes |

| Online MF Buy | Yes |

| News Flash | Yes |

| Research Reports | No |

| Easy Installation | Yes |

| Global Indices | Yes |

| Stock Tips | No |

| Personalized Advisory | No |

| Interactive Charts | Yes |

| Live Markets | Yes |

| SMS Alerts | No |

| Email Alerts | Yes |

| Multi Account Management | No |

The Fyers discount security broker offers three trading platforms with a distinctive and unique function.

- The trading platform supports all the customer login and also enables non-customers to browse through certain basic features in order to better understand the functions of the trading platform.The feature enables the customer to view the designated stocks on the main screen.

- They propose multiple attributes for technical research with a various range of data options. Works perfectly with low bandwidth connection of the internet.

- Obtain more than 20 years of historic EOD and more than 9 months of historical equity market charts with more than 65 technical indicators. This is also a specialized feature of the mobile phone app. It provide trader to search for real time charts more handy.

- Historical charts are obtainable for basic analysis

- Implementation with 25 + major stock transactions.

- Different sorts of graphs and charts, such as candlesticks with several sculpting techniques users can specifically utilize and personalize according to their analyses.

The information is as follows:

Terminal Based Platform – FYERS ONE

It is trading platform software which helps to trade by technical as well as fundamental reasearch at the same time. Trader does require to install and upload their application on desktop or computer. Certain features are provided by the trading application:

- Updated graphics chart functionality up to 30 days of Intraday and past EOD up to 5 years data with more than 60 indicators.

- This trading platform does offer daily based charts for indices they claim to be the only one to do that.

- “Stock Screeners” functionality supports user opinions to monitor, filter and analyse stocks.

- Get a detailed update of the world indice market with a single click.

- Alerts and news releases of important Board discussions and results and market events in real time

- One of the very few features that received its most positive comments from analysis users. Its features, like “One click trading,” take into consideration the time aspect of trade, and enable customers to make an order with one click.

- Unique features, like “heat maps,” prevent a lot of time

Mobile based platform- FYERS Mobile

- This mobile app is intended to use limited data on the internet to have the optimum level of information and trading at real speed.

- Both the Android and iOS versions of the Mobile app are easily accessible and function the following:

- Data analysis of statistical information with the most important information and less complicated data.

- The stock screener enables you to simultaneously evaluate and find trade opportunities in the various sectors and indices.

- They present its clients, in term of trading in desktop and cellular phone software with one of the best trading platforms.”

- Get significant exposure to over 43 various strategies for options

- Transfers of funds with even more than 25 banks through the mobile phone app

- Highly interactive charting is available.

- The broker certainly can operate to speed up his upgrade frequency cycle, especially when you look at the competitiveness and the mobile applications they offer to their customers.

Web based platform – FYERS WEB TRADER

Fyers Web Trader is a compact trading app depending on a browser which enables you to trade online.It is designed to keep things simpler and seamless for traders with limited features. A few of the fundamental features of this app provide:

- Portfolio monitoring with the allocation of resources obtainable

- Calculator of innovative stock SIP

- In built automatic option techniques to help you to understand easily.

- A relatively small number of functionalities give you a basic trading experience.

- It is better to use the desktop-based trading solution than this application, when you are searching for technical and fundamental assessment with this website app.

Fyers Thematic Investing

The theme of thematic investing are very well analyzed portfolios which depends on sure precise ideas. Now, rather than individual stocks, you can concentrate on your concepts. The place to invest in the Indian share market is robust and more integrative. Target higher yields, assign your capital and become trouble-free.

- The Trader can now able to select from a large range of personalized portfolio and themes are put together on ground-breaking ideas

- Instantly consolidate by making an investment in any of our equivalent subjects and investment funds that can increase profits while decreasing risks.

- It is free of cost, do not have any fixed subscription fees,

- The commitments charges are zero & do not have any hidden charges.

- Diversify your investment strategies and issues regularly without any difficulties with the diverse landscape of investment

Fyers Securities Customer Support

| Customer Support | |

| Dedicated Dealer | No |

| Offline Trading | No |

| Online Trading | Yes |

| 24*7 Support | No |

| Email Support | Yes |

| Chat Support | No |

| Toll Free Number | No |

| Branches | No Branch |

- The overall processing time in the Fyers case is perfect and users can quickly expect a quality solution.

- The customer support team resolve problem related trading only in online mode.

- They provide Email support to be in touch and solve any query of their customers.

- Customer support service is available only on their office hours not 24*7 support.

- Many more facility are required for customer care support like should provide chat support, toll free number and offline trading.

Fyers Securities Complaints & Feedback

| Complaints (Current Year) | |

| Lodged in BSE | 45 |

| Resolvd in BSE | 40 |

| Lodged in NSE | 64 |

| Resolved in NSE | 58 |

Find the list of total complaints lodged & resolved at both the exchanges.

- Traders are always advised to check total complain register and how many are resolved.

- According to last year in BSE total 45 complaints were lodged and 40 complaints were resolved.

- In NSE total 64 complaints were lodged and 58 complaints were resolved.

Fyers Securities Disadvantages

- They do not have talented professionals team for market analysis.

- The trader can perform trading in only NSE.

- DP service is not provided.

- Commodity trading cannot be performing with Fyers.

Fyers Securities Conclusion

The FYERS has proven its innovative name as an outcome of a superb job performed by young finance business owners.

You will only be registered at NSE and this gives you less chance to expand your portfolio. As can be seen by being new comer in stock trading Fyers offer services at extremely nominal costs, we also advise you to go to FYERS even after this disadvantage.

They offer you the fresh and technical sensible online platform for free, together with relatively inexpensive costs.

Although the graphics and other functionalities are similar to some of the others, in terms of stock testing this terminal is much better than others. Therefore they were awarded the best stock screener application in 2018.

This trading platform is 100% free. You just have to open a Fyers trading and demat account. The account opening procedure of the account is also free of charge.

Fyers Review FAQs

Ques – Is Fyers safe for trading?

Answer – Yes, this stock broking house is highly reliable and have a stable place in the market already. They have a significant customer base that have been investing with them efficiently and growing their funds as per the investment needs they have.

Ques – What is the brokerage of Fyers?

Answer – If you wish to have a clarity about the brokerage as charged by Fyers, they you must know that they charge a pretty minimal amount, since they are discount brokers. Their charge for all segments is Rs.20 per executed order or 0.03% (Whichever is lower), other that the options segments where it is Rs.20 per executed order.

Ques – How to open Fyers demat online?

Answer – This page provides all the details you need in order to open an account, and it also provides the possibility of applying for the account. If you choose Fyers as your stock broker, hit the “Open Demat Account” button in this page and fill in the pop up form, followed by the KYC form.

Ques – Can I invest in IPO via Fyers?

Answer – Yes, you sure can invest in IPO if you choose Fyers as your stock broker. They have all the provisions to let you invest in the latest IPO, and you must check out the process, terms and conditions before you choose to take an investment decision.

Ques – What Leverage does Fyers provide?

Answer – Taking a look at the leverage provided by Fyers, you can expect for up To 16x exposures, which is designated for the segments – Intraday. Rest of the insights are provided in the table and you can check the exposure you can avail for as per the kind of order you place and the segment you trade in.

Ques – Does Fyers have trading App?

Answer – Yes, it is one of the prime focus for this stock broking house, which is inclined at making everything highly organized and offered in the most seamless manner. So, accordingly the clients of this stock broking house get to invest through a trading app.

Ques – How to contact Fyers customer care?

Answer – They are a discount broker and hence there is no branch available for the mode of offline support. This diminishes the offline access, however, since they provide online trading and in case of issues, the client can reach out via their email address.

Ques – Does Fyers provide Research?

Answer – No, research provision is not a thing with this stock broker, however that is not all. The stock broker has seamlessly planned this aspect as well, and provides research tools for comparisons and other reports perfect for technical analysis.

Ques – Is Fyers good for Beginners?

Answer – Yes, this stock broking house is a great place to begin with as they are a discount broker and they provide cheap plans of brokerage. This is essential for any beginner as they generally wish to start small and bring in fewer funds to invest.

Ques – Who Founded Fyers?

Answer – The year dated as the founding year for Fyers is 2015. It is a successful venture as introduced by its 3 founders Tejas Khoday, Shreyas Khoday and Yashas Khoday. Tejas is the CEO of this company, while Shreyas has role in Strategy while Yashas has in Technology.

Get a Call Back from Fyers Securities

Find Reviews of other Stock Brokers

| Just Trade | LSE Securities | Fyers | Indira Securities |

| Kalpataru Multiplier | Maheshwari Financial | Elite Wealth | Inditrade Capital |

| Kantilal Chhaganlal Securities | Mandot Securities | Finvasia | Indus Portfolio |

Most Read Articles