Mangal Keshav Securities Review, Brokerage Charges, Demat A/C, Platforms & more

Last Updated Date: Nov 18, 2022Mangal Keshav Securities is one of the oldest names in the financial services industry with its history dating back to 8 decades.

The company has seen the stock markets evolve from they were to where they are today and gone through all the ups and downs together with it.

In today’s article, we will be doing an intrinsic study on the policies and procedure of Mangal Keshav Securities, understand their brokerage rates and plans, any other charges that they levy on traders, the various services and products that they offer to their customers and the trading platforms that they offer for trading.

With this extract, you will get a complete insight about whether this company is a worthwhile investment for your trading needs or not.

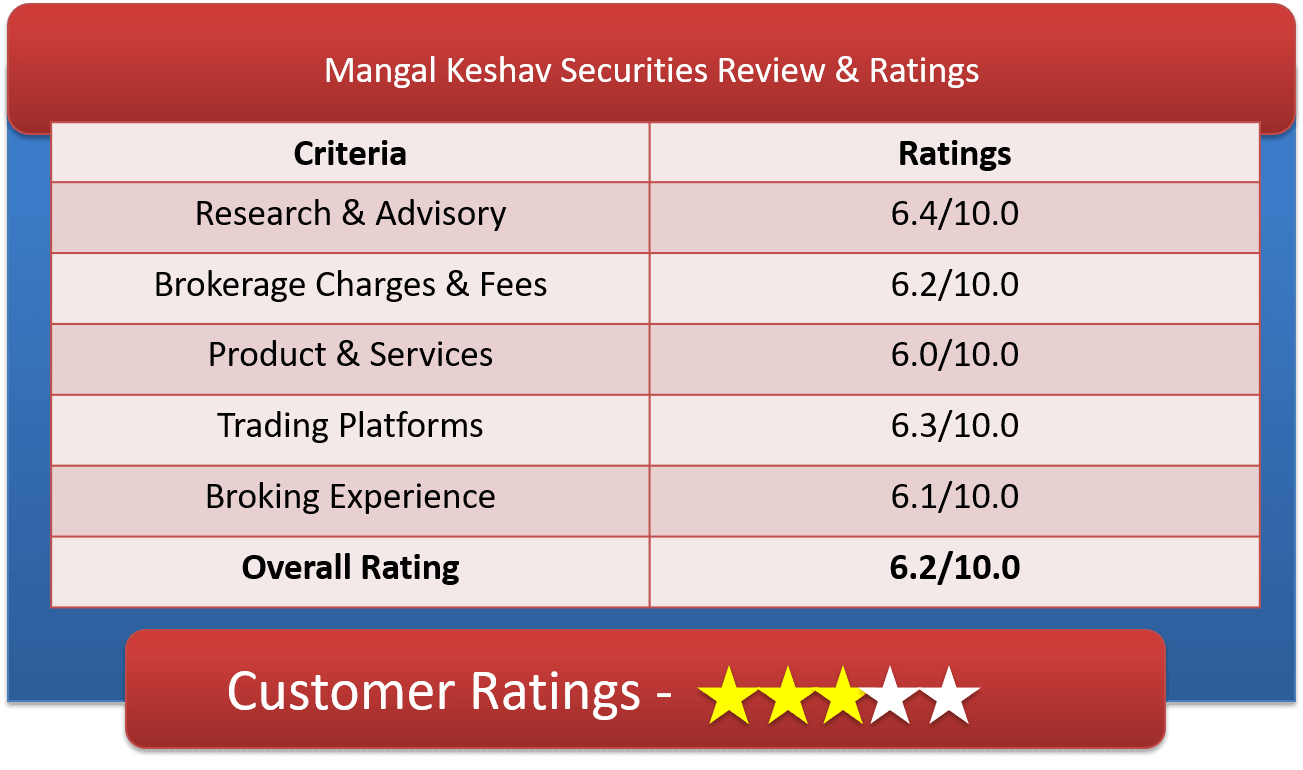

Mangal Keshav Securities Customer Ratings & Review

About Mangal Keshav Securities

| Overview | |

| Company Type | Private |

| Broker Type | Full Service Broker |

| Headquarters | Mumbai, Maharashtra |

| Founder | Paresh Bhagat |

| Established Year | 1939 |

Mangal Keshav Securities is probably one of the oldest broking house in India with a versatile and dynamic health of being stable & strong for more than 8 decades.

The inception of this organization was done in 1939 by Mr. Paresh Bhagat in Mumbai, Maharashtra. It first started out with BSE trading in 1939 and registered for NSE in 1995.

This is a critically acclaimed organization having its roots all across the country as well as strong international presence in Africa & Middle East. They have over 325 business locations spread across 80 territories to widen their growth path.

Mangal Keshav has been a market leader since its inception with innovative technology integration, strong understanding of the business and its diverse product line.

They have structured offerings for all segments of investors be it Broking services, Mutual Funds, IPO services, Depository services, Institutional Trading, NRO services, Insurances, Wealth Management or Corporate FD.

With this entire galaxy of offerings and services, they safely become the pioneer of the financial services in the country with an unmatchable customer experience track record as well.

Lets do some further deep dive on their brokerage and other services they offer.

Get a Call Back from Mangal Keshav Securities. Fill up this Form.

Mangal Keshav Securities Brokerage Charges

| Brokerage Charge & Fees | |

| Equity Delivery Trading | 0.30% |

| Equity Intraday Trading | 0.03% |

| Commodity Options Trading | 0.03% |

| Equity Futures Trading | 0.03% |

| Equity Options Trading | Rs.100 per lot |

| Currency Futures Trading | 0.03% |

| Currency Options Trading | Rs.50 per lot |

| Minimum Brokerage | Rs.20 |

| Demat AMC Charges | Rs.300 |

| Trading AMC Charges | Free |

| Margin Money | Rs.10,000 |

| Brokerage Calculator | Mangal Keshav Brokerage Calculator |

With a humungous exposure in the broking industry, they have seen it and done it all and hence they are sure to offer the best for their customers. Their brokerage charges are also no different from this phenomenon.

If you compare Mangal Keshav’s brokerage charges with any other broking house, you will find a stark difference in the quotations. While they do have flexible brokerage charges for regular and high valued traders, but the above table gives a brief idea of the general brokerage charges.

The Equity Delivery trading charge is only 0.30% while the others like Equity Intraday, Commodity Options, Equity Futures & Currency Futures, all come for a mere 0.03% brokerage charge.

If you are going for an Equity Options trade or a Currency Options trade, the charges would be based on per lot and not on the trade value, which is Rs. 100 & Rs. 50 per lot respectively.

The trading account and the Demat account can be opened absolutely free of charge with Mangal Keshav; however to get started, one has to deposit Rs. 10,000 as a Security deposit. This is the Margin money that they keep as a safe deposit with them while you are trading.

Compare Stock Brokers

Find brokerage charges of other Full Service Brokers

| Sharekhan | Edelweiss | Indiabulls Ventures | Kotak Securities |

| Angel Broking | HDFC Securities | India Indoline / IIFL | Motilal Oswal |

| Axis Direct | ICICI Direct | Karvy | Upstox |

Mangal Keshav Securities Charges

| Other Charges | |

| Transaction Charges | 0.00319% of Total Turnover |

| STT | 0.0112% of Total Turnover |

| SEBI Turnover Charges | 0.0007% of Total Turnover |

| Stamp Duty | Depends on State (very minimal) |

| GST | 18% of (Brokerage + Transaction Charges) |

Apart from the Brokerage charges, the company charges some amount of other charges as well as part of their deal while trading with them. These are some charges on which the broker has no control; they are governed by the Government of India & the Stock Exchange Bureau of India.

There are five different types of charges that are incurred upon the trader namely – Transaction charge, Securities Transaction tax, SEBI turnover charge, GST & Stamp Duty. While there are nominal charges for each of them, they add up to a very minute percentage of your total trade value.

To give an example, the Transaction charge is only 0.00319% of the total turnover amount, which means if someone trades for around 1Lac, his Transaction charge would be only Rs. 3.19/-.

The Stamp Duty is decided by the state government where you are trading and the GST is 18% of the sum of your brokerage charge and transaction charge.

The reason why this table is illustrated to you is to give you a clear understanding as to what extra charges you would need to bare while trading with Mangal Keshav Securities.

Mangal Keshav Securities Demat Account Opening Fees

| Demat Services | |

| Depository Source | CDSL & NSDL |

| Account Opening Charges | Rs.250 |

| Demat AMC Charges | Rs.300 per Annum |

| Trading AMC Charges | Free |

| Margin Money | Rs.10,000 |

| Offline to Online | No |

Mangal Keshav Securities, being a legendary trading services partner, also is a registered Depository member with CDSL & NSDL. It offers Demat services to all its customers who enroll for trading with them.

The Trading account opening & the Demat account opening is done free of charge; you can enroll online on their website. Anyone who is an Indian resident, HUF, NRI or any proprietorship or partnership company can open an account with Mangal Keshav and get started with their trading journey.

You need to deposit Rs. 10,000 as a security deposit to start off which will be kept as custody with them and refunded during separation. There is also an Annual Maintenance charge which they levy i.e. Rs. 300 per annum for the Demat services they offer.

Mangal Keshav Securities Offers

| Offers | |

| Free Demat Account | No |

| Free Trading Account | Yes |

| Discount on Brokerage | Yes |

| Trading Happy Hours | No |

| Flexible Brokerage Plans | Yes |

| 1 Month Brokerage Free | No |

| Holiday Offers | No |

| Referral Offers | Yes |

| Zero Brokerage for Loss Making Trades | No |

Mangal Keshav Securities has been into this remarkably long and successful journey in the financial services Industry only due to its unfathomable dedication to its customers.

They are an extremely customer centric organization and have always come up with plans and offers matching their customers’ needs and requirements.

It offer free Trading and Demat account services; they offer discounted brokerage plans to regular traders; they also offer customized and tailor-made brokerage plans for their esteemed high trading customers and they also offer some referral bonanzas to customers who refer other traders to them. This way they encourage more participation from their customers and increase their portfolio

Find Offers from other Broking Houses

| Dealmoney Securities | Farsight Securities | GEPL Capital | HEM Securities |

| Elite Wealth | Fast Capital Markets | Globe Capital | HSE Securities |

| Emkay Global | Findoc Investmart | Gogia Capital | IFCI Financial |

How to open Demat Account with Mangal Keshav Securities?

Getting started with Mangal Keshav is a very simple and easy task. You can simply click on the “Open An Account” tab on their main home page and get started. Mangal Keshav claims that you can get started with your trading journey within just 15 minutes of registering & opening the account. The entire account opening process is explained in a simplified manner for your perusal:

- Once you click on the “Open An Account” button, you will get a pop-up form.

- Here, you need to enter details like Full Name, Email address, Mobile No, and city.

- You also need to mark your preferences for the segment you want to trade in – Equity , Commodity, Currency or Derivatives

- Once you do that, click on Apply Online or Get a Call back. If you click on apply online, you need to upload your KYC documents online itself and if you click on “Get a Call back”, then a sales representative will get in touch with you to get your account opening formalities done.

- You need to submit the below mentioned documents, either soft copy or in hard copy: Pan Card, Adhaar Card, Bank Account details and proof (Cancelled cheque of your bank account) , Latest photograph & Signature.

- Once you submit all these documents, your details will be instantly verified and validated by the Mangal Keshav officials and your E-Account will be generated within 15 mins

- For Verification purpose, the company needs to conduct an IPV (In person verification) which is a mandate from SEBI. However, even if you are not available to visit the branch personally, you can certainly get a IPV done through a Webcam as well.

Get a Call Back from Mangal Keshav Securities

Why Open Mangal Keshav Securities Trading Account?

As per the governance from the Stock Exchange Bureau of India (SEBI), it is a mandate for one to have a trading account to be able to do any kind of trading in shares. The Trading account is more for transactional purposes while Demat account is for depository requirements. Hence, to get started, you will need to open a trading account as well with Mangal Keshav Securities.

Now, if we look at why should one opt for Mangal Keshav and not any other broking house, there are quite a few reasons for the same:

- The first and foremost being, their tenure in the financial services industry. You will hardly find any other company have a legacy of over 8 decades and being able to sustain itself with proven track record.

- They have a strong analytics team which will help you analyze your investments and its output at periodic intervals

- Their reports are quite elaborate and Goal defined

- They can illustrate for you your Cash-flow projection right till you retire

- Risk Management strategies are well defined

- Strong technological advancement in their portals as well as platforms

Mangal Keshav Securities Products & Services

List of products & services provided to its clients

Mangal Keshav Securities Products:

| Products | |

| Equity Trading | Yes |

| Commodity Trading | Yes |

| Currency Trading | Yes |

| Options | Yes |

| Futures | Yes |

| Mutual Funds | Yes |

| Forex | No |

| Banking | No |

| SIP | Yes |

| Insurance | Yes |

Mangal Keshav Securities provides its customers a platter full of products and does not serve just one dish meal. They are constantly revisiting their customers’ requirements and come up with better products and services to cater to those requirements.

With respect to broking products, they dela with all segments, be it Equity, commodity, Currency, Options or Futures. They deal extensively in Mutual Funds and have a strong portfolio there.

They provide Insurance and SIP products as well, so an investor who is looking at fixed return with a long term investment and defined goal, can also be interested in getting associated with them.

Mangal Keshav also deals in IPO services, NRO services and Corporate FD as well. In a nutshell, you name it and they have it all; that’s the flagship of Mangal Keshav Securities.

Mangal Keshav Securities Services:

| Services | |

| Demat Services | Yes |

| Trading Services | Yes |

| 3 in 1 Acount | No |

| Intraday Services | Yes |

| IPO Services | Yes |

| Stock Recommendations | Yes |

| Robo Advisory | No |

| PMS | Yes |

| Trading Institution | No |

| Trading Exposure | Upto 2X |

Mangal Keshav offers a wide range of Services along with the bucket full of products for their customers. They offer Broking services wherein a customer can trade in multiple exchanges, multiple segments at the same time using the same portal and platform.

They have an Institutional Trading desk which handles all the services like a Full Service trader with constant flow of intelligent research, analysis driven for capitalization, providing direct assistance in investment strategies and overall building your portfolio.

For IPO services as well, they provide complete assistance and guidance to customers. They also provide Stock recommendations and stock tips to customers so that they can increase their corpus. Moreover for high value customers and their esteemed traders, they provide complete end-to-end portfolio management service which includes advisory services, dedicated account manager, stock recommendations, detailed trend analysis of investments, Risk management and much more.

Mangal Keshav Securities Research, Advisory & Stock Tips

| Research & Advisory | |

| Fundamental Reports | Yes |

| Research Reports | Yes |

| Company Reports | No |

| Annual Reports | No |

| Company Stock Review | Yes |

| Free Stock Tips | Yes |

| IPO Reports | Yes |

| Top Picks | Yes |

| Daily Market Review | No |

| Monthly Reports | No |

| Weekly Reports | Yes |

| Offline Advisory | Yes |

| Relationship Manager | Yes |

When we talk about Research & advisory services, Mangal Keshav invests a lot of time and money in building up these services for their customers.

They have a robust and seasoned of market analysts who work on market trends, analyze where the market is heading towards and provide personalized stock tips to customers.

It sends out a number of reports to the customers so that they could evaluate for themselves as well which is the best stock to trade in.

They send out monthly reports, weekly reports and daily reports too. it publishes Fundamental reports, company trend reports and research reports to facilitate better trade experience.

Mangal Keshav Securities Exposure or Leverage

| Exposure / Leverage | |

| Equity Delivery | Upto 1X |

| Equity Intraday | Upto 2X |

| Equity Futures | Upto 2X |

| Equity Options | Upto 2X |

| Currency Futures | Upto 1X |

| Currency Options | Upto 1X |

| Commodities | Upto 1X |

| Margin Calculator | Mangal Keshav Margin Calculator |

Mangal Keshav Securities offers lots of leverage and exposure to its customers to enable smooth trading transactions and complete transparency.

It offers upto 2 times leverage than the average exposure in Equity Intraday & Futures, upto 2 times leverage in Equity Options; with respect to Currency trading, it offers upto 1 time leverage in Currency Futures & the same in Currency Options and commodities as well.

They also have a Margin Calculator using which they can calculate the margin money that needs to be paid.

Check Margin or Exposure of other stock brokers

Mangal Keshav Securities Trading Platforms

| Trading Platforms | |

| Desktop Platform – Windows | Yes |

| Desktop Platform – Mac | Yes |

| Desktop Browser Platform | Yes |

| Mobile Site Platform | Yes |

| Android App Platform | No |

| iOS App Platform | No |

| Windows App Platform | No |

| Other Mobile OS Platform | No |

| Real time Updates | Yes |

| Portfolio Details | Yes |

| Online MF Buy | Yes |

| News Flash | Yes |

| Research Reports | No |

| Easy Installation | Yes |

| Global Indices | Yes |

| Stock Tips | Yes |

| Personalized Advisory | No |

| Interactive Charts | Yes |

| Live Markets | Yes |

| SMS Alerts | No |

| Email Alerts | Yes |

| Multi Account Management | No |

Mangal Keshav has three types of Trading Platforms for its users:

- Mangal Trader Workstation

- Web Trading

- Mangal Trader App

Mangal Trader Workstation: Mangal Keshav Trading Terminal

This is a Desktop based platform which a user can use from his desktop and trade seamlessly. It has certain features

- Bulk Order entry can be done

- Constant Market Watch and reports in excel

- Basket Trading options available

- Arbitrage Watch on the market performance from time-to-time

- High speed performance and maintains faster trading

Mangal Keshav Web Trading:

Mangal Keshav’s Web based trading platform provides lot of flexibility to the customers to trade from anywhere and has many benefits:

- Flexibility to trade on the go

- Seamless trading through the web based platform

- Highest level of security features for data confidentiality

- Real-time market watch and updates

- Customizable Workspaces

- End-to-end portfolio management

Mangal Trader App: Mangal Keshav Mobile Trading App

This mobile based platform has given a lot of flexibility to traders. Some of its features are:

- Has all features of the Desktop platform & the Web based platform on your mobile

- Can trade on the go from anywhere across the globe.

- Follow global indices

- Tracking portfolio and positions easily

- Latest market reports and updates

- Get up to date ledger

- Transfer funds from the mobile itself

- High speed and secure functioning

Mangal Keshav Securities Customer Support

| Customer Support | |

| Dedicated Dealer | Yes |

| Offline Trading | Yes |

| Online Trading | Yes |

| 24*7 Support | No |

| Email Support | Yes |

| Chat Support | No |

| Toll Free Number | No |

| Branches | 12 |

You can reach out to Mangal Keshav customer services team anytime either by calling their customer service number or by email support as well.

They also have dedicated relationship managers deployed for your assistance at any point of time.

Mangal Keshav Securities Complaints & Feedback

| Complaints (Current Year) | |

| Lodged in BSE | 28 |

| Resolvd in BSE | 25 |

| Lodged in NSE | 45 |

| Resolved in NSE | 42 |

Every company, no matter how big they are, would have some percentage of customers complaining about their services and products.

Similarly, Mangal Keshav also has a few complaints in their basket , however they have seemed to resolve most of them.

if you see in the current year, they had received 28 complaints in BS tE out of which 25 have been already resolved. And in NSE, they had 45 complaints logged this year out of which 42 have been resolved.

Mangal Keshav Securities Disadvantages

Mangal Keshav Securities has a long drawn legacy dating back to 8 decades and there seems to be everything that they are doing right to get their customers glued on to them.

However, one feedback that most customers end up providing is that they don’t have clear Brokerage plans defined on their website. If that’s provided transparently, it would be easier for a trader to connect.

Mangal Keshav Securities Conclusion

Mangal Keshav is a very well reputed Broking house and has maintained its position as a leader due to its best practices.

If they continue to remain the same, they would certainly have a very bright future in the financial services industry

Get a Call Back from Mangal Keshav Securities

Find Reviews of other Stock Brokers

| Ezwealth | Fyers | Grovalue Securities | Indira Securities |

| Fair Intermediate | Ganpati Securities | Guiness Securities | Inditrade Capital |

| Fairwealth Securities | GCL Securities | Hedge Equities | Indus Portfolio |

Most Read Articles