Finvasia Review, Brokerage Charges, Demat Account, Trading Platforms & more

Last Updated Date: Aug 28, 2023Finvasia is an ultra discount broker based out of Chandigarh. Let’s have a detailed Finvasia Securities Review & get good understanding of Finvasia Brokerage Charges, Finvasia Demat Account, Finvasia Trading Platforms & other important features.

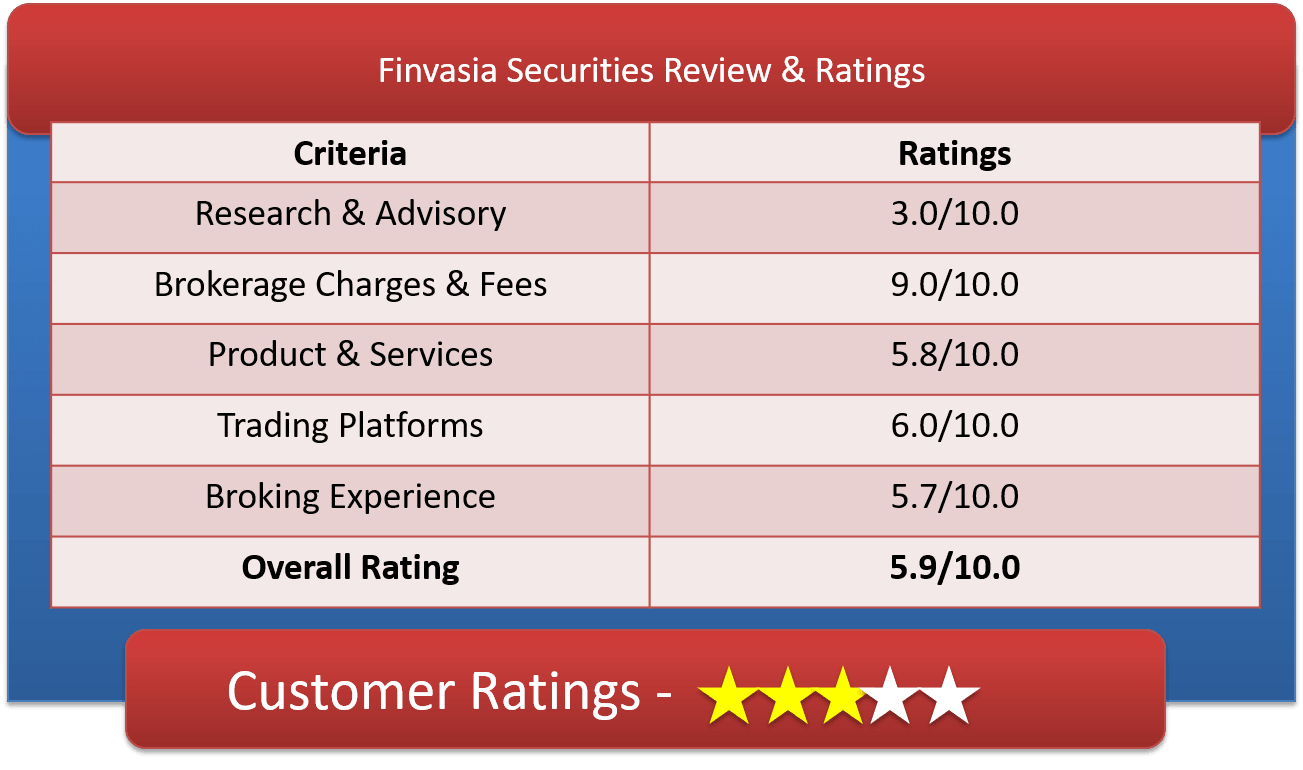

Finvasia Ratings & Review by Top10StockBroker

About Finvasia Securities

| Company Type | Public |

| Broker Type | Discount Broker |

| Headquarters | Chandigarh |

| Owners | Natty Virk (CEO) and Sarvjit Singh Virk (Co-founder) |

| Established Year | 2013 |

It is a Fintech company started in the year 2013, Finvasia has emerged as a challenge to existing brokers, very fast growing among the competitors, giving very effective brokerage fees and plan from time to time. To catch up the potential client it came with the concept of zero brokerage.

Besides the stamp duty charges and new trading platform, Finvasia is working it out to mark is strong prance. It helps you in capital market advisory to brokerage services like equities, derivatives, commodities; asset managements and investment banking.

Finvasia serves for Foreign Portfolio Investors or FPIs. It also provides advisories NRIs or foreigners who are willing to invest in Indian markets. Finvasia has a strong hold in 14 different countries from Australia to Brazil.

Before choosing Finvasia as your broker you should be aware what are you dealing with in Market and how will you deal the tough times. After sometime, the controlled expenditure in form of outgoing brokerage will lead to extra money in the trading process, and hence you can trade in more securities over time.

Open Demat Account with Finvasia

Finvasia Securities Brokerage Charges

| Equity Delivery | 0.00% |

| Equity Intraday | 0.00% |

| Equity Futures | 0.00% |

| Equity Options | 0.05% |

| Currency Futures | 0.00% |

| Currency Options | 0.04% |

| Commodity | 0.00% |

| Minimum Brokerage | Zero |

| Demat AMC Charges | Zero |

| Trading AMC Charges | Zero |

| Margin Money | Zero |

Finvasia is an ultra discount broker which doesn’t charge any brokerage for Equity Delivery, Equity Intraday, Equity Futures, Currency Futures & Commodity Trading. It only charges brokerage for Equity Option & Currency Option & that too a very minimal of 0.05% & 0.04% respectively.

Finvasia Charges

Other than brokerage charges various other charges are levied to the client but these charges are very small in number & percentage.

| Transaction Charges | 0.00325% of Total Turnover |

| STT | 0.025% of selling value |

| SEBI Turnover Charges | 0.00015% of Total Turnover |

| Stamp Duty | Depends on State (very minimal) |

| GST | 18% of (Brokerage + Transaction Charges) |

Find Brokerage Charges of other Brokers

| IDBI Direct | KIFS Trade Capital | Nirmal Bang | Prabhudas Lilladher |

| Jhaveri Securities | Mastertrust Capital | Groww | Profitmart |

| JM Financial | Monarch Networth Capital | Paytm Money | Reliance Securities |

Finvasia Demat Account Opening Fees

| Depository Source | CDSL |

| Account Opening Charges | Zero |

| Demat AMC Charges | Zero |

| Trading AMC Charges | Free |

| Margin Money | Zero |

| Offline to Online | No |

The broking house doesn’t charge any account opening fees, Demat AMC, Trading AMC & Margin Money. This discount broker is giving everything for free to the client.

Finvasia Offers

| Margin Money | Yes |

| Free Demat Account | Yes |

| Free Trading Account | Yes |

| Discount on Brokerage | Yes |

| Trading Happy Hours | No |

| Flexible Brokerage Plans | No |

| 1 Month Brokerage Free | No |

| Holiday Offers | No |

| Referral Offers | No |

| Zero Brokerage for Loss Making Trades | No |

Here are the list of offers published by Finvasia:

- Zero Margin Account

- Free Demat Account

- Free Trading Account

- Intraday Trading for Free

- Zero Brokerage for Life

The stock broking house provides everything end to end free to the client from Account Opening to AMC & Brokerage.

To know about offers of other stock brokers check below

| Dealmoney Securities | Farsight Securities | GEPL Capital | HEM Securities |

| Elite Wealth | Fast Capital Markets | Globe Capital | HSE Securities |

| Emkay Global | Findoc Investmart | Gogia Capital | IFCI Financial |

How to open Demat account with Finvasia?

- Fill up the Lead Form – Click here

- Prospect will receive a call from sales team

- Appointment will be set-up as per prospects availibility

- Sales person will visit the prospect

- Prospect will have to provide few information & documents like Aadhaar Details, PAN Details, Account Opening Fees & POA

- Account will be activated within 1 working day

This Entire process takes 3-4 days to complete.

Why Open Finvasia Trading account?

- Account Opening process is very smooth

- Very smooth working Trading Platforms

- Allows investment in other asset classes like Mutual Funds, Insurance, Bonds, NRI Trading, etc.

- No Brokerage on Intraday

- Free Demat & Trading Account

Get a Call back from Finvasia

Finvasia Products & Services

Here is the list of Products & Services provided by the broking house

Finvasia Products

| Equity Trading | Yes |

| Commodity Trading | Yes |

| Currency Trading | Yes |

| Options | Yes |

| Futures | Yes |

| Mutual Funds | Yes |

| Forex | No |

| Bonds | Yes |

| SIP | Yes |

| Insurance | Yes |

List of Products offered are:

- IPO

- Mutual Fund

- Trade stocks

- F&O

- FPI & FII

- Retails

- Corporate Services

- Prop shop

- NRI services

Finvasia Services

| Demat Services | Yes |

| Trading Services | Yes |

| 3 in 1 Account | No |

| Intraday Services | Yes |

| IPO Services | Yes |

| Stock Recommendations | No |

| Robo Advisory | Yes |

| PMS | No |

| Trading Institution | No |

| Trading Exposure | Upto 10x |

Various Services offered:

- Demat Account

- Trading Account

- Intraday Services

- Robo Advisory

- IPO Services

- Exposure upto 10x

Finvasia Research, Advisory & Stock Tips

Look at this table for all information about their research & recommendations

| Fundamental Reports | No |

| Research Reports | No |

| Company Reports | No |

| Annual Reports | No |

| Company Stock Review | No |

| Free Stock Tips | No |

| IPO Reports | No |

| Top Picks | Yes |

| Daily Market Review | No |

| Monthly Reports | No |

| Weekly Reports | No |

| Offline Advisory | No |

| Robo Advisory | Yes |

| Relationship Manager | No |

Finvasia’s research & tips services is entirely dependent on their robo advisory platform. This robo advisory platform provides daily stock tips, weekly stock performance & other recommendations.

Finvasia Exposure or Leverage

The broking company provides upto 10x exposure to their clients. Exposure varies on various parameters

- Clients Holdings (Trader client or high value client gets high exposure)

- Clients History (old client gets high leverage)

- Type of investment (Equity, Derivatives, Currency, Commodity)

- Company Scrip (High networth company has high exposure scrip)

| Equity Delivery | NA |

| Equity Intraday | Upto 10 times |

| Equity Futures | Upto 2 times |

| Equity Options | NA |

| Currency Futures | NA |

| Currency Options | NA |

| Commodity | Upto 2 times |

Find Exposure or Margin of other Stock Brokers

Finvasia Trading Platforms & Charges

The Discount broker provides trading platform for all types of devices & browsers, Let’s have a detailed review of the same.

| Desktop Platform – Windows | Yes |

| Desktop Platform – Mac | Yes |

| Desktop Browser Platform | Yes |

| Mobile Site Platform | No |

| Android App Platform | Yes |

| iOS App Platform | Yes |

| Windows App Platform | No |

| Other Mobile OS Platform | No |

| Real time Updates | Yes |

| Portfolio Details | Yes |

| Online MF Buy | Yes |

| News Flash | Yes |

| Research Reports | Yes |

| Easy Installation | No |

| Global Indices | Yes |

| Stock Tips | Yes |

| Personalized Advisory | No |

| Interactive Charts | Yes |

| Live Markets | Yes |

| SMS Alerts | Yes |

| Email Alerts | Yes |

| Multi Account Management | Yes |

The functionalities include advanced market watch, quick order execution, smart and clear charting and live streaming quotes. The trading tools are – IOB, HFT TRADING, ALGOPLUGINS, FIX ENGINE and Latency sensitive API.

Finvasia allows its customers to use some of its trading platforms for free. The discount broker has six different trading platform:

Finvasia Nest Review: Finvasia Desktop based Trading Terminal

It is a terminal software for trading. Multiple indicators and charting share the same common screen.

- Designed for noticeable performance and doesn’t strain the eye much.

- Only single sign in, is required and after that go trading.

- User friendly interface makes trading hassle free.

- Global Buy/Sell window.

- Real time sharp market watch and updates.

Finvasia Now Review: Finvasia Web based Trading Platform

It is a web trading platform from NSE, which allows you to access the market dynamics from any available mobile or desktop.

NSE NOW traders can have access to the following traits:

- NSE servers tops trade execution speed.

- View reports in off market hours as well.

- Track portfolio.

- Analytical Charting display with over 90 plus indicators

- Notifications available via mobile, email.

- Real time multiple market watch.

Finvasia Presto Review

It is useful for those traders who carry forward the larger trade volumes. And they mostly prefer to evaluate and analyze technical aspects by themselves in trading. Presto is API based that helps its customers to do customized trading because of various algorithms associated with trading are also implemented with it. The other features are below:

- Secured from malwares

- Direct access to various exchanges.

- Excellent connectivity and other charting tools.

- Run many strategies together.

Finvasia AmiBroker

It allows you to explore and back-test data on live feed. This leads to better trading performance and minimizing human error.

- Easily-customizable charting tool at a very affordable price are present.

- Analyze the markets with a user-friendly interface.

Apart from these 4, there are 2 more platforms provided by Finvasia.

SCALPERT: It shows real time chart; good for online fund transfer to over 30 plus banks. Available for both Web and mobile for charting and trading application.

BLITZ TRADER: an API based model for superfast executions. It uses other strategies like POV, TWAP, VWAP, scalping, cross market, etc.

Finvasia doesn’t charge any brokerage from their client but their trading platforms are not completely free. They come with some charge based on usage & segment investment. Check he table below

| Trading Platforms | Charges |

| NOW | Rs.0 for NSE, Rs.120 for BSE per segment |

| NEST | Standard Plan – Rs.149 per segment, Rs.99 bracket order, Premium Plan – Rs.777 for all segments, Rs.0 for bracket order |

| Presto | Rs.1599 per month + license cost extra |

| Blitz | Rs.7777 per month + tax |

| AMI Broker | Rs.299 per month + tax |

Finvasia Customer Support

Here are the list of Support the discount broker provides to their client

| Dedicated Dealer | No |

| Offline Trading | No |

| Online Trading | Yes |

| 24*7 Support | No |

| Support Number | 0172-6670000 |

| Email Support | Yes |

| Chat Support | No |

| Toll Free Number | No |

| Branches | Zero |

Finvasia Complaints & Feedback

Here are the total number of complaints lodged & resolution status of Finvasia for the current year.

| Lodged in BSE | 0 |

| Resolved in BSE | 0 |

| Lodged in NSE | 93 |

| Resolved in NSE | 77 |

The broking house resolves the complaints at a very high speed.

NOTE* – Their TAT for resolving any kind of complaints are 20 days. This is not very bad.

Finvasia Advantages & Disadvantages

Here are the pros & cons of the broking house

Advantages

- User-interface is good.

- Trading execution at Real-time.

- Advance technological features and secure transaction for trading.

- No Brokerage

- No account opening fee

Disadvantages

- Hidden and manipulative Brokerage charges and taxes. And offering very low margin value compare to other brokers

- Across all the segments, leverage is very low.

- Customer support is not satisfactory.

- Being new in the market leading to some personal glitches

Finvasia Conclusion

Finvasia is a true Indian Robinhood. No Brokerage Charge, No Account opening fee, No Demat & Trading AMC. They are charging fees for providing high end trading platform as they claim. Their business model is quite unique to the Indian stock market ecosystem. Our expertise knowledge & their customer review suggest that one should give finvasia a try & open demat account with them & try out their paid platforms.

We suggest to open demat account with Finvasia if you are an experienced trader.

Open Demat Account with Finvasia

Find Reviews of other Stock Brokers

| Ezwealth | Fyers | Grovalue Securities | Indira Securities |

| Fair Intermediate | Ganpati Securities | Guiness Securities | Inditrade Capital |

| Fairwealth Securities | GCL Securities | Hedge Equities | Indus Portfolio |

Most Read Articles