LSE Securities Review, Brokerage Charges, Demat A/C, Platforms & more

Last Updated Date: Dec 02, 2022LSC Securities, which was formerly known as LSE Securities, is a subsidiary of the Ludhiana Stock Exchange and has been incorporated to increase trade in the said exchange.

In this article, today we will discuss in detail about LSE Securities as a Broking house and take a deep dive into their policies and procedures, their services and products that they offer, their brokerage plans and charges, any other charges that they may add on to the customer and most importantly understand their various trading platforms.

In case you ever wish to get associated to LSE Securities for trading purposes, you would get a clear understanding of their systems through this module.

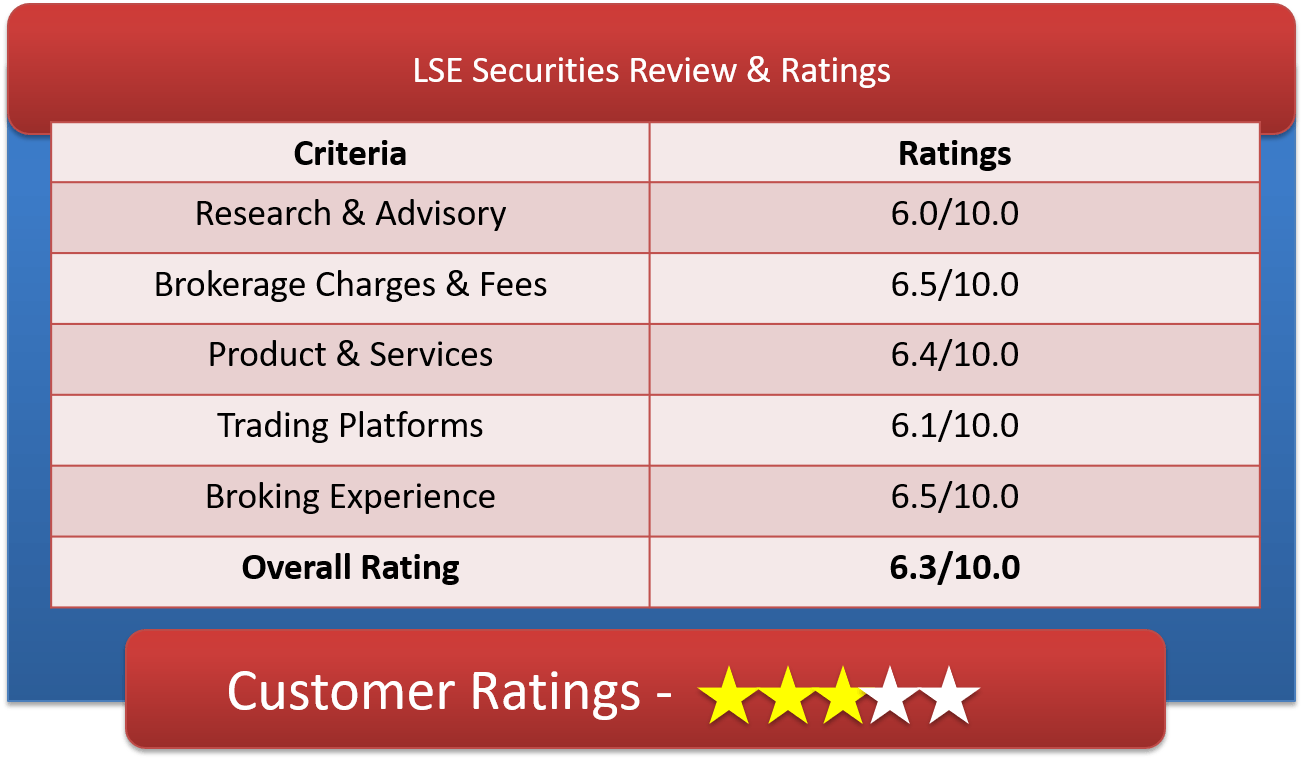

LSE Securities Ratings & Review by Top10StockBroker

About LSE Securities

| Overview | |

| Company Type | Private |

| Broker Type | Full Service Broker |

| Headquarters | Ludhiana, Punjab |

| Founder | S.P. Oswal & B.M. Munjal |

| Established Year | 1981 |

LSE Securities was the original name and now it is called LSC Securities. This was basically formed as a subsidiary Ludhiana Stock exchange with the intent to increase their trade capability. It is a Full Service broker founded by Mr. S.P Oswal & B.M. Munjal and is based out of Ludhiana, Punjab.

The company has partnered with major exchanges of the country like BSE & NSE to facilitate trade with them. They offer trade in all the segments namely Equity, Currency, Derivatives and Commodities.

It also deal with various services like IPO services and Mutual Funds. They have been in the financial services industry for over 3 decades now and have continuously worked on meeting the customer expectations through their various deals and offers.

Get a Call Back from LSE Securities. Fill up this Form.

LSE Securities Brokerage Charges

| Brokerage Charge & Fees | |

| Equity Delivery Trading | 0.30% |

| Equity Intraday Trading | 0.03% |

| Commodity Options Trading | 0.03% |

| Equity Futures Trading | 0.03% |

| Equity Options Trading | Rs.110 per lot |

| Currency Futures Trading | 0.03% |

| Currency Options Trading | Rs.30 per lot |

| Minimum Brokerage | Rs.15 |

| Demat AMC Charges | Free or Rs.250 |

| Trading AMC Charges | Free |

| Margin Money | Rs.10,000 |

| Brokerage Calculator | LSE Securities Brokerage Calculator |

The above mentioned chart illustrates the various brokerage charges that LSE securities charges to its customers for trading in different type of segments and stocks. If we compare the rates with most broking companies, they are much more competitive than many others.

They charge 0.30% of the transaction value in case of Equity delivery trade whereas for Equity Intraday, they charge 0.03%. For Commodity trading as well they charge 0.03% and for Equity Futures & Currency futures, the charges are same i.e. 0.03% of the trade value.

In case of Equity Options trading, they charge Rs. 110 per lot irrespective of the value of the trade and for Currency Options trading; they charge Rs. 30 per lot. In all these scenarios, the minimum brokerage that is charged per transaction is Rs. 15/-.

LSE Securities charges a nominal Margin money or Security deposit amount of Rs. 10,000/- during the account opening stage; however the account opening is totally free of charge for both Trading account as well as Demat account.

However, they have an annual maintenance charge for their Demat account maintenance which is Rs. 250/- per annum.

Compare Stock Brokers

Find brokerage charges of other Full Service Brokers

| SBICap Securities | Aditya Birla Money | Asit C Mehta Investment | Bonanza Portfolio |

| 5Paisa | Alice Blue Online | Astha Trade | Choice Broking |

| Zerodha | Anand Rathi | BMA Wealth Creators | Geojit Finance |

LSE Securities Charges

| Other Charges | |

| Transaction Charges | 0.00315% of Total Turnover |

| STT | 0.0112% of Total Turnover |

| SEBI Turnover Charges | 0.0007% of Total Turnover |

| Stamp Duty | Depends on State (very minimal) |

| GST | 18% of (Brokerage + Transaction Charges) |

Just like when you go out for shopping and the store owner would charge you service tax and GST etc over and above the actual cost of the product, similarly SEBI (Stock exchange board of India) charges certain extra taxes from the brokers which they in turn they need to submit to the government.

Let’s look at what types of such charges are added. LSE Securities charges 0.00315% of the total turnover value as Transaction charges; 0.0112% of the turnover value as STT charges and 0.0007% of the total turnover value as SEBI turnover charges.

If you calculate it, altogether if you trade for around 1Lac a month, then all these three charges put together, you would only be charged Rs. 15 extra; hence these charges may seem really too much, but if you actually calculate them, they are very negligible.

Besides these charges, they also charge the stamp duty which differs from state to state and they also have a GST charge which is 18% of the total Brokerage & Transaction charge paid.

LSE Securities Demat Account Opening Fees

| Demat Services | |

| Depository Source | CDSL & NSDL |

| Account Opening Charges | Free |

| Demat AMC Charges | Free or Rs.250 per Annum |

| Trading AMC Charges | Free |

| Margin Money | Rs.10,000 |

| Offline to Online | Yes |

Like most brokers, LSE Securities is also a depository participant as well apart from being a broker; they have collaborated with CDSL & NSDL for depository services. This means that you can open up a trading account as well as a Demat account with them.

With respect to the account opening, LSE doesn’t charge anything to the customers during the account opening process; they would just ask the customer to deposit Rs. 10,000/- as a security deposit or margin money.

The only charge they levy apart from this is an annual maintenance charge on the Demat account of Rs. 250/- per annum.

LSE Securities Offers

| Offers | |

| Free Demat Account | Yes |

| Free Trading Account | Yes |

| Discount on Brokerage | Yes |

| Trading Happy Hours | No |

| Flexible Brokerage Plans | Yes |

| 1 Month Brokerage Free | No |

| Holiday Offers | No |

| Referral Offers | No |

| Zero Brokerage for Loss Making Trades | No |

LSE Securities has been a leading financial services provider since more than 3 decades and hence it is very well aware of the customers’ requirements and needs. That is exactly why they keep coming up with good deals and offers for their customers periodically.

To start with, they have free Demat and free Trading account features whereas most other companies charge for the same. They also provide special discounts on brokerage charges especially to customers who have been regular traders with them.

Moreover, they also provide flexible brokerage plans; you can customize your brokerage plan as per your trend and needs. Apart from all this, the company boasts of a great customer experience team which is available for any kind of assistance all the time.

Find Offers from other Broking Houses

How to open Demat Account with LSE Securities?

LSE Securities is a top financial service provider of the country and many traders join the group every now and then; hence they have kept the joining process quite simple and easy to understand.

- You can simply go to their official website and click on the “Open Trading accounts” tab.

- Once you click on the tab, you will be directed to another page where you need to enter all your details like your full name, address, contact number, email id, place of residence, nationality etc. You also would need to enter your financial status like if you’re salaried or self employed and how much do you earn per month and per annum.

- Make sure that you enter all the details accurately and also cross check them before clicking on the Submit button.

- Once you click on the submit button, you will get a prompt for successful registration.

- Post the registration, the backend process starts. You might receive a call from the LSE Marketing team as well to validate and verify the details entered.

- Once the validation and verification process is complete, you Demat account will be opened and you can start off by logging into your account.

Get a Call Back from LSE Securities

Why Open LSE Securities Trading Account?

Opening a Trading account along with a Demat account is a mandate. Without opening a trading, you cannot transact using your stocks at all.

Demat account is only used to deposit the shares in it and save it; however for the trading, one has to have a Trading account.

Now let’s see why should you prefer opening a trading account with LSE Securities:

- The 3 decade long experience of the company itself speaks volumes about its proficiency and credibility

- Diverse product and services offer a platter of investment options to customers.

- Trading in multiple segments be it Equity, Commodities, Currency or Derivatives is also an added advantage

LSE Securities Products & Services

List of products & services provided to its clients

LSE Securities Products:

| Products | |

| Equity Trading | Yes |

| Commodity Trading | Yes |

| Currency Trading | Yes |

| Options | Yes |

| Futures | Yes |

| Mutual Funds | No |

| Forex | No |

| Banking | No |

| SIP | No |

| Insurance | No |

LSE Securities offers a wide variety of products for their customers who wish to trade. With them, you can trade in Equity, Currency, and Derivatives & Commodities too.

You can go for Intraday, Options and Future trading as well. LSE Securities also deals a lot in Mutual funds and IPO services as well. To summarize, they offer the customer with a platter full of options; not just one dish meal.

LSE Securities Services:

| Services | |

| Demat Services | Yes |

| Trading Services | Yes |

| 3 in 1 Acount | No |

| Intraday Services | Yes |

| IPO Services | Yes |

| Stock Recommendations | Yes |

| Robo Advisory | No |

| PMS | No |

| Trading Institution | No |

| Trading Exposure | Upto 6X |

LSE Securities is known for the services that they offer to their customers. They offer free Trading account & Demat account so that can just get started without any hassle. Are Intraday services, IPO services come as a bundled package.

They also provide Stock recommendations; so if you are a novice when it comes to stock market, you can leverage from this feature. They also provide Trading exposure upto 6 times more than any other competitor.

They also have a strong and robust research team whose core job is to do market analysis and provide you insights on which stocks to invest and when.

LSE Securities Research, Advisory & Stock Tips

| Research & Advisory | |

| Fundamental Reports | No |

| Research Reports | Yes |

| Company Reports | No |

| Annual Reports | No |

| Company Stock Review | No |

| Free Stock Tips | Yes |

| IPO Reports | No |

| Top Picks | Yes |

| Daily Market Review | No |

| Monthly Reports | No |

| Weekly Reports | No |

| Offline Advisory | No |

| Relationship Manager | Yes |

The LSE Securities research team works tediously in getting you the accurate market details so that you can make methodical and calculative decisions. They issue certain reports at periodic intervals to ensure that you can make best use of them and plan your trade accordingly.

Publish detailed Research reports which talk about the highest and lowest trending stocks, the industry and companies which could be most profitable bets, the health and trending to top companies and much more.

They also provide Free Stock tips & Top picks to customers so that they could take their investment decisions. LSE Securities also provides dedicated Relationship manager to handle your portfolio.

LSE Securities Exposure or Leverage

| Exposure / Leverage | |

| Equity Delivery | Upto 1X |

| Equity Intraday | Upto 6X |

| Equity Futures | Upto 2X |

| Equity Options | Upto 3X |

| Currency Futures | Upto 1X |

| Currency Options | Upto 1X |

| Commodities | Upto 1X |

| Margin Calculator | LSE Securities Margin Calculator |

The above mentioned table illustrates what kind of exposures or leverages you can expect as a trader with LSE Securities as a trader or investor. Exposure is the maximum limit you can trade even without having that much amount in your account.

This feature is mostly given by brokers for investors so that they can trade without any hurdles on their way. LSE Securities also offers from good exposures. For their Equity delivery they offer upto 1 time the exposure, for Equity Intraday, you can go up to 6 times the exposure.

Equity Futures, you can go upto 2 times the limit whereas in Equity Options, you can go upto 3 times. Under Currency futures, Currency options and commodities, you can only go upto one time of trading limit. LSE website also has margin calculator where you can check all options

Check Margin or Exposure of other stock brokers

| ISE Securities | Lakshmishree Investment | Marfatia Stock Broking | Indbank Online |

| JK Securities | LFS Broking | Indianivesh Securities | India Advantage |

| Joindre Capital | LKP Securities | Maverick Brokers |

LSE Securities Trading Platforms

| Trading Platforms | |

| Desktop Platform – Windows | Yes |

| Desktop Platform – Mac | Yes |

| Desktop Browser Platform | No |

| Mobile Site Platform | No |

| Android App Platform | No |

| iOS App Platform | No |

| Windows App Platform | No |

| Other Mobile OS Platform | No |

| Real time Updates | Yes |

| Portfolio Details | Yes |

| Online MF Buy | No |

| News Flash | Yes |

| Research Reports | No |

| Easy Installation | Yes |

| Global Indices | Yes |

| Stock Tips | No |

| Personalized Advisory | No |

| Interactive Charts | Yes |

| Live Markets | Yes |

| SMS Alerts | No |

| Email Alerts | Yes |

| Multi Account Management | No |

LSE Securities has launched a Desktop based trading platform named ODIN (Open Dealer Integrated Trading Network) which can be accessible on a Windows based desktop or laptop and also from a Mac based laptop. Below mentioned are salient features of this platform:

- Multiple exchange utilities at the same time (can trade in BSE & NSE together)

- Real time Stock market updates and market watch

- Provides research and analytical capabilities on the user desk

- Interactive charts and graphical representation of data

- Trend analysis of various high end companies segmented as per industry types

- Trading as well as amount transfer facilities inbuilt

- Stock tips and top picks provided periodically

- Monthly and weekly reports published

- News flashes are done regularly

- Email alerts are also sent out

LSE Securities Customer Support

| Customer Support | |

| Dedicated Dealer | Yes |

| Offline Trading | Yes |

| Online Trading | No |

| 24*7 Support | No |

| Email Support | Yes |

| Chat Support | No |

| Toll Free Number | No |

| Branches | 9 |

LSE Securities, as a company focuses a lot on customer experience and hence has provided various channels for customers to reach out to them.

You can reach out to LSE securities team through their 24*7 customer support desk; you can also email them regarding any support that you may need.

They also have dedicated dealers for your assistance and they have offline as well as online trading options for your flexibility. LSE Securities has 9 branches across the country wherein you could also reach out for any support or help required

LSE Securities Complaints & Feedback

| Complaints (Current Year) | |

| Lodged in BSE | 22 |

| Resolvd in BSE | 19 |

| Lodged in NSE | 38 |

| Resolved in NSE | 34 |

The smallest and the largest of companies would have a percentage of complaints falling into their kitty, Hence, voice of the Customer becomes a key focus point for any company.

The only differentiator is how fast and effectively the company resolves the issues of the customers. In LSE Securities, they reach out to customers immediately after the complaint is lodged and try to resolve it immediately.

Hence, the stats above clearly states that there were 22 complaints lodged in BSE this year out of which they have already resolved 19 and 38 complaints were lodged in NSE out of which 34 have been resolved.

LSE Securities Disadvantages

Although LSE securities is a seasoned player in the financial industry, but they still need to work on a few areas:

- Their trading platform is only Desktop / Laptop based; need to come up with Mobile trading options as well

- Need to improvise on their Stock advisory and reports as well. A little more investment in the research and analysis team is needed

LSE Securities Conclusion

LSE Securities is a stable and established company when it comes to Stock trading; however, the advancements of technology need to be combined with their expertise as well; only then it could be appealing as a great package deal for any investor or trader.

Get a Call Back from LSE Securities

Find Reviews of other Stock Brokers

| Just Trade | LSE Securities | Fyers | Indira Securities |

| Kalpataru Multiplier | Maheshwari Financial | Elite Wealth | Inditrade Capital |

| Kantilal Chhaganlal Securities | Mandot Securities | Finvasia | Indus Portfolio |

Most Read Articles