Zero Coupon Bond Yield Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 16, 2022Zero Coupon Bonds are also referred to as Accrual bond. Such bonds are unlike the normal bonds, where coupon payment is launched for the entire period the bond is held. Below you will find Zero Coupon Bond Yield Calculator, that will help you calculate Zero coupon bond yield.

Zero coupon bonds do not have coupon payment schemes and are traded in a discount rate which when redeemed at the Face values, leads to the lump sum profits made by the owners at the end of the maturity period. Some bonds are originally zero coupon, while the other can be transferred into a zero coupon later on.

Zero Coupon Bond Yield Calculator

Open Demat Account Now! – Save upto 90% on Brokerage

Zero Coupon Bond Yield Calculator Details

The factors required for the commutation of this formula are:

- Face Value of Bond

- Present Value of Bond

- Time / Period

All the above factors apply to the formula we wish to gain insights on, and so investors need to understand the same. The first factor required to commute the formula is the face value of the bond, the price at which the bond will be redeemed at the end of the maturity period.

The second factor is the present value of bond which is the amount to be paid to invest in the bond, after it is discounted from the face value. The last variable is the time for which the investment is held.

Check out more Financial Calculators here –

Zero Coupon Bond Yield Calculator Details

The above mentioned variables are the backbone of the equation, upon which the formula heavily relies. Therefore, sorting out the need for the variables and obtaining them should be the first concern. If you do the same you can easily find the end result.

The product in this equation is the formula itself, i.e. the zero coupon bond yield, and the calculator will help you find the end result.

The product of the formula lets the investor know how much of a return he is fetching each period. The assumption is, return will be added to the price value of the stock and paid at the end, when the bond is sold or redeemed at the end of the maturity period. For either of the cases the price value of the stock will be the same.

How to use Zero Coupon Bond Yield Calculator?

It is therefore easy to understand a zero coupon bond and how it functions and investors who want capital gains and do not care for yearly income choose these zero coupon bonds.

The formula is not based on the compounding effect, rather simple fashion. So, if you have the factors of the formula, we have the rest of process to find the yield sorted for you.

We are referring to the calculator which we have added at the bottom go the article to help our reading commute the formula easily.

Enter in the factor details precisely and then press the enter button on keyboard and the product along with the working will be displayed in front of you.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Zero Coupon Bond Yield Calculator Usage

A bond which is offered to the public for a rate of Rs.700 for investment, after being discount, has a face value of Rs.1000. The period for which the bond is to be held is 5 years. The yield of the bond will be.

The formula is:

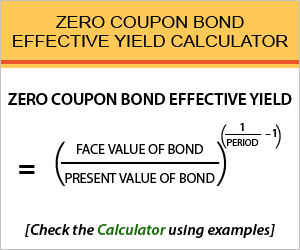

Zero Coupon Bond Effective Yield = ((Face Value of Bond / Present Value of Bond) ^ (1 / Period)) – 1

The process of solution we need to use is:

Zero Coupon Bond Effective Yield = ((1000 / 700) ^ (1 / 5)) – 1

Here, the bond will provide the investor with a yield of 7.39%

What is the use of Zero Coupon Bond Yield Calculator?

Comparison emerged in different kinds of bonds is to learn the best investment option and the bond which provides the maximum return.

For these zero coupon bonds, the debt instruments, no interest is paid on a yearly basis. The bond is discounted, offered for sale and then redeemed in its face value, therefore this formula is used to commute the yield which can made in full and final, at the end of the maturity period.

Use this formula to compare which of the zero coupons bond is the best to invest in, comparing a number of them

Zero Coupon Bond Yield Calculator Formula

Let us go on with the formula again after the example, for clearer perspective.

The other time value of money formulas needs an interest rate from each period of the investment. This is why finding the yield for the zero coupon bond is essentially easy, for all the investors need to take into account is the required rate of return.

It is because no interest on the investment is paid and therefore no reinvestment needs to be done, and the compounding effect does not exist.

Zero Coupon Bond Yield – Conclusion

This formula is used by investors who want to know the yield, a particular zero coupon bond will pay. Taking no interest into account, we hope you will be able to find the yield in the form of percentage, and if you want any additional information on this formula let us know in the comment section we have provided below.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles