Capital Asset Pricing Model Calculator – Find Formula, Check Examples, Calculate & more

Last Updated Date: Nov 16, 2022The Capital Asset Pricing Model Calculator provides the means of understanding how risky a stock is, by determining its expected rate of return. People often happen to choose risk free rate expected return, the investment which shows nil signs of risks.

Securities are often associated with risk they carry, but the range of risk each of the security carries differs as well. You may also classify securities based on riskier and less risky, and this has a direct effect on the rate of return you would make on the security.

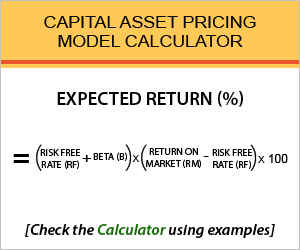

Capital Asset Pricing Model Calculator

Open Demat Account Now! – Save upto 90% on Brokerage

Capital Asset Pricing Model Calculator Details

The factors you will need, in order to evaluate the expected return are:

- Risk free rate

- Beta of the investment

- Return on the market

The first factor, risk free rate implies the rate of investment which is expected to bear no risk, or in other words a security having the particular risk free rate, would be the least risky option to invest in.

The beta is the rate of risk the investment option sustains, and if it is more than 1, it probably adds a high rate of risk as compared to the market and vice versa. The return on the market is the expected rise in value of the market.

Check out more Financial Calculators here –

Capital Asset Pricing Model Calculator Product Details

If all the factors are derived and placed upon their respected place in the formula, the resulting percentage will be the expected return of stock, or in other words the product.

Now, this product is often used as a basis of discount made to the future dividends and capital appreciations throughout the time period, the respective stock are desired to be held.

The formula holds its part of criticisms which state the product cannot be held in real world, but with all such shortcomings, it holds a significant value and is actively used to compare a number of stocks which fall in the risk category.

How to use Capital Asset Pricing Model Calculator?

Using the CAPM calculator is just as easy as using the other regular calculator. We provided the factors which are required to calculate the expected return and for the first thing, you need to gather them all.

Once, you have all the factors, you will need to fill them up on the respective columns and for the last thing, you need to press enter.

You will immediately find your product displayed just below, with an abstract of how the formula was worked as well. The product is the expected return, and based on the percentage displayed, you can seamlessly make your investment decision.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Capital Asset Pricing Model Calculator Usage

| Factors | Product | |

| Risk Free Rate (%) | 10% | 14.0%

|

| Beta | 2 | |

| Return on the Market (%) | 12% | |

Let us assume an investor is willing to know the expected rate of return of a stock which is price at Rs.100 per share. The risk free rate is 10%, beta compared to market is 2 and the expected rise in value is 12%.

The formula is:

Expected Return (%) = (Risk Free Rate + Beta * (Return on Market – Risk Free Rate))*100

Let us go through the workout:

Expected Return (%) = (10 + 2 * (12 – 10))*100

Try the said example in the calculator and you will find an expected rate of return of 14%.

What is the use of Capital Asset Pricing Model Calculator?

CAPM is used to evaluate the risk an asset class possesses, and the rate of return the investor is likely to make over the asset. It is used throughout the finance industry, but majorly to calculate the expected returns of securities which are tagged to be risky.

Such securities which carry a high range of risk are priced, followed by which the expected return is obtained. This lets the investors invest in securities promising a proportionate return thereby eliminating the risk to be taken up to an extent.

The beta of the formula is used as the measure of risk, and therefore declares which security is riskier or less risky in relation with the market price.

Capital Asset Pricing Model Calculator Formula

Let us go through the formula precisely to help you evaluate the expected rate of return of any stock by yourself.

Here,

Rf = Risk free rate

B = Beta of the investment

Rm = Return on the market

Use the calculator as per your need now, putting in all the factors as discussed. As for the beta, 1 is the constant variable used to determine the risk class, and any investment below the same are less risky while above 1 are riskier. As per the above example, the investment option is twice as risky, compared to the market price.

Capital Asset Pricing Model – Conclusion

Being curious and concerned about him money is what drives an investor to choose the best option, as the decision is taken after thorough evaluation. We hope the article did satisfy your curiosity about the security you wish to invest in by determining which risk class it belongs to, with the help of the calculator.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles