Bond Equivalent Yield Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 16, 2022Find Bond Equivalent Yield Calculator here. People who wish to invest in bonds, both discounted and zero coupon can know the yield they are likely to make from the investing into a particular bond.

The formula is basically based up on the annual returns or yield the investor will be granted. This way, the investors can compared the yield of a bond based on different time intervals, say 6 months or 12 months.

This is to compare, if both the investment options provide similar returns and or if there is a difference, given the change in time periods.

Bond Equivalent Yield Calculator

Open Demat Account Now! – Save upto 90% on Brokerage

Bond Equivalent Yield Calculator Details

The details you will need for the formula of Bond equivalent yield are:

- Face value

- Price

- Days to maturity

So, while calculating the Bond equivalent yield, you would need the information of face value of the bond and the prices, followed by the days of maturity you are considering to hold the bond for.

The face value in this equation is referred to the amount which is paid for the bond, at the end of the maturity period, whereas the price refers to the money which is paid by the investors at the time of investment. The days to maturity determines the annual yield.

Check out more Financial Calculators here –

Bond Equivalent Yield Calculator Product Details

Factors being gathered and then placed in their respective order in the formula gives the required result. Result here is referred to the Bond equivalent yield. When you enter the factors in the calculator, or solve the formula by your own, you will get the product, i.e. the Bond equivalent yield.

This makes comparison based on different maturities easy, and also possible. Being important, investors who wish to investment is profitable bonds, would evaluate the formula and then move forward to make the investment. This is therefore the rightful procedure to follow, as the formula basically is a follow up action on the yield.

How to use Bond Equivalent Yield Calculator?

The calculator is simple and easy to use, which you will find at the bottom of the page. The calculator exists to serve you in the best possible way and to add on to your investment planning.

Now that you know what factors are required, once you get your hands on the factors, inter them all in their respective field in the calculator and you will be able to get the result in a go. The enter process would probably take up a minute or two, whereas the time taken by the calculator to evaluate the product is just a few second.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Bond Equivalent Yield Calculator Usage

A person wishes to invest in a bond priced Rs.80, which will be repaid with a price of Rs.85 in a duration of 6 months. He wishes to know the bond equivalent yield the investment made. Here is how the calculation is to be done.

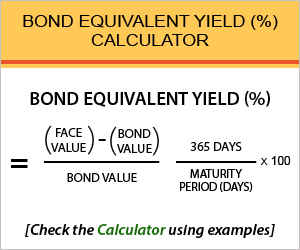

The formula is:

Bond equivalent yield = face value – price/ price x 365 / d

Let us solve the example:

Bond equivalent yield = 85 – 80 / 80 x 365 /d

The yield hence earned from the aforementioned bond is 1140.65. Likewise, another workout can be done based on a yearly duration to compare the profitable ones based on the duration for which the bind will be held.

What is the use of Bond Equivalent Yield Calculator?

The use of this calculator is subject to benefit for people who wish to invest in different types of bonds. The first and foremost consideration of investors while investing in bonds happens to be the yield they will earn in the course of time.

Here, the calculator lets the concerned individual calculate and compare the yield hence earned at different intervals to check whether holding for longer periods is beneficial or if simultaneous 6 months investment is beneficial.

It is assumed, 6 months return will be less than a 12 months return, obviously, but the formula solve the question if both of them are equally profitable.

Bond Equivalent Yield Calculator Formula

The formula which puts up with the yield of bond is:

Here,

FV = face value

P = Price

d = days of maturity

Formula being briefly explained, can be broken down to two parts. The first part will give the investors the percentage return. Follow up the formula to commute the returns in percentage for the first part.

You nearly have the estimate returns as the second part of the formula is nothing but the percentage expressed on an annual basis. This is in order to gain heavy as well as steady returns.

Bond Equivalent Yield – Conclusion

Investing in discount bonds and zero coupon bonds are aspired by a lot of investors. So, the calculator we put up in this article is to make the job of comparing and planning easy for the investor. We hope your job has been partially completed by the calculator, and if you still face difficulties, let us know via the comment section.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles