Present Value Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 19, 2022Present Value Calculator uses the formula of (PV) present value, which determines what value a future fixed amount bears in the present day.

The formula is based on the theory that there is “time value of money”. The concept of (TVM) holds a superior place of importance for investors as a sum of money held today is more valuable than the same amount held a year after or so.

The reason of the same is, earning capacity of money.

Present Value Calculator

Open Demat Account Now! – Save upto 90% on Brokerage

Present Value Calculator Details

Here are the details you need, in order to find out the present value using the calculator.

- Cash Flow of a Period

- Rate of Return %

- Time / Period (Yr.)

The significant factor details required in the equation are Cash flow of the period, Rate of return in percentage and the time period.

Here, the cash flow of the period is the amount which is aspired to sustain in the future period of time. The rate of return is the percentage of interest the holder will be earning on the present amount in equal intervals.

On the other hand, the time period is the duration for which the holder wishes to hold the money in order to make the estimated cash flow of a period. The above mentioned three factors are to be put in the equation to find the present value.

Check out more Financial Calculators here –

Present Value Calculator Product Details

Product is the figure obtained after the factors are put into the equation and then worked out. Here, in the Present Value, the product you will get would be the present day value.

The product will be the amount which you need to have in hand with you or at bank. This money when further invested at a rate of interest for a fixed period of time will get you the aspired cash flow of a period.

The formula and the product lets an investor compare between an amount today and an amount at a future time, to make smart money returns by means of increasing the potential earning capacity of money.

How to use Present Value Calculator?

The present value calculator is given below in the article, with all the factor details and an adjacent blank to fill up the factors.

The blanks are to be used by you, to fill up the Cash flow of the period, Rate of return in percentage and the time period.

Enter the details as aspired and click on the enter button, where the calculator would work out the formula for you and display the results.

The formula and how the calculator worked out the result will as well be displayed. You may try different combinations of investment options in order to reach the investment goal you want to.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Present Value Calculator Usage

Mr. A wants to know how much money he needs in his money market account in order to have Rs.100 in a year, if he makes a constant return at the rate of 5%, calculated in simple interest.

The formula is:

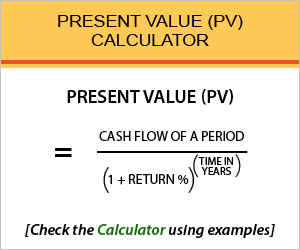

Present Value (PV) = Cash Flow of a Period / (1 + Return %)^ Time in Years

Working out the example, we have –

PV = Rs.100 / 1.05

So, when Mr. A solves the above formula, he would need to invest Rs.95.24 in his money market account in order to make Rs.100 a year from now, at the rate of 5% simple interest.

What is the use of Present Value Calculator?

Taking the time value of money into consideration, the present value calculator helps one determine the present day value of a future estimated figure.

Present value formula and calculator can be put to use for a wide range of areas in finance. The areas of finance include corporate, banking where PV is mostly used to calculate annuities and also in investment finance.

Its importance is not only applicable in the areas of finance, as it is also used alongside other financial formulas, basically as a component. Being a simple formula and a component, it comes handy while calculating other major financial formulas.

Present Value Calculator Formula

Formula of the present value calculator is:

We have discussed what the formula denotes, or in other words what factors are required to be entered. Taking all of them into account, you may as well calculate the PV of a fixed future amount, based on the formula into account.

Make sure you use the formula as it is, as no formula is subject of alteration, nor are they customization. You may though try different combination of digits to try various investment figures.

Present Value – Conclusion

The calculator is provided to you for the ease of calculation, though you may as well choose to calculate the PV on your own based on the formula we have provided.

This is to ensure you get to reach you aspired investment goals, making sure you are taking the appropriate investment decision.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles