Risk Premium Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: May 12, 2022The reason why the risk is born is the reason they are entitled to a higher return, and fair enough, they deserve some additional money for the additional risk they take up. Risk Premium Calculator helps you evaluate the risk involved in particular stock using factors like market return and risk free return.

There are certain investment options which do not have risk tagged along them, and is the reason why they yield almost the same amount of returns every time. Then there are other investment options which have risk associated with them, and so does the returns for them vary.

Risk Premium Calculator

Open Demat Account Now! – Save upto 90% on Brokerage

Risk Premium Calculator Details

There are some factors you need to take into consideration in order to evaluate the formula and they are:

- Market return

- Risk free return

The first variable in the process is the market return, i.e. the return they made by investing in the particular assets. Next factor is the risk free return, where the assured return which would be provided by the risk free investment options, is taken into consideration.

The risk premium is the expectation an investor has with any investment because he is willing to take up the risk to add on to the company’s funds.

Check out more Financial Calculators here –

Risk Premium Calculator Result

We have discussed about the factors in brief as to what each of the factors mean for the formula. Moving on to the result, as for this formula, the product is the risk premium percentage itself.

The investors of risky investments are paid compensation for risk taken and so the results are meant to be merrier.

The part where investment can fail is the risk borne by the investors and yet they choose to invest in bonds. So, they shall be provided with the returns that exceed the risk free return, given, the company did not make a default.

How to use Risk Premium Calculator?

It is necessary to understand what value this formula holds and how it helps us in connection with investment options that have a certain rate of tagged risk free return being risk free investments.

The next step is to ensure the ingredients required to calculate the formula are within access, i.e. the factor details. By using the formula, you can use the calculator which has been put up in this article, at the end of the page.

The calculator has been set up with the risk premium formula already, so you just have to enter in the variable figures in the respective field and press enter button in order to get the results in a matter of seconds.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Risk Premium Calculator Usage

A risk free investment, say a treasury bond has a risk free return of 2% and the investors, who investors taking risk into consideration got a final market return of 7%. The investor will know the risk premium if he does this:

The formula is:

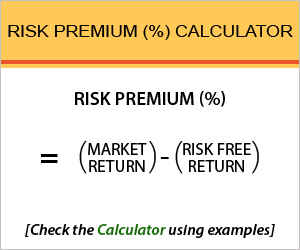

Risk Premium (%) = Market Return – Risk Free Return

Here is the workout:

Risk Premium (%) = 7 – 2

So, the Treasury bond has actually returned him a percentage risk premium of 5 for the risk of loosing the entire money he/she took.

What is the use of Risk Premium Calculator?

The use of this formula is merely to calculate the returns on the risk and money the investors put in line. Chances of making a default always lies on the part of the borrower. This types of risk in what we are referring to here.

So, the compensation which the investors deserve is what we have for use of risk premium. Use of risk premium directly associated with the investors assuming to have a part to play in the bigger payoffs.

The premium which is commonly referred to is the equity risk premium, i.e. the premium to stock.

Risk Premium Calculator Formula

Let us go again through the formula of risk premium after understanding the example.

Risk premium had another name and reference, and it is known as default risk premium. The result is described in terms of percentage and it determines the percentage of excess amount made over the threshold of risk free rate.

The risk free rate is the assured return on investment which is provided on the investment options that have no risk involved with them.

The risk which is associated with market fluctuations is the systematic risk. On the other hand, the investments which do not have market related risks are unsystematic risk.

Risk Premium – Conclusion

Investors make risky investment with the motive of gaining excess of returns over the fixed rate free return.

Their expectations will be fulfilled with the fair amount of compensation in the form of risk free returns.

Let us know the same in the comment section, in case of any doubts and we will reach back to you.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles