Dividend Payout Ratio Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 16, 2022Investors like staying updated about the happenings of the company they invest in, because it affects the share price, and one such item which would serve in their need is the Dividend Payout Ratio Calculator.

Some want to know the dividend company pays to its shareholders, and if it has any reinvestment strategies. Others like predicting how often the prices are subject to market surge or if the shares will lose their worth, and dividend payout ratio is one such measure, to know how likely or unlikely the share prices would appreciate.

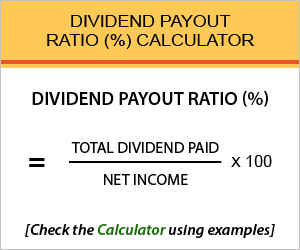

Dividend Payout Ratio Calculator

Open Demat Account Now! – Save upto 90% on Brokerage

Dividend Payout Ratio Calculator Details

The factors needs to obtain the formula in percentage are:

- Dividend paid

- Net income

The 2 factors needed are dividend paid and the net income of the company. One can find the net income from the company’s income and expenditure statement and the dividend is the part of income which is paid to the shareholders for investing in the company.

The remaining income which is not paid in the form of dividend, rather reinvest, is known as retained earnings. Companies which have a higher reinvesting ratio have a higher growth prospects while the company which pays a lot of dividend will face cut down share, prices. This helps the investors make a fruitful decision.

Check out more Financial Calculators here –

Dividend Payout Ratio Calculator Product Details

If you are now clear with the prospects of the factors, we can move forward and understand the significance of product and what it really refers to.

The product in this formula is referred to the Dividend Payout ratio, once all the factors are set up in the formula and commuted further. The product, i.e. the dividend payout ratio is also referred to as payout ratio.

Product determines whether the company belongs to the category of having high growth potential or the ones which provides its investors a steady income throughout the year. This is used by investors to understand the investments options they take into consideration.

How to use Dividend Payout Ratio Calculator?

We gathered the factors for you and have also conveyed where they can be found, and what exactly is the product of this formula. If you have understood it well enough you will not experience any kind of difficulties in using the formula and also the calculator.

The formula is briefly explained below, and as far as using the calculator is of concern, you need to gather the factors and simple enter the numbers in the respective fields in the calculator.

Make sure you cross check, so you know you did it right, and then press the enter button. The calculator will do the commutation job for you and broadcast the result in couple of seconds.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Dividend Payout Ratio Calculator Usage

Suppose a person wants to know the payout ratio of the company XYZ, given, the total dividend paid by the company is 100000, whereas its net income is 500000. Here is how it can be done.

The formula is:

Dividend Payout Ratio (%) = (Total Dividend Paid / Net Income) * 100

Moving on to the working:

Dividend Payout Ratio (%) = (100000 / 50000) * 100

So, if you work the above formula, with the figures, using the calculator, you will find that XYZ Company has a payout of 20%

What is the use of Dividend Payout Ratio Calculator?

The formula shows evidence that it can be put into a number of uses. Investors calculate the ratio to determine the retention rate, as in the net income which is not paid to the shareholders as dividend, rather retained by the company to be put into use to pay out debt, reinvest in a new venture, enter new markets, or simply to stop the cut off on stock prices.

It is by nature of markets, that companies which do not retain a sufficient amount of net income, will experience a backlash and this makes no point for companies to release the entire income for dividend.

Dividend Payout Ratio Calculator Formula

We should go through the formula to make sure you have the right understanding.

The dividend payout ratio is calculated for varied purposes and we believe you have your own. After evaluation, if you find out the company has a 0% payout ratio, you should assume the company pays no dividend at all.

On the contrary, ratio is 0, you shall assume the company paid out everything it earned in the form of dividend. The percentage ratio determines the surge in share prices. Higher payout ratio means the company may not experience surge and vice versa.

Dividend Payout Ratio – Conclusion

The liberty of doing what they people when a profit is earned during a financial year stands with the company and there are a lot of things they plan on doing with it.

Among which paying dividend to the shareholders is a part, and this article is based on the payout ratio i.e. the dividend company rolls out to the public. If you face issues which calculating, or a part of this article is not clear enough for you, leave a comment below for us to look over it.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles