Preferred Stock Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 19, 2022If you have reached this page, we are sure you are in the search of preference share valuation which is different as compared to the normal stocks of the company, and you would already have an idea about it. We have also put a Preferred Stock Calculator in this article for easy commutation.

The preference shares have somewhat properties of a bond, and hence, you may make the comparison as per your perspective.

But the owners have a specific dividend and the benefits over other common shareholders and, this formula, is applicable only for the simple dividend and not the convertible, retractable or callable preference dividend stocks.

Preferred Stock Calculator

Open Demat Account Now! – Save upto 90% on Brokerage

Preferred Stock Calculator Details

The factors which would be of use for this formula are:

- Dividend per preference stock

- Rate of return

The preference stocks have a dividend payout of fixed amount for every period. The monthly returns are to be added up in order to find the annual dividend pay-out per year and then is to be embedded in this formula.

The second factor you would need is the formula is the discount rate or the expected rate of return the share would fetch.

So, if you need to find the value of the preference stock you are investing in, you need to get the aforementioned information, i.e. the factors.

Check out more Financial Calculators here –

Preferred Stock Calculator Product Details

The product we have been referring to in this formula is pretty simple and easy. There are a lot of benefits which the preference shareholders enjoy, which include the benefit of getting paid the value of preference share before the common share holder, in case a company go through bankruptcy.

Also, because the dividend payment fashion for the product is different, the normal payment formula cannot be used for preference shareholders.

So, keeping this formula in mind, you will be able to obtain the value of the preferred stock as the product for this formula, with access to all the factors.

How to use Preferred Stock Calculator?

The factors which are needed to calculate the formula are just 2 simple items. If you have access to them both, it would become more than easy for you to calculate the value of the preference share in question, given, we also have put up the calculator embedded with the formula at the bottom of the page.

Also understand what you have been searching out in need of the product and then you can simply put in the factors in their respective field in the calculator and then press the enter button on keyboard, and your product need would be fulfilled in a matter of seconds.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Preferred Stock Calculator Usage

An individual who wished to invest in a preference share of straight characteristic learns that the stock pays a dividend of Rs.100 per year, where the expected rate of return is 5%.

The formula is:

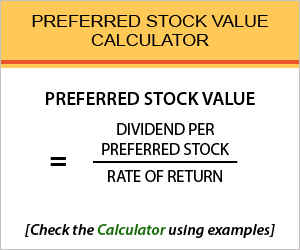

Preferred Stock Value = Dividend per Preferred Stock / Rate of Return

Let us solve it out using the calculator:

Preferred Stock Value = 100 / 0.005

So, when the factors are specified and are as given in the table above, the value of the preferred stock in concern would be Rs.2000.

What is the use of Preferred Stock Calculator?

The formula can also be used for the Gordon growth model which has an additional variable added to the denominator i.e. the denominator would be r-g.

This generally is taken for the preference shares which have a growth or the company guarantees or assures the existence of future constant growth.

So, the growths are as well subtracted from the formula, thereby increasing the value of the preference share therefore held.

This stock uses the perpetuity formula wherein an annuity pays periodic payments yet for infinity. The characteristic of the formula wherein the holders get a fixed dividend and have preference over the common shareholders, makes it appropriate to use this formula.

Preferred Stock Calculator Formula

The formula for the straight preference shares which do not have the characteristics of other convertible and likewise preference shares is:

The preferred stocks are the ones which have a fixed payment of dividend throughout the time they are held, and so will the commutation of the value of these stocks be different.

So, in order to determine the values of these stocks, you need to discount the series of payment received till the moment to find the value of stock.

Preferred Stock – Conclusion

Potential appreciation is definitely a factor for preference shares but with a rather steady income in the form of dividend.

So, if you plan on investing in any such shares and avail the benefit of it by knowing the dividend payment, this formula would come handy for you. Also, for any more help regarding this article, you can leave a comment down, at the bottom.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles