Net Profit Margin Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 18, 2022This Net Profit Margin Calculator can be used by the investors who wish to check on the investment options financial health and the companies as well which wish to speculate the progress or decline of its profit margin and their competitions in the industry.

Net profit margin lets companies determine the pace at which they stand and to take necessary actions when required. As for the investors, they can track if the net profit margin is growing or if it is just not enough to bear with the operational costs, and is rather declining.

Net Profit Margin Calculator

Open Demat Account Now! – Save upto 90% on Brokerage

Net Profit Margin Calculator Details

The factors which are to be gathered for this formula are:

- Net income

- Sales revenue

There are simply two factors to be gathered for the formula and the first one is net income. Net profit and net income, both the terms are interchangeably used for this formula and any of them will be given in its income statement disclosed by the company.

The second factor required is the sales revenue, i.e. the revenue which is earned from the products and services sold. It is as well disclosed by the companies, probably quarterly when they release their earnings.

Check out more Financial Calculators here –

Net Profit Margin Calculator Product Details

Factors are all clear and visible in the above paragraph and also the means to find them are mentioned in brief. Now is when you draw the factors together in order to extract the result out of the equation.

The product here is the formula, the net profit margin. The product you will find, make sure to convert it into percentage by multiplying it with 100.

A company needs to be financially stable in order to run efficiently and effectively and the net profit margin is the way we can find out how well the company is managing itself, i.e. how is it performing.

How to use Net Profit Margin Calculator?

We tried to explain the factors and products as clearly and precisely as we could and now we aim to influence your calculation procedure, but to make it easier.

Therefore, we have provided a calculator at the end of the article which thrives to make your job easier and better, for the calculation procedure.

You are only required to enter the factor details appropriately and we will take care of the remaining commutation, as the calculator has already been set up with the formula of net profit margin.

So just when you press the enter button, you will have your answers displayed right in front of you.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Net Profit Margin Calculator Usage

Let us assume a company has a sales revenue of Rs.100000 and after all the operation costs are taken off the table from revenue, the company has Rs.56000 as its net income. In order to find the net profit margin we have to:

The formula is:

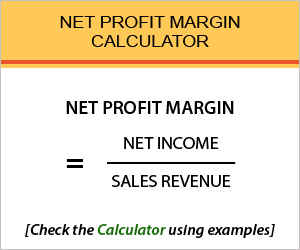

Net Profit Margin = Net Income / Sales Revenue

Solving the same:

Net Profit Margin = 56000 / 100000

If we solve the equation using the calculator given at the end of this sheet, we will get an answer of 0.56, which when converted into percentage would be 56% of net profit margin.

What is the use of Net Profit Margin Calculator?

A company goes through a series of changes every now and then. It is when a company grows, that it experiences an increase in the costs which are incurred by it.

It is only a matter of time that expenses will surpass the sales revenue, and this is when a company’s net profit margin falls down.

So, the net profit margin should be founded every now and then in order to monitor the pace at which the company is moving in order to make sure the company goes on and on without any kind of barriers.

If not, the company has the danger of getting shut down.

Net Profit Margin Calculator Formula

The formula and which it signifies if given below, check it out:

The net profit margin is basically expressed in percentage and this makes it easy to form the basis of comparison in between the companies, also by keeping a watch on the competitive companies.

The net profit margin is basically the percentage of the sales revenue which is retained by the company in the form of net profit.

It is pretty important for the company to keep a check on its net profit margin, because if not, the operational costs will override the net profit margin, thereby dragging the company to losses, which may further lead the winding up of business.

Net Profit Margin – Conclusion

Profits are the reason why a company strive and is the base upon which the company’s existence rides. It is important for companies to adopt measures which would increase the net profit margins every year, for the expenses increase year after year as well.

So, being an investor you need to notice an increasing fashion in the net profit margin of the companies which are considering investing in.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles