Estimated Earnings Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 16, 2022It is basically through the earnings that a company’s performance is evaluated. Investors check the earnings of the company because it shows the financial status and the performance. One such formula which investors wish to commute is Estimated Earnings and we have enclosed an Estimated Earnings Calculator in this article.

A company which is financially stable performs well and therefore pays a good return to the investors. So, a present trend of earnings, or a series of present and past earning trend is fetched in order to estimate the coming earnings for a period, say quarterly, half yearly or annually.

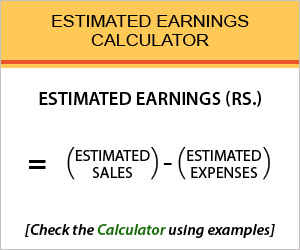

Estimated Earnings Calculator

Open Demat Account Now! – Save upto 90% on Brokerage

Estimated Earnings Calculator Details

There are collectively 2 factors you will need in order to commute the formula and they are:

- Estimated sales

- Estimated expenses

Analysts basically try evaluating what will be the possible future earning for a project using a verified set of business models. The factors are basically the estimated or forecast sale and expenses, these are well determined by the analyst of the company.

The earning determined here is the net income the company will make during the next fiscal year or period subject to some changes in the operational activities or even a new project undertaken by the company.

Check out more Financial Calculators here –

Estimated Earnings Calculator Product Details

Now that you are well versed with the details of who uses this formula, the reason why it is used and lastly what factors are required to get the product, you will be able to successfully fetch the same.

The product we have been referring to here is the formula we have been taking about itself, i.e. the Estimated earnings. We want you to use the calculator we have put in the article in order to determine the formula estimated earnings.

It would be easy to commute as the calculator knows how to pick up on your product, if you enter in the factor appropriately.

How to use Estimated Earnings Calculator?

It is pretty easy to use the estimated earnings calculator. As the formula is just subtracting the former factor with the latter factor, you may do it on your own as well.

But the company’s sales and expenses are not likely to be in simple figures, as they are pretty much complicated and this is how the calculator will come handy.

You need to fill in the sales and the expense details in the calculator, beside their respective names, and at last you need to press enter button on your keyboard. The commutation will be done and displayed below immediately.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Estimated Earnings Calculator Usage

The estimated sales and the estimated expenses of the company XYZ for the coming period is Rs.500000 and Rs.400000 respectively. Here is how the estimated earning can be taken out.

The formula is:

Estimated Earnings (Rs.) = *Estimated Sales – Estimated Expenses

Let us take a look at how the working will be:

Estimated Earnings (Rs.) = 500000 – 400000

So, upon subtracting the estimated expenses from the estimated sales, earnings the company is likely to make for the next period would be Rs.100000. This way the analyst will also determine the fair value of the company.

What is the use of Estimated Earnings Calculator?

This formula of estimated earning is also used as an important component while evaluating the value of the firm. If you wonder how this can be done, it is undertaken by the analyst of the firm, who first determines the estimate earning for any period of time and then further places it into the cash flow analysis.

This can give an approximation of fair value, which helps determine the target share price. It is when change in any operational aspects of the company arises, that this formula is evaluated by the analysts to understand what the coming period’s earning margin will be.

Estimated Earnings Calculator Formula

This formula will let you through the estimates of the future.

This is the basic way of calculating the earnings is given above, but this is not all, as there are many other things to be included in the process. Some of the left-out things are interest, tax etc, thereby making the formula a lot more complex.

So, there for sure are many ways of calculating an estimated earning of the company, but the above one is the simplest of them all. This is to have an understanding of the scenarios and not necessarily the actual earning.

Estimated Earnings Calculator – Conclusion

As the formula can also prove to be useful for investors, you can evaluate the same in order to know how profitable the future year will be, if you chose to invest in the company’s stock. Use the formula as per your benefit and let us know if you any issues in the process, through the comment section.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles