Contribution Margin Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 16, 2022This article basically focuses on Contribution Margin Calculator and here we guide you to calculate Contribution Margin in a simple manner.

The word Contribution Margin is widely heard when we talk of profit earned on a product. It means the difference between the selling price and variable cost of any product.

This method is applicable in the case, when an investor needs to find the profit earned on a particular product of a company.

Contribution Margin Calculator

Contribution Margin Calculator Details

If you want to find out Contribution Margin of a product of a company, there are some basic factors required for the calculation.

- Sales Revenue

- Variable Cost

- Number of Units Sold

These are the factors required to put in the formula to find out the value of Contribution Margin.

Discussing in detail, the first point indicates the income received by the company after selling their goods and services.

The next thing which is important to know the Contribution Margin is Variable Cost. It is the cost on which the product is sold. It is different from the selling price.

The third thing we should be aware of is number of units sold.

Check out more Financial Calculators here –

Contribution Margin Calculator Product Details

Following are the product details:

- Sales per Unit

- Variable Cost per Unit Sales

- Contribution Margin

So now, when you have decided to find out in depth details of a company, we would like to guide you in this journey.

After knowing sales revenue, variable cost and number of units sold, we can easily calculate the above three values, i.e., sales per unit, variable cost per unit sales and contribution margin.

And after collecting the required details, you need to input in the formula discussed further. After correctly entering the values, you will then get the product. The product received is itself Contribution Margin.

In this process, one can find the Contribution Margin of any product or multiple product one by one. This helps you to know a company better for evaluating its future performance.

How to use Contribution Margin Calculator?

Simple is the process to use Contribution Margin Calculator, for this there are three important things you should know. This calculator gives an idea of profit of the company earned by a company after selling its products.

This task can be performed for any company one wish to invest in. Further, we have illustrated an example for you for better understanding.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Contribution Margin Calculator Usage

In this section, we will discuss here an example. For an idea, we assume that ABC is a company, and here we will calculate its Contribution Margin

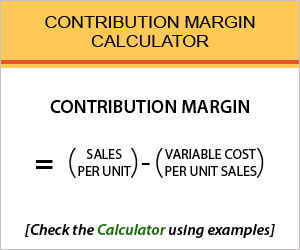

The formula to calculate Contribution Margin is:

Contribution Margin = Sales per Unit – Variable Cost per unit Sales.

The details required for computation is available in the table given above.

Sales per unit (Rs.) = 100

Variable cost per unit sales (Rs.) = 30

Now putting the values in formula,

Contribution Margin = 100-70

Contribution Margin = Rs.30

As we can see, with this simple procedure one can easily find the product.

What is the use of Contribution Margin Calculator?

There can be various use of Contribution Margin Calculator. Via this calculator, sales per unit, variable cost per unit and contribution margin cab be calculated of any product.

This enables investors to have an idea of profit earned by a company. One can have strong reasons from this factor, whether it is right to invest in the company or not?

Contribution Margin Calculator Formula

The Contribution Margin Calculator Formula can give various information about the firm.

The details require here can be easily obtained from the company. It shows that whether a company is earning profits for its sale or not.

Contribution Margin – Conclusion

Here, in this article we have discussed every minute detail regarding Contribution Margin Calculator.

Via this, an investor can compare various companies on the basis of their profits earned.

For more information or any query, you can contact us via writing your comments in the comment box.

Open Demat Account Now! – Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles