Bid Ask Spread Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 16, 2022Check out Bid Ask Spread Calculator here. People, who are interested in investing in securities from the exchanges or buy some of the same, shall check out how mobile the option is. To do so, the Bid Ask Spread formula comes handy.

In this article we have mentioned all the uses to which this formula is applicable, way of calculating and also what the significant figure speak of the investment option. It is used in a number of investments but majorly in exchange investment.

Bid Ask Spread Calculator

Open Demat Account Now! Save upto 90% on Brokerage

Bid Ask Spread Calculator Details

The details necessary to be entered into the formula are:

- Ask price

- Bid price

The two details required to calculate the formula are ask price and bid price of the investment in concern. The ask price is the amount in which the owner of the investment offer to sell at.

Whereas, the bid price is the amount which a buyer is willing to pay for the same investment option. Both the criteria’s are to be met for the transaction to take place. And the difference between both the referred prices is denoted as the bid ask spread.

Check out more Financial Calculators here –

Bid Ask Spread Calculator Product Details

When the above mentioned details are obtained and used with the formula, you will get the result also mentioned to as the bid ask spread.

The difference, or the result here speaks of the current demand and supply of investment option in concern, as there are vast numbers of buyers willing to buy a security and proportionately higher number of sellers willing to sell their securities, both at different price mediums.

They proportionately vary in terms of variety of investment options. You may be able to have an idea of the mobility of the investment option, if you calculate the formula and evaluate a series of products.

How to use Bid Ask Spread Calculator?

You will find the bid ask spread calculator at the end of the page, where you will find separate columns for both the ask price and the bid price.

If order to catch hold of the liquidity of the investment option in concern, you need to enter in both the details in the respective columns, followed by which you need to press the enter button.

In a second or so, you will be able to get the basic difference between both the ask price and the bid price, or in other words, the result referred to as Bid ask spread here.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Bid Ask Spread Calculator Usage

Let us get to the forking of the formula.

The formula is:

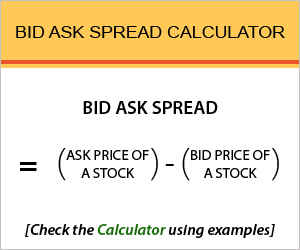

Bid ask spread = Ask price – bid price

Let us work the rather easy formula:

Bid ask spread = 0.05

So, here we have a stock, which is offered for sale at Rs.37.80 and the bid which is received for the same stock is Rs.37.75, thereby creating a bid ask spread of Rs.0.05. Here, the stock will only be bought or sold when the offer price matches the bid price or a bid process matches the offer price.

What is the use of Bid Ask Spread Calculator?

Liquidity of an investment is the outcome of the calculating bid ask spread. It usually is used and also differs based on investments such as properties or articrafts and securities which are traded on exchanges.

Investments listed on securities generally have a lower bid ask spread and higher trade volume, for the people bidding and asking are proportionately higher, whereas people willing to buy properties or articrafts are lower in number.

Another criteria one has to understand regarding an investment option is that the securities which have higher liquidity would have a simultaneous lower bid ask price and vice versa. Stocks, commodity futures, currency etc are all more liquid.

Bid Ask Spread Calculator Formula

Though easy, let us go through the formal a bit more formally.

As we have already gone through the details required pretty clear, memorizing the formula is pretty clear. You now are free to execute the formula, while checking on the liquidity in securities, or investments.

You know the obvious and where the formula can be applied. The formula can also come handy while calculating the profit which is earned by an intermediary if he offers to sell a stock at a fixed price and also offer to buy it at another price range.

Bid Ask Spread – Conclusion

We have contributed to you as much as we could, and the rest depends upon your decision making criteria. Being well versed with the formula you can now evaluate the liquidity of investment options and choose the best possible one, where investments will bear you actual fruitful returns, exceeding your expectations.

Open Demat Account Now! Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles