Assets Turnover Ratio Calculator – Find Formula, Check Example, Calculate & more

Last Updated Date: Nov 16, 2022Take the right step with Assets Turnover Ratio Calculator, to know the productivity of assets of any company.

This article in the end will lead you to know the Assets Turnover Ratio of any firm by a simple calculation, which in turn gives you an idea of sales of a company via assets.

Read the full article to know how to calculate the ratio with a simple formula.

Assets Turnover Ratio Calculator

Open Demat Account Now! Save upto 90% on Brokerage

Assets Turnover Ratio Calculator Details

Initially to find the ratio, you need to know some necessary factors which are as follows:

- Total Assets at the Beginning of the Year

- Total Assets at the End of the Year

- Sales Revenue

On the basis of above three factors, investor can easily find out the ratio in least time. For better understanding, the first and the second factor is the total asset which a company holds in the beginning and the end of the year.

Further these details are available on the balance sheet of the company.

Sales Revenue, third factor that is required for calculating ratio means the income which a company receives via sale of goods and services.

Check out more Financial Calculators here –

Assets Turnover Ratio Calculator Details

Now when you are aware of the factor details, the next part is the execution of calculating process.

The factors need to be properly placed in the formula to calculate Assets Turnover Ratio.

Also The result than received after putting details in the formula is the product of the calculation.

As the result you receive is Assets Turnover Ratio.

So, now we think you are well aware of the details to find out the ratio with the help of Assets Turnover Ratio Calculator.

Have a quick look on the further discussion to know the use of this calculator.

How to use Assets Turnover Ratio Calculator?

As we know, to move ahead with the calculation process, it is important to know the sales revenue and total assets of a company in the beginning and the end of the year.

This information can be gathered form the balance sheet and income statement of the year. Remember to take total asset value for the beginning and end of the year, both.

Further, you don’t have to do much, the calculator ahead will calculate the ratio. Do keep a check on all the factors, so you know they are placed in the right place to get the accurate product.

Find out other Financial Ratios & Technical Analysis Calculators here

Example of Assets Turnover Ratio Calculator Usage

Making it simpler, discussing here an example to Assets Turnover Ratio of an XYZ Company.

If a person wants to know the Assets Turnover Ratio of XYZ Company, the basic details required are:

Total Assets at the Beginning of the Year (Rs.) = 200000

Total Assets at the End of the Year (Rs.) = 400000

Sales Revenue (Rs.) = 150000

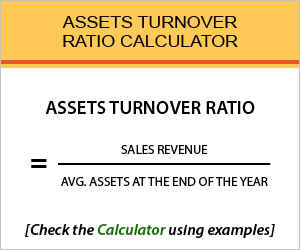

Formula to calculate Assets Turnover Ratio = Sales Revenue / Average Assets at the end of the Year

Let’s find out the Average Assets in the end of the year = (total assets at the beginning of the year + total assets at the end of the year)/2

Average Assets in the end of the year = (400000+200000)/2 = 300000

Putting these values in the formula = 150000 / 300000

So, Assets Turnover Ratio = 0.5

You can find out Assets Turnover Ratio of any company with the same process.

What is the use of Assets Turnover Ratio Calculator?

For the investors, concern about the financial balance of the company this calculator can help them to know up to what extent assets of company are profitable.

Moreover, higher the Assets Turnover Ratio, asset value will also be higher. This calculator is one of the important sources to know the how much revenue can be generated via assets of a company.

Assets Turnover Ratio Calculator Formula

Looking at Assets Turnover Ratio Calculator Formula:

The formula require the average of total assets of a company in the beginning and in the end of the year.

When you are aware of the ratio, it is easy to determine the value of company. Higher the Assets Turnover Ratio, an investor can generate more revenue and vice versa.

Don’t opt the company for investment if the ratio is too low.

Assets Turnover Ratio – Conclusion

Each point discussed in this article is easy to understand and making investment journey a little smooth, now investor will can compute Assets Turnover Ratio in just no time.

If any issue is faced regarding Assets Turnover Ratio calculator, write to us and get your issue resolved asap.

Open Demat Account Now! Save upto 90% on Brokerage

Find out all Business & Fundamental Analysis Calculators here

Most Read Articles