Zerodha Coin Platform – Review, Usage, Charges, Features & more

Last Updated Date: Dec 01, 2022These days many people are looking to invest their hard-earned money in mutual funds. Mutual funds can be purchased through a distributor and the other option is to purchase them directly from AMC.

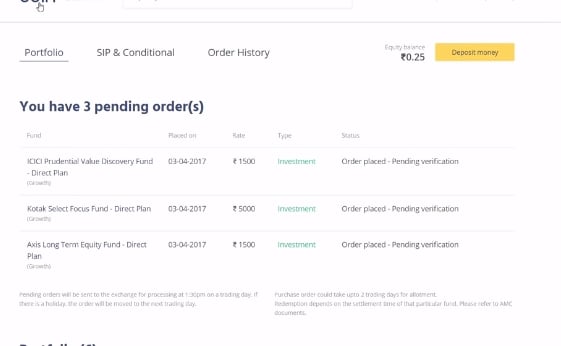

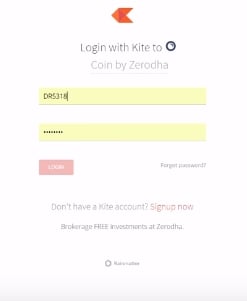

Now through Zerodha Coin, you can put conditional order or NAV Tracking order to buy Direct Mutual Funds which is only applicable through Zerodha. Also, you need to Login through Zerodha Kite if you want to access the Zerodha Coin platform.

Zerodha Coin Review & Ratings by Top10StockBroker

| Zerodha Coin Ratings | |

| Criteria | Ratings |

| Processes | 8.4/10 |

| Usability | 8.3/10 |

| Features | 8.5/10 |

| Speed | 8.3/10 |

| Performance | 8.5/10 |

| Overall Ratings | 8.4/10 |

| Star Ratings | ★★★★★ |

About Zerodha Coin

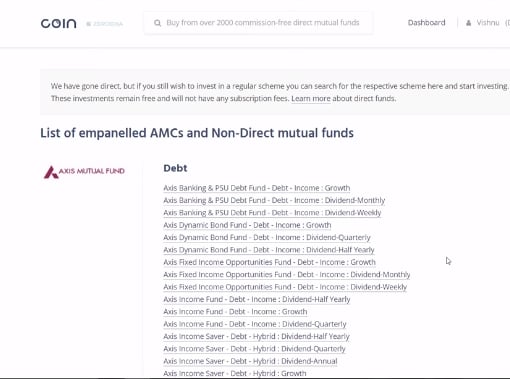

Zerodha Coin is a direct Mutual Fund platform, through which the investors can purchase mutual- funds directly and without any distributor. The investors are charged a zero commission for their investments in these mutual funds. By utilizing this platform, one can get mutual funds directly in the Demat account.

Thus, now the customers of Zerodha can have a single platform for diversified portfolio options like currency, mutual funds, stocks, and bonds. There is no fee charged for subscribing to the Zerodha Coin tool and one can have unlimited transactions in this subscription.

Investment through Distributors

When we purchase the mutual funds through the distributor, the distributors get a commission of 1.5 % on the investment done. They also get a trial commission of about 1.5 % of the investment each year for the years till the investment is active. This is the major reason you will find a lot of distributors, pushing you to have an investment in the mutual funds through them.

Direct Investment in MF

This is the alternate way of investing in mutual funds. In this option, the investors purchase the mutual funds directly from AMC. There are no intermediaries in this case. This will save the commission you have to give to the distributors when purchasing through the distributors. Both the upfront well as trail commissions can be saved in this case.

If one wants to invest directly, he can visit the office of the fund’s house or the website of the fund’s house. You will be required to fill a form to invest in a particular fund.

The negative aspect of direct mutual funds purchasing is that one has to track investments done in different funds, separately. One has to sign multiple forms (NACH) for SIP. It is also very inconvenient to make capital gain settlements as well as stop the SIP.

As per the latest updates, all the investments done by institutions are through direct mode. More than 90% of retail investors purchase mutual funds through distributors. This is because of the lack of awareness as well as lack of accessibility to a platform, which is convenient to invest in by employing the Direct Option.

Based on the recent circular from SEBI, the exchange platforms can now offer direct mutual funds. These mutual funds are provided in the Demat form.

Get a Call back from Zerodha – Fill up the form now!

Know everything about other Stock Broker Trading Platforms

Zerodha Coin Charges

In an attempt to make amendments to the current prevailing market demand, Zerodha offers a free Mutual Fund Platform now, which was previously attached to a fixed charge. Zerodha efficiently collaborated its brokerage free plan to go with Free Mutual Fund Platform.

In this manner, irrespective of the amount you invest in this platform, there shall be no charges tag attached. Each and investment made in Coin is FREE from Brokerage. There are no fees no brokerage or commission, while you can plan unlimited investment.

Zeroda Coin – Salient Features

Unlimited Free Investments

While regular mutual funds are subject to a percentage of commission, direct mutual funds let you invest for free. Herein, Zerodha lets you invest in Mutual Funds for free, via the free-to-use Mutual Fund Platform Coin. You may connect with AMC directly and avail for funds with Zero brokerage or commission.

Flexibility

SIPs you invest in will be under your management, with utmost flexibility. You will be able to create, pause, and modify your SIPs at free will. Also, the process is instant and with no barriers.

Easy Navigation

In this platform, navigation is at its best and simplest form. You can instantly place search and encounter funds you are looking out for. You can check and search for funds as per categories and also on the basis of sector data.

In Dept Scheme Data

You can easily take a peek into the underlying securities of the fund. End-to-end data on weights of the same is provided, and data is also classified and categorized as per sector.

Insights on Fund House

You can be your judge and select the funds as per the managers assigned to it. The platform features short videos, where managers give the inverts a sneak peek into the funds.

Tax and Payments

Payments are instant, and the easiest of the medium, i.e. UPI payment is provided. Furthermore, ELSS Funds are as well included, which lets you save tax under section 80C. Filing tax is as well one-click away in accords with the One-click statement option.

Other features

- eMandate facility is provided, which lets the investors automatically transfer funds for SIP installments.

- Other features include XIRR or annualized and absolute returns.

- Dematerialization of Mutual funds is the means for easy pledging, to further invest in derivatives and stocks.

Find Trading Platforms of other Stock Brokers

Advantages of Zerodha Coin Platform

As mentioned above, Zerodha Coin is one of the best platforms available to purchase mutual funds directly. Some of the key advantages of the Zerodha Coin platform are as follows:

1) Firstly, there is no distributor involved in this process and thus, you directly deal with the fund’s houses.

2) It saves a lot of commission when compared to the distributor-based option.

3) The mutual funds are provided in the Demat format, which is convenient to maintain a diversified portfolio.

4) One can avail a single capital gain statement for different investment entities.

5) One can avail single profit and loss visualization for investment done in various options.

6) The traders and investors can start an easy SIP. That is, they can start, stop and modify their SIPs at any time and with convenience.

7) One can place orders based on the net asset value or NAV of various mutual funds. These NAVs based orders can be placed similarly to the limit orders of stocks

Disadvantages of Zerodha Coin Platform

Zerodha Coin is a platform that streamlines the process of buying mutual funds by the traders as well as investors. However, there is a disadvantage to this platform as well:

1) This platform is rendered in the web format. Hence, one will need an active internet connection to operate this platform. This tool cannot be accessed offline.

Conclusion on Zerodha Coin

Zerodha Coin is a one-stop solution for the needs of traders and investors, who want to invest in mutual funds. This is an interface, through which various mutual funds can be purchased in the Demat format directly from the fund’s houses. This will save a lot of commission which was charged while investing through the distributors. This platform will help traders to have a diversified investment portfolio through a single interface. There are numerous other benefits of this platform which were discussed in the previous sections.

Get a Call back from Zerodha – Fill up the form now!

Find Advanced Trading Platforms of multiple Stock Brokers

Most Read Articles