Networth Direct Review & Brokerage Charges

Last Updated Date: Nov 18, 2022Networth Direct is a Full Service broker based out of Mumbai. Lets have a detailed Networth Direct Review & understanding of Networth Direct Demat Account, Networth Broking Brokerage Charges, Networth Stock broking Trading Platforms & other important features.

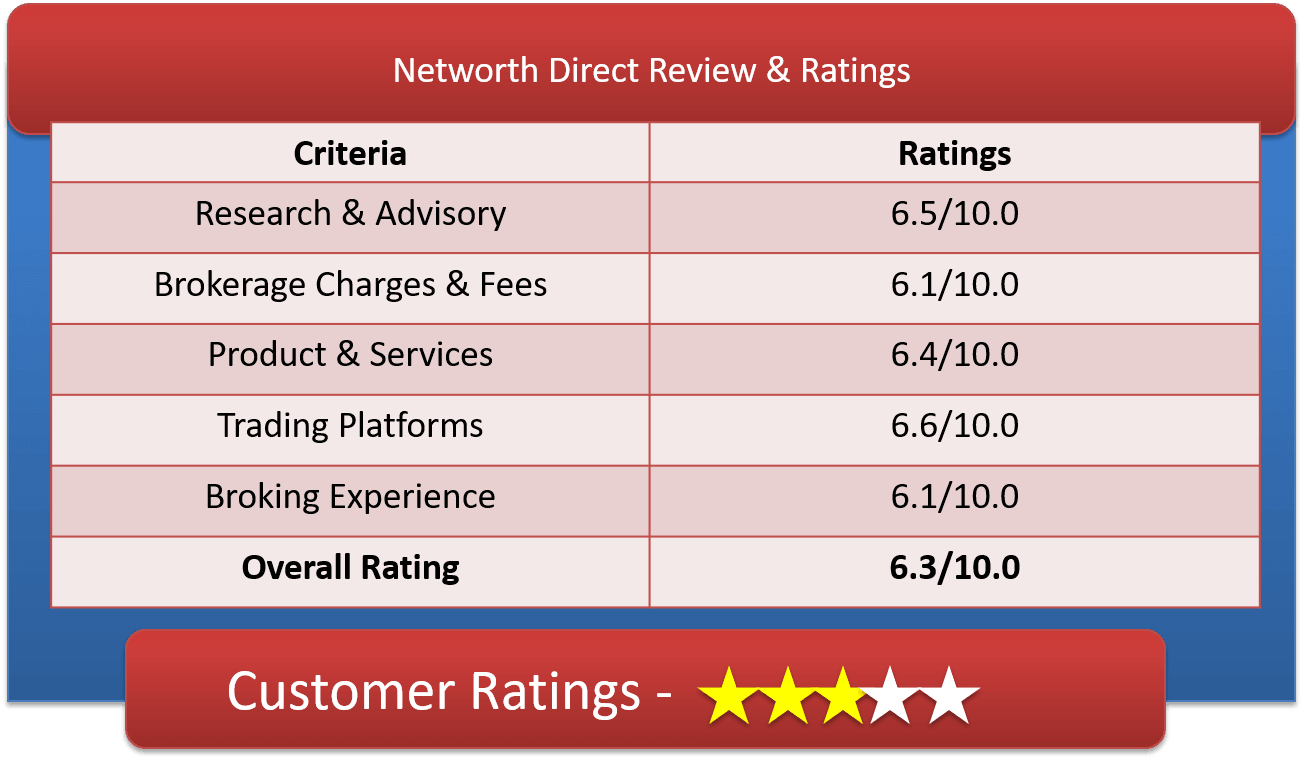

Networth Direct Customer Ratings & Review

About Networth Direct

Networth Financial Services Ltd. has been effectively providing premium financial services and information for more than a decade. Networth Broking also known as Networth Direct or Networth Stock Broking offers services to trade in equity, derivatives, commodity and currency. The broking house also provides its services on IPO, MF, and other services like loans, bonds, FDs, Life Insurance, General Insurance and Depository services.

Open Demat Account with Networth Direct

Networth Stock Broking Ltd. (NSBL) is the stock Broking arm of Networth that has membership in NSE and BSE for Capital Market as well as Derivatives (Futures & Options) segment and with NSE, BSE, USE & MCX-SX for currency derivatives segment. The full service broker has DP with CDSL and NSDL. Networth Direct has a network of around 340 branches across India and around 100,000 plus loyal customers. The company is in alliance with PNB for online trading. Networth Direct is also a Charter member of Financial Planning Standards Board of India [FPSB].

More About Networth Stock Broking

NCIL is the commodities arm of NSBL. It is a member at the Multi Commodity Exchange of India and National Commodity & Derivatives Exchange (NCDEX).

Call and trade facility is available for free at a special toll free number 1800 3000 0333 which we see among few brokers.

Networth broking also offer trading facility to NRIs. For this a NRI trading account can be integrated with a depository account to give NRI full investing functionality in their own country. Networth Direct’s dedicated Research Cell provide in-depth research reports like India Market Report, Pivot Points, Result preview and updates, Company’s financial reports, IPO analysis etc. They also send research tips through SMS to advice their investor.

Customer Care is taken care well at Networth. Response to all queries are addressed within 1hr which we found to be really surprising. Networth Direct provides regular updates on ledger balance, credit of bonuses and dividend. All other trading related details are also sent through SMS service.

Networth Direct Products & Services

Here is the list of products & services offered by Networth Broking

Networth Broking Products

- Equity

- Derivatives

- Commodity

- Currency

- Mutual Fund

- Insurance

- Bonds

- Fixed Deposit

- Loans

Networth Stock Broking Services

- Demat Account

- Trading Account

- Depository Services

- Advisory Services

- Research Reports

- IPOs

- 24*7 Customer Support

- NRI Services

Networth Direct Brokerage Charges & Fees

Brokerage charges are negotiable and customizable so it not available onsite. You can contact the local broker to know all the charges and fees.

Networth Stock Broking Brokerage Charges: Basic Plan

| Brokerage Plan | Basic Plan |

| Flat Fee | NA |

| Equity Delivery | 0.10% to 0.30% |

| Equity Intraday | 0.005% to 0.03% |

| Equity Futures | 0.005% to 0.03% |

| Equity Options | Rs.25 to Rs.50 per lot |

| Currency Futures | 0.005% to 0.03% |

| Currency Options | Rs.25 to Rs.50 per lot |

| Commodity | 0.005% to 0.03% |

Open Demat Account with Networth Direct

How to Open Networth Direct Demat Account?

There are few simple ways to open an account with Networth.

- Fill an online Application Form: Fill the Contact Form

- Call at one of the below number and ask to open an account with them.

- Toll Free No.: 1800-220-223

- Other No: 022-30641700

- Call & Trade (Toll Free): 1800 3000 0333

- Visit one of their nearest branch and you will find representative to help you out: Click on this link Networthdirect.com/Branches/BranchNetwork.aspx to find the branch closest to you. They have 156 branches across the India.

- Mail them your details at reachus@networthdirect.com, and their relationship manager will contact you.

Why Open Networth Broking Demat Account?

- Free Call and Trade service

- Efficient Grievance handling

- Serves multiple investment products

- Highly skilled and Dedicated Research Team

- Around 300+ centers across India

- A Charter member of Financial Planning Standards Board of India [FPSB]

- Own DP service

- Serves NRIs

- Other services like Health Plan, General Insurance and Life Insurance

Networth Direct Trading Platforms Review

This broking house supports web based trading through their highly secured web portal networthDirect.com.

Networth Broking Web based Trading Platform: NetworthDirect.com Review

This is the online platform of Networth. This is enriched with features like invest online in IPOs/MFs/Equities, you can customize and integrate screen as per your need which makes it handy. Integration of your bank account, trading account & demat account, Online Portfolio Tracker and 128-bit encryption to ensure the highest level of safety. Integrated with multiple payment gateways and depository services for seamless transaction capability makes it pleasurable experience.

Networth Direct Backoffice Portal: My Networth

This is backoffice support by Networth that provides access to your accounts and statements, with 24×7 availability. You have access to multiple transactional detailed reports viz. financial statements, net position, settlement bills, delivery reports, transaction statement, contract note etc.

Networth Direct Advantages / Disadvantages

Networth Direct is more interested in carrying business through their sub brokers and branches in different cities. Their focus is to attract local customer city wise and not on centralized online trading. It can be visualized by simple site design and not many tools and platforms offered. Brokerage is also negotiable.

Networth Stock Broking Advantages

- Well-organized and effective Complaint Handling

- Free-call & trade

- SMS Service

- Tips & recommendations based on quality research and multiple trading products available.

Networth Broking Disadvantages

- Mobile app based trading not available

- Investment tools missing

Open Demat Account with Networth Direct

List of all Full-Service Brokers in India –

Angel Broking , Motilal Oswal , Kotak Securities , HDFC Securities , Sharekhan , India Infoline / IIFL , ICICI Direct , Edelweiss , Karvy , SBI Cap Securities , Geogit BNP Paribas , Anand Rathi , Religare Securities , Indiabulls Ventures , Just Trade , Ventura Securities , Aditya Birla Money , Axis Direct , SMC Global , GEPL Capital , IDBI Direct , GCL Securities , Arihant Capital , Mangal Keshav , MasterTrust , Networth Direct , Reliance Securities , Sushil Finance , LSE Securities

Important Blog Posts –

Top 10 Stock Brokers in India , Top 10 Intraday Trading Brokers in India , Top 10 Sub Broker Partner in India , Best Demat Account in India , Full Service Broker vs Discount Broker in India , 10 Best Practices of Share Market Investment , Mutual Fund vs Real Estate Investment