SMC Global Review & Brokerage Charges

Last Updated Date: Jan 05, 2024SMC Global is one of the largest full services brokers based out of New Delhi. Let’s have a detailed review of SMC Online Demat Account, SMC Global Brokerage Charges, SMC Trade Online Trading Platforms & other important features.

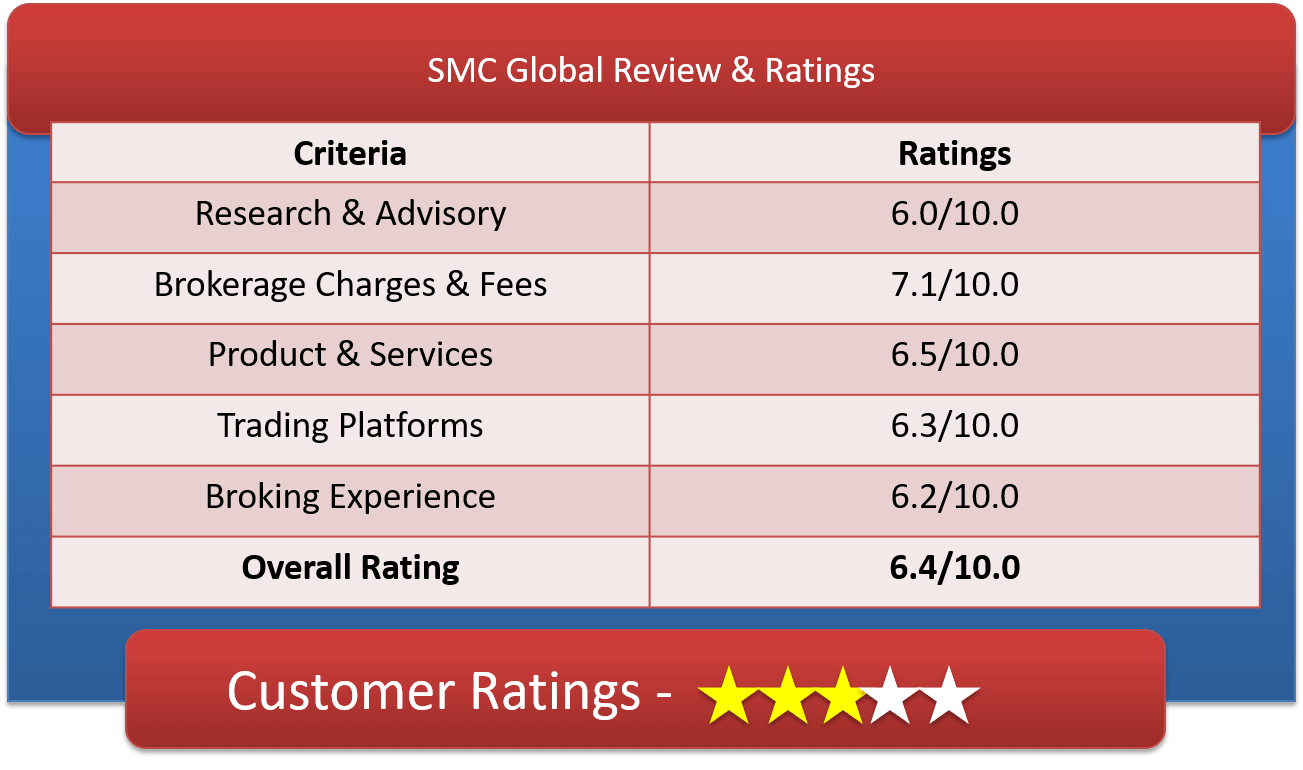

SMC Online Ratings & Reviews by Top10StockBroker

SMC Global or SMC Online belongs to the domain of discount brokers, or rather the trending brokers. This company has managed to gain a vast customer base, all of which have mostly had positive reviews to provide. The satisfaction level of the existing clients is high, which makes them a good choice for trading needs.

About SMC Global / SMC Online

SMC Global or SMC Online or SMC Trade online is offering services in stock, commodity and currency broking. Apart from this, they are also offering investment banking, wealth management, distribution of third-party fin products, research, financing, depository services, insurance broking, and clearing services. SMC Global also helps you with real estate advisory services (mainly to corporate, institutional, high net-worth individuals and other retail clients).

Online Stock Trading is a new endeavour of SMC Global. SMC Global by having a tie-up with Punjab National Bank is providing a share trading facility to its clients. SMCtradeonline.com and SMCindiaonline.com is the way out for all the information related to the broker. The Broker got awarded as Best Commodity Broker, Best Currency Broker, and Best Research analyst for Equity, IPO and Commodity.

You can do online trading in Equities, Derivatives, Currency, Commodities, IPOs, MF and Bonds with SMC Global.

SMC have an excellent team of Research Analysts and Advisory Managers to help you with strategies for equity and derivatives investment. The team also provides valuable recommendations for trading in the futures & options segment.

Customer care is taken into account via email, phone, toll-free no and SMS. They have one of the largest distribution networks in the country. SMC Global boasts of having a network of 61 branches. Their branches include an overseas office in Dubai and more than 2,290 registered sub-brokers and authorized persons with a presence in regional India and over 550 cities.

Open Demat Account with SMC Global

SMC Global Brokerage Charges & Fees

SMC Online claims to have competitive brokerage rates but they prefer to serve on one to one basis depending upon your volume traded and bargain quality. This broking house serves their clients personally as they have branches and sub-brokers offices available across the country.

SMC Global or SMC Online Brokerage Charges

| Plan | Brokerage Slab |

| Elite | 0.16% (Delivery) & 0.016% (Intraday, F&O) |

| Premia | 0.20% (Delivery) & 0.02% (Intraday, F&O) |

| Prefered | 0.30% (Delivery) & 0.03% (Intraday, F&O) |

| Lite | 0.35% (Delivery) & 0.035% (Intraday, F&O) |

| Basic | 0.40% (Delivery) & 0.04% (Intraday, F&O) |

There are 5 separate plans offered by the stock broker and the rates differ as per the plans. The basic plan has a brokerage of 0.40% for Delivery) & as for intraday and F&O, the brokerage is 0.04%. Here is the add-on information you need to know about.

- Elite – You get an AMC waiver of up to 3 years in this plan. The margin amount is 1,00,000 and above, AOC is nil and the brokerage cash back limit is Rs.50,000.

- Premia – For this plan, the margin amount is Rs.50,000 and above. If you opt for this plan, you will not have to pay an opening charge, or AMC for 2 years. Finally, the brokerage cashback limit is Rs.25,000.

- Preferred – There is a margin amount of Rs.25,000 and above for this brokerage plan. For opting this plan, you need to pay an opening charge of Rs.599, and an AMC from the second year, which means it is free for a year. Now, the brokerage cashback limit is Rs.10,000

- Lite – Rs.10,000 and above is the margin for this plan. AMC is not present for up to a year in this plan, whereas the opening charge is Rs.599. The brokerage cashback limit is Rs.5,000.

- Basic – As for the margin for the basic plan, it is less than Rs.10,000, AOC is Rs.599 and the brokerage cashback limit is Rs.1,000. AMC is waived off for a year here.

Know the Brokerage Charges of other Discount Brokers

| Sharekhan | Edelweiss | Indiabulls Ventures | Kotak Securities |

| Angel Broking | HDFC Securities | India Indoline / IIFL | Motilal Oswal |

| Axis Direct | ICICI Direct | Karvy | Upstox |

SMC Online Charges

Equity Intraday: 0.025% on the Sell SideEquity Futures: 0.01% on Sell SideEquity Options: 0.05% on Sell Side(on Premium)Commodity Futures: 0.01% on sell-side (Non-Agri)Commodity Options: 0.05% on sell-side currency F&O: No STTOn Exercise transaction: 0.125%Right to entitlement: 0.05% on sell-side

| Other Charges | |

| SEBI Turnover Charges | 0.00005% (Rs.5/Crore) |

| STT | |

| Stamp Duty | (On buy side only) Delivery: 0.015%, Intraday: 0.002%, Equity Futures: 0.002%, Equity Options: 0.002%, and Currency F&O: 0.0001%.Commodity Futures: 0.002%, Commodity Options: 0.002% (MCX) |

| GST | 18% on (Brokerage + Transaction Charge + SEBI Fee) |

| Margin Funding Charges | NA |

| Reactivation Charges | Rs 20 per instruction |

| Account Closure Charges | NIL |

| Dematerialisation Charges | Rs 5 per certificate |

| Pledge Creation | Rs 60 per Instruction |

| Pledge Invocation | Rs 20 per Instruction |

| Margin Pledge/Unpledge/ Pledge closure | Rs 20 per Instruction |

| Margin Repledge | Rs 25 per ISIN |

The tabular representation which is featured above gives you a brief overview of the other charges taken along with brokerage. All of the charges are taken on the basis of the overall turnover of the transaction and are in minor proportion. They are also subject to slight variation, as per separate segments.

SMC Global Other Charges

- Dematerialisation – There is a charge associated with this service and it is 5/- Per Certificate (Rs. 30/- for 1st Certificate). This comes in addition to the Courier Charges (Rs.25/- for Local & Rs.40/- for outstation courier).

- Rematerialisation – As per the charge set for remat, you need to pay 30/- per Certificate (1 Certificate / 100 shares). There is an add of Courier Charges of Rs.25/- for Local & Rs.40/- for outstation courier.

- Pledge – For the purpose of creating a pledge, you need to pay Rs.60/- per Instruction. Contrarily for closure of pledge or invocation, you will be required to pay Rs.60/- per Instruction

SMC Global Demat Account Opening Charges

| Account Opening Fees | |

| Trading Charges [One Time] | NIL |

| Trading AMC [Yearly] | NIL |

| Demat Charges [One Time] | Rs 499 |

| Demat AMC [Yearly] | Rs 200 |

| Margin Money | Rs.10,000 |

| Offline to Online | Yes |

The above table is the summed-up analysis of the charges in relation to the demat account. There is a demat account opening charge of Rs.299 you need to pay, following which you need to pay an AMC or account maintenance charge of Rs.200 per annum.

The account opening change and AMC is subject to changes as per the type of account you wish to hold. The price is higher for NON POA and Corporate accounts.

SMC Online Offers

| Offers | |

| Free Demat Account | No |

| Free Trading Account | Yes |

| Discount on Brokerage | Yes |

| Trading Happy Hours | No |

| Flexible Brokerage Plans | Yes |

| 1 Month Brokerage Free | No |

| Holiday Offers | Yes |

| Referral Offers | Yes |

| Zero Brokerage for Loss-Making Trades | No |

There are a bunch of offers provided by SMC Global, which are closely related to a great trading experience for the clients. Though there is no free demat account service provided by the stock broker, you get a flexible discount on the brokerage plan. You also get referral benefits.

Precisely, there is a reward of Rs.1000 attached, when you refer a friend to SMC. There are also additional benefits provided, which are subject to constant changes.

How to Open SMC Global Demat Account?

- Fill up your details here – Fill Contact Form

- Following this, you will get a call from the company executives regarding the further application process.

- They will instruct you to go through the EKYC process, which is mandatory. They will provide you with the link to the KYC form, where you need to fill in the details of your identity, provide certain documents as proof and also attach a photograph.

- The broker will get in touch with you in case there is any other internal process of registration.

- When your identity is verified, you will get your account credentials in your email address.

Why Open SMC Online Demat Account?

- Integrated Bank, Trading and Demat accounts

- Useful Research & advisory support from a highly expert team

- Multiple trading options

- Portfolio tracker and User-friendly platforms that make trading a pleasant experience

- Invest online in IPOs, Mutual Funds, and GOI Bonds all from one website. General Insurance (non-life) is also available.

- Trading facility for NRI’s is a thing to watch

- Margin Trading facility to the tune of upto 5x

SMC Global Products & Services

Here is the list of Products & Services SMC Online Offers:

SMC Online Products

| Products | |

| Equity Trading | Yes |

| Commodity Trading | No |

| Currency Trading | Yes |

| Options | Yes |

| Futures | Yes |

| Mutual Funds | Yes |

| Forex | No |

| Banking | No |

| SIP | Yes |

| Insurance | Yes |

This discount broker is the perfect hub for investment and financial needs. They have efficiently managed demat and trading account services, alongside other investment vehicles. You can invest in a lot of segments, including derivatives.

There are also Mutual Funds and Insurance plans available with these stock brokers, making it the perfect one-stop-shop for financial needs.

SMC Global Services

| Services | |

| Demat Services | Yes |

| Trading Services | Yes |

| 3 in 1 Account | No |

| Intraday Services | Yes |

| IPO Services | Yes |

| Stock Recommendations | Yes |

| Robo Advisory | No |

| PMS | NS |

| Trading Institution | No |

| Trading Exposure | Upto 5x |

You get to invest in the intraday segment via the demat and trading account provided by SMC Global. There are also IPO services provided by the stock broker, alongside certain stock recommendation services, which would look out for you.

SMC Global Research

| Research & Advisory | |

| Fundamental Reports | Yes |

| Research Reports | Yes |

| Company Reports | No |

| Annual Reports | No |

| Company Stock Review | No |

| Free Stock Tips | Yes |

| IPO Reports | Yes |

| Top Picks | Yes |

| Daily Market Review | Yes |

| Monthly Reports | Yes |

| Weekly Reports | Yes |

| Offline Advisory | Yes |

| Relationship Manager | Yes |

Though SMC is a discount broker, yet, you can expect a certain kind of help related to research from them. The exact arenas in which they would help you are given in the table above, which includes top picks and daily market reports for your convenience.

SMC Global Exposure / Leverage

| Exposure / Leverage | |

| Equity Delivery | 1x |

| Equity Intraday | Upto 5x |

| Equity Futures | 1x |

| Equity Options | 1x |

| Currency Futures | 1x |

| Currency Options | 1x |

| Commodities Future | 1x |

| Commodities Option | 1x |

| Margin Calculator | SMC Margin Calculator |

Leverage or exposure is a service opted for by a lot of investors, who wish to crack profitable deals. As per the provided insights, you can see that the stock broker SMC Global provides an exposure of up to 5 times for the maximum in the intraday segment. The rest of the segments have an exposure limit of up to 1x and 1x respectively.

Check the Margin or Exposure of other stock brokers

| IDBI Direct | KIFS Trade Capital | Nirmal Bang | Prabhudas Lilladher |

| Jhaveri Securities | Mastertrust Capital | Groww | Profitmart |

| JM Financial | Monarch Networth Capital | Paytm Money | Reliance Securities |

SMC Global Trading Platforms Review

This full-service broking house supports Web-based, software-based and mobile App based trading Platforms for their clients. SMC Global’s trading platforms perform well in terms of speed, convenience and risk management.

Their two web-based platforms are:

SMC Select: SMC Online Web-based Platform

This is the web-based trading platform by SMC mostly suited to Retail investors for online trading and does not require any special software installation. The main features are:

- Trade on different exchanges on a single window

- Online transfer of funds through multiple banks is available

- Online Back office to track your investments

- IPO & Mutual Fund Online

- Technical SMS alerts facility is also available

- Latest news, market information and research reports on email.

SMC Exclusive: SMC Global Web-based Platform

Another web-based trading platform with live streaming quotes, This account is ideal for Active traders who transact frequently and in large volume during the day’s trading session to capitalize on intra-day price movements.

SMC Privilege: Trading Terminal

A software-based platform for active traders. It comes with features like Real-time streaming quotes, intraday charting, and Multiple Exchanges on a single screen. It also has a Fully Customizable Market Watch, Track Multiple Stocks on a single screen, Hot Key Functions etc.

SMC Mobitrade: SMC Global Mobile App

It is an application-based user-friendly interface for trading across Equity and commodities. It provides real-time access to market information like Script Info, Contract info and Best Five. Mobitrade is available in two modes, Lite which is refresh-based and Streaming which provides continuous streaming quotes. SMC mobitrade is available on BSE, MCX Commodity & NCDEX but not on NSE.

SMC TabTrade: Tablet-based Trading Platform

This is the app designed for I-pads and Android phones and tablets for trading in NSE Cash, NSE F&O, BSE Cash, BSE F&O, MCX, NCDEX & NSE Currency. Other feature remains more or less the same as SMC Mobitrade.

SMC Online Customer Care

| Customer Support | |

| Dedicated Dealer | Yes |

| Offline Trading | Yes |

| Online Trading | Yes |

| 24*7 Support | No |

| Email Support | Yes |

| Chat Support | No |

| Toll-Free Number | Yes |

| Branches | Zero |

Customer care services are pretty crucial, especially for a discount broker which operates online. You get pretty great assistance from SMC and multiple channels of communication which you can choose from.

Choose any medium of communication with them, and they shall be prompt regarding the resolution process, which is longed for by every investor.

SMC Trade Advantages / Disadvantages:

SMC Global offerings are no less no more but just right. The Broker has something extra to offer on almost all trading segments. The Brokers need to be more transparent in terms of brokerage and other charges.

Advantages

- Pan-India presence

- No trading account AMC

- Dedicated customer care

- Multiple Trading platforms

- Call and trade facility

- Clients can place AMO and BTST (Buy Today Sell Tomorrow) order options are available too.

Disadvantages

- Brokerage charges not disclosed easily

- Mobile trading is not available for NSE scripts

- No 3 in 1 account option available

- Extra charges for their featured products

- Good Till Cancelled (GTC) as well as Good Till Date/Time (GTD) Orders options are not available in the equity segment.

SMC Global – Conclusion

SMC Global is a name which carries positive weightage, with a fair share of satisfied customers. The service and products this stock broker has decided to provide are in line with the present need of investors, thereby making them a firm which is in demand.

For a discount broker, SMC can be deemed a rather great hub for satisfactory investment services. You can instantly get started with the firm and enjoy everything it has to offer, via its online and simple demat account.

SMC Global Review FAQs

Is SMC Global safe for trading?

Yes, SMC Global has emerged as a leader in the stock market and is one of the most competitive companies present in the market. They already have an active and satisfied client base, which is the assurance of the company’s reliability.

What is the brokerage of SMC Global?

The brokerage taken by this stock broking firm is subject to the 5 different plans it has to offer. You can check the article for precise insights on the plans, and their AOC, AMC or margin amount.

How to open SMC Global demat online?

If you have plans to open an SMC Global demat account then this page is your perfect spot. You must first click on the “Open Demat Account” button you see at the bottom of the page. Now, you must enter the data asked in the following quick pop-up and then follow up with the company.

Can I invest in an IPO via SMC Global?

Yes, IPO investment is absolutely possible with this stock broking house, SMC Global. You can seamlessly invest in the IPO you wish to, given you find a worthy opportunity. On the other note, you must be well aware of the process, terms and conditions.

What Leverage does SMC Global provide?

Looking out for the leverage facility, you can expect good enough support from SMC Global’s end. It is because this stock broking house provides up to 5x exposure. This is the highest leverage provided y with the company, and it is extended for the intraday segment.

Does SMC Global have a trading App?

Yes, a trading app is one of the highest demanded provisions in the market right now, and this stock broker has stood up to the same. They have a clean and simple app designed for their clients, to help them invest from anywhere and everywhere.

How to contact SMC Global customer care?

In case you ever have any queries or wish to speak with the stock broking firm’s customer care department, you can choose one of the mediums they provide for communication. You can choose to call them via their contact number, or even send them an email.

Does SMC Global provide Research?

Yes, you can expect research and advisory support from the company as they have a team working for the same. They have some of the industry experts working, who release research reports and tips for their customers.

Is SMC Global good for Beginners?

Yes, this stock broking house can result as a worthy enough option for investment, especially when getting started with stock market investment. They provide great assistance to their investors in many ways and including research and advisory support.

Who Founded SMC Global?

SMC Global has its origin dated back to the year 1994. It successfully started its services in the same year and was founded by Subhash C. Aggarwal who is presently the Chairman & Managing Director, and Mahesh C.Gupta, who is presently the Vice Chairman & Managing Director.

Know in detail about other Stock Brokers

| Religare Securities | Shri Parasram Holdings | Sushil Finance | Ventura Securities |

| SAMCO | Shriram Insight | Swastika Investmart | Way2Wealth |

| 5Paisa | SMC Online | Tradebulls | Yes Securities |

Open Demat Account with SMC Global

Most Read Articles