Arihant Capital Review, Brokerage Charges, Demat A/C, Platforms & more

Last Updated Date: Jan 16, 2023Arihant Capital is a part of Arihant Group was established in 1992. This security broker is associated with NSE and BSE. They provide a platform to trade in equity, commodity, and forex.

It offers financial services for demat, investment banking service, and merchant banking. Get to know more about Arihant Capital Stock Trading in detail about brokerage charges, offer, product and services and many more.

Let us examine in-depth information about the various proposals of value that it must offer its customers. This will hopefully help you decide whether or not to take Arihant Capital for your trading.

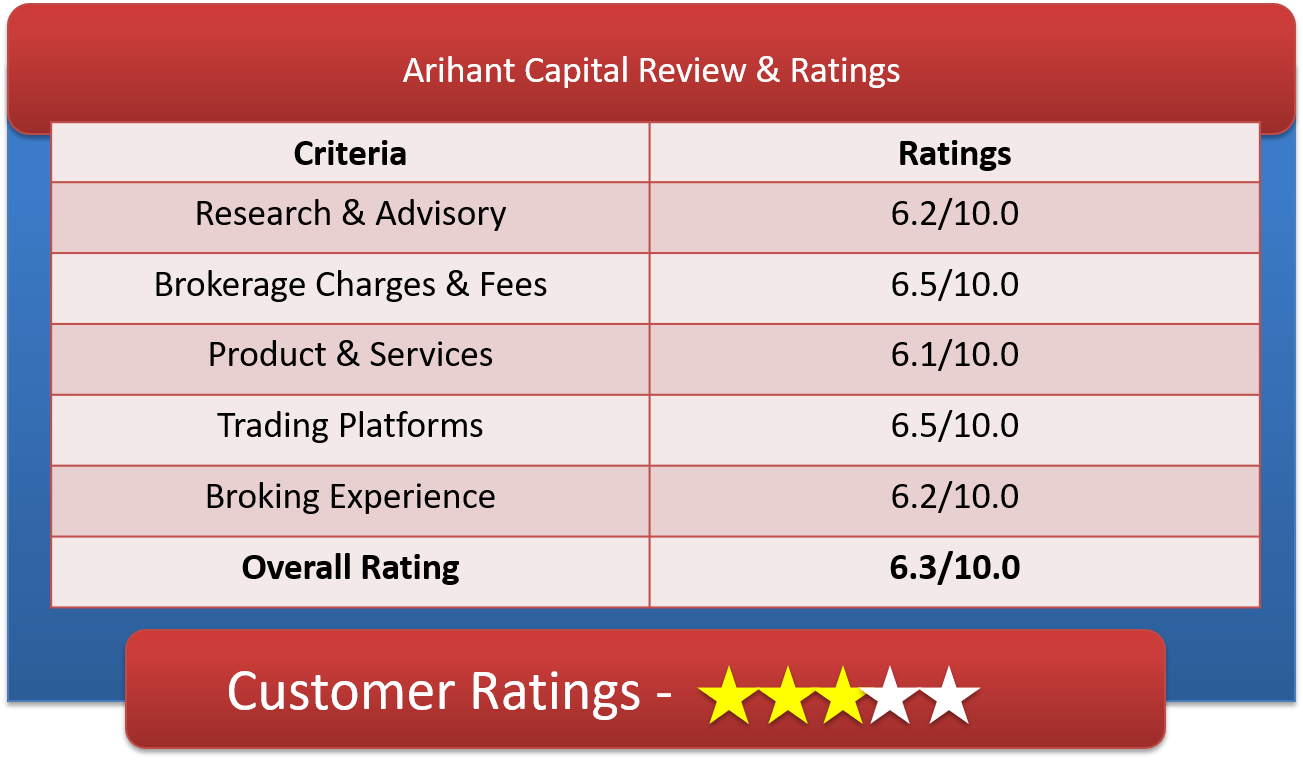

Arihant Capital Customer Ratings & Review

About Arihant Capital

| Overview | |

| Company Type | Public |

| Broker Type | Full Service Broker |

| Headquarters | Mumbai, Maharashtra |

| Founder | Ashok Kumar Jain |

| Established Year | 1992 |

Arihant Capital is a Mumbai based full-service stockbroker, incorporated in the year1992. This stockbroker has its presence in many cities of the country with close to 150 branches. It was founded by Ashok Kumar Jain.

Arihant Capital Markets Limited is a prominent financial service security in India that provides online and offline brokerage services with a variety of finance products and services like trading in equity, derivative commodity, and currency.

They provide many other financial options like clearinghouse services, distribution of financial instruments and merchant banking to a significant and varied clientele, including individuals, HNI clients, retail investors and financial institutions of financial products and commercial banking.

It has an organizational team for catering mutual fund firms, insurance companies, and all the leading banks active in the equity market segment.

They allow you to provide your customers with a Demat account on your own instead of a third party or partnership.

Get a Call Back from Arihant Capital. Fill up this Form.

Arihant Capital Brokerage Charges

| Brokerage Charge & Fees | |

| Equity Delivery | 0.30% |

| Equity Intraday | 0.03% |

| Equity Futures | 0.03% |

| Equity Options | Rs 30 per lot |

| Currency Futures | 0.03% |

| Currency Options | Rs 30 per lot |

| Commodity | Rs 30 per lot |

| Minimum Brokerage | Rs.30 per executed order |

| Demat AMC Charges | Rs 412 + GST |

| Trading AMC Charges | Free |

| Margin Money | 75% Margin |

| Brokerage Calculator | |

They provide you an opportunity two ways of trading in the security markets by paying brokerage charge. It is a charge levy on executing on every transaction of trading.

- Minimum brokerage charged is Rs.30 on trading.

- Equity Intraday trading brokerage is 0.03% of total transaction value.

- When you trade shares and hold on delivery of the shares overnight 0.30% of brokerage is charged for delivery trading.

- For trading in equity derivative future brokerage of 0.03% are levied.

- The brokerage of Rs.30 per lot for trading on equity derivative option is levied.

- Trading in currency derivative future brokerage of 0.03% is charged for every side of trading.

- For Currency options trading flat Rs.30 per lot are charged.

- Trading with Arihant Capital requires minimum 75% Margin of margin money to maintain on Demat account.

- Annual maintenance amount for Demat account is Rs 412 + GST and for trading is free.

Compare Stock Brokers

Find brokerage charges of other Full Service Brokers

| SBICap Securities | Aditya Birla Money | Asit C Mehta Investment | Bonanza Portfolio |

| 5Paisa | Alice Blue Online | Astha Trade | Choice Broking |

| Zerodha | Anand Rathi | BMA Wealth Creators | Geojit Finance |

Arihant Capital Charges

| Other Charges | |

| SEBI Turnover Charges | 0.00005% (Rs.5/Crore) |

| STT | Equity Delivery: 0.1% on both Buy and Sell Equity Intraday: 0.025% on the Sell Side Equity Futures: 0.01% on Sell Side Equity Options: 0.05% on Sell Side(on Premium) Commodity Futures: 0.01% on sell side (Non-Agri) Commodity Options: 0.05% on sell side Currency F&O: No STT On Exercise transaction: 0.125% Right to entitlement: 0.05% on sell side |

| Stamp Duty | (On buy side only) Delivery: 0.015%, Intraday: 0.002%, Equity Futures: 0.002%, Equity Options: 0.002%, and Currency F&O: 0.0001%.Commodity Futures: 0.002%, Commodity Options: 0.002% (MCX) |

| GST | 18% on (Brokerage + Transaction Charge + SEBI Fee) |

| Margin Funding Charges | 18% |

| Reactivation Charges | Rs 20 per instruction |

| Account Closure Charges | Rs 35 per instruction |

| Dematerialisation Charges | Flat Rs 5 per certificates |

| Pledge Creation | 0.02% of the value of the scrip (Min Rs 25) |

| Pledge Invocation | 0.15% of the value of the scrip (Min Rs 25) |

| Margin Pledge/Unpledge/ Pledge closure | 0.02% of the value of the scrip (Min Rs 25) |

| Margin Repledge | 0.02% of the value of the scrip (Min Rs 25) |

The transaction level charges laid by Arihant Capital are quite rational and marginal in essence, as relative to the industry norms, especially amongst the full service security broking.

- A per transaction fee of 0.00290% of total turnover is a cost a trader must pay each time it processes trading.

- STT charge of 0.0126% on total turnover a trader pay on the value of securities transacted by a stock exchange. It is exempted of commodities and currency trading.

- Stamp Duty varies from state to state.

- GST of 18% is charged on sum of total brokerage and transaction charge.

Arihant Capital Demat Account Opening Fees

| Demat Services | |

| Trading Charges [One Time] | NIL |

| Trading AMC [Yearly] | NIL |

| Demat Charges [One Time] | Rs 100 |

| Demat AMC [Yearly] | Rs 412 + GST |

| Margin Money | 75% Margin |

| Offline to Online | Yes |

- Depository Source for trading is both CDSL & NSDL.

- Opening account charges for trading is free of any charge.

- Maintenance of Demat account is Rs.412 + GST is needed to pay yearly.

- It is free of charge to maintain a trading account.

- Traders are required to maintain 75% Margin as the security deposit.

Arihant Capital Offers

| Offers | |

| Free Demat Account | No |

| Free Trading Account | Yes |

| Discount on Brokerage | Yes |

| Trading Happy Hours | No |

| Flexible Brokerage Plans | Yes |

| 1 Month Brokerage Free | No |

| Holiday Offers | Yes |

| Referral Offers | No |

| Zero Brokerage for Loss Making Trades | No |

Arihant Capital security offers attractive plans to engage its customers and maximum trading.

- Trading account is provided free of cost to traders to boost trading.

- Traders are provided a discount on brokerage.

- They have flexible brokerage plans so traders can select plans as required.

- Holiday Offers are rewarded to their customers.

Find Offers from other Broking Houses

How to open Demat Account with Arihant Capital?

To open demat account for trading follow these simple steps.

- Visit the Arihant Capital website and tap for option ‘Open trading account’.

- Fill the form provided with all complete details.

- You will receive a call for fixing an appointment.

- The representative will visit your place to complete and collect full documentation.

- Within a few days you will receive your demat account.

Get a Call Back from Arihant Capital

Why Open Arihant Capital Trading Account?

Around the same time, if you continue with Arihant Capital, you will receive the following benefits:

- As a full-service stock broker they have fair prices.

- Equity, MCX, NCDEX, depository services, currency derivatives, IPOs, mutual funds, online trading, bonds you can get all this at the Arihant security regardless of what investment services and products you want.

- A wide range of trading platforms supports every device.

- Professional representative in finance to help you to build a personalized portfolio and trading.

- Appoints experts with skilled financial planners for planning your financial opportunity.

- Various financial modules are offered for investments and trading.

- Center of knowledge and understanding for newcomers and beginners for trading.

- Various customer problem resolution channels are accessible.

- Provide attractive investment opportunities and assist you to associate major market patterns and ensure that data reaches you as soon as possible.

Arihant Capital Products & Services

List of products & services provided to its clients

Arihant Capital Products:

| Products | |

| Equity Trading | Yes |

| Commodity Trading | No |

| Currency Trading | Yes |

| Options | Yes |

| Futures | Yes |

| Mutual Funds | Yes |

| Forex | No |

| Banking | No |

| SIP | Yes |

| Insurance | No |

A large range of financial investment and solution are provided to suits your financial objectives.

- In order to create and maintain a portfolio you can have access that suits to your needs, to a wide variety of investment options, online trading systems, analysis and investment education, and training.

- They offer many financial products for individuals are a mutual fund, cash, and derivatives, forex, MCX, NCDEX, fixed earnings, IPO, online and offline trading, PCG, demat, research, NRI services, Demat services, security lending and loan, webinars of asset and trading, RGESS.

- They have a variety of product for corporate and organizations like business banking, speculation or investment banking, organizational broking, FPI, Corporate Investment Services.

Arihant Capital Services:

| Services | |

| Demat Services | Yes |

| Trading Services | Yes |

| 3 in 1 Account | No |

| Intraday Services | Yes |

| IPO Services | Yes |

| Stock Recommendations | Yes |

| Robo Advisory | No |

| PMS | No |

| Trading Institution | No |

| Trading Exposure | Upto 5x |

Arihant Capital offer varies finance service.

- They serve all financial services for the Demat account.

- They have designed trading services to maximize your wealth.

- Intraday services for online and offline trading are offered to customers.

- They serve initial service offers to their traders.

- Provide stock advice on the basis of fundamental and technical research.

Arihant Capital Research, Advisory & Stock Tips

| Research & Advisory | |

| Fundamental Reports | No |

| Research Reports | Yes |

| Company Reports | No |

| Annual Reports | No |

| Company Stock Review | No |

| Free Stock Tips | Yes |

| IPO Reports | Yes |

| Top Picks | Yes |

| Daily Market Review | Yes |

| Monthly Reports | No |

| Weekly Reports | Yes |

| Offline Advisory | Yes |

| Relationship Manager | Yes |

Arihant Capital offers multiple types of research products for all different segments. Various customers tend to trade or invest in various segments, which mean that the security broker has separated its products as demonstrated in their reporting structure:

- They provide daily research report for all segments.

- Trading tips by their research team for trading with proper levels of trading are provided free of cost.

- Market review of every index is provided at pre-open of market.

- Top stocks pick of the day to focus and trade are offered.

- Market review by their research team bases of analysis is offered daily.

- Their customer support team advice and support offline also.

- Arihant Capital offers a personal relationship manager to their traders.

Arihant Capital Exposure or Leverage

| Exposure / Leverage | |

| Equity Delivery | 1x |

| Equity Intraday | Upto 5x |

| Equity Futures | 1x |

| Equity Options | 1x |

| Currency Futures | 1x |

| Currency Options | 1x |

| Commodities Future | 1x |

| Commodities Option | 1x |

| Margin Calculator | |

Arihant Capital provides leverage, it is the capital taken from a broker when a position is open. Traders may sometimes wish to leverage their investment strategy, with a view to gaining more exposure with limited equity.

Exposure proposed by Arihant Capital is very standard.

- It must be noted that both losses and profits are multiplied, therefore it is mostly avoided.

- They provide the maximum leverage of 5 times to trade in equity intraday.

- For holding stock maximum 1 times of exposure are offered.

- Trading in equity future broker offers up to 1 times of exposure.

- For trading in derivative option maximum, 1 times of leverage are offered.

- Leverage for currency option is 1 times and future maximum 1 times of leverage are offered.

Check Margin or Exposure of other stock brokers

Arihant Capital Trading Platforms

| Trading Platforms | |

| Desktop Platform – Windows | Yes |

| Desktop Platform – Mac | Yes |

| Desktop Browser Platform | Yes |

| Mobile Site Platform | No |

| Android App Platform | Yes |

| iOS App Platform | Yes |

| Windows App Platform | No |

| Other Mobile OS Platform | No |

| Real time Updates | Yes |

| Portfolio Details | Yes |

| Online MF Buy | Yes |

| News Flash | Yes |

| Research Reports | No |

| Easy Installation | Yes |

| Global Indices | Yes |

| Stock Tips | No |

| Personalized Advisory | No |

| Interactive Charts | Yes |

| Live Markets | Yes |

| SMS Alerts | No |

| Email Alerts | Yes |

| Multi Account Management | No |

They provide a trading platform which supports browser, desktop and mobile. Customers can select according to their requirements. Following are the trading apps:

- Trading Platform: Ari-Invest Ease

- A Trading Platform: Ari-Trade Speed

- Trading Platform: Ari-Trade Pro

- Arihant Mobile: Mobile Trading

Arihant Capital has its own in-house platforms for trading for its customers, accessible at every device. Following are the details:

ARIHANT CAPITAL – INVEST EASE – Web Based Trading Platform

Invest ease is the trading platform for browser friendly trading by Arihant Capital. Customer can easily log in directly to this application by any device or any place. The following features are available on this web and mobile based trade platform:

- Can easily operate as a web based trading platform can be used from all devices – laptop, tablet or mobile phone.

- Customer can access real-time market data.

- Clients can observe various market watch lists provision with a personalized functionality at one place.

- You can operate it from any computer connected to the internet. You don’t need to install the software and operate on your browser freely.

- Informative detailed charts of different period of time slot with research reports for technical research.

- The customer is able to transfer fund with more than 25 banks.

- Numerous variety of trading orders are available for execution like basket, cover, spread, normal, etc.

- The function of Hotkeys is offered to place order at very less time.

- Reports, suggestions, and advice for analysis accessible on the trading platform.

ARI-Trade Pro

- Ari Trade Pro is an extremely useful tool to trade in the Indian market with a new depth. You can make use of all the fluctuations in the markets.

- It is an incredibly fast strategic assessment and application capabilities. Ari-Trade Pro is by far the most potent trading platform in the market to enable you to perform high-speed competent orders.

- To easily identify the shares and choices that you would like to evaluate you can create custom watch lists.

- Provide several asset trades and exchanges on a single screen – shares, derivative, NSE, BSE, MCX, and NCDEX with super-fast

- You can detect trend lines, mitigate risk and carry out your own study through efficient charting tools. You can also save your diagrams to explore later.

- Multiple securities are even more expedient to monitoring with Ari-Trade Pro’s alert service. Alerts allow you to set notifications to display, email and SMS which activate higher, lower, greater or equal price conditions. A popping up display keeps you up to date about recent market price developments without your screen being constantly monitored if a condition is caused.

ARI-TRADE SPEED – Trading Terminal

Ari Trade Speed is trading platform the trader can install and upload on their computer or desktops. This is mainly appropriate for bulky traders who require the fast click trade execution feature on trading platforms for fast placing order.

One such software is Ari Trade Speed, which comes with the following benefits:

- Ari-Trade Speed is a computer based trading platform software that allows you to combine your stock markets with the best combination of versatility and efficiency.

- Take advantage of the opportunity; take measures on the trade and position trade orders until the markets open at no extra cost.

- Find patterns and manage the risk of using the competent graphs tool, which provides dozens of chart patterns and surveys measuring patterns, dynamics, and uncertainty.

- Customers are able to trade in all various segments across all exchanges.

- You can easily place your trade; you can also perceive your trading account by clicking on the tab and immediately transfer the funds in your banking account anytime. This is a fully optimized online platform.

- Specialized charts with several candlestick patterns are provided.

- Traders are able to place orders easily at trading hours.

ARIHANT CAPITAL – ARI MOBILE APP

It is a mobile trading app Ari Mobile has been developed by Arihant capital. Customers can trade across all various segments and exchanges by their app, can also be used throughout tablet devices. The mobile app offers the following functions:

- The Ari-Mobile can operate on Android and iOS

- Able to place the order and buy back stock cancel and change trade on all exchange easily.

- The ARI mobile app can update itself depends on the internet connection potency.

- You can generate and personalize various Market watch lists according to your preferences.

- The trader can easily order trades with one tap.

- Offer to follow the stock that you choose by generating customized watchlists. You can also control the preferred watch lists and watch the phone trading software ‘ My Investments ‘ and ‘ My Positions ‘

- A single screen shows various types of trade and the correlating position.

Arihant Capital Customer Support

| Customer Support | |

| Dedicated Dealer | Yes |

| Offline Trading | Yes |

| Online Trading | Yes |

| 24*7 Support | No |

| Email Support | Yes |

| Chat Support | No |

| Toll-Free Number | No |

| Branches | 150 |

- Their customer care support team provides assistance in trading offline and online trading.

- They resolve customer problem by email. The forms of communication are passable enough.

- The broker service relies on various aspects, it includes professionalism and proper management they need to focus on ability on their interaction style and tone.

- The customer care executive needs a normal training program, with a particular focus on ensuring the as a whole conversation with the end consumer remains as good as possible.

- The problem resolve time tracker should be used by the staff to resolve problems are definitely needed. The turnaround times tracking should be carried out and the end consumer should be notified accordingly.

- Customers can visit branch office for any query.They have around 150 branches presents all over India.

Arihant Capital Complaints & Feedback

Find the list of total complaints lodged & resolved at both the exchanges.

| Complaints (Current Year) | |

| Lodged in BSE | 52 |

| Resolved in BSE | 50 |

| Lodged in NSE | 74 |

| Resolved in NSE | 69 |

According to data last year percentage of No. of complaints received against the number of active clients are 0.01%.

- In BSE total 52 complaints were lodged, and 50 complaints were resolved.

- In NSE total 74 complaints were lodged, and 69 complaints were resolved.

Arihant Capital Disadvantages

Having used the services of Arihant Capital service security broker, here are some of the considerations:

- In contrast to other full service security broker, their presence is comparatively less than other brokers.

- The pricing of product and services is not perfectly clear; we would recommend that you make it clear during executive interaction.

- As far as time of resolve of your query solve is concern, customer support is less than average.

Arihant Capital Conclusion

The Arihant Capital is one of the oldest names in the full-service stockbroking space and provides decent research to go along with low pricing for account opening, maintenance, brokerage but still, the broker has not been able to create a positioning for themself.

Arihant Capital is among the older known in the stock market and offers good research to keep pricing low for account opening, maintenance, brokerage but the broker could not develop a status for them.

Get a Call Back from Arihant Capital

Find Reviews of other Stock Brokers

Most Read Articles