GCL Review, Brokerage Charges, Demat A/C, Platforms & more

Last Updated Date: Dec 02, 2022GCL Securities is India’s top financial services provider which deals into multiple financial products and offerings.

It has been a leading player in its domain since more than 2 decades and growing at a fast pace both financially and with respect to its market penetration as well.

In today’s article, we will discuss about the benefits this company brings to table with respect to the Products & services it offers, the brokerage charges that they charge, the advisory services they offer, the diversity of the trading platforms that they have created and the overall health of the organization from an investor’s perspective so that you can make a conscious decision to join them or look for other options.

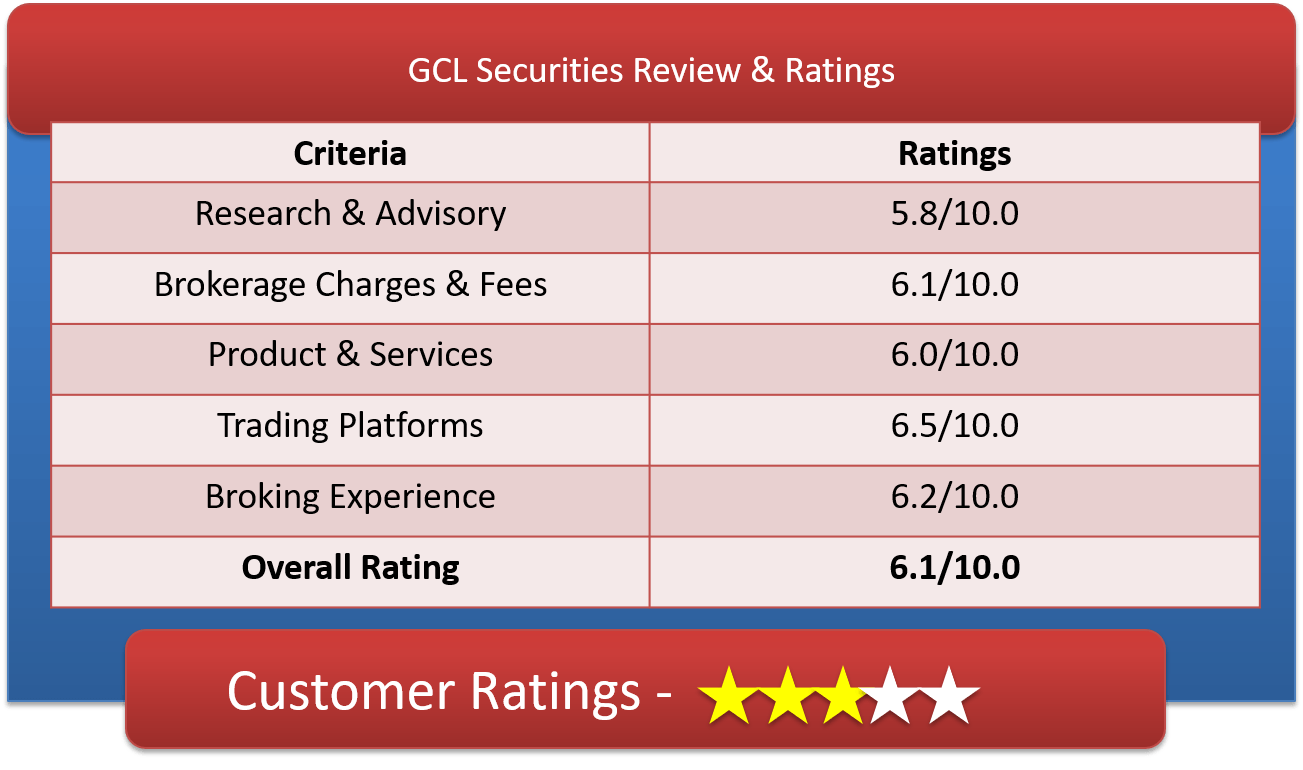

GCL Securities Ratings & Review by Top10StockBroker

About GCL Securities

| Overview | |

| Company Type | Private |

| Broker Type | Full Services Broker |

| Headquarters | Kanpur, Uttar Pradesh |

| Founder | Tilak Raj Sharma |

| Established Year | 1994 |

GCL Securities Ltd is a Private Full Service broker which is into this financial industry since 1994. It was founded by Mr. Tilak Raj Sharma and its headquarters is in Kanpur, Uttar Pradesh.

Though they started out very small as an entrepreneurial setup but they managed to become the market leaders with their perseverance and dedication to excel.

GCL Securities deals with all the major stock exchanges of the country – namely BSE, NSE, MCX & NCDEX.

With respect to the services they offer as well, they are into Trading of Equities, Commodities, Derivatives & Commodities. They also offer IPO services and Mutual Funds as well as Systematic Investment plans for future savings.

Get a Call Back from GCL Securities. Fill up this Form.

GCL Securities Brokerage Charges

| Brokerage Charge & Fees | |

| Equity Delivery Trading | 0.10% |

| Equity Intraday Trading | 0.01% |

| Commodity Options Trading | 0.01% |

| Equity Futures Trading | 0.01% |

| Equity Options Trading | Rs25 per lot |

| Currency Futures Trading | 0.01% |

| Currency Options Trading | Rs.10 per lot |

| Minimum Brokerage | Rs.20 |

| Demat AMC Charges | Rs.300 per Annum |

| Trading AMC Charges | Free |

| Margin Money | Rs.10,000 |

| Brokerage Calculator | GCL Securities Brokerage Calculator |

Every Broking firm charges Brokerage charges to their customers for their trading services that they offer; however if you compare GCL securities charges’ with other companies, their brokerage charges are much on the lower side.

They charge only a nominal 0.10% of the trade amount for Equities Delivery trading and if it is Equity Intraday trading, the charge goes further down to only 0.01% of the Amount traded which means if you trade worth Rs.1,00,000, then you end up paying only Rs. 10/- extra for the brokerage.

The same goes for the Commodity Options trading & the Equity Futures trading; they charge 0.01% of the trade value.

For Equity Options, they charge Rs. 25 per lot irrespective of the transaction amount and for Currency options trade; they charge Rs. 10 per lot.

With GCL Securities, you can get started with a minimum amount of Rs. 10,000 as the security deposit or margin money. They also have a GCL Securities Brokerage calculator online wherein you can calculate the brokerage before executing the transaction.

Compare Stock Brokers

Find brokerage charges of other Full Service Brokers

| Religare Securities | Shri Parasram Holdings | Sushil Finance | Ventura Securities |

| SAMCO | Shriram Insight | Swastika Investmart | Way2Wealth |

| SAS Online | SMC Global | Tradebulls | Yes Securities |

GCL Securities Charges

| Other Charges | |

| Transaction Charges | 0.00280% of Total Turnover |

| STT | 0.0112% of Total Turnover |

| SEBI Turnover Charges | 0.0006% of Total Turnover |

| Stamp Duty | Depends on State (very minimal) |

| GST | 18% of ((Brokerage + Transaction Charges) |

Similar to other broking companies, GCL Securities also adds some extra charges apart from the Brokerage charges to the customers account as these are mandatory charges levied by the Stock exchange board of India and the Government of India as well.

They charge 0.00280% of the total turnover amount as Transaction charges; 0.0112% of the total Turnover amount as STT charge and 0.0006% of the total turnover as SEBI turnover charges.

There is also a Stamp Duty that is charged which varies from state to state and there is the GST charge which equates to 18% of the total of brokerage paid and a Transaction charge.

This was highlighted in this article to enlighten you as to what kind of charges you would need to pay as an investor

GCL Securities Demat Account Opening Fees

| Demat Services | |

| Depository Source | CDSL & NSDL |

| Account Opening Charges | Free |

| Demat AMC Charges | Rs.300 per Annum |

| Trading AMC Charges | Free |

| Margin Money | Rs.10,000 |

| Offline to Online | No |

Since GCL Securities is a Stock broking company, it has to provide Demat account services as well and hence they have tied up with CDSL as well as NSDL for their depository services.

They provide free account opening facility be it for the Trading account as well as for the Demat account. Just that when you get started, you need to keep Rs. 10,000 as the minimum security deposit or margin money so that you can start trading.

Apart from this, there are no extra charges for account opening. There is an annual maintenance charge of Rs. 300 per annum for the maintenance of the Demat account but fore the trading account, there is no maintenance charge.

GCL Securities Offers

| Offers | |

| Free Demat Account | Yes |

| Free Trading Account | Yes |

| Discount on Brokerage | Yes |

| Trading Happy Hours | No |

| Flexible Brokerage Plans | Yes |

| 1 Month Brokerage Free | No |

| Holiday Offers | No |

| Referral Offers | No |

| Zero Brokerage for Loss Making Trades | No |

GCL Securities is a seasoned player in the financial industry and realizes that customers get attracted to offers and discounts; hence they provide all possible offerings for customers.

They provide Free Trading Account & free Demat Account as well. They also provide discounts on brokerage charges depending upon the customer’s trade value and they also have flexible brokerage plans for regular traders who have a good amount of trading done through them.

Find Offers from other Broking Houses

How to open Demat Account with GCL Securities?

GCL Securities is a renowned name in the financial services industry and they have been able to keep their repute intact since more than two decades due to the undying commitment towards their customers and their perseverance to be the best. If you wish to join GCL Securities as a trader, it is very simple and easy task; all you need to do is open up a trading account and get started:

- Click on the “Open New Account” tab on the top right corner of the home page of the GCL Securities website

- Enter all your details accurately as mentioned in the given spaces. You need to enter details like your full name, contact details, email id, PAN number, Adhar number, address and nature of business etc.

- Once you enter all the details accurately, upload all your KYC documents on the site itself. They would include your Adhar card, PAN card, address proof and one photograph.

- On successful completion of the upload the system will generate a confirmation code stating registration done.

- Post the registration, the process take around 2-3 days to get your Demat and trading account opened

- In the interim, someone from the GCL Securities office will contact you to validate all details entered and get your verification done

- Post verification, your account id will be created and sent to you on your registered email id.

Get a Call Back from GCL Securities

Why Open GCL Securities Trading Account?

Opening a trading account along with a demat account is mandatory for any trader who wants to trade in Stocks. Trading account is just like the saving account which is required when you need to carry out any financial transactions.

Why you should consider opening your account with GCL Securities and not any other company is something which could be illustrated with the below mentioned reasons:

- They have an overall experience of about 25+ years in the financial industry and the fact that they have been able sustain themselves in such a volatile environment and also grown in multifold, talks itself about their efficiency

- The diverse product ranges that they offer enables the trader to look at all options for his financial needs in-house itself and not hunt outside. It becomes more of a one stop shop for all investment needs

- The advanced trading platforms and enablement of technology helps traders trade smoothly

- The strong research and development team looks into all the latest updates of the industry and provides insights to customers on timely basis.

GCL Securities Products & Services

List of products & services provided to its clients

GCL Securities Products:

| Products | |

| Equity Trading | Yes |

| Commodity Trading | Yes |

| Currency Trading | Yes |

| Options | Yes |

| Futures | Yes |

| Mutual Funds | Yes |

| Forex | No |

| Banking | No |

| SIP | Yes |

| Insurance | No |

GCL Securities has been the market leader in the financial industry since a long time and hence it offers an array of products to its customers. They offer Equity trading, commodities trading, Currency as well as Options trading as well.

They also deal with futures trading. Apart from the various stock trading products, they also deal with Mutual Funds and SIP plans so that you can invest at other options as well.

They have various products like Fixed return products, Retirement planning products, Child Education plans, Child Marriage plans, and education first plans as well. Overall, GCL securities gives a holistic view to all investment portfolios and adds options to their customers profile

GCL Securities Services:

| Services | |

| Demat Services | Yes |

| Trading Services | Yes |

| 3 in 1 Acount | No |

| Intraday Services | Yes |

| IPO Services | Yes |

| Stock Recommendations | No |

| Robo Advisory | No |

| PMS | No |

| Trading Institution | No |

| Trading Exposure | Upto 6X |

Being a Full Service Broker, GCL Securities offers all sorts of Services to its customers pertaining to trading and effective trading.

The list is exhaustive but they offer all services like Demat and Trading Account services, Intraday & IPO Services, Stock recommendations which can be useful for new entrants and also Portfolio Management Services wherein they would manage your entire portfolio and guide you to invest in the right shares at the right time.

Over and above that, they provide an exposure of upto 6 times more than the expected trade amount.

GCL Securities Research, Advisory & Stock Tips

| Research & Advisory | |

| Fundamental Reports | No |

| Research Reports | No |

| Company Reports | No |

| Annual Reports | No |

| Company Stock Review | No |

| Free Stock Tips | Yes |

| IPO Reports | No |

| Top Picks | No |

| Daily Market Review | No |

| Monthly Reports | No |

| Weekly Reports | No |

| Offline Advisory | No |

| Relationship Manager | No |

GCL Securities has a full-bodied Research and Analysis team deployed 24*7 to help out customers and guide them for accurate investment solutions.

The team shares a number of reports with the clientele on timely intervals so as to augment their knowledge about the Stock broking industry and provide insights to fortify their portfolio.

They share reports like Fundamental Reports, Company reports, Research reports and annual reports as well which give a complete abridgment of a particular company’s growth path. They also share Free Stock tips and Top picks, IPO reports and Daily market reviews as well.

These reports are shared on a monthly, weekly and daily basis as well. Moreover, they also deploy a dedicated Relationship Manager who will handle your portfolio and guide you time and again for better profits

GCL Securities Exposure or Leverage

| Exposure / Leverage | |

| Equity Delivery | Upto 2X |

| Equity Intraday | Upto 6X |

| Equity Futures | Upto 3X |

| Equity Options | Upto 3X |

| Currency Futures | Upto 2X |

| Currency Options | Upto 2X |

| Commodities | Upto 2X |

| Margin Calculator | GCL Securities Margin Calculator |

GCL Securities offer lots of leverage and exposure to its customers to enable smooth trading transactions. It offers upto 2 times leverage than the average exposure in Equity Delivery & Futures, upto 6 times leverage in Equity Intraday; with respect to Equity Futures they offer 3 times leverage andfor Equity options they offer 3 times as well.

It offers upto 2 times leverage for both Currency Futures & Currency Options, whereas in Commodities, it offers upto 2 times the leverage than an average exposure should be. They also have an online Margin calculator which can guide you on how to calculate the margin

Check Margin or Exposure of other stock brokers

| ISE Securities | Lakshmishree Investment | Marfatia Stock Broking | Indbank Online |

| JK Securities | LFS Broking | Indianivesh Securities | India Advantage |

| Joindre Capital | LKP Securities | Maverick Brokers |

GCL Securities Trading Platforms

| Trading Platforms | |

| Desktop Platform – Windows | Yes |

| Desktop Platform – Mac | Yes |

| Desktop Browser Platform | No |

| Mobile Site Platform | No |

| Android App Platform | Yes |

| iOS App Platform | Yes |

| Windows App Platform | No |

| Other Mobile OS Platform | No |

| Real time Updates | Yes |

| Portfolio Details | Yes |

| Online MF Buy | Yes |

| News Flash | Yes |

| Research Reports | No |

| Easy Installation | Yes |

| Global Indices | Yes |

| Stock Tips | Yes |

| Personalized Advisory | No |

| Interactive Charts | Yes |

| Live Markets | Yes |

| SMS Alerts | No |

| Email Alerts | Yes |

| Multi Account Management | No |

GCL Security provides 3 powerful Online trading platforms for their users’ convenience and flexibility:

Online Web based platform for online traders

Desktop software – which is for their Desktop and laptop users

Mobile App for their mobile users

Lets look at some benefits that each of them are providing:

GCL Securities Web Based platform:

This is designed for people who don’t access the trading portal that regularly but this can give them access to it from anywhere in the country:

- It gives a personalized watch on the market updates

- Live streaming of market quotes

- Single screen view on all reports

- Easy order placing capability

GCL Securities Desktop platform

You can access this platform anytime from your laptop or desktop:

- Live streaming of quotes

- Instant market updates

- Personalized screen for orders placed and portfolio summary

- Alert facilities for notifications and alerts

- Top picks of the market on a daily basis and recommendations too

- Interactive charts for analysis purposes

GCL Securities Mobile Trading App

- Easy display of all relevant information on your mobile screen

- Seamless download and upload capacity

- Easy order placing methodology

- Easy navigation between segments and exchanges

- Convenience to trade on the go.

GCL Securities Customer Support

| Customer Support | |

| Dedicated Dealer | No |

| Offline Trading | No |

| Online Trading | Yes |

| 24*7 Support | No |

| Email Support | Yes |

| Chat Support | No |

| Toll Free Number | No |

| Branches | Zero |

GCL Securities provides customer support to their customers through various channels like Online and Offline and email support as well.

You can also choose to immediately get in touch with any of the Business Associates of GCL and they would assist in case of any queries at any given time.

GCL Securities Complaints & Feedback

Find the list of total complaints lodged & resolved at both the exchanges.

| Complaints (Current Year) | |

| Lodged in BSE | 45 |

| Resolvd in BSE | 42 |

| Lodged in NSE | 63 |

| Resolved in NSE | 60 |

Every company, no matter how big they are, would have some percentage of customers complaining about their services and products. Similarly, GCL Securities also had a few complaints in their basket, however they have seemed to resolve most of them.

GCL Securities Disadvantages

Although GCL is a seasoned name in the financial industry, it still has a few grey areas where they need to work:

- Trading on BSE is not available on the Mobile App which creates inconvenience for customers

- Some customers also claim that their brokerage services are not very transparent and clear

- Trading platform needs to be more advanced with better features

GCL Securities Conclusion

GCL Securities has been in business since more than 25 years now and has a stable customer base; however there are still a few elements that they need to work and better themselves

Get a Call Back from GCL Securities

Find Reviews of other Stock Brokers

| Just Trade | LSE Securities | Fyers | Indira Securities |

| Kalpataru Multiplier | Maheshwari Financial | Elite Wealth | Inditrade Capital |

| Kantilal Chhaganlal Securities | Mandot Securities | Finvasia | Indus Portfolio |

Most Read Articles