How to Read an Annual Report of a Company? – Know Everything

Last Updated Date: Nov 17, 2022In this article, you will know everything about Annual Report of a Company & its analysis. You will learn about the most important elements in Annual report that impacts Fundamental Analysis of a Company.

Lets Dig Deep & learn about Annual Report Now.

About Annual Report & its Analysis

The annual report is a document that a company publishes at the end of every financial year.

The company updates an annual report on its website in the form of a PDF document. However, you can contact the company to receive a hard copy of the same.

It contains all the essential and materialistic information about the company, which is verified by the company.

The annual report has an auditor’s certificate, which makes it authentic and official. In case you find a misrepresentation of facts in the annual report, you can legally sue the company.

The main purpose of releasing a financial statement is to cater to the needs of the shareholders as well as other interested parties such as potential investors etc.

If you are personally planning to invest in a company, you must look at the company’s annual report.

One of the most important things you need to keep in mind is the source from where you collect the annual reports.

You should always refer to the report published on the official website of the company as it is unaltered, while media websites may follow different criteria.

Open a Demat Account in 10 Min & Start Trading Now!

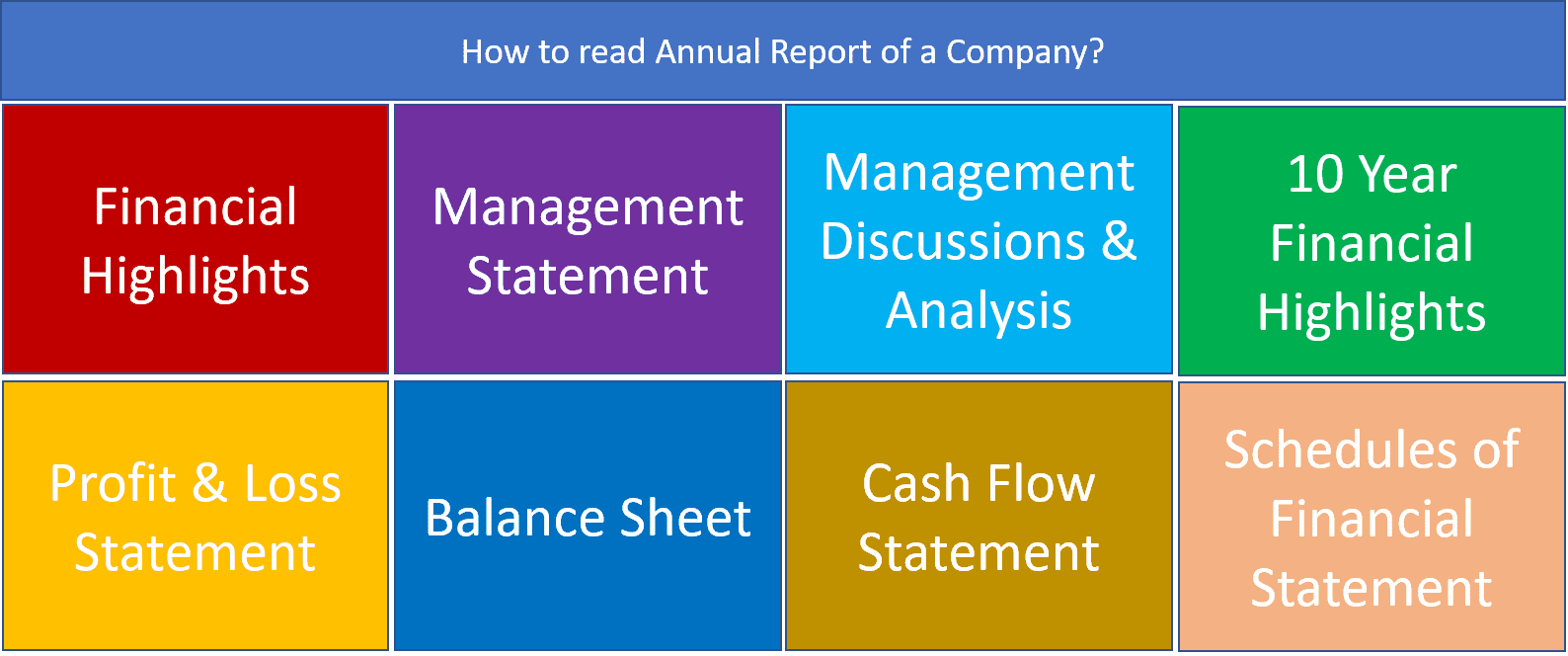

What to read while going through the Annual Report?

While doing an Annual report analysis, one must understand now everything is important in the report. You should only look for certain elements which impacts the fundamentals of a company.

Since the annual report is a consolidated document presented by the company at year-end with all the information, it may contain things that might not be that useful.

Every individual looks at the annual report with a different mindset. If the information is materialistic or otherwise, would depend on the purpose behind reading the report.

Therefore, the same piece of information can either be useful or useless, depending on your purpose.

While reading an annual report, you must be cautious, and you should be able to distinguish between facts and marketing strategies.

This misinterpretation of facts can sometimes lead to a chaotic situation and a wrong investment decision.

Although every annual report is unique, you will find the following points in almost every report. We are going to take a brief look at a few of them.

Financial Highlights

As the name suggests, the financial highlights give you an overview of the company’s performance in the previous year.

It is a brief, graphical representation and analysis of the company’s financial statements and other things too.

For instance, you might get to see various accounting ratios which are calculated by the company for making comparison easier.

But you should not spend a lot of time reading the financial highlights and ratios because later on, you might have to re-calculate the ratios, as per your requirements.

The Management Statement

This section of the annual report comprises of the management’s opinion and reviews for the company.

If you are planning to invest in a company, you must know what the owners of the company feel about their company.

The management statement helps you gain information about the company’s current position from the chairman’s perspective.

Management Discussion & Analysis

In this part of the reports, we get to learn about the company’s outlook for macroeconomic policies.

Therefore, the management discussion and analysis helps the trader to know about the chairman’s view of the current macroeconomic trends.

While going through this section of the annual report, you also get to know how the company is affected by macroeconomic.

If the company is involved in imports and exports, the changes in international policies would also be considered.

10 year Financial highlights

In this section, you gain information about the company’s overall performance in the previous years.

The 10 year financial highlights help you in comparing how the company is performing in comparison to the previous years.

Therefore, by reading the 10 year financial highlights, you can also analyze the growth potential of the company.

To do this, you need to analyze the trend of performance; an upwards trend indicates that the company is growing year over year and vice versa.

Apart from these three, there are other sections too. The below-mentioned sections may be useful to a certain set of audience based on their requirements:

- Corporate Information

- Director’s Report

- Report on Corporate governance

- Financial Section, and

- Notice

Learn everything about Fundamental Analysis Now!

The Financial Statements of a Company

The financial statements are the last but probably the most important section of an annual report.

By reading the financial statements properly, you can calculate various ratios for inter and intra firm comparison.

Moreover, the financial statements give you an insight into the company performance in that particular year.

With the help of financial statements, you can collect key information regarding the revenues, net profits, debts, etc.

Depending upon the nature and scale of operations, the financial statements can be divided into two types i.e., Consolidated and Standalone.

Let’s take an example to understand these two.

ABC company has a massive scale of operations and has diversified into multiple sectors. For doing this, it invested in another company, XYZ, and owns a 100% stake in it.

At the year-end, it was found that the Company ABC incurred a loss of 500 crore rupees while the company XYZ made a net profit of 300 crores.

Therefore, if we talk in standalone terms, ABC has made a loss of 500 crore rupees

But if we look at the consolidated profit and loss, then ABC has lost 200 crores only. This is because it owns a 100% stake in XYZ, which ended up making a profit of 300 crore rupees.

The three financial statements found in every annual report includes the following:

The Profit and Loss Statement

The Profit and Loss Statement is known by various names such as Income Statement, P/L statement, statement of operations, etc.

Profit and loss statement comprises all the information regarding the revenues generated in that year, the expenses incurred for generating the revenues, the tax paid, and the depreciation charged.

The calculation of these factors helps us in analyzing the income per share. Get detailed understanding on Profit & Loss Statement & its Analysis here.

The Balance Sheet

The Balance Sheet is a financial statement that represents information like the company’s assets, outsider’s liability, and shareholder’s equity.

While the purpose of the Profit and Loss statement is to determine profitability, the balance helps us in looking at the overall evolution of the company since its beginning.

This is because the balance sheet is made from scratch and therefore contains all previous information since the company was formed.

Get detailed understanding on Balance Sheet & its Analysis here.

The Cash Flow Statement

As the name suggests, the cash flow statements tell us about the net cash flow in the company during that particular year.

If we put this in simple words, the cash flow statement helps us in knowing how much cash is made by the company in a year.

It is important to note that the cash flow statement is different from profit and loss because it includes the cash factor only.

This implies that the profit and loss statement might only tell you about the profit generated in the year.

In contrast, a cash flow statement will tell about the portion received in cash and the cash left with the company after meeting other obligations.

Get detailed understanding on Cash Flow Statement & its Analysis here.

Schedules of Financial Statements

If you look at the financial statement of any company, you will come across multiple things. Some of those might be easy to understand, and you will grasp them at a glance.

But, there are some which might require prior knowledge. For instance, there is a column named Note No., and many people consider it irrelevant.

But it is important to understand that everything mentioned in the financial statements is crucial. The note number is present adjacent to all the heads in the financial statements.

In simple words, the note number is used for reference. If you read the values written in a head and you are curious to know more about it, you can refer to the note number.

The note number redirects you to a page that contains detailed information and the calculations used for arriving at the value mentioned under the head.

Therefore, the readers can obtain more clarity about the financial statements by referring to the note numbers mentioned.

Annual Report of a Company – Conclusion

The annual report is one of the most important documents published by a company.

As an investor, you should always know about the financials of the company you are going to invest in. For doing this, it is important to read the annual report of the company.

It gives you an insight into the company’s performance and covers almost every aspect which can help you in making your investment decision. While investing, one of the most commonly used technique is fundamental analysis.

Fundamental analysis helps the investor in knowing every materialistic detail about the company, and this can be done with the help of an annual report.

Moreover, the annual report can be used to differentiate two companies in terms of performance; therefore, if you want to make an investment decision and choose a company out of many, you can compare the annual reports of two companies.

This inter-firm comparison will help you in choosing the best company which can offer you substantial returns in the long run.

Open a Demat Account in 10 Min & Start Trading Now!

Most Read Articles