EzWealth Review, Brokerage Charges, Demat A/C, Platforms & more

Last Updated Date: Nov 17, 2022EzWealth is a discount broker with services of a full-service broker and that makes it stand out in the market in the eyes of the clients.

It has achieved a lot in its more than a decade journey and it believes in sharing that experience with the retail as well as the HNI clients they have.

They are a bunch of risk lover people who came together to provide the opportunity to the investors to trade and mitigate risk and this article which is EzWealth brokerage review will enlighten your knowledge about the firm, their business plans, brokerage, trading platforms and everything that you as an investor would like to know about the stockbroker.

They call themselves different from the rest and they are truly different from various perspective.

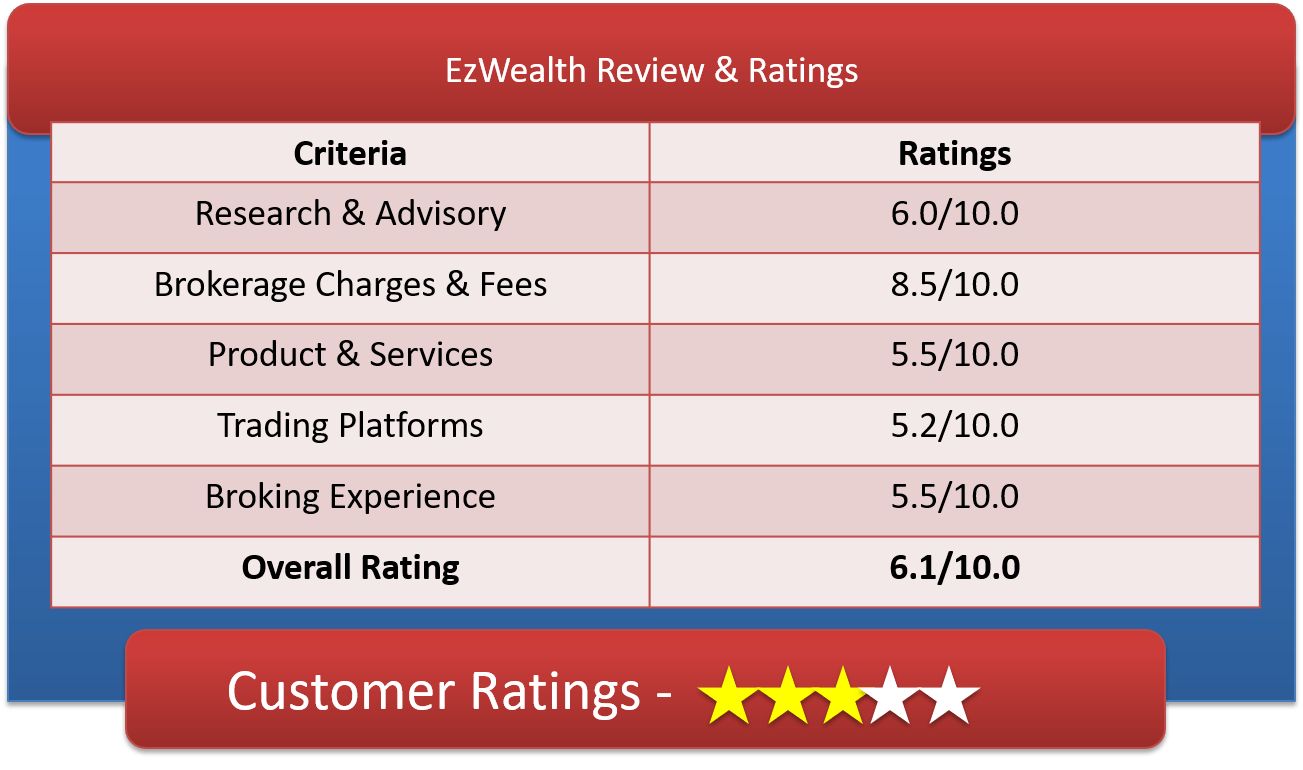

EzWealth Customer Ratings & Review

The table above suggests that they have a rating of 5.7 a bit higher than the average. As per the ratings, their services and products along with their other facilities are well absorbed by the clients through there is huge space to be filled and improve.

About EzWealth

| Overview | |

| Company Type | Private |

| Broker Type | Discount Broker |

| Headquarters | New Delhi, Delhi |

| Founder | Rajeev Agarwal & Rahul Agarwal |

| Established Year | 2007 |

Rajeev Agarwal, the founder, and the CEO and Rahul Agarwal, the director of the company established the company in the year 2007 with a perspective to bring some change in the stock market business with their different stock broking style and business plans.

They both have years of experience in the international business and financial market which they bring to the table.

The company has been registered as a private organization and they have their headquarters in the Capital city – Delhi.

They being a discount broker by tag offers services that are only offered by traditional brokers and charge as a discount broker which is really fascinating for most of the clients and the investors.

They are registered under SEBI and has a membership of most of the major exchanges in the country which facilitates your trading experience. They offer a wide range of products and services to make trading fruitful.

Get a Call Back from EzWealth. Fill up this Form.

EzWealth Brokerage Charges

| Brokerage Charge & Fees | |

| Equity Delivery Trading | Rs.11 per executed order |

| Equity Intraday Trading | Rs.11 per executed order |

| Commodity Options Trading | Rs.11 per executed order |

| Equity Futures Trading | Rs.11 per executed order |

| Equity Options Trading | Rs.11 per executed order |

| Currency Futures Trading | Rs.11 per executed order |

| Currency Options Trading | Rs.11 per executed order |

| Minimum Brokerage | Rs.11 |

| Demat AMC Charges | Rs.300 per Annum |

| Trading AMC Charges | Free |

| Margin Money | Zero Margin |

| Brokerage Calculator | EzWealth Brokerage Calculator |

The brokerage they charge is kind of unbelievably low and hardly there are few discount brokers in the country who charges such low rates for each of the segments.

Whether you trade stock or derivative, trade few stocks or in bulk, for one single order, they have their rate card fixed at Rs. 11.

As you can see in the table above, they charge Rs. 11 for every segment and on per order basis. It doesn’t matter how much you trade and that makes it easy for the bulk investors especially.

Compare Stock Brokers

Find brokerage charges of other Full Service Brokers

| IDBI Direct | KIFS Trade Capital | Nirmal Bang | Prabhudas Lilladher |

| Jhaveri Securities | Mastertrust Capital | NJ Wealth | Profitmart |

| JM Financial | Monarch Networth Capital | Paytm Money | Reliance Securities |

EzWealth Charges

| Other Charges | |

| Transaction Charges | 0.00310% of Total Turnover |

| STT | 0.0113% of Total Turnover |

| SEBI Turnover Charges | 0.0006% of Total Turnover |

| Stamp Duty | Depends on State (very minimal) |

| GST | 18% of ((Brokerage + Transaction Charges) |

The charges which as a trader or investor you have to pay are the same with EzWealth as well though the percentage varies.

For transaction charges, you have to pay 0.00310% of the total amount of the order. GST is levied at 18% on the brokerage amount added to the transaction cost of the order itself.

For the other three charges which are SEBI charges, Stamp duty, and STT the rates are 0.0006%, according to the state and 0.0113% respectively. These charges are fixed by the higher authority and there is no way you can avoid these charges.

EzWealth Demat Account Opening Fees

| Demat Services | |

| Depository Source | CDSL & NSDL |

| Account Opening Charges | Free |

| Demat AMC Charges | Rs.300 per Annum |

| Trading AMC Charges | Free |

| Margin Money | Zero Margin |

| Offline to Online | No |

To open the EzWealth Demat account, you do not need to pay any amount as the opening of the account is free of cost. You get both Trading and Demat account together as a two-in-one account.

The charge that you have to pay towards the account is the annual maintenance charge for the Demat account which is Rs. 300 per annum.

For the trading account, there are no such charges as well. The firm charges no margin money as well which is another huge relief for most of the retail investors.

EzWealth Offers

| Offers | |

| Free Demat Account | Yes |

| Free Trading Account | Yes |

| Discount on Brokerage | Yes |

| Trading Happy Hours | No |

| Flexible Brokerage Plans | Yes |

| 1 Month Brokerage Free | No |

| Holiday Offers | Yes |

| Referral Offers | Yes |

| Zero Brokerage for Loss Making Trades | No |

The offers provided by EzWealth are lucrative enough and helps in saving a lot in the client’s front.

- As you have seen above, the accounts are opened free of cost

- There is no maintenance fee for the trading account

- There are ample ways you can reduce your brokerage using the discounts given by the firm

- There are an abundance of holiday offers

- You can refer and earn money with EzWealth

- They also provide flexible brokerage plans

Find Offers from other Broking Houses

| Dealmoney Securities | Farsight Securities | GEPL Capital | HEM Securities |

| Elite Wealth | Fast Capital Markets | Globe Capital | HSE Securities |

| Emkay Global | Findoc Investmart | Gogia Capital | IFCI Financial |

How to open Demat Account with EzWealth?

There are three ways in which you can open an account with EzWealth –

- Online Process

- Manual Process

- Via Courier

For the online process –

- You have to submit the form of application with all the details

- Upload all the documents – AADHAAR being the most import document here. It is used for verification of the details and the other documents. With AADHAAR based account opening, it only takes around a few minutes to open the trading and Demat account both.

For manual process –

- You need to download the form and print and submit it to the firm with all the necessary KYC documents, details.

- They will verify the documents within a few

- Once they are done with the verification you will receive a call for further verification in person.

- After complete verification, your account will be opened and handed over to you.

For applying via courier if you are living in a remote location without internet or so, you can request the firm to courier you the form.

You fill the same with the details, and send it back with the KYC documents – PAN, AADHAAR, voter id, Income proof, and Address proof as well along with the bank statement.

Once you submit all of these, they are going to cross-check every detail and once they are satisfied, they will ensure your account is opened within a few days.

Once your account is on, you will receive two emails from the broking house –

- First one with the login details and password for the back office platform

- Password for login into the trading platforms and for transactions.

Get a Call Back from EzWealth

Why Open EzWealth Trading Account?

There are multiple reasons to trade with –

- Variety of plans to suit different investors pocket and requirement

- Yearly brokerage plans and per order plans which are extremely cheap

- No distinctive charges for the different segments – for all trades you pay the same across the segments

- Highly technologically advanced trading platforms for each of the devices

- Exceptional support from the back office, customer care and the team of the firm for any trading related issue

- Instant account opening with AADHAAR

- There are no hidden charges

- You pay for a discount broker but get services of a traditional broker which is really money savior

- They do have the lowest of the transaction costs and the mandatory charges

- Various offers from referrals to the holiday offers

- If you want to associate with them as business partners, there is ample opportunity and also they offer various programs to become a partner with a low amount of investment

- They have years of experience in the market and they provide that knowledge for the clients

- For the clients, they have specialized research services as well

- You can avail their advisory services just by throwing a call

EzWealth Products & Services

List of products & services provided to its clients

EzWealth Products:

| Products | |

| Equity Trading | Yes |

| Commodity Trading | Yes |

| Currency Trading | Yes |

| Options | Yes |

| Futures | Yes |

| Mutual Funds | Yes |

| Forex | No |

| Banking | No |

| SIP | Yes |

| Insurance | No |

EzWealth products include equities, derivatives, commodities, and currencies but these are not only products they offer.

They also have mutual funds and SIP investment products that you can buy and invest in. Being a discount broker offering mutual funds and SIP investment is really commendable.

EzWealth Services:

| Services | |

| Demat Services | Yes |

| Trading Services | Yes |

| 3 in 1 Acount | No |

| Intraday Services | Yes |

| IPO Services | Yes |

| Stock Recommendations | No |

| Robo Advisory | No |

| PMS | No |

| Trading Institution | No |

| Trading Exposure | Upto 10X |

They offer every kind of possible service which a discount broker should offer and those include the trading services – facilities of the trading platform and Demat services.

They are the depository participants of both the depository we have in our country – CDSL and NSDL. They offer the intraday trading opportunity to the clients and also IPO services.

EzWealth Research, Advisory & Stock Tips

| Research & Advisory | |

| Fundamental Reports | No |

| Research Reports | No |

| Company Reports | No |

| Annual Reports | No |

| Company Stock Review | No |

| Free Stock Tips | No |

| IPO Reports | No |

| Top Picks | No |

| Daily Market Review | No |

| Monthly Reports | No |

| Weekly Reports | No |

| Offline Advisory | No |

| Relationship Manager | Yes |

The research and advisory facility is not available from the broker though they provide fundamental reports twice in a month for the clients they have.

The clients can request for the service of the relationship manager for advises if required. As a discount broker, they are free from proving this service but then also they do a bit which shows their customer-centric attitude.

EzWealth Exposure or Leverage

| Exposure / Leverage | |

| Equity Delivery | Upto 2X |

| Equity Intraday | Upto 5X |

| Equity Futures | Upto 3X |

| Equity Options | Upto 3X |

| Currency Futures | Upto 2X |

| Currency Options | Upto 2X |

| Commodities | Upto 2X |

| Margin Calculator | EzWealth Margin Calculator |

While trading with the EzWealth brokerage firm, you can get exposure of 5 times to the maximum for the cash trading segment.

For the rest of the segments like currency futures and currency options and commodities, and also for equity delivery, the exposure is three times at the most.

For the equity futures and equity options, the leverage is up to 3 times. As you can see they provide an average amount of exposure which is at par with the peers it has in the market.

Check Margin or Exposure of other stock brokers

EzWealth Trading Platforms

| Trading Platforms | |

| Desktop Platform – Windows | Yes |

| Desktop Platform – Mac | Yes |

| Desktop Browser Platform | Yes |

| Mobile Site Platform | Yes |

| Android App Platform | Yes |

| iOS App Platform | Yes |

| Windows App Platform | No |

| Other Mobile OS Platform | No |

| Real time Updates | Yes |

| Portfolio Details | Yes |

| Online MF Buy | Yes |

| News Flash | Yes |

| Research Reports | No |

| Easy Installation | Yes |

| Global Indices | Yes |

| Stock Tips | Yes |

| Personalized Advisory | No |

| Interactive Charts | Yes |

| Live Markets | Yes |

| SMS Alerts | No |

| Email Alerts | Yes |

| Multi-Account Management | No |

The EzWealth trading platforms are exceptionally well designed and have everything that you may ask for in a trading platform. They have different platforms for all your devices and all your needs and they are –

EZ DESK – EzWealth Trading Terminal:

This is a superb trading platform for the desktop users who want a trading terminal for their bulk trades. The software is easy to download and install and then you can trade easily. The features which set it different are –

- Charting facility on the real-time data

- Wide range of technical indicator

- Variety of options strategies and also you can use the option calculator which comes in-built with the software

- The features are fully customizable – you can customize the market watch with your favorite scrips of stocks from the market

- Intraday charts and historical data are available. You can modify the charts and make them according to your use.

- You can even place after market orders for which you have to have the fund transfer set-up with the client

- This software can be integrated with the Ami-Broker software for proportional automated trading options. This can be done by adding the certain plug-in. you can choose any of the plans and do the same.

EZ WEB – EzWealth Web-based trading platform:

You can access this browser-based trading platform EZ WEB from any browser – Internet Explorer, Google Chrome, Firefox by Mozilla and even on Safari.

This is one of the newest in the kitty of the firm and they are still working on it to make it more useful and adding new features. However, the features it has in the current version available are –

- You get stock market quotes on a real-time basis along with recommendations and reports of stocks and companies

- You can segregate and make your own market watch as you wish – according to the industry you want to trade, track, segments or the asset class.

- The fund transfer on this platform is really secure and there is no security issue involved

- There is an alert facility as well which you can use for tracking the market always. You can set an alert on email or on SMS as well.

EZ MOBI – EzWealth Mobile-Based trading platform:

This platform is for them who like trading anywhere they go and track the market on their mobile screen and make use of every opportunity. The features which make this platform a superior one are –

- You can check your holdings and their value in real-time

- If you have slow internet, you need not worry as this app will be working under a slow internet connection as well

- Do technical charting on your mobile screen, you the indicators to track market

- Push notifications

- Order customization and many other features

EzWealth Customer Support

| Customer Support | |

| Dedicated Dealer | Yes |

| Offline Trading | No |

| Online Trading | Yes |

| 24*7 Support | No |

| Email Support | Yes |

| Chat Support | No |

| Toll Free Number | No |

| Branches | Zero |

The customer care service of EzWealth is available on email and on call. You can mail them at help@ezwealth.in.

You can call them on their toll-free number which is 180030705970.

They extend help for online trading, dedicated clients and any queries related to trading and account opening or similar.

EzWealth Complaints & Feedback

Find the list of total complaints lodged & resolved at both the exchanges.

| Complaints (Current Year) | |

| Lodged in BSE | 28 |

| Resolvd in BSE | 23 |

| Lodged in NSE | 52 |

| Resolved in NSE | 45 |

Last year, on NSE, there were 52 complaints against this broker and they resolved 45 out of the same. On BSE, there were 28 out of which 23 got resolved.

EzWealth Disadvantages

- Poor level of leverage provided

- Customer service is not up to the mark

EzWealth Conclusion

EzWealth in every sense is different from most of the brokers in the country. The way they serve the clients with products and services and facilities is noteworthy.

Get a Call Back from EzWealth

Find Reviews of other Stock Brokers

| Ezwealth | Fyers | Grovalue Securities | Indira Securities |

| Fair Intermediate | Ganpati Securities | Guiness Securities | Inditrade Capital |

| Fairwealth Securities | GCL Securities | Hedge Equities | Indus Portfolio |

Most Read Articles