MDirect Review, Brokerage Charges, Demat A/C, Platforms & more

Last Updated Date: Nov 18, 2022MDirect which is also known as Moneylicious Capital for its exceptional services and range of products is one of the renowned brokers in the country at present.

Being a discount broker, it has gained enough repute to stand out and here is an article which has all the details about the company in the truest form and every detailed has been analyzed as well for you to get the right idea of the company and take your decision wisely.

This MDirect brokerage review will enlighten you about the various offerings of the company starting from their services to the trading platforms and everything which you should know before investing with them.

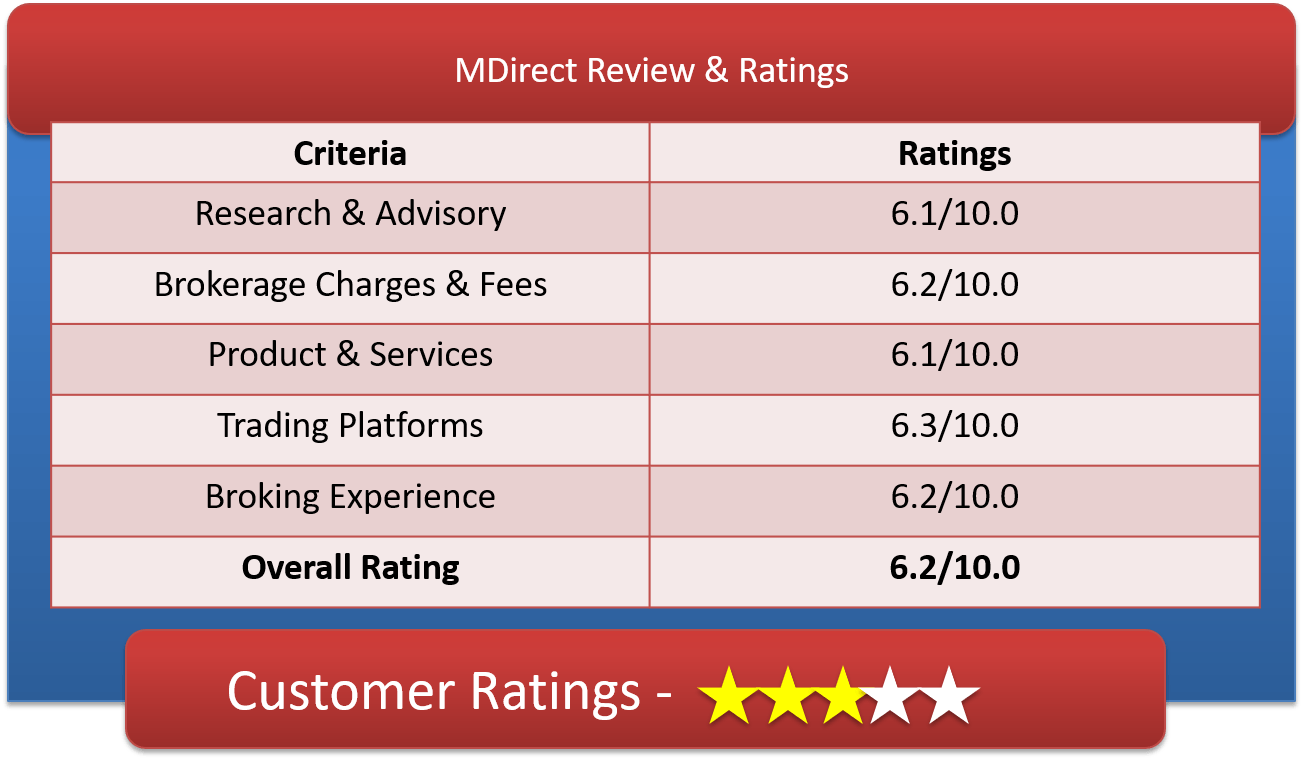

MDirect Customer Ratings & Review

The popularity and acceptance of the company are well depicted by the ratings it has on the cards. As you can check from the table, the company has an overall rating of more than 6 points on a 10 pointer scale. This depicts that the company is better than the average share brokers in the industry.

About MDirect

| Overview | |

| Company Type | Private |

| Broker Type | Discount Broker |

| Headquarters | Mumbai, Maharashtra |

| Founder | Sushil Agarwal |

| Established Year | 1997 |

MDirect is a private enterprise and it was founded by Mr. Sushil Agarwal with the headquarters in the city of Mumbai.

The firm started its operation in the year 1997 and since then it is working towards the investor’s benefit and client’s satisfaction.

They are discount brokers and thus the charges they charge are very cheap and one can easily trade with them without thinking of huge brokerage payments.

Get a Call Back from MDirect. Fill up this Form.

MDirect Brokerage Charges

| Brokerage Charge & Fees | |

| Equity Delivery Trading | Rs.18 per Order |

| Equity Intraday Trading | Rs.18 per Order or 0.01% whichever is low |

| Commodity Options Trading | Rs.18 per Order |

| Equity Futures Trading | Rs.18 per Order |

| Equity Options Trading | Rs.18 per Order |

| Currency Futures Trading | Rs.18 per Order |

| Currency Options Trading | Rs.18 per Order |

| Minimum Brokerage | Rs.18 |

| Demat AMC Charges | Rs.400 |

| Trading AMC Charges | Free |

| Margin Money | Rs.10,000 |

| Brokerage Calculator | MDirect Brokerage Calculator |

The brokerage charges of MDirect are fixed as you can see for any discount brokers. The fixed rate of brokerage is Rs. 18 per trade of any volume across all the segments except for the cash segment.

For the equity intraday segment or the cash segment, the charge is lower of Rs. 18 per order or 0.01% of the entire transaction.

So, basically, here the minimum and the maximum cost towards brokerage is Rs. 18 and for the cash segment it can be lower than Rs. 18 but cannot be more than it.

This brokerage plan is really helpful for all types of traders as there is the huge scope of saving on brokerage and especially for the heavy traders who trade in bulk every day, this kind of brokerage plan is best for them.

Compare Stock Brokers

Find brokerage charges of other Full Service Brokers

| Sharekhan | Edelweiss | Indiabulls Ventures | Kotak Securities |

| Angel Broking | HDFC Securities | India Indoline / IIFL | Motilal Oswal |

| Axis Direct | ICICI Direct | Karvy | Upstox |

MDirect Charges

| Other Charges | |

| Transaction Charges | 0.00301% of Total Turnover |

| STT | 0.0112% of Total Turnover |

| SEBI Turnover Charges | 0.0007% of Total Turnover |

| Stamp Duty | Depends on State (very minimal) |

| GST | 18% of (Brokerage + Transaction Charges) |

The other charges you have to bear include the transactional charges which are levied at 0.00301% and STT at 0.0112%. The SEBI charges on the total turnover are at 0.0007%.

These are mandatory charges that you have to bear as a trader with any broker you trade but the percentage of the charges vary from one broker to another.

The GST is charged at the fixed rate of 18% on the amount cumulated together taking brokerage and the transactional charge of the order. The stamp duty charges are as per the state you are trading from.

MDirect Demat Account Opening Fees

| Demat Services | |

| Depository Source | CDSL & NSDL |

| Account Opening Charges | Rs.500 |

| Demat AMC Charges | Free or Rs.400 per Annum |

| Trading AMC Charges | Free |

| Margin Money | Zero Margin |

| Offline to Online | No |

With MDirect, you can open the trading and Demat account with Rs. 500. This opening fee is average according to the other discount brokers in the country.

It has been observed that the discount brokers charge something around this amount only for opening a 2-in-1 account with them.

The annual maintenance charge, on the other hand, is nil on the trading account and Rs. 400 for the Demat account and it can also be waived out in certain circumstances and according to a certain plan, this company offers.

As a discount broker, they do not ask for any margin money to be kept in the trading account which is one of the benefits of trading with discount brokers.

MDirect Offers

| Offers | |

| Free Demat Account | No |

| Free Trading Account | No |

| Discount on Brokerage | Yes |

| Trading Happy Hours | No |

| Flexible Brokerage Plans | No |

| 1 Month Brokerage Free | No |

| Holiday Offers | No |

| Referral Offers | Yes |

| Zero Brokerage for Loss Making Trades | No |

The MDirect offers are few but lucrative –

- They offer discounts on brokerage on various occasions from time to time

- There are referral offers which the clients and the investors can take benefit from.

Find Offers from other Broking Houses

| Mdirect | Networth Direct | Pravin Ratilal | RK Global |

| Microsec Capital | N G Rathi | Progressive Share | Rudra Shares |

| Modex Securities | Nine Star Broking | Prostocks | R Wadiwala Securities |

How to open Demat Account with MDirect?

For opening MDirect Demat account you just need to form the online application/registration form.

- Then you will receive a call from the executives of the firm asking you to schedule a date for further verification.

- On the date of the meeting, you have to give them the KYC documents like AADHAAR, PAN, Voter ID, Address Proof and Bank details – bank and income statements.

- Once they verify all the documents and approve your application, you will receive the login details of your account within a few

The account opening process is simple and easy and anyone can do it with the minimum you of the internet. It is also fast and you get to trade with your account instantly.

Get a Call Back from MDirect

Why Open MDirect Trading Account?

An MDirect trading account can facilitate you in trading across different segments and exchanges. The benefits of trading with this firm are –

- With one sign in option, you can trade various segment. There is no hassle in trading with this firm as it offers various products and services under one roof.

- The brokerage plan is plain and simple, you do not need to calculate brokerage every time you trade as it is flat Rs. 18 per order.

- The research team is active and dedicated towards the clients and they are always striving for bringing in new opportunities for the clients and the investors trading in equities, currencies as well as commodities.

- You will receive newsletters from the firm which contains various stock market-related news to keep our updated.

- You can make intraday as well as positional trades just by sending SMS.

MDirect Products & Services

List of products & services provided to its clients

MDirect Products:

| Products | |

| Equity Trading | Yes |

| Commodity Trading | Yes |

| Currency Trading | Yes |

| Options | Yes |

| Futures | Yes |

| Mutual Funds | Yes |

| Forex | No |

| Banking | No |

| SIP | Yes |

| Insurance | No |

The products for trading provided by MDirect are inclusive of the general stock market products and also the financial investment products.

They provide equities and commodities, currencies, derivatives and also mutual funds and SIPs. So, you can invest in direct equities or in mutual funds using your own Demat account and trading account.

MDirect Services:

| Services | |

| Demat Services | Yes |

| Trading Services | Yes |

| 3 in 1 Account | No |

| Intraday Services | Yes |

| IPO Services | Yes |

| Stock Recommendations | No |

| Robo Advisory | No |

| PMS | No |

| Trading Institution | No |

| Trading Exposure | Upto 2X |

The services they are offering now includes the usual trading and Demat services and they are the depository participants of both of the Depositories in the country – NSDL and CDSL.

Under the trading services, there are also intraday and IPO services which are offered by this firm.

MDirect Research, Advisory & Stock Tips

| Research & Advisory | |

| Fundamental Reports | No |

| Research Reports | No |

| Company Reports | No |

| Annual Reports | No |

| Company Stock Review | No |

| Free Stock Tips | Yes |

| IPO Reports | No |

| Top Picks | No |

| Daily Market Review | No |

| Monthly Reports | No |

| Weekly Reports | No |

| Offline Advisory | No |

| Relationship Manager | No |

The research service which is offered by the company is completely free of cost and they provide daily stock tips.

Other than these tips in the stocks, they do not provide any reports or reviews as they are discount brokers and there are very few discount brokers who provide complete research services.

MDirect Exposure or Leverage

| Exposure / Leverage | |

| Equity Delivery | Upto 2X |

| Equity Intraday | Upto 2X |

| Equity Futures | Upto 2X |

| Equity Options | Upto 2X |

| Currency Futures | Upto 2X |

| Currency Options | Upto 2X |

| Commodities | Upto 2X |

| Margin Calculator | MDirect Margin Calculator |

The exposure provided by the firm is only up to 2 times which is really low and the clients have to have money in their trading account with which they want to trade.

Check Margin or Exposure of other stock brokers

| MPSE Securities | Pace Stock Broking | Prudent Broking | Saaketa Consultants |

| Multiplex Capital | Patel Wealth | Quantum Global | Safal Capital |

| Muthoot Securities | PCS Securities | Raghunandan Capital | Satco Capital |

MDirect Trading Platforms

| Trading Platforms | |

| Desktop Platform – Windows | Yes |

| Desktop Platform – Mac | Yes |

| Desktop Browser Platform | Yes |

| Mobile Site Platform | Yes |

| Android App Platform | No |

| iOS App Platform | No |

| Windows App Platform | No |

| Other Mobile OS Platform | No |

| Real time Updates | Yes |

| Portfolio Details | Yes |

| Online MF Buy | No |

| News Flash | Yes |

| Research Reports | No |

| Easy Installation | Yes |

| Global Indices | Yes |

| Stock Tips | No |

| Personalized Advisory | No |

| Interactive Charts | Yes |

| Live Markets | Yes |

| SMS Alerts | No |

| Email Alerts | Yes |

| Multi Account Management | No |

The trading platforms of MDirect are dynamic and accessible on each and every device – desktop, mobile, and laptops. They are offering all the three types of trading platforms which are –

MDirect Trading Terminal – NEST PLUS:

This platform is designed by Omnesys NEST and it is –

- Easy to install and you can just download it and install in any of the two devices – desktop or laptop.

- It is apt for the heavy traders who have a huge bulk of trades to make using terminal for trading

- There are tools for technical analysis and charting which you can use to predict the market

- There are various strategies in-built in the system (trading platform) to be used for analyzing the options

- Real-time news and updates of the market and market watch with customization available with all your favorite scrips

MDirect Web-based Trading Platform – WEB NEST PLUS:

The platform offers –

- No installation requirements

- Accessible across various browsers

- Technical indicators for market prediction and analysis

- Lightweight and friendly user-interface

- You can easily access this platform on your desktop/laptop and even on mobile.

MDirect Mobile Trading App:

You get MDirect mobile application when you register and open account with them. This makes you’re daily trading easier while traveling and also makes it very handy and the best part is you can track the market and your portfolio even when you are not in front of the trading terminal. The features it offers are –

- Exceptional speed and quick order placement

- Technical charts, indicators are all available in your mobile application only

- There is a smooth fund transfer system

- You can check various indices

MDirect Customer Support

| Customer Support | |

| Dedicated Dealer | No |

| Offline Trading | No |

| Online Trading | Yes |

| 24*7 Support | No |

| Email Support | Yes |

| Chat Support | No |

| Toll Free Number | No |

| Branches | Zero |

For reaching out the customer care of the MDirect broker you can email them on helpdesk@mdirect.co.in. They are available on email for any kind queries related to online trading.

For any complaints or grievances, you can shoot a mail on the same email id.

For opening account, you can call on 18602671671. For the existing clients, they have two calling numbers which are –

022-66018386 which is for any kind of assistance in trading

022-66018324 which can be used for any assistance in noon-trading related matters.

MDirect Complaints & Feedback

| Complaints (Current Year) | |

| Lodged in BSE | 12 |

| Resolvd in BSE | 9 |

| Lodged in NSE | 19 |

| Resolved in NSE | 17 |

The firm received only 19 complaints on NSE last year and 12 on BSE out of which they solved 17 and 9 respectively. The number of complaints received shows that the company is really doing a great job and takes care of the clients really well.

MDirect Disadvantages

- There is a very low exposure level

- There is no three-in-one account facility

- Research is bare minimal with no fundamental or annual reports

MDirect Conclusion

With extensive years of business experience in the market, this firm knows how to handle their clients and capture the market. They offer many services which are not offered by many discount brokers and that too at a lower level of brokerage.

Get a Call Back from MDirect

Find Reviews of other Stock Brokers

Most Read Articles