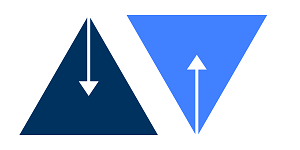

Top Down vs Bottom Up – Compare & Select Best Investment Strategy

Last Updated Date: Nov 17, 2022This article will ramp up your interest level in these both strategies through a glance at the contrast on why one is better than another, i.e. Top Down vs Bottom Up Investment Strategy.

The right strategy is the foundation of any profitable decision. If you’ve obtained the right idea of building and managing your investment portfolio, you can expect huge.

For instance, if you want to attract a big chunk of returns from your investment, you’ll have to employ a good number of strategies.

Though, investors who know the value of strategy might already have noticed some very basic and highly effective options.

Though, investors who know the value of strategy might already have noticed some very basic and highly effective options.

Such as the Bottom Up vs Top Down investing strategies that come top in the list. Both of these strategies are popular in the financial market.

You might have also been influenced by the tactics that these strategies use to boost the profits from an investment. But which one to choose is an exciting question.

Before you start to Compare Top Down vs Bottom Up Strategy, you should know what these strategies are & how they work.

Top Down Strategy

The Top Down investing strategy wants the investor to analyze the market on a macro-level. The strategy focuses on analyzing the overall economy instead of focusing on an individual company’s profile.

Which macro-economic factors are likely to drive a big rise in the market or a big loss? It asses them all.

As you know, various factors in the market can raise the value of stock prices in a particular sector. Though, the strategy also tries to get an insight into the industry or a sector’s performance.

For instance, if the industry is doing well in the market, the value of the stocks of companies operating in this sector tends to incline.

Top Down Investment Strategy ensures

- The economic growth of a country should be growing.

- GDP shouldn’t be bad

- Monetary policy should be favorable.

- The changing price of the commodities

- Inflation rate

- Bond prices and yields etc.

Open Demat Account Now! – Zero Brokerage on Delivery

Overview of Top Down Investment Strategy

Suppose an investor is planning to invest in real estate. But recently, he sees that the interest rate is declining in the market.

That’s why to get a full-fledged insight into the market; the investor opts for a Top Down investment approach.

After taking an overview of the market, he finds that more buyers will purchase properties if the real estate industry rate falls.

Hence, it can lead to a spike in the real-estate sector. That’s why it’s high time for an investor to search for a company in this sector and end up purchasing its stocks.

Let’s take another example if you buy stocks of a company. You come to know that the company uses oil for the manufacturing of its numerous products.

Recently, due to some reasons, the prices of stocks have spiked. In this way, the company is likely to invite huge expenses over its output.

The prices of its product will also go higher, and there, the company will observe a decline in its products’ demand.

Similarly, investors who have purchased the assets of the company are likely to earn the loss.

But those investors who use the Top Down strategy will be able to prevent themselves from inviting the loss.

The Top Down strategy also focuses on analyzing a country’s economy if you want to invest internationally.

More Information on Share Market Trading & Investment

Bottom Up Strategy

Investors who aren’t too good at analyzing the macro-economic factors focus on a Bottom Up strategy.

But it doesn’t mean that a Bottom Up investment strategy requires a minimal effort of the trader for the final execution.

Indeed, to get more out of this investment strategy, you’ll have to obtain a full-fledged insight into a company’s profile.

A Bottom Up strategy is a narrow approach that focuses more on an individual company. It doesn’t mean that the strategy ignores the macro-economy, industry fundamentals, and market conditions.

The strategy also takes a glimpse into these factors and tries to sum up its impact on the company’s stock value.

The company’s performance in the past and its future plans are the important points of discussion in this strategy.

The Bottom Up Strategy ensures

- The financial profile of a company, such as its net profit margin, return on equity, and current ratio.

- Company’s growth over the past few years and its future

- Sales and Revenue growth of the company

- A brief financial analysis of the company

- The cash flow of the company

- The demand for the company’s product and growth of its market shares

Related Articles On Share Market Trading & Traders

| Styles Of Trading | Momentum Trading | Pullback Trading Strategies |

| Position Traders | Position Trading | Swing Trading for Beginners |

| Swing Trading | Pullback Trading | What is Scalping? |

Overview of Bottom Up Investment Strategy

Bottom Up investors feel confident in their investment decision. They assume if the company is performing well, the chances of earning profits inclines.

Though, investors who follow this strategy often pick the top-performing company in the market. In most instances, these investors give extensive time to the brief analysis of a company.

Top Down vs Bottom Up – Which strategy is best for you?

Here is the comparison of Top Down vs Bottom Up Investment Strategy & you can find out which one is more suitable for you.

However, it doesn’t remain that much important which strategy can work better for you. Both Top Down & Bottom Up strategies have their own underlying qualities and way of working.

The biggest point is what type of financial analysis you can better carry out. If you’re an expert in microeconomics, you can get more out of the Bottom Up strategy.

On the other hand, if you are an expert in macro-economics, the Top Down strategy might give you the most desired results.

Though, the obtained data from both these strategies remains a subject of uncertainty. That’s why you can’t fully rely on the principles that these strategies to follow.

For example, if you’re using a Bottom Up investment strategy, you can’t rely on it completely. You’ll have to go through an analysis of the market or industry to secure your position.

On the other hand, if you’re using a Top Down strategy, it’ll be a stupid idea to initiate investment without exploring the company’s growth and market value.

Articles Related to Share Market Investment Strategies and Indicators

Top Down vs Bottom Up – Conclusion

Here is the detailed comparison of Top Down vs Bottom Up Investment Strategy.

In the end, your final decision will be fully up to your skills and efforts. For instance, which strategy you use and how well you understand it will decide the outcomes.

Bottom Up and Top Down strategies are the opposite of each other. But many times, you can use both strategies at once, mainly if your investment is huge.

However, if you want to reap the benefits of a diversified portfolio, the Top Down strategy is going to assist you a lot. This is because this strategy goes through a brief analysis of the market or economy.

Hence, sometimes, you can grab some special insights from the market. Possible, you come to know the budding opportunities and upcoming risks in the market.

On the other hand, the Bottom Up strategy will provide you an idea of how the individual company is well prepared to double its profits from the opportunities.

Or if it incurs a loss, how it’ll overcome it? Hence, you can’t conclude which strategy is the best.

Open Demat Account Now! – Zero Brokerage on Delivery

Most Read Articles