Iron Butterfly Spread – An Advanced Neutral Trading Strategy

Last Updated Date: Nov 17, 2022Iron Butterfly Spread is an advanced options trading strategy used by traders. This strategy is used in neutral market conditions.

Find all details of Iron Butterfly Spread Options Strategy here.

About Iron Butterfly Spread

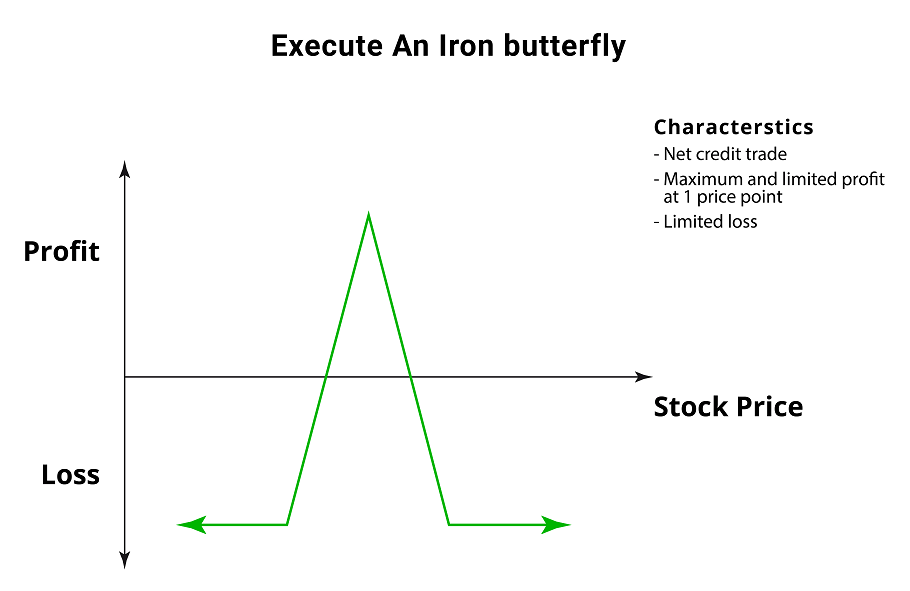

The Iron Butterfly Spread is a trading strategy that is focused on earning a limited profit in large probability when the underlying stocks are expected to have low volatility. It is a limited risk and limited profit strategy of trading.

The traders construct the Iron Butterfly Spread trading strategy by buying a lower strike out-of-the-money put. Then they sell the middle strike at-the-money put, and at-the-money call.

The traders buy the higher strike out-of-the-money call. A net credit resulted from the strategy is put on the trade.

Iron Butterfly Spread is likely a very complex trading strategy in which four trading options or legs in the trading spreads are used which are termed as calls and puts.

One needs to be equipped with a piece of great trading knowledge and experience to indulge in this strategy professionally.

The aforementioned spread helps you to earn handsome profit with a minimal loss involved, therefore this strategy is also well known as Wingspread strategic group which basically comprises of a very limited risk methodology with the concern of earning a limited profit.

This particular strategy is best suited when you have a strong gut feeling that the prices and demands of security will relatively be stable throughout.

Open a Demat Account Now! – Apply this Options Strategy

When to Apply an Iron Butterfly Spread

The best time period to use and apply this high risk but extremely efficient trading strategy technique is, when there is little to absolutely no volatility in the market.

Moreover, when the price of the security is pretty balanced and can help you in yielding an impressive profit.

And if you are capable and confident enough of taking high potential risks and related losses then you may adjust your margins.

It’s a quite flexible strategy to attain a greater probability of returning the profit if one is prepared and ready to risk higher potential losses. In the share market and trade, the risk is involved in almost everything.

How to Apply an Iron Butterfly Spread?

As we know that this strategy comprises four phases which indicate that for initiating this strategy you need to place four orders and discuss them with your respective broker.

These orders or transactions are:

- Buy out the money calls.

- Sell at the money calls.

- Buy out of the money puts.

- Sell at the money puts.

One important thing you should take care of is that the number of options in every leg of the strategy should always be the same and they must also hold the same expiry date.

Also, the strikes of the out of money calls and the strikes of the out of the money puts should be at equal level with the current trading amount of that security.

If you wish to make a good profit, then, it will be advisable to use far out of the money contracts because the spectrum of the profit will be higher.

But this comes with a disadvantage too as it may increase and affect the maximum loss if the security moves out of the desired range of profit.

Find out other Neutral Option Trading Strategy here

| Calendar Straddle | Covered Put | Short Straddle |

| Covered Call | Short Strangle | Call Ratio Spread |

| Albatross Spread | Iron Condor Spread |

Example of Iron Butterfly Spread Execution

Here is an example that provides a detailed overview of how an Iron Butterfly Spread can be applied.

- Company A’s stock is trading at Rs.5000 and X (a person) is expecting that the price will stay at around that price and not fluctuate.

- X then buys one contract (1000 options, Rs.1.50 each) out of the money calls (strike Rs.60) at a cost of Rs.1500. This is the Leg A or the first leg of Iron Butterfly Spread trading.

- X then writes one contract (1000 options, Rs.2 each) of the money calls (strike Rs.55) for a credit of Rs.2000. This is the Leg B or the second leg of Iron Butterfly Spread trading.

- Next, X buys a contract (1000 options, Rs.1.50 each) out of the money put (strike Rs.45) at a cost of Rs.1500. This is the Leg C or the third leg.

- X again writes a contract (1000 options, Rs.2 each) of the money put (strike Rs.60) for a credit of Rs.2000. This is the Leg D or the fourth leg.

- The overall credit received is Rs.4000 and the total cost spend is Rs.3000. So hereby an iron butterfly spread has been successfully created for a net credit of Rs.1000.

Potential Profit- Limited Profit

The call and put options are sold at a strike price. When the underlying stock price at expiration is equal to this strike price then the traders attain maximum profit. At this price when the traders enter the trade, they can have the entire net credit.

When the commission paid is deducted from the net premium received then there is maximum profit.

In other words when the price of the underlying stock is the same as the strike price of short call or put, then the traders achieve maximum profits.

When the stock price falls at or below the lower strike of the purchased put then the maximum loss occurs. In addition to this, the maximum loss occurs when the stock price rise above or equal to the higher strike of the call purchased.

Find out more relevant Neutral Option Trading Strategy below

| Condor Spread | Calendar Put Spread | Iron Albatross Spread |

| Calendar Call Spread | Short Gut | Covered Call Collar |

| Put Ratio Spread | Iron Butterfly Spread | Calendar Strangle |

Example of Iron Butterfly Spread Options Strategy

Consider an example; a company’s stock is trading at INR40 in the month of June. The Iron Butterfly Spread Strategy of trading is executed by the options trader. For INR50, the trader buys a JUL 30 put and writes a JUL 40 put for INR300.

The trader then writes another JUL 40 call for INR300 and buys another JUL 50 call for INR50. The maximum possible profit for the trader is the net credit received when entering the trade which in this case is INR500.

Suppose the company’s stock is still trading at INR40 on expiration in July then the four options expire worthlessly.

The trader gets to keep the entire credit received as profits which is the maximum possible profit. Suppose the company’s stock trades at INR30 on the expiration then except the JUL 40 put sold all the options expire worthlessly.

The intrinsic value of the JUL 40 put will be INR1000. To exit the trade, this option has to be bought back by the trader.

The initial credit received by the trader was INR500 and when this amount is subtracted from this option, then the trader suffers the maximum possible loss of INR500. The overall profit or loss is also significantly impacted by the commission charge.

As four legs are involved in the Iron Butterfly Spread trading strategy, the impact of commission charge is more significant.

When executing the trading strategy of Iron Butterfly Spread. The traders should look for a brokerage firm that charges a low fee per contract.

Profit Earning Probability of Iron Butterfly Spread Strategy

Iron Butterfly Spread Trading Strategy provides you with a higher probability of gaining profit.

This strategy is effective as well as efficient as compared to the other trading strategy as it only comprises either bear or bull spreads but not both.

This is an advantageous strategy if one wishes to establish a substantial trade and most importantly if they are pretty much sure that the security involved doesn’t fluctuate during the trade. It involves limited risks to obtain a limited but guaranteed profit with best-expected results.

Well, especially when it is near to the expiry date and at the money stage of trade. If one has expertise in trading and all the required knowledge then surely you can opt for this technique.

Iron Butterfly Spread: Conclusion

With the help of the Iron Butterfly Spread trading strategy, the traders can realize the maximum profit based on whether the stock price is above the highest strike or below the lowest strike on the date of expiration.

The profit potential is limited for this trading strategy and the commission is higher compared to other similar strategies.

When executing this trading strategy, traders should have patience and trading discipline. The strategy helps to achieve profit by trending stock price movement that is outside the range of strike prices.

In addition to this, the stock price action can be unsettling. When it approaches the expiration, it rises and falls around the highest and lowest strike price.

The traders should be careful about the position that is being opened or closed in executing the Iron Butterfly Spread trading strategy.

Open a Demat Account Now! – Apply this Options Strategy

Similar Topics on Options Trading