Put Ratio Spread – An Advanced Neutral Trading Strategy

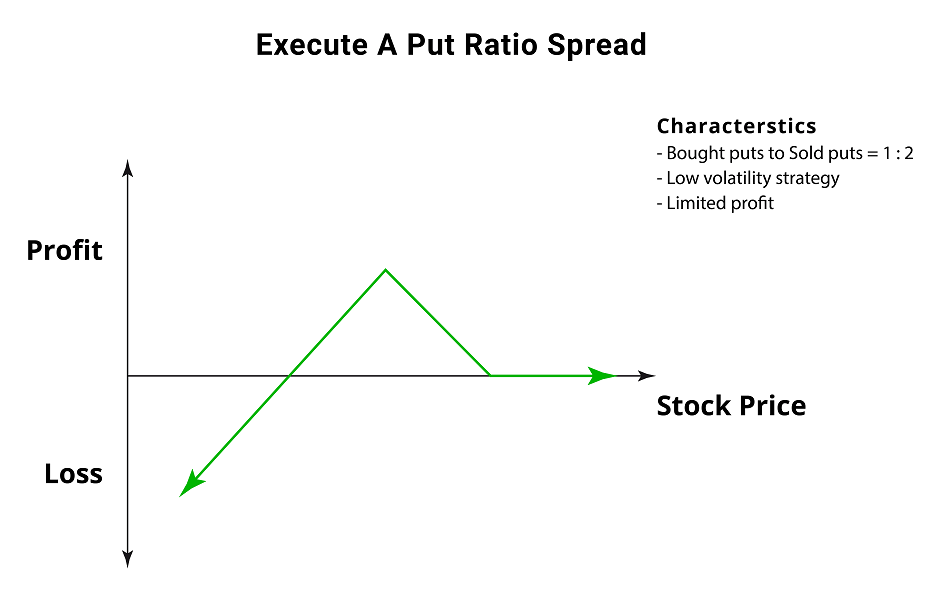

Last Updated Date: May 12, 2022Put Ratio Spread is an advanced option trading strategy. This strategy is used mainly in neutral market conditions.

Know everything about Put Ratio Option Trading Strategy now.

About Put Ratio Spread

It is an undeniable thing that the put ratio spread is rendered to be a complicated process, and yet there are several advantages of the same.

It is one of the neutral trading strategies, which brings considerable profits even when the security price is stagnant.

Not only that, but the investor also gets the profit when the security price goes up indifferent to the amount.

This is one of the best three-leg option strategies, in which the trader has to buy two OTM put options and sell one ITM put option.

This is an ideal strategy that brings maximum profit even when the security price goes down. Therefore even if there are three possible chances of the security price direction, there will be no chance of loss.

Open a Demat Account Now! – Apply this Options Strategy

Best Time to Initiate the Put Ratio Spread

When the trader thinks that the security will fall on a moderate basis near the expiration of the sold strike, it is the time to use the put ratio spread.

This strategy helps reduce the cost of Premium, and the trader can also receive the Advance Credit.

Overview of the important aspects of Put Ratio Spread

There can be various scenarios depending on the price of the security. Listed below are the technical terms as well as the explanation for each

Delta

There will be a positive Delta if the recipient gets the net Premium from the spread. Therefore any enhancement of the security price will lead to Marginal profits, but a major downside of the security price can lead to great loss.

Vega

The spread of put ratio has a negative Vega, which means there will be an adverse effect depending on the price volatility.

Theta

As the expiration date is coming near, there will be a good impact on the strategies.

Gamma

The opposition of the Put ratio spread is quite short, which means there will be no profitability once the security price has gone down to a great extent.

Find out other Neutral Option Trading Strategy here

| Calendar Straddle | Covered Put | Short Straddle |

| Covered Call | Short Strangle | Call Ratio Spread |

| Butterfly Spread | Albatross Spread | Iron Condor Spread |

Application Time of Put Ratio Spread

The put ratio spread is a flexible strategy, and it is multifunctional. Even though specific security price goes down to some extent, there is a considerable amount of profit.

Similarly, it also returns the maximum profit even when the security has an enhancement in price. The same happens even when the price is unchanging.

It will be the perfect strategy if the expectation is to drop the security price by a little bit. Similarly, it is going to be effective even if it is an unchanging price and even an increasing one.

But, in case there is an expectation that the security price is falling to a great extent, this strategy can prove to be a complete loss.

Application Working Mechanism of Put Ratio Spread

There are two different ways in which this strategy can work, but both the legs are going to be unequal. There are two definite decisions to take up whenever you try to create the spread combining the puts.

These are going to be harder and faster decisions and newbie traders should not take them up at all. Among the two decisions, one is to understand the ratio to be put to use and the strikes. Once both the decisions are in ideal manner, there will be no looking back.

The spread has to be clever enough because you need to write more puts compared to the number of buys. Do write it down at the same security price but with a lower strike rate.

The recommended ratio is 2:1 or 3:1. That possibly means that you can write 2 times the puts that you buy or three times the buy. If you want to go in the middle, you can also try out the ratio 2.5:1.

Managing the Risk

The put ratio spread can have a lot of risks if the asset value goes low. The put ratio spread is going to be at its optimum level if the security price is going to go up or down to a small extent.

It is important to analyze the assets because it will bring maximum profit when the stock’s price expires.

When the position reaches to a range of 25 to 50% of the net profit potential, then it is a good thing to close the ratio spread according to the experts.

While the trading is closed while nearing the maximum profit, the investor can sell out the debit spread while withholding the short option.

The trader can also rule out the short option if there is an extension in the position time.

Find out more relevant Neutral Option Trading Strategy below

| Condor Spread | Calendar Put Spread | Iron Albatross Spread |

| Calendar Call Spread | Short Gut | Covered Call Collar |

| Iron Butterfly Spread | Calendar Strangle |

The Potentiality of Profit And Loss

If the underlined security price is equal to the option strike until the expiration point, there will be absolute profit.

In the spread, if both legs A and B expire in-the-money, then both the options will be worthless. Therefore, you will not be able to get the profit that you are looking for.

In some other cases, one of the legs might be comprised of liability, and even that might end up in a loss.

But if the investor is clever enough to write two or three times the options that have been bought, there will be a boost in the liabilities at a faster rate.

Put Ratio Spread Strategy Example

Let us take a hypothetical situation in which there is a put ratio spread. Let us suppose that a company is named X which has a stock trade of INR 3500.

Now let us consider that the price will remain the constant for a short-term. There is a one-year term expiration and the trading is at INR 140.

Therefore, 100 of the options will be returned at a credit of INR 14000. This can be considered as leg A.

If it is a money call with a longer-term of exploration and the trading is at INR 140, the leg B will be different.

The Creator will buy one contract of hundred of options for about INR 28000. This is a call spread that comes within the cost of INR 14000.

Final verdict on Put Ratio Spread

According to the trading experts, there is a specific advantage of getting profit from multiple scenarios while practicing the put ratio spread. Even if the security price stays the same or goes up, there will be a basic profit.

There is a chance of profit even if the price goes down but not too low. But even then, there is a significant amount of risk, and it is going to be a complicated strategy.

The trader should have a basic level of experience to put one of the best strategies to use with huge profit impact.

Open a Demat Account Now! – Apply this Options Strategy

Similar Topics on Options Trading