Short Strangle – A quite straightforward Neutral Trading Strategy

Last Updated Date: Nov 19, 2022Short Strangle is an options trading strategy used in neutral market condition. This is one of the most used neutral trading strategy.

About Short Strangle

The short strangle is a type of trading strategy. It is quite an exact process and working as the short straddle. Both of these strategies are the options trading strategies that come under neutral options.

Some of these neutral trading strategies ripe profits on a condition that security price limit itself in a defined range for a particular set of time.

Moreover, the significant potential profits have a lower value than the ones in a short straddle. Nevertheless, the profit percentage is possibly higher because of the range of price that has a wide window.

In return, such a strategy comprises writing options to gain credit. It involves writing options according to the expectation that it will expire and run out of money.

If the security price goes down or rises significantly, the short strangle strategy can have a consequence that leads to big losses. Thus, it is not a welcoming strategy for beginners, which they should use.

Open a Demat Account Now! – Apply this Options Strategy

Key Points

- The Short Strangle is not suited for newcomers.

- The strategy is neutral.

- Write puts and writes calls are there in two transactions of the short strangle.

- There are two alternate names of the short strangle. One is Naked Strangle Sale, and the other one is Sell Strangle.

- The necessity of “High-Level Trading”

- Distinctive options of trading strategies.

Best Time to Apply For A Short Strangle

When there is a neutral viewpoint, traders can use short strangle. It means that traders do not believe that the short strangle cost will drastically move in either of the directions.

However, if traders wish to let pass a slightly more costly movement compared to short straddle, then it will not put barriers. So, it gives a green signal.

There is a possibility of substantial losses if the security goes up or down, considering significant pricing. Thus, it must be used only when traders have top-notch confidence, and the consideration is such that scenarios will not occur.

Traders require a higher trading level with the broker of yours for applying such spread.

Therefore, it is not appropriate if a trader doesn’t have great investment capital (though the spread with the help of margin generates an upfront credit). Or else, you have no other option other than only restricted trading experience.

Applying Short Strangle

Applying for a short strangle is a straightforward process to write call options on appropriate underlying security while you write an equal puts’ amount on the same security.

So, one can say that traders have a bunch of decisions to make.

Settle Upon The Expiration Date

The first decision says the traders should settle upon the expiration date. Also, there is nothing in the hustle for any hurry regarding the expiration date other than one should use the same expiry date for transactions (long-term and short-term).

Moreover, a short-term expiration significantly offers a better opportunity to make huge profits. The reason behind this is there’ll be less time to move for the “price of the underlying security.”

Also, when you use long-term expiration, it carries a higher chance of risk. However, they’ll be very expensive, and hence, traders will acknowledge a higher credit.

See The Strikes

The second decision concludes what strikes one must use. Contrary to the short straddle, where traders write at money contracts, they require writing out of the money contracts. The traders should decide how long one wishes to have out of the money.

The additional out of the money is, the higher will be the price of the underlying security as both are directly proportional to each other.

And hence, both “out of the money” and “the price of the underlying security” need to move for a neutral strategy for resulting in a state of loss.

Nonetheless, the further out of the money is, the cheaper will be the options. Hence, traders will have less money to write contracts far out of the money.

Find out other Neutral Option Trading Strategy here

| Calendar Straddle | Covered Put | Short Straddle |

| Covered Call | Albatross Spread | Call Ratio Spread |

| Butterfly Spread | Iron Condor Spread |

Example on How Experienced Traders Can Apply Short Strangle

Let’s see how traders might apply such a spread. For instance, a firm whose name is B, stock trades at Rs.4434.74. Further, you conclude that regarding the stock, it is the price that will circulate Rs.4434.74.

Let’s see how traders might apply such a spread. For instance, a firm whose name is B, stock trades at Rs.4434.74. Further, you conclude that regarding the stock, it is the price that will circulate Rs.4434.74.

The call contracts out of the money that strikes at Rs 3991.27, trades at Rs 110.87. You will write one of these contracts that contain 100 options, for Rs 11086.86 credit. So, it is called Leg A.

On the other hand, the put contract of out of the money when a strike is at Rs 3399.97, the trade settles at Rs 36.96. Also, you write one of these put contracts for a further Rs 3695.62 credit. So it is known as Leg B.

Furthermore, the creation of a short strangle is there for the net credit of Rs 100. The above example does not use the precise market data. Also, it doesn’t use hypothetical prices.

Potential of Loss and Profit

The profit traders make the boundation by the upfront credit amount that is Rs 7391.24 here.

Traders can have the maximal revenue if the cost of the underlying security has a trading that ranges two strikes, i.e., lies between Rs 3399.97 & Rs 3991.27.

It says that both Leg A & Leg B would expire without any value. Hence, traders will have no sense of responsibility or liability.

Also, the command of upfront credit will be there with the traders, which they will keep as the profit percentage.

Moreover, traders will lose money if the moving of the price of the underlying security goes at a greater distance in either direction.

The reason behind this is that the options that are written might result in the form of liability better than the receiving of the total credit.

Find out more relevant Neutral Option Trading Strategy below

| Condor Spread | Calendar Put Spread | Iron Albatross Spread |

| Calendar Call Spread | Short Gut | Covered Call Collar |

| Put Ratio Spread | Iron Butterfly Spread | Calendar Strangle |

The Appropriate Calculations

There is no limit to the potential losses. Also, the appropriate calculations for losses, break-even points, and profits are as follows-

- Traders can get the maximal revenue when: Strike in Leg A is greater or equal to the “Price of Underlying Stock.” Plus, the Strike in Leg B” is lesser or equal to Strike in Leg A.

- A tradesman can have the highest surplus when he receives the net credit, and it implies, “(Number of Options Written * Price of Options in Leg B)” + “(Number of Options Written * Price of Options in Leg A).

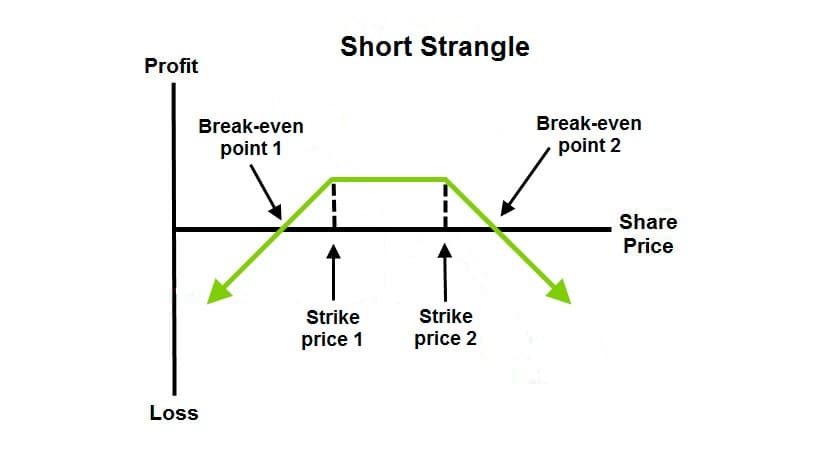

- In the strategy of the short strangle, two break-even points have their existence. Hence, there lies a lower & upper break-even point.

- You will see a Lower Break-Even Point when “Strike of Leg B – (Price of Options in Leg B + Price of Options in Leg A).”

- Traders will have an Upper Break-Even Point = “(Price of Options in Leg B + Price of Options in Leg A) + “Strike of Leg A.”

- The neutral trading strategy of short strangle has loss as its outcome when Upper Break-Even Point is lesser than the “Price of Underlying Security, or the Lower Break-Even Point is greater than Upper Break-Even Point.”

- The strategy of short strangle has profit as its outcome when “Upper Break-Even Point is greater than the Price of Underlying Security & the Lower Break-Even Point is lower than the Upper Break-Even Point.”

Any time, the position of yours can be sealed before getting expired, by way of opting nearby in order to repurchase them at a later date.

By this, you can lock in all your profits through trading options at a lower price while writing. You can also prevent losses if safety is going beyond “break-even points”.

Short Strap Strangle and Short Strip Strangle

It comes under two different forms:

- The short strap strangle

- The short strip strangle

One can apply for the short strip strangle if we write a high amount of puts compared to calls, while the short strap strangle is applicable if we write a high amount of calls with respect to puts. One of two strangles can be used if your viewpoint was neutral.

Still, there is a possibility that the price of specific underlying security can increase (using the short strip strangle), or it can decrease (using short strap strangle).

Moreover, because of such variations that comprise more writing options, the acceptance of upfront credit is much higher.

On the other hand, the losses will be much higher if the “price of underlying security” has too many moves and goes wrong.

Short Strangle: Conclusion

Considering a neutral overview, a short strangle is an easy way of having a profit. However, there exist large risks. Also, such a method contains a greater possibility of having a profit compared to a short straddle.

However, when traders talk about the maximum profit, it is comparably lower. Moreover, you will require quality and highly efficient trading levels to take the help and use of short strangle. In this high trading level, the margin is also incorporated.

The traders should use this concept only when they have high confidence concerning the underlying security’s cost. It is a security price that will not move extensively and considerably in either direction.

Open a Demat Account Now! – Apply this Options Strategy

Similar Topics on Options Trading