Calendar Straddle – An advanced Neutral Options Trading Strategy

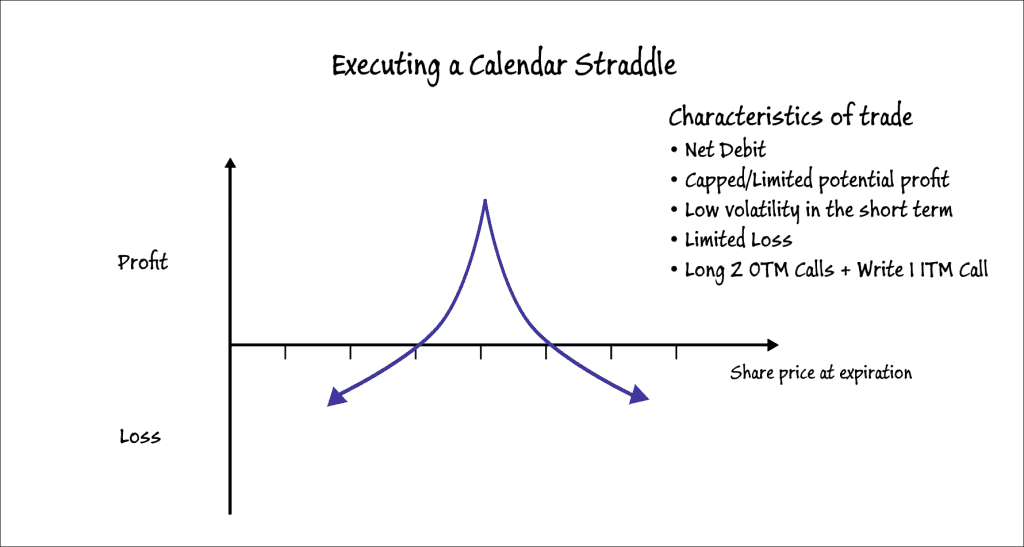

Last Updated Date: Nov 16, 2022The Calendar Straddle has evolved as a part of the Straddle form that has been implemented in trading. It involves a complex process of reading consisting of four transactions.

Besides, it includes long and short straddles and this classifies as a neutral straddle. It is important to consider the various background elements before implementing Calendar Straddle.

Considering Options

There are a number of things to consider before using Calendar Straddle. One is the security of the trading price in a short period of time and the volatility range in the longer period.

We have to ensure these two before choosing Calendar Straddle to be the strategy in trading. If the trade focuses more on the profits, it might be better to consider other strategies.

The Calendar Straddle strategy involves less profit with fewer risks that we could consider when the trade predicts little volatility in the underlying stock price for a short period in future.

We can expect the profit from the rapid time decay experienced by the selling of the near term options.

Open a Demat Account Now! – Apply this Options Strategy

Features of Calendar Straddle

The main aspect of Calendar Straddle is that the trader can expect limited profits with limited risks from the strategy.

Maximum profits from the Calendar Straddle are what we obtain when we trade the stocks at the strike price of the options sold during the expiration of the near term straddle.

Thence, the longer straddle will experience less amount of loss due to time decay.

The limited maximum profit can be experienced only on or before the expiration period of the near term straddle.

This is because the trader can choose to hold on to the longer term of straddle which can provide unlimited profit potential.

Limited Risks Associated with Calendar Straddle

Another element to consider is the few risks we may experience. There is less maximum loss when implementing Calendar Straddle.

This maximum loss is less compared to what we experience when there is a drastic movement of the stock price in either direction.

This can occur in closing to the expiration of the near term straddle. At this stock price, two things occur. The near term straddle will have a sale and the long term straddle will also experience equality in value.

At such a point, the trader will choose to sell the long term straddle in order to buy the near term straddle.

This will lead to a situation where the maximum loss becomes equal to the initial debt that was to enter the trade.

Using Calendar Straddle

The Calendar Straddle is formed as a result of four transactions. It also involves a combination of call options and puts.

The long and short straddles are merged together in this. The short straddle is included with a close expiration date and the long straddle uses a further expiration date.

The four transactions included in the Calendar Straddle are, write at the money calls with a near term expiration date, write at the money puts with the same expiration date, buy at the money calls with a later expiration date, and buy at the money puts with the same later expiration date.

It should be taken into account that all transactions have to be conducted at the same time and each transaction should consist of the same number of options.

Find out other Neutral Option Trading Strategy here

| Iron Condor Spread | Covered Put | Short Straddle |

| Covered Call | Short Strangle | Call Ratio Spread |

| Butterfly Spread | Albatross Spread |

Hypothetical Situation

The following hypothetical situation is what we can use for understanding the implementation of the Calendar Straddle.

A company, X is trading with the initial input at Rs.50. We suppose that the price will remain around the same range in the short term and that a possibility of fluctuation in either direction could be expected in the long term.

Money calls with a near expiration date are trading at Rs.2. Here, a contract is written for a credit of Rs.200. This can be considered to be Leg A.

Money puts with the bear term expiration are in the trading at Rs.2. A contract is here for another credit of Rs.200. This becomes Leg B.

Money calls with a longer-term expiration date trade at Rs.4. The trader purchases the contract for the cost of Rs.400. This is what we call as Leg C.

Money with a longer-term expiration date is trading at Rs.4. A contract is bought for Rs.400 and this is named Leg D.

Here, the total credit is Rs.400 and the total costs become Rs.800. This will in turn lead to a net debit of Rs.400.

Potential Profits and Losses

The situation that could be considered to be ideal is that the price of the underlying security does not change during the time of expiration of the option written as Legs A and B.

The options will expire and become worthless. The options bought in Leg C and D will also be at the money. However, for the latter case, there would be a remainder of the time value.

The profits happen due to the effects happening due to time decay and also because there is a loss of time value for the near term options which is faster than the longer-term options.

When the time of the expiration of options in Legs A and B approaches, considering that the underlying security for the price has not changed, we expect that the joint value of the options in Legs C and D is higher than that on the initial net debit.

The degree of maximum profit that can be made at the time depends on the measure of the time decay that has affected the prices of the options written.

We could predict that using theoretical analysis by making use of the Black Scholes Options Pricing Model. However, this cannot be fully accurate.

Find out more relevant Neutral Option Trading Strategy below

| Condor Spread | Calendar Put Spread | Iron Albatross Spread |

| Calendar Call Spread | Short Gut | Covered Call Collar |

| Put Ratio Spread | Iron Butterfly Spread | Calendar Strangle |

Price Movements

One can also make profits if there have been movements in either direction of the price. However, there is a chance of losing money in case there is a significant movement.

Maximum debit stays limited to the net debit. This is because the existing options can cover any liabilities that might be due to the written options.

When there is worthless expiration of Legs A and B, two choices could be considered. We could sell the options of Leg C and D as one choice.

This would cover the cost required in establishing the spread and making a profit. This would cause closure.

Another choice would be to place Legs C and D as open positions. This now leaves behind a long straddle.

If the initial prediction was correct which was of the security to belong to a period of volatility, there are possibilities of gaining unlimited profits by the long straddle.

If the trader predicts any change in the underlying security before the expiry of Legs A and b, then one can consider closing these legs much before time. This leaves out the long straddle.

Choosing Follow up Action on near Term Expiration

One of the important considerations is to decide on the right follow up action that could be taken during the expiration time of the near term option.

The trader can make a decision based on the new outlook of the underlying security at that point in time.

If it is evident that the underlying volatility will remain low, the trader can choose to enter another calendar straddle by means of writing another near term straddle.

If the situation has a significant increase in volatility, it would be better to hold into the long term straddle which can provide profits due to any possible price movements.

In the case of the uncertainty of the underlying volatility, the trader should try to take the profit and carry on evaluating other possibilities of trading.

Similar Strategies

The trader can consider a number of other strategies similar to Calendar Straddle. The following strategies offer similarity in having low volatility with limited risk and profits.

A few examples are Neutral Calendar Spread, Long Put Butterfly, and Iron Condors. Choosing the right strategy can be based on considering a number of elements.

The reason for investors to use Calendar Straddle is because it is helpful in situations where there is a predicted movement in a stock’s price along with uncertainty in the movement of the price

Calendar Straddle Option Strategy – Conclusion

A calendar Straddle is a complex strategy with its own pros and cons. It could be quite helpful in a certain situation of uncertainty in the fluctuation of price. The trader can expect a return of profit after a period of price stability.

This short straddle can be converted to the long straddle if there is a chance of a period of volatility. There are fewer risks with similar profits in this strategy.

One of the major disadvantages of the strategy is the involvement of four transactions. This in turn can lead to increased commission rates.

It would be better to have a good experience in the field before implementing Calendar Straddle.

Open a Demat Account Now! – Apply this Options Strategy

Similar Topics on Options Trading