Iron Condor Spread – An Advanced Neutral Trading Strategy

Last Updated Date: Nov 17, 2022Check out all details of Iron Condor Spread, an advanced Option Trading Strategy used in Neutral Market Condition.

Find everything related to this Neutral Options Strategy here.

About Iron Condor Spread

The iron condor spread concept is another effective options trading strategy that has similarities with the butterfly spread of iron condor.

Often, tradespeople favor the iron butterfly spread. The reason behind it is that there is a higher possibility of generating maximal profit.

Additionally, the iron butterfly spread has the requirement of an underlying security that should remain at a precise price for the highest return.

Also, the iron condor spread promises to return a hefty profit by offering a specified range underlying security.

Moreover, though there lays a trade-off, as the percentage of maximum revenue is lesser. Now, have a scan at the essential details of this crucial spread

Open a Demat Account Now! – Apply this Options Strategy

Key Points to this Advanced Neutral Trading Strategy

- The iron condor spread is a neutral trading options strategy.

- Risky for beginners.

- There are four transactions in iron condor spread: write puts, write calls, buy calls, and buy puts.

- When you receive an upfront credit, it is called the “credit spread.”

- There is a need for a “high trading level” here.

- Alternative trading strategies.

Time to use The Iron Condor Spread Strategy

As iron condor spread is a neutral trading strategy; therefore, traders can use it when they expect a slight cost movement in the underlying security.

As you can see above, iron condors can also return the maximal profit if there’s a little movement in the underlying security in either direction.

Thus, it will be an apt choice if traders think that there may exist a tiny volatility amount. Further, it is an intricate neutral trading strategy that traders should not use without an excellent confidence level and experience.

Usage of Iron Condor Spread Strategy

Like an iron butterfly spread, the spread of iron condor strategy contains four legs that mean traders require placing four orders with their broker.

Therefore, a combo of calls and puts are there. Traders require to buy & write both the options. Now, have a look at the four trades:

- Purchase out of the money calls

- Purchase out of the money puts.

- If there is a lesser strike than above, then sell out of the money calls.

- If the strike is higher than the above, then sell out of the money puts.

The number of options sold or purchased in every leg must be the same, as must be the use of the expiration dates.

There must be the use of strikes in two short legs that remain at a great distance from the current trading cost of the underlying security, as must be the use of long legs. Now, traders have to decide what exact strike they must use.

The more equidistant from the current trading price of the long legs are, the lower will be the chance of iron condor spread having a loss.

However, there will be a higher potential loss. Higher the difference is between the short legs’ strikes; wider will be the range for the utmost profit. Nevertheless, there will be a lower potential profit.

Find out other Neutral Option Trading Strategy here

| Calendar Straddle | Covered Put | Short Straddle |

| Covered Call | Short Strangle | Call Ratio Spread |

| Butterfly Spread | Albatross Spread |

Example of Iron Condor Spread

Let’s see an iron condor spread instance, to get a wider picture of how you can use it. We must underline that there is the use of hypothetical and simplified options prices in the instance instead of the market’s real data.

Moreover, we have not included any commission costs.

- A firm B stock makes transactions at Rs 3670.50. Now, traders expect that the cost remains comparatively closer to the above price.

- Tradespeople can purchase one contract out of 100 options that trade at Rs 36.71 each. One can buy a single contract from out of the money calls with a strike Rs 3964.14 and 3670.50. So, we call it Leg A.

- When the price is Rs 73.41, each and traders have to write a single contract out of the money calls among 100 options with a strike Rs 3817.32 for a net credit of Rs 7341.01. Thus, it is known as Leg B.

- Tradespeople can purchase a single contract; out of 100 options with a price of Rs 36.71 each form out of the money puts that strike at Rs 3376.86 at Rs 3670.50 price. It is what we understand as Leg C.

- Out of 100 options, a tradesperson can write one contract at Rs 73.41 each from out of the money put, striking at Rs 3523.68 for Rs 7341.01 credit. Hence, it is the Leg D.

The net receiving of credit is equal to Rs 14682.01. And the further price is Rs 7341.01. Also, tradespeople organized a spread of iron condor for an overall Rs 7341.01 credit.

Potential Profit Plus Loss

The spread of iron condor generates the utmost probable return when trades of the underlying security lie at a cost between the strike of shorts legs that are Leg B and Leg D.

When you see this example, the underlying security price must range between Rs 3523.68 and Rs 3817.32.

Further, it has the outcome in the form of four legs that expire worthless out of the money. Also, traders will have the net credit amount as their profit.

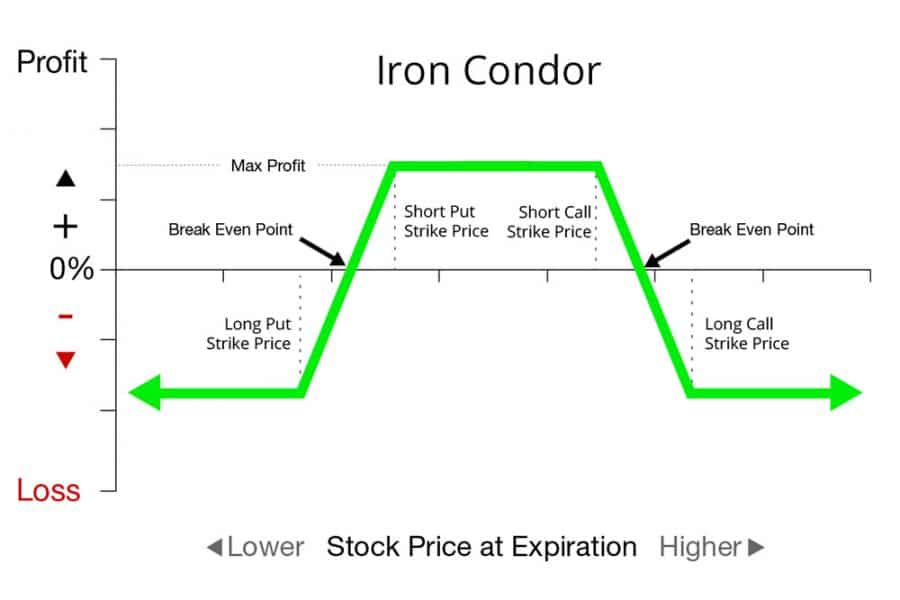

The iron condor spread encompasses two break-even points that reside on either side of the price range.

Also, traders can still have profit (although a lower profit) if the underlying security price ranges between those two break-even points. Thus, if the price goes beyond the range, traders will have a loss.

Find out more relevant Neutral Option Trading Strategy below

| Condor Spread | Calendar Put Spread | Iron Albatross Spread |

| Calendar Call Spread | Short Gut | Covered Call Collar |

| Put Ratio Spread | Iron Butterfly Spread | Calendar Strangle |

Different Formulas to Apply In Iron Condor Spread

We have the compilation of different formulas that traders can strategically apply to the iron condor spread.

These formulas offer the outcomes of some of the essential hypothetical scenarios.

- If the cost of a trading company name is T whose stock remains accurate for Rs 3670.50 by the expiration time, then the purchased options in both Leg A and Leg C would expire worthlessly and stay out of the money.

- The options written in Leg B and Leg D will expire worthlessly and will stay at the money. The profit of traders would result in total credit. It will also be the same scenario if the underlying security lies between Rs 3523.68 – Rs 3817.32.

- If any stock company naming Y rises to Rs 3964.14 by expiration time, the purchased options in Leg A will stay at the money and will expire worthlessly. Moreover, the options in Leg B that are written stays in the money plus they cost approximately Rs 146.82, each having a net liability of Rs 14682.01.

- Further, in Leg C and Leg D, the written options would expire worthlessly and stay out of the money. Moreover, traders would get a net liability of Rs 14682.01. Thus, around a net profit of Rs 7341.01 would be thereafter calculating the basic net credit.

- If the cost of stock of a firm named Z tumble down to Rs 3376.86 by expiration time, the writing options will expire worthlessly and will be out of the money in Leg A & Leg B.

- Furthermore, the already purchased writing options in Leg C would expire worthlessly and will be at the money.

- In Leg D, the other writing options would cost approximately Rs 146.82 with a net liability of costing at Rs 14682.01.

- Traders would have the net liability pricing approximately at Rs 14682.01. Therefore, an overall loss would stay around Rs 7341.01 after the report for the original total credit.

Adjustments of Iron Condor Spread

- Traders can receive the highest profit in the case when Strike Price in Leg B is higher than “the Price of Underlying Stock” and also higher than the “Strike Price in Leg D.”

- The maximal revenue is the receiving of the net credit.

- In an iron condor spread, you will see two break-even points.

- One break-even point is the Upper Break-Even Point.

- The other one is the Lower Break-Even Point.

- Iron condor spread’s Upper Break-Even Point is equal to “(Number of Options in Every Leg/Net Credit) + “Leg B Strike.”

- Iron condor spread’s Lower Break-Even Point is equal to “Leg D Strike – (In every leg, Number Of Options/Net Credit).”

- The outcome will be a profit in an iron condor spread if the “Upper Break-Even Point” is greater than the “Price of Underlying Security.” And it is also greater than the “Lower Break-Even Point.”

- The outcome will be a loss in the iron condor spread if “Price of Underlying Security is greater than the Upper Break-Even Point, or else, it is lesser than the Lower Break-Even Point.”

- The loss will be maximum when the “Price of Underlying Security is greater or equal to the Strike Price of Leg A,” or The Strike Price of Leg C is greater or equal to the Price of Underlying Security.”

Quick Overview of Iron Condor Spread

If you talk about the alternative of iron butterfly spread, then do not look further than the iron condor spread if traders try to make a profit from the corner of neutral outlook.

Even though the highest potential profit that exists is lesser, the possibility of having that revenue is much greater.

The reason behind it is the iron condor produces the greatest returns when the trading of the underlying security is within the price instead of the accurate pricing.

The drawbacks of the iron condor spread have so much similarity to the iron butterfly spread. In all, it is an intricate strategy that comprises four legs, and it means that there are greater commission charges.

Open a Demat Account Now! – Apply this Options Strategy

Similar Topics on Options Trading