Covered Call Collar – A Simple Options Strategy for Beginners

Last Updated Date: Nov 16, 2022Covered Call Callar is a simple options trading strategy. This strategy is used in Neutral Market conditions & can be used by beginners aswell.

Knnow everything about Covered Call Collar Options Trading Strategy here.

About Covered Call Collar

It is a covered call position with the addition of a put, which acts as an insurance policy and limits losses to a minimal amount.

Similarly, profits are also limited. However, traditional investors find it a good trade-off to limit profits for losses.

We can use it if one already owns the security and want to protect it from downward neutral trends. Selling someone a call using the stock they already own grants the buyer feasibility to buy their stock at a specified price.

It limits profit potential, and the cash reduces cost. The cash premium stays irrespective of the situation further. Therefore, even if the stock declines in price, one might incur a loss, but they’re better than owning it.

The covered call collar is a neutral trading strategy that is fairly simple and suitable for beginners.

It can protect security from being in a neutral trend if it faces losses due to falling prices. It returns a profit from stable stock prices in a similar manner as the covered call.

Open a Demat Account Now! – Apply this Options Strategy

What is Collar in Options?

This could be considered as a protective option strategy that takes place by the purchase of an out of the money put option and simultaneously, working out on writing the call option on the same as it and it is considered as hedge wrapper.

Purchasing an out-of-the-money put option helps prevent huge losses when we predict a large downward move. It locks profit in the prices on underlying shares.

The premium that the trader receives from selling any out-of-the-money call might reduce the buying cost of the put option in the same out-of-the-money put.

A collar is determined as an element that a trader establishes by having shares from stock by buying a safe put or writing out a cover call.

This Idea requires a situation wherein the trader looks out for the price of the existing stock rising to the strike price which is mostly contractual.

Objective of Covered Call Collar Strategy

The objective of covered call collar is to profit from a long stock position that doesn’t assumedly increase in value in a given time frame. It provides a facility to generate a return from stock at a stable price.

It is an extended version of the covered call that involves sacrificing profitability to stabilize the stock falling in value.

We can create a covered call collar from scratch or apply it directly to the stock. The creation includes a procedure of buying a stock and applying the required option trades on it.

It is a lengthy and not-so-proper way to profit from a neutral outlook because of the commission involved.

Find out other Neutral Option Trading Strategy here

| Calendar Straddle | Covered Put | Short Straddle |

| Covered Call | Short Strangle | Call Ratio Spread |

| Butterfly Spread | Albatross Spread | Iron Condor Spread |

Transactions involved in Covered Call Collar

As for transactions, there are only two requirements to make sure the strategy is in place. It includes the writing of calls on any available stock and then selling it to any open order.

The trader must buy the same amount of put in this case and make sure the expiration date is the same for both sets of options.

The major factor while implementing this strategy is the strikes one chooses to use. In general, one can write “out-of-the-money” calls at a slightly higher strike than the current price of the stock they own.

Choosing higher strikes enables them to make more profit upon an increase in stock price, but it can receive a lower credit and make less if the price doesn’t increase.

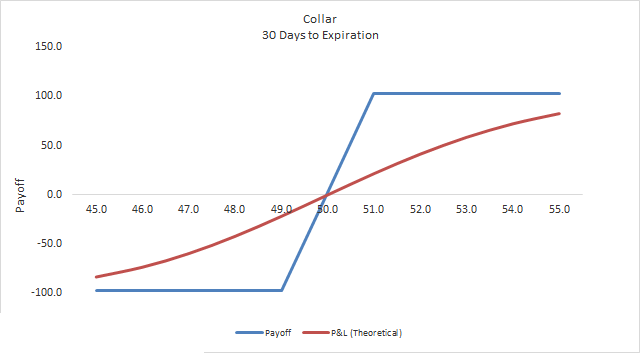

Potential profits of Covered Call Collar Options Strategy

We get back the maximum profit at the time of expiration if the stock price has increased to the strike of the calls written.

Profit will not be applicable if the price of the stock is higher than the Strike price offered by the option contract.

Also, it is the responsibility of the trader to calculate the difference between the existing stock price and the starting point and pricing for the options present in every other share.

Now, the trader can attain maximum profit if the price of the stock equals the options price.

However, it is not an easy task to achieve the same considering the price fluctuations that the trader should be expecting when it comes to options trading.

Find out more relevant Neutral Option Trading Strategy below

| Condor Spread | Calendar Put Spread | Iron Albatross Spread |

| Calendar Call Spread | Short Gut | Calendar Strangle |

| Put Ratio Spread | Iron Butterfly Spread |

Risks involved in Covered Call Collar

The maximum loss can occur when the price of underlying stock matches with the strike of options.

The difference between the starting point and strike of options and the price per option and less price per option is the maximum loss per share.

If the stock rises above the options’ strike, then only the covered call collar can cost profits. But, if the trader holds the stock, and we apply another strategy, one can gain larger profits.

Trends in Connection with the Strategies

It is possible that the trend might go on for a few weeks and months and it could cause some trouble between the investor’s and stock traders when it comes to profit under a few circumstances.

Mostly, the trader can expect stability in pricing and when it comes to the investors, which is a lot of opportunities to be seen.

It also helps the investor in turning their existing time decay into a space with a lot of productivity thereby reducing the exposure for risk. On the other hand, the options traders can try out other neutral strategies to bring more profit as well.

It is always about the strategy that the trader can master and be able to apply the same without second thoughts.

Now, it is not mandatory that the strategy is same for every other trader, which is why every trade and must find out their forte when it comes to options trading.

Covered Call Collar Strategy: Conclusion

As discussed earlier, the traders should understand if he should be using the covered call collar option as a trading strategy because the underlying stock makes a big difference.

The trader should have an understanding of the stock situation and the trends applicable to the covered call option trading before he steps in.

Open a Demat Account Now! – Apply this Options Strategy

Similar Topics on Options Trading