Condor Spread – An Advanced Neutral Options Trading Strategy

Last Updated Date: Nov 16, 2022Condor Spread is another advanced Options Trading Strategy used in Neutral Market Condition. Know everything about this option trading strategy now.

About Condor Spread

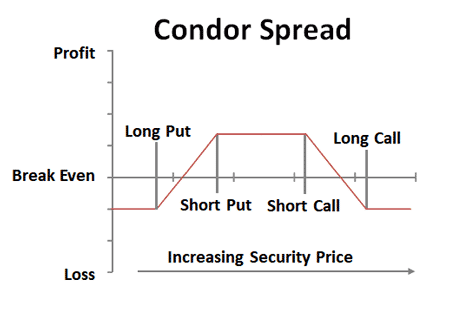

The Condor Spread is an advanced non-directional and neutral trading strategy that helps the trader earn a profit when the underlying security price shows minimal movement and stays within a defined range. The setting up of the trade requires an upfront cost.

The strategy involves four transactions of buying and selling the calls or puts over underlying security and for different time duration.

The Condor Spread is one of the most complex trading strategies but provides better profit opportunities as it has good flexibility in setting a varied price range.

Open a Demat Account Now! – Apply this Options Strategy

Objectives of Condor Spread Strategy

The traders pick up Condor Spread as it is an easy strategy, especially those who hold expertise in the domain.

An investor who has a deep knowledge of the market risks, as well as the spikes and dips of the price variation, can use the strategy to spread the trade gaining profits at lowered risks gradually.

The trader must keep in mind that the underlying security either does not move at all or moves within a presumed range to trade profitably at the decided strike.

It allows better flexibility than the butterfly spread in terms of defining the strike. However, it is more expensive and requires a relatively greater upfront cost.

Setting up the Condor Spread

Condor Spread can be set up by establishing four legs. The trader has to make four orders with the broker to start a successful spread.

The first step involves buying deep in money calls, followed by writing in the money calls at a higher strike price than the bought deep in calls.

A far-out money call is bought, and another call is written out at a strike price lower than the bought far outcall.

These orders can be made at one time or simultaneously depending upon the trader’s market capacity.

The number of call options must be the same for all the four transactions, and the clause and period of contract termination must be properly drafted. The expiry date for all the calls is usually the same.

Strikes made at a price closer to the current trading price of security assets tend to increase the profit amount and the spread’s overall productivity, but the range has to be reduced.

Strikes made at a price farther to the current trading price might lower the overall profitability of the spread and provide a wider range to earn a profit.

Find out other Neutral Option Trading Strategy here

| Calendar Straddle | Covered Put | Short Straddle |

| Covered Call | Short Strangle | Call Ratio Spread |

| Butterfly Spread | Albatross Spread | Iron Condor Spread |

Types of the Condor Spreads

The Condor Spreads operate both in calls and puts and can be categorized in several sub-categories. Some of them are;

Long Condor with Calls

Long Condor with Calls always results in a net debt to the trader’s amount. It involves the following four transactions;

- You are buying a call at a certain strike price, which is usually the lowest strike price.

- We are selling a call at a slightly greater strike price, i.e., the second-lowest strike price.

- We are selling a call at a yet higher strike price, which is the second-highest strike of all the transactions.

- You are buying a call at the highest strike price.

The profit is to be earned from the less volatile and neutral price variant underlying asset. Maximum profit is obtained when the underlying security falls between the two middle strikes of the transactions at the time of termination.

The maximum loss is the total cost used in setting up the spread, which includes the upfront cost and the underlying asset.

Long Condor with Puts

Long Condor with Puts also results in a net debt to the trader’s amount. It involves the following four transactions;

- You are buying a put at a certain strike price, which is usually the lowest strike price.

- We are selling a put at a slightly greater strike price, i.e., the second-lowest strike price.

- We are selling a put at a yet higher strike price, which is the second-highest strike of all the transactions.

- You are buying a put at the highest strike price.

The trading strategy and the trading curve are similar to that of the Long Condor with Calls.

Short Condor with Calls

Short Condor with Calls always results in a net credit to the trader’s amount. It involves the following four transactions;

- We are selling a call at a certain strike price, which is usually the lowest strike price.

- You are buying a call at a slightly greater strike price, i.e., the second-lowest strike price.

- Besides, you are buying a call at a yet higher strike price, which is the second-highest strike of all the transactions.

- You are selling a call at the highest strike price.

Short Condor tries to earn the profit from the high volatility of the market. It is assumed that the price of the underlying security moves beyond the highest or the lowest strike. The maximum profit is the credit left at the trader’s end after all commissions are paid.

The maximum loss can be estimated by the difference between the middle strike prices at the time of termination and the implementation cost and the commissions.

Short Condor with Puts

Short Condor with Puts also results in a net credit to the trader’s amount. It involves the following four transactions;

- We are selling a put at a certain strike price, which is usually the lowest strike price.

- Buying a put at a slightly greater strike price, i.e., the second-lowest strike price.

- You are buying a put at a yet higher strike price, which is the second-highest strike of all the transactions.

- We are selling a put at the highest strike price.

The trading strategy and the trading curve are similar to that of the Short Condor with Calls.

Find out more relevant Neutral Option Trading Strategy below

| Calendar Strangle | Calendar Put Spread | Iron Albatross Spread |

| Calendar Call Spread | Short Gut | Covered Call Collar |

| Put Ratio Spread | Iron Butterfly Spread |

Profit Potential

The Condor Spread is an advanced risk-oriented trading strategy that revolves mainly around earning profits from the initial investment or security.

The potential losses are reduced if the market price at the time of contract expiration is around the range of the contract’s two middle strike prices. Prices above the highest strike and below the lowest strike are beneficial in short term trade.

The Condor Spread mostly returns the profit to the trader regardless of the direction of the price fluctuation as there is subsequent buying and selling of the money calls.

However, if the fluctuations are too considerable, the trader might get affected depending upon the fluctuation direction.

Loss Potential

The losses are major if the underlying security prices are moved too far in either direction beyond the breakeven points. If the prices fall too sharply, all the money calls turn worthless.

This, in turn, leaves the trader with no returns and liabilities, and thus, the trader might lose all the money he invested in the initial spread.

Since there is a price range facility with this type of trading, chances of profit slightly increase if the underlying security moves within the assumed price range.

If the prices increase suddenly and show an unexpected hike, the in-calls show a subsequent price hike. However, the calls have equal impact, and thus the payments fall upon the upfront. This can cause a considerable loss to the trader.

The trader can call off the call positions, or terminate the contracts before the expiry date if the trader sees a profit at the point of termination.

Variations of Condor Spread Strategy

The Condor Spread shows two major variations apart from the types mentioned above. These are the call broken wing condor, and the put broken wing condor.

The trader can consider the call broken wing condor when he buys the strikeout of the money calls of better value.

The profit slightly reduces. However, the potential risks reduce even if the underlying security falls below the estimated price.

The put broken wing condor comes in when the strike of the bought out of the money calls is decreased. The profit slightly reduces. However, the potential risks reduce even if the underlying security rises above the estimated price.

Risk Management of Condor Spread

Being a strong strategy, ‘Condor Spread’ involves heavy-risks and needs proper policies for loss management.

It demands expertise in the trading domain and can cause potential damage to the trade and finance to the novice investors.

High functional knowledge is what we need to carry out the complex in and out of money call for the trade, which can bring potential losses if not taken in care.

Condor Spread – Conclusion

The Condor Spread can prove to be one of the best options for trading. It involves not only flexibility but also considerable profits.

The traders can adjust the strike prices as per their choice, i.e., whether to reduce the underlying risks or increase profits.

We can manage the profit and risks as per the profit-risk trade-off. The underlying asset can also withstand the price movement within an assumed price range, further increasing profits.

However, we should calculate the risk properly as a failed condor spread can cause heavy losses to the trader.

Open a Demat Account Now! – Apply this Options Strategy

Similar Topics on Options Trading