Synthetic Option Trading Strategy – Meaning, Types, Usage & more

Last Updated Date: Nov 17, 2022Know everything about Synthetic Option Trading Strategy here.

Options trading involve significant risks that are not appropriate for all investors. Some additional costs associated with option strategies call for multiple purchases and sales options such as a collar.

The profitability of options trades and its risks regarding the price of trade and distribution of stock prices focuses on the volatility of different periods.

Options are one of the most common ways to profit from market scales. They offer a low-cost way to invest with less capital. It is irrespective of the choice to either trade currency or buy shares of a corporation.

What Are Synthetic Options Trading Strategies?

Synthetic options are a way to recreate the risk profile and pay off a particular option. It does so using suitable combinations of underlying tools and different options.

A synthetic call is created by a long position combined with a long position in an at-the-money put option.

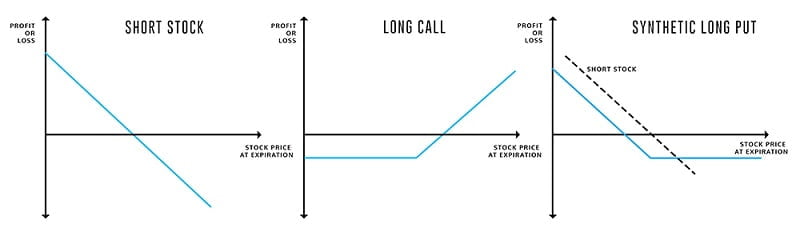

On the other hand, the opposite position creates a synthetic put. That is, a short position in the underlying combined with a long position in the at-the-money call option.

In comparison between vanilla options, the synthetic option can help eliminate the issues. It happens without any impact from the options or its expiring date.

Open a Demat Account Now! – Apply this Options Strategy

Types of Synthetic Options Trading Strategy

Synthetic call and put are the two different synthetic options available. These are based on the future position or cash position within the options.

As defined earlier, synthetic put is a short cash or futures position combined with the purchase of a call option. We call it a synthetic long put.

A synthetic call needs a purchase of an at-the-money put option on the same stock that the investor holds. It is to protect against depreciation in the stock price.

It is also a married call or protective call and investors consider it to be similar to an insurance policy. Also, it happens against the dropping stock in the duration that they hold shares.

A drawback of synthetic options or trading options overall is that they generate their own set of problems. A stable market resulting in little or no activity can cause an at-the-money option to lose value due to time decay.

But, investors with experience can turn it into their profit by proper implementation resulting in making trading less expensive and simplifying decisions to manage positions more effectively.

Learn everything about Option Trading & start making big money in Options Market

Why Use Synthetic Options Trading Strategies?

Investors and traders can use the Zerodha or Angel Broking tool to capture details of their plan and use a profit or loss calculator to simulate the synthetic position.

The put-call parity makes the synthetic options possible by – implication of them in different pricing models.

It is a principle that defines the relationship between the price of put options and call options of the same underlying asset, price, and expiry date.

It delivers the same return as holding a futures contract on the same underlying asset and other factors.

If these factors are not the same, it does not hold a relationship but an opportunity exists that traders can theoretically earn a risk-free profit.

The price of a Indian call option and the Indian put benefits the same. Here, it spots the price or the current market value.

Then, it checks for expiration date and risk-free rate that presents the value of the strike price.

Synthetic Options Trading Strategies

The Synthetic options trading strategies include:

Synthetic calls use stock shares and put options to stimulate the call option performance that gives investors the theoretical knowledge of unlimited growth potential with a specific limit to the amount risked.

Synthetic long calls include long put and long stock. Here, the investor thinking of opening a married put position desiring an upside of stock but want limited downside risk can consider buying a call that shares the risk or reward profile.

Synthetic long put includes long call along with the short stock. Traders can flip their long call into a bearish trade by shorting the stock. In either way, they have created a risk or reward profile of a long put.

Synthetic short calls include short stock and short put. Here, the synthetic position consists of two components. If the investors have one of the two they can quickly alter their risk exposure by adding the other one.

Synthetic short puts include long stock and a short call. Investors might face Limited profit and when it comes to loss, it would be unlimited.

Find out some of the Best Options Trading Strategies here

Synthetic Straddle

Synthetic Straddle provides Enormous profits with the help of a combination of call options with more put options with Long stock while the call option is of short stock.

It is a blend of stocks and calls options that produce the same pay off traits like a long straddle options trading strategy.

It provides very great flexibility with unlimited profit and limited loss. There is a limited maximum loss that we limit to the extrinsic value of options they purchase when the stock remains stagnant and unlimited maximum profit upon implementation of the synthetic straddle.

We calculate the break-even points in the upper breakeven as the sum of option strike price and extrinsic value of options.

And we calculate the lower breakeven as the difference between the option strike price and the extrinsic value of options.

Synthetic Short Straddle

Synthetic Short Straddle includes long stock along with short two calls. It is the combination of stocks and calls options that produce the same payoff characteristics as a short straddle options trading strategy.

The synthetic straddle options strategy and synthetic short straddle work similarly, however, there are limited maximum profit and unlimited maximum loss. It reaches profitability when the underlying stock closes at the strike price of the short options.

But, there are two break-even points associated with a synthetic short straddle. One is when the underlying asset goes up and another when it goes down, named as upper breakeven and lower breakdown.

Upper breakeven is calculated as the addition of option strike price and extrinsic value of options and the lower breakeven is calculated as the difference between the same.

There are also two ways to send out a synthetic short straddle. One of them involves selling twice at-the-money call options as the investor has long stocks and the other is by selling many at-the-money put options as the investors have short stocks.

They are also called a short call synthetic short straddle and short put synthetic short straddle.

Synthetic Covered Call

Synthetic Covered Call involves writing calls against long stock. Many traders that write cash puts to get a stock assigned and start writing calls against their shares.

It produces positions that are equivalent to payoff characteristics of all-time favorite options strategy.

These include naked-put-writes by buying an underlying stock and writing an out-of-the-money or at-the-money call option.

The main reason and advantage behind using a synthetic covered call is the cost-saving by upfront investment.

Needless to buy an underlying stock, they can save on commissions by only having one leg instead of two in the covered call.

The advantages include a much lower cost than actually covered call and a similar profit and loss profile to a covered call.

But the disadvantage here lies is – no gain from dividends if the underlying stock pays a dividend. And the risk or reward is the unlimited maximum loss possible.

It happens if the price of the stock drops below the strike price of short put options. It also requires a margin to set strategy.

We calculate the losing point here as the difference between the strike price and the extrinsic value of put options.

Synthetic Option Trading Strategy: Conclusion

There is a lot more to synthetic option trading strategies than just easing trade decisions and eliminating problems.

It provides a wide range of viable parity that provides options pricing to reduce cost and supplementary trading.

They can provide more efficient use of capital and flexibility. The trader can achieve this by using different synthetic positions and marker tools in trading.

They have a method of analysis for time, direction, and volatility.

Open a Demat Account Now! – Apply this Options Strategy

Similar Topics on Options Trading

| Live Nifty Option Chain |

| Live NSE Option Chain |

| Open Interest Stock Options |

| Open Interest Index Options |

| Most Active Index Options |

| Most Active Stock Options |

| Put Call Ratio |