Karvy Franchise / Partner / Sub Broker Review

Last Updated Date: Mar 27, 2023Karvy Franchise is one of the best-known stockbroking franchises in the country. They are based out of Hyderabad.

Let’s have a detailed Karvy Franchise Review & deep understanding of Karvy Sub Broker Offerings, Karvy Franchise Revenue sharing models & other features of the Karvy Partner Program.

Table of Contents

- Rating & Review

- Overview

- Business Models

- Commission

- Investment

- Offers

- Eligibility Criteria

- Support

- Documents Required

- Pros & Cons

- Earning Potential

- FAQs

- Become a Karvy Partner Now!

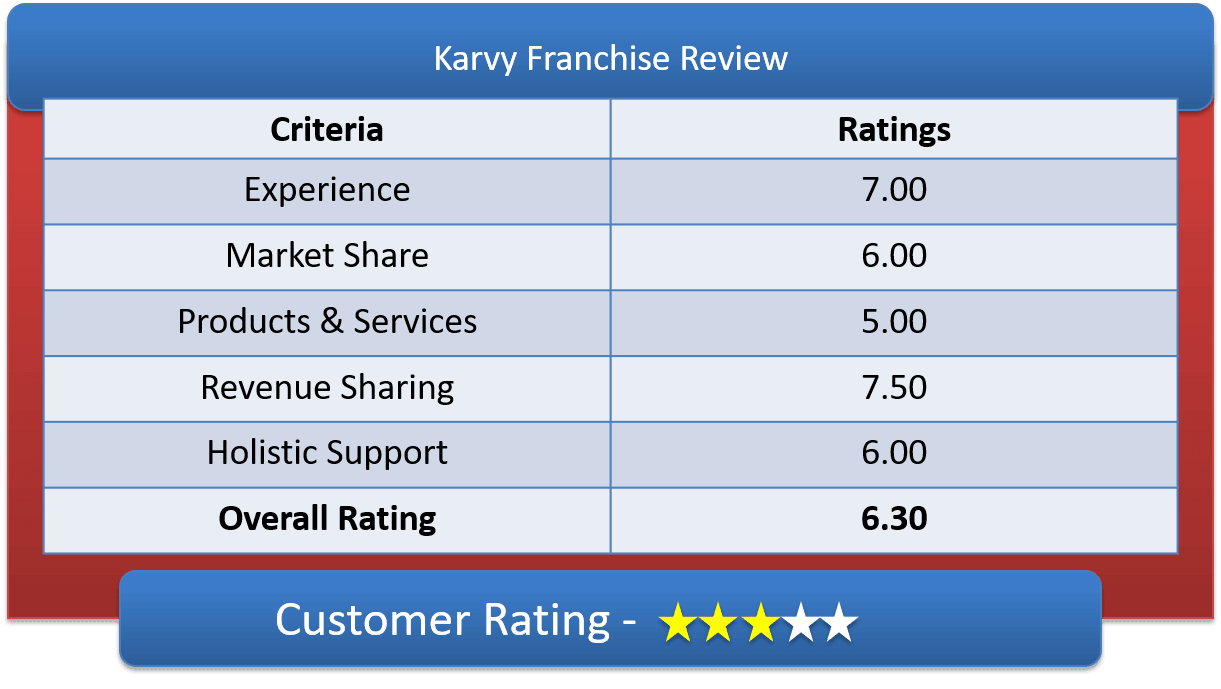

Karvy Franchise Customer Ratings & Review

About Karvy Franchise

Karvy Online Franchise is now completely handled by Karvy Fortune. This group provides you with partnerships with Karvy and all other related supports.

Currently, Karvy has around 60 million investors across India and provides their investor’s services across India among 400 plus corporate houses.

Currently, Karvy has around 60 million investors across India and provides their investor’s services across India among 400 plus corporate houses.

Karvy has a presence in 330 cities, 787 associates in India, and over nine thousand highly qualified Teams of Karvy.

Karvy Fortune is always on its feet to help hard-working, ambitious partners for a mutually profitable business. Becoming a partner to start an enterprise with Karvy is hassle-free.

The risk of loss with Karvy after becoming a franchisee is also very low. And a strong brand name in the financial markets in India that has great value is important for client acquisition.

To have a better grasp on the subject of Best Sub Brokers, go to the page.

Types of Karvy Sub Brokership

Self-Setup Broker or Karvy e-Franchise

Remisier

You need to deposit Rs. Twenty-five thousand to become a Remisier, and revenue sharing is 40% to you and 60% to Karvy.

Master Franchise

In this, if you introduce any franchisee, you get 5-10% of that Franchisee’s brokerage amount. You will have to deposit Rs. 50,000 (deposit refundable during exit). You need to get signed an Agendum with Karvy and Introducer.

Their franchise is known as Karvy Fortune. Karvy Fortune helps individuals and small organizations forge a partnership with Karvy.

Start your Broking Business with Karvy Franchise

Karvy Franchise Types of Business / Partnership Model & their benefits

Karvy sub-broker program, Karvy master franchise, and Remisier are the three most prominent partnership models run by the broking firm.

Aspiring people can choose the best option that suits their business interests. These business models are as follows:

Karvy Sub Broker Program

Every business model that Karvy runs is different. Such as the sub-broker program by the broking firm invites you to become a self-set-up broker.

As a Karvy sub-broker, your job will be limited to handling Karvy’s existing clients, tackling challenges, and improving business.

Karvy Master Franchise

Karvy Master franchise builds a golden opportunity for franchisees willing to earn something extra in addition to their standard revenue stream.

If you bring more franchises into the Karvy business, you can earn up to 5% to 10% of the brokerage amount they paid.

Karvy Remisier

It is an easy-to-understand business opportunity built by Karvy. As a Remisier, you are expected to bring as many clients as possible into the business.

You can make 40% of the revenue in this business model. There’s no setup cost; you only need a decent fan following that can become a permanent client to the broker.

Karvy Sub Broker Revenue Sharing, Initial Investment & Fees

Let’s discuss Karvy Franchise Revenue Sharing, Karvy Sub Broker Initial Deposit & other fees.

Karvy Partner Revenue Sharing & Fees:

Regarding brokerage revenue sharing, you need to be honing your bargaining skills with the house. For Commodity, the deposit required is Rs 25000 – Rs 50000; revenue sharing is 70:30;

Registration charge is RS 2390 (non-refundable), and CTCL is 250 per month. For Currency, NSE registration fees are Rs 2500; CTCL is 250 per month; revenue sharing is 70:30. For Equity, there are types of revenue sharing:

Equity e-Franchise Model

The deposit required is Rs 25000, and they charge Rs 7500 for registration (BSE, NSE, and F&O). Here, CTCL is not applicable. The revenue sharing is 40% to you and 60% to Karvy. And no Offline trading facility.

Brick and Mortar Model

The deposit required is Rs 50000; revenue sharing is 70:30, and they charge Rs 7500 for registration (BSE, NSE, and F&O); also, the back-office charges extra.

Similar Sub Brokers, you may also Like

- Sharekhan Franchise

- Tradebulls Securities Franchise

- Reliance Securities Franchise

- Religare Securities Franchise

- Ventura Securities Franchise

Karvy Sub Brokers Initial Investment Amount

For the Self-Setup type, Rs. 25,000 – Rs. 50,000 is needed to be deposited as a security amount. This amount is refundable when you exit the Karvy Franchise.

Based on your client base, you will get access to all the segments to trade into with Karvy. You will also have to bear the expenses of running the office and the internet.

Apart from the refundable amount mentioned above, you also need to pay Rs.2360/- (non-refundable) for each segment you want to trade into, and a CTCL of Rs. 250 per month.

Karvy Franchise Infrastructure Investment

Infrastructure investment is considered a priority by many business folks and aspiring people. You may also have questions related to the Karvy Franchise that need to be answered.

Well, as we know, Karvy Franchise offers multiple business models. Each comprises a different set of rules and principles that must be followed to pass the criteria for eligibility.

Infrastructure investment also lands on the list of these conditions. Such as, except for Remisier’s business model, you need to make an initial investment in almost every business program Karvy offers for traders.

The investment amount can go anything from Rs 50 k to Rs 3 Lakh depending on the city. However, registration fees of Rs 7500 to Rs 50,000 may be charged separately.

If you plan to join the Karvy Sub-broker business model, you must also have a well-built, spacious office.

Karvy Sub Broker Offers

Karvy Fortune offers a wide range of financial products to satisfy your client in any segment they want to trade into. The broking house is registered under SEBI.

They offer Loans on collaterals, commodities, currency trading, PMS, DP, merchant banker, corporate agency, MF and its distribution, IPO and its distribution, corporate advisory services, etc.

Karvy Eligibility Criteria

Let’s look at the eligibility criteria that will provide you with the key to unlocking opportunities built by Karvy in its business models.

You don’t need to pass every eligibility metric, as most are optional. Take a look to understand them better:

- The applicant should not be less than 20 years of age when applying for the franchise according to SEBI

- The applicant must have a 12th pass certification, and a bachelor’s degree may be required

- They must be well-mannered and know how to convince the audience

- Best if they have any former experience

- Legal identifiable documents must be available when filling up the form

Karvy Support and Training

In addition, as a franchise owner, one can focus on your core skills in running a business without needing to assemble a team of specialists from scratch, as the company provides them with the technical and fundamental support and training.

They provide robust training about business pitches and software like Omnesys NEST and all back-office Support.

Helps you with well-trained dealers for fast execution of orders and Online cash management. Once registered with Karvy, they will offer you training on their trading platform, free of cost.

How to become a Sub Broker of Karvy?

Provide a few documents & one can easily become a sub-broker of Karvy Online. The documents required are:

- Pan Card

- Aadhaar card

- Educational certificate (minimum one should be 12th pass), and 21 years of age.

- Cancelled Cheque

- Two photographs

Also, you should have a minimum of two years of experience in the stock market and trading.

Once you are ready with these papers, you are asked to sign an agreement approved by a registered chartered accountant and get a Franchise code. This is the final step after which you get the business going with Karvy Online.

Why Partner with Karvy?

- A brand is known to everyone.

- Strong presence in the financial world across many segments of financial instruments. This feature raises your chances of making money when you partner with Karvy.

- Counted among the top 5 in its field

- Serves over 70 million customers

- The customer base has around 600 corporate houses.

Karvy Franchise – Pros & Cons

Mentioned below are the major pros and cons attached to acquiring Karvy Franchise. You must watch them carefully to pinpoint the broker’s pluses and minuses.

Pros

- Karvy has a well-built market reputation

- Diversified business models

- Reasonable earning potential

- Lower initial investment

Cons

- Limited offline presence

- Limited earning scope

Karvy Franchise Registration

The steps involved in the registration for Karvy Franchise can’t be missed. It is the professional way to acquire Karvy Franchise. Follow them to take action.

- Start by filling up the registration form and entering contact details

- A person from the Karvy team will get in touch with you via the provided information

- Discuss your confusion or get proper details on the business model from the team

- Submit legal documents as required by the broker to grant you access to the franchise

- Wait for the approval once you have done submitting the documents

- Make an investment or arrange an office (depending on the selected business model)

- Start bringing in clients and make money with Karvy.

Earning the potential of a Karvy Partner / ROI

Well, earning potential can be affected by multiple factors. The broker has a total of three business models to offer its clients.

Similarly, the pay rate in each varies significantly during investment. You can make anything between 40% to 60% – 70% commission per client.

Karvy Franchise Referral Program

Karvy’s Remisier business model is exactly similar to the referral program. The program allows you to reserve a 40% commission per client.

All it takes is a considerable client base that is convinced to become a business partner of Karvy.

Brokerage Charges levied to the clients of Karvy Partners

Mentioned below are the major brokerage charges levied on the clients of Karvy Partners. Take a look – The broker charges 0.01% – 0.03% for equity intraday and delivery segments.

A similar charge rate can be seen for futures, currency futures, and commodity trading. The broker charges a fixed commission on every trade or investment. Only Equity and currency options invite Rs 10 to Rs 30 Per lot charges.

Karvy Authorised Person – Products Offered

Karvy Authorized persons are exposed to the following products they can service to their clients and benefit from the Karvy business model.

The name of the products that Karvy provides is as follows:

List of Top Karvy Partners / Business Partners

Set up in 1983, Karvy online broking firm has come a long way in establishing itself among the top players in the financial market.

The company currently works with 30k + employees in its team with head office spread across multiple cities and towns in the nation.

In brief, the company has 900+ offices nationwide, giving us some positive cues that Karvy is unarguably a strong name in the sector.

Karvy Authorized Person Testimonials

Here’s a quick glimpse of Karvy’s business partner’s testimonials. They have been actively working for the broking firm for a long time, while few have newly engaged with the broker.

It will help you decide the right choice in case you are confused about the Karvy Franchise.

Karvy Franchise Conclusion

So, do not delay any more. Get your eyes on the best business model by Karvy and sign the deal. Established in 1983, the broker proves its credibility and reputed image built in the industry.

If you are also searching for a great partnership program that can help you make anything between 40% to 70% commission per client, delay no more.

Acquire the Karvy franchise and make the best decision of your life. The broker has kept its business models well-diversified, ensuring people could benefit from a specific business model based on their interests.

Karvy FAQs

Here is a list of FAQs related to the Karvy Franchise:

Does Karvy have a Sub Broker Model?

Karvy offers a large subset of sub-broker models for interested candidates to choose from or be a part of.

Karvy, a Hyderabad-based stock house, has been one of the most loved and reliable broker houses by their business partners and clients all over the nation.

Does Karvy have multiple Franchise models?

Karvy has been running its company on three business models, repeatedly proven to be the epitome of success.

Karvy’s self–setup and Karvy e- franchise has been repeatedly chosen for new generation sub-brokers, along with which register and master franchise are other options for Karvy’s prospective business partners to choose from.

What is the Karvy Sub Broker Commission?

Karvy companies follow a defined commission model for all of their sub-broker models. For the remisier model, the commission shared can be between 40%-60%.

It should also be noted that the commission share strictly depends on the sub-broker model the individual has chosen.

How much does the Karvy Franchise Cost?

Karvy’s commission models also have different franchise costs for different business models. For the Karvy Self setup model, partners must pay between RS 25,000 – RS 50,000 as the security deposit.

Does Karvy have a Partner Program?

Yes, Karvy has different partner programs for different individuals, starting from their remisier, where the partners need to deposit RS 25,000 and enjoy a lucrative commission of 40%-60%.

While Karvy’s master franchise program requires business partners to deposit an assumption of RS 50,000, which is refundable during contract breakage.

What are Karvy Partners Sharing?

Karvy has a different partner sharing model for different business models they propose – starting from their master franchise model, Karvy offers a reasonable commission of 5-10% to their business partners.

Considering Karvy’s 70 million customer base, these commission statistics return higher and more profitable payback.

Is the Karvy Partner Program Free?

Clients at Karvy are obligated to pay an initial investment to the company upon gaining official authorization.

The investment amount or security varies and depends on the business model partners wish to pursue their journey with Karvy.

Does Karvy provide Training Assistance?

The training assistance at Karvy goes beyond the usual training provided to sub-brokers.

Karvy not only takes training the partners to enhance their trading platform skills but also provides technical support.

How to Become a Karvy Sub Broker?

One only needs to cover specific eligibility to be a part of Karvy, a minimum of 2 years of experience in the stock market is one of them.

Candidates must collect all the documents and get the agreement signed by a registered chartered accountant.

Once the individual gets the franchise code, the individual is ready to start a business with Karvy online.

Does Karvy Franchise provide Support?

Karvy provides not only online Support but also undertakes technical Support for their respective business executives.

Karvy provides its sub-brokers with business pitches and software to make it easier for the partners to function in the workspace.

How do I become a Karvy agent?

It is fairly easy, though. All you need to do is, fill up a form, provide legal documents, and pass the standard criteria discussed by the broking firm.

You can also contact the Karvy support team to get further details on the subject.

How do I get my money back from Karvy?

If Karvy turns defaulter or due, for some reason, your money is stuck with the broker, you have a 90 days window to file the complaint with the exchange.

Can I transfer my shares from Karvy to another account?

Of course, you can. You can even transfer your shares from any broker account to any other company you trust.

If they are based in India and are registered firms, of course, you are allowed to do so.

Get the DIS slip and submit it to your existing broker. The broker must forward the DIS slip to the depository, which transfers your shares to the desired broker.

Are KFintech and Karvy the same?

In 2019, GA changed the name of Karvy Fintech to KFintech, so yes, you can name it a new version of Karvy.

What is the benefit of the Karvy sub-broker?

Karvy Sub brokers can enjoy 40% to 70% commission per client by entering into a partnership deed with the broker.

Another great benefit promised by Karvy here is that it builds a smartly planned business model in which you don’t need to bring extensive capital in, depending on your choice.

How much can a Karvy sub-broker earn?

There’s no limit on how much a Karvy sub-broker can earn. The commission figure can go anything from 40% to 70% per client, depending on your business model.

You will make a fixed percentage from every client until they actively use Karvy for trading or investment.

What is the procedure for Karvy sub-brokers?

Get the franchise form if you want to apply for the Karvy Sub-broker business model. Fill out the form with contact details, including mobile number and name.

Attend the call from the Karvy team and get the pertinent details regarding the overall business plan. If you are ready to invest 3 lakhs, you are welcome as a sub-broker.

Alternatively, you can go with the Remisier business model.

Start your Broking Business with Karvy Franchise