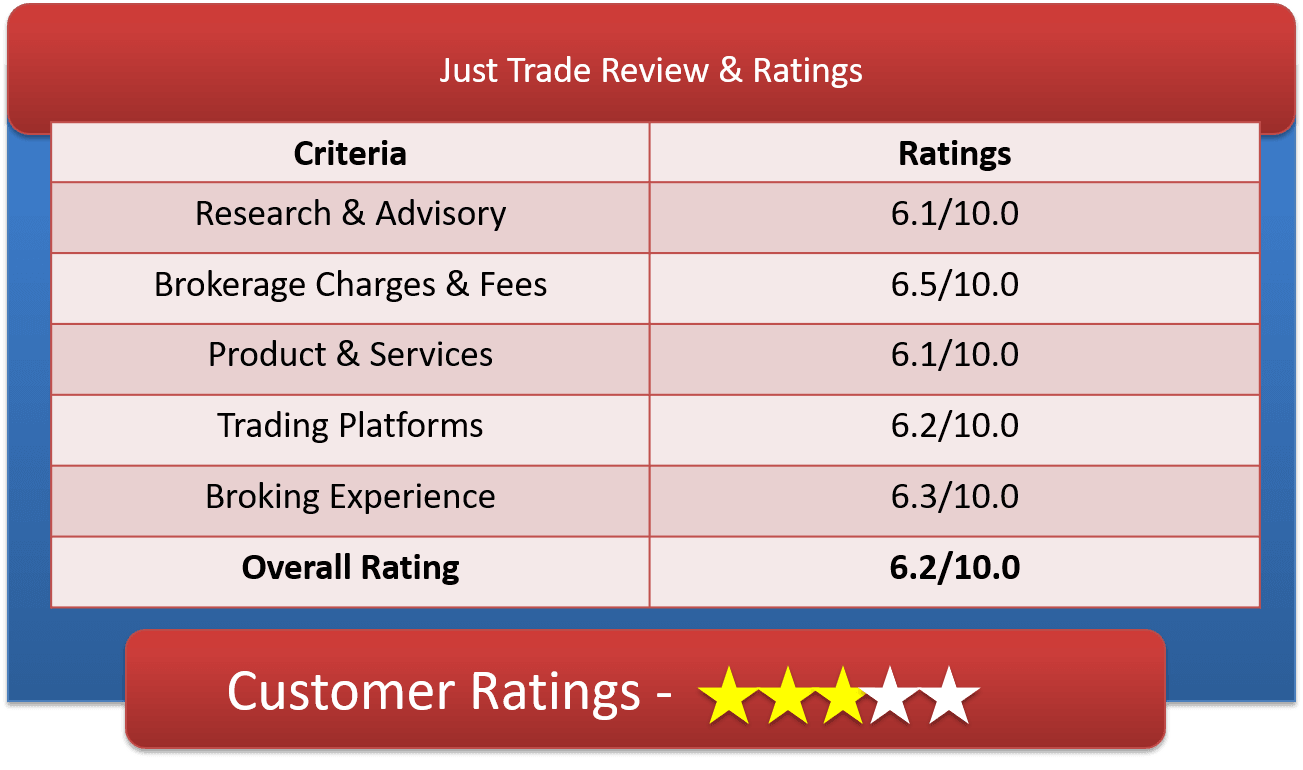

Just Trade Review, Brokerage Charges, Demat A/C, Platforms & more

Last Updated Date: Nov 17, 2022Just Trade is a popular online stockbroking and financial service offering company promoted by the leading firm “Bajaj Capital”.

In this article, we will discuss Just Trade brokerage charges, trading platforms, offers, products, services, research & advisory, exposure etc.

Just Trade Customer Ratings & Review

About Just Trade Securities

The table chart given below is providing the entire details about it-

| Overview | |

| Company Type | Private |

| Broker Type | Full Service Broker |

| Headquarters | Mumbai, Maharashtra |

| Founder | K K Bajaj |

| Established Year | 2008 |

Just Trade is the leading stock broking house located in Mumbai, Maharashtra. It is a private full-service broking company established by KK Bajaj in the year 2008.

The main aim of it is to provide a seamless trading experience to the traders or investors or India who can invest online now and with privacy.

Get a Call Back from Just Trade. Fill up this Form.

Just Trade Brokerage Charges

The table chart provided below is detailing about its Brokerage Charges-

| Brokerage Charge & Fees | |

| Equity Delivery Trading | 0.2% 0.4% |

| Equity Intraday Trading | 0.02% – 0.04% |

| Commodity Options Trading | 0.02% – 0.04% |

| Equity Futures Trading | 0.02% – 0.04% |

| Equity Options Trading | Rs.30 per lot |

| Currency Futures Trading | 0.02% – 0.04% |

| Currency Options Trading | Rs.10 per lot |

| Minimum Brokerage | Rs.20 |

| Demat AMC Charges | Rs.280 per Annum |

| Trading AMC Charges | Free |

| Margin Money | Rs.10,000 |

| Brokerage Calculator | Just Trade Brokerage Calculator |

Just Trade stock broking house normally offers investment and financial products at nominal brokerage fees to all of its users.

Its minimum brokerage charges are Rs. 20. It charges 0.2% to 0.4% for equity delivery trading, 0.02% to 0.04% for equity intraday trading, commodity options trading, equity futures trading and currency futures trading.

The broking house charges Rs. 30 per lot on equity options trading and Rs. 10 per lot on currency options trading.

It charges Rs. 280 per annum for the maintenance of the demat account. Apart from that, the company asks for Rs. 10,000 from its customers as margin money for security.

Compare Stock Brokers

Find brokerage charges of other Full Service Brokers

| IDBI Direct | KIFS Trade Capital | Nirmal Bang | Prabhudas Lilladher |

| Jhaveri Securities | Mastertrust Capital | Groww | Profitmart |

| JM Financial | Monarch Networth Capital | Paytm Money | Reliance Securities |

Just Trade Charges

The table chart provided below is detailing about its other charges-

| Other Charges | |

| Transaction Charges | 0.00295% of Total Turnover |

| STT | 0.0114% of Total Turnover |

| SEBI Turnover Charges | 0.0008% of Total Turnover |

| Stamp Duty | Depends on State (very minimal) |

| GST | 18% of ((Brokerage + Transaction Charges) |

Along with the brokerage fees, the broking house charges some other charges from its investors or traders.

It charges 0.00290% of total turnover as transaction charges, 0.0114% of total turnover as STT charges, 0.0008% of total turnover as SEBI charges, stamp duty is dependent on state and 18% of brokerage + transaction as GST charges.

All these charges are charged on the basis of market value. These charges will not disbalance your trading performance as they are minimal.

Just Trade Demat Account Opening Fees

The table chart provided below is detailing about its Account Opening Fees-

| Demat Services | |

| Depository Source | CDSL & NSDL |

| Account Opening Charges | Rs.710 |

| Demat AMC Charges | Rs.280 per Annum |

| Trading AMC Charges | Free |

| Margin Money | Rs.10,000 |

| Offline to Online | No |

Just Trade is the top-notch financial service offering company available in the stock market. Its depository source is CDSL & NSDL.

The company basically charges fees for opening up any accounts. It charges Rs. 710 for opening trading and demat account.

Also, it charges AMC for the demat account maintenance. Apart from that, it imposes Rs.10,000 as margin money from its customers or users.

Just Trade Offers

The table chart given below is detailing about its Offers-

| Offers | |

| Free Demat Account | No |

| Free Trading Account | No |

| Discount on Brokerage | No |

| Trading Happy Hours | No |

| Flexible Brokerage Plans | Yes |

| 1 Month Brokerage Free | No |

| Holiday Offers | Yes |

| Referral Offers | Yes |

| Zero Brokerage for Loss Making Trades | No |

Just Trade is the most popular and leading stockbroking house offers qualitative and effective financial services with impressive offers.

It makes people trade in the stock market with satisfaction and convenience. The offers provided by the stockbroking house are listed below-

- The broking house offers flexible brokerage plans so that customers can trade in the market with convenience.

- The company also offers brokerage calculator for easy brokerage calculation.

- Holiday and referral offers are also provided to the customers in order to provide a seamless trading experience.

Find Offers from other Broking Houses

| Dealmoney Securities | Farsight Securities | GEPL Capital | HEM Securities |

| Elite Wealth | Fast Capital Markets | Globe Capital | HSE Securities |

| Emkay Global | Findoc Investmart | Gogia Capital | IFCI Financial |

How to open Demat Account with Just Trade?

Having a demat account is important to keep stocks and shares safe and secure. Demat account normally protects shares and stocks electronically and also assists users in trading.

It makes users have a great experience in all financial segments. If you are looking forward to opening up a demat account with it, go through the below-given steps-

- Firstly, you will be needed to fill up the lead form of the demat account given at the website of Just Trade.

- After filling up the accurate data, you have to tap on the ” submit” icon in a way to lodge your demat account opening request.

- Once the company will receive your request, any of the company’s executive will call you for further processing.

- Then you may surely be needed to upload your KYC documents such as- identity card, PAN card, aadhaar card, photograph and age proof.

- After uploading up the entire KYC documents and demat account opening form, you will get a final phone call from the company for the verification process.

- Once the verification process is done then you will be able to operate your demat account in order to safeguard your shares.

Get a Call Back from Just Trade

Why Open Just Trade Trading Account?

Having a flexible trading account is extremely important to trade easily and flexible in the stock market. It makes the entire trading process easy.

With a trading account, you will be able to trade in equities and derivatives market with ease. So, here is why one should open up a trading account with it-

- Just Trade provide flexibility in opening up a premium trading account.

- It’s trading account makes trading easy and flexible.

- Apart from that, the broking house offers useful and effective trading products to its customers for huge convenience and satisfaction.

JustTrade Products & Services

List of products & services provided to its clients

Just Trade Products:

The table chart given below is providing the entire details regarding its Products-

| Products | |

| Equity Trading | Yes |

| Commodity Trading | Yes |

| Currency Trading | Yes |

| Options | Yes |

| Futures | Yes |

| Mutual Funds | Yes |

| Forex | No |

| Banking | No |

| SIP | Yes |

| Insurance | No |

Just Trade is an extremely comprehensive and wide-ranging company avails a huge variety of financial services and products for their customers at nominal brokerage charges.

It enables customers to easily trade in the market and get a seamless trading experience. The trading and financial products provided by the broking house are given below-

- Equity trading

- Commodity trading

- Currency trading

- Options

- Futures

- SIP

All these products are greatly useful and effective that will surely make your trading experience seamless.

Just Trade Services:

The table chart given below is providing the entire details regarding its Services-

| Services | |

| Demat Services | Yes |

| Trading Services | Yes |

| 3 in 1 Account | No |

| Intraday Services | Yes |

| IPO Services | Yes |

| Stock Recommendations | Yes |

| Robo Advisory | No |

| PMS | No |

| Trading Institution | No |

| Trading Exposure | Upto 6X |

JustTrade is a renowned company provides a great level of services to all of its customers. It is actually well-known in the stock market due to its service offerings. It offers services for all financial segments including-

- Demat Services

- Trading Services

- Intraday Services

- IPO Services

- Stock Recommendations

All the above-mentioned services are offered to all of its clients in order to provide huge satisfaction and convenience. Apart from that, the company offers trading exposure up to 6x to the customers.

Just Trade Research, Advisory & Stock Tips

The table chart provided below is detailing about its Research & Advisory-

| Research & Advisory | |

| Fundamental Reports | Yes |

| Research Reports | Yes |

| Company Reports | No |

| Annual Reports | No |

| Company Stock Review | No |

| Free Stock Tips | Yes |

| IPO Reports | Yes |

| Top Picks | Yes |

| Daily Market Review | No |

| Monthly Reports | No |

| Weekly Reports | No |

| Offline Advisory | No |

| Relationship Manager | Yes |

The comprehensive full-service broker offers deep research and analysis on stocks to all of its customers. It’s research and advisory services include-

- The company is good at offering fundamental and research reports for the deep analysis of the stocks.

- Free stock tips, IPO reports and top picks are also provided for the seamless trading experience.

- The best thing about the company is it provides a relationship manager facility to the customers for resolving queries and taking information regarding trading.

JustTrade Exposure or Leverage

The table chart provided below is detailing its Exposure-

| Exposure / Leverage | |

| Equity Delivery | Upto 3X |

| Equity Intraday | Upto 6X |

| Equity Futures | Upto 4X |

| Equity Options | Upto 4X |

| Currency Futures | Upto 3X |

| Currency Options | Upto 3X |

| Commodities | Upto 3X |

| Margin Calculator | Just Trade Margin Calculator |

The stockbroking house offers trading exposure up to 6x. It provides massive leverage in equity intraday, equity futures and equity options.

Check Margin or Exposure of other stock brokers

JustTrade Trading Platforms

| Trading Platforms | |

| Desktop Platform – Windows | Yes |

| Desktop Platform – Mac | Yes |

| Desktop Browser Platform | No |

| Mobile Site Platform | No |

| Android App Platform | No |

| iOS App Platform | No |

| Windows App Platform | No |

| Other Mobile OS Platform | No |

| Real time Updates | Yes |

| Portfolio Details | Yes |

| Online MF Buy | No |

| News Flash | Yes |

| Research Reports | No |

| Easy Installation | Yes |

| Global Indices | Yes |

| Stock Tips | No |

| Personalized Advisory | No |

| Interactive Charts | Yes |

| Live Markets | Yes |

| SMS Alerts | No |

| Email Alerts | Yes |

| Multi Account Management | No |

Just Trade is a wide-ranging broking house. It offers various trading and financial products to the users. Apart from that, it provides trading platforms for flexible trading. It’s flexible trading platforms are briefly described below-

Just Activ Basic Plus

Just Activ Basic Plus is the flexible trading platform which can be accessed for easy buying and selling of stocks in the market.

It enables users to buy and sell options, futures, mutual funds, shares and also can apply for IPO online with a little bit of paperwork.

This kind of trading platform offers two basic options for online share trading. The first option is users can make use of the pull technology through which they can select a particular stock at a time, check for the price quotes and directly place the order and the second option is users can operate the web-based streaming price quotes engine that might look like a dealer trading platform.

Just Activ Premier

The Just Activ Premier is normally an account that offers a flexible online trading platform in order to accomplish trades with “0” brokerage fees for a minimal charge except the taxes and statutory charges paid to the government authorities.

Just Activ Gold

The Just Activ Gold is also an account that offers investment advice in zero transaction fees for a nominal charge except the statutory charges and taxes payable to the government.

Just Lite

The Just Lite is an easy-to-use online trading service that assists investors in buying and selling of futures, shares, options and mutual funds.

It also enables users to apply for IPO service online with a bit of paperwork. It offers very easy and simple trading to all the users.

The share trading process can be easily executed on push-pull technology where investors can select the stock type and check for the price quotes and directly place the order.

JustTrade Customer Support

The table chart given below is detailing about its Customer Support-

| Customer Support | |

| Dedicated Dealer | Yes |

| Offline Trading | Yes |

| Online Trading | No |

| 24*7 Support | No |

| Email Support | Yes |

| Chat Support | No |

| Toll Free Number | No |

| Branches | 6 |

The company offers good customer support to all its users. It offers online and offline support for the huge convenience and satisfaction.

Customers can send emails to the company executive to resolve any type of queries. It also has 6 branches through which customers can physically resolve queries.

JustTrade Complaints & Feedback

The table chart provided below is detailing about its Complaints-

| Complaints (Current Year) | |

| Lodged in BSE | 15 |

| Resolved in BSE | 12 |

| Lodged in NSE | 28 |

| Resolved in NSE | 24 |

The company has performed well in the stock market. But it has received a few complaints which company has not yet resolved. So it requires to improve the service offerings for customer satisfaction.

JustTrade Disadvantages

With disadvantages, the company has a few disadvantages also-

- It does not offer 3 in 1 account opening services

- Offline to online trading option is not available

- Average customer service

JustTrade Conclusion

JustTrade is a wide-ranging stockbroking house that offers qualitative trading products and services at nominal brokerage charges. It also offers flexible trading platforms.

If you want to trade and looking for any reliable stock broking house then go for it and get flexible trading services.

Get a Call Back from Just Trade

Find Reviews of other Stock Brokers

| Ezwealth | Fyers | Grovalue Securities | Indira Securities |

| Fair Intermediate | Ganpati Securities | Guiness Securities | Inditrade Capital |

| Fairwealth Securities | GCL Securities | Hedge Equities | Indus Portfolio |

Most Read Articles