Central Pivotal Range – Meaning, Concepts, How it works, How to use & more

Last Updated Date: Nov 16, 2022Central Pivotal Range or CPR is one of the well know Intraday Indicators used by technical analyst in their day to day work life.

Analyzing trading charts is one of the most important factors in every trade. There are a variety of methods and different types of indicators available for the technical analysis, which includes Central Pivotal Range.

Pivot points have remained an efficient trading indicator for a long time, however, one kind of pivot points, that is currently much popular among traders is the central pivot range or the CPR indicator.

This piece of writing attempts to give adequate knowledge of CPR and related concepts.

What is Central Pivotal Range (CPR)?

The central pivotal range (CPR) is the most prominent technical indicators for traders on price. CPR is mostly to identify the stock price movements by indicating crucial price points.

The traders largely use it for intraday trading. This efficient indicator provides a range that incorporates 3 different levels, which are the pivot point, top central pivot point, and bottom central pivot point.

Calculating the 3 different pivot points within the CPR is as follows,

- Pivot point- (High + Low + Close)/ 3

- Bottom central pivot point (BC)- (High + Low)/ 2

- Top central pivot point- (Pivot – BC) + Pivot

The High, Low, and Close refer to the previous schedule’s highest, lowest, and closing price of the stock respectively.

As per this calculation, the highest value is often the TC value and the lowest is that of BC.

The CPR approach works basically on the idea that understanding the market trend using the prices of the previous period can help the trader in predicting the price movement for the next schedule.

Open Demat Account in 10 Min & Start Trading Now!

Basic Concepts of Central Pivot Range or CPR

CPR consists of 2 major concepts i.e.

- Trading Chart & Candlestick Pattern

- Support & Resistance

Trading chart and Candlestick Pattern

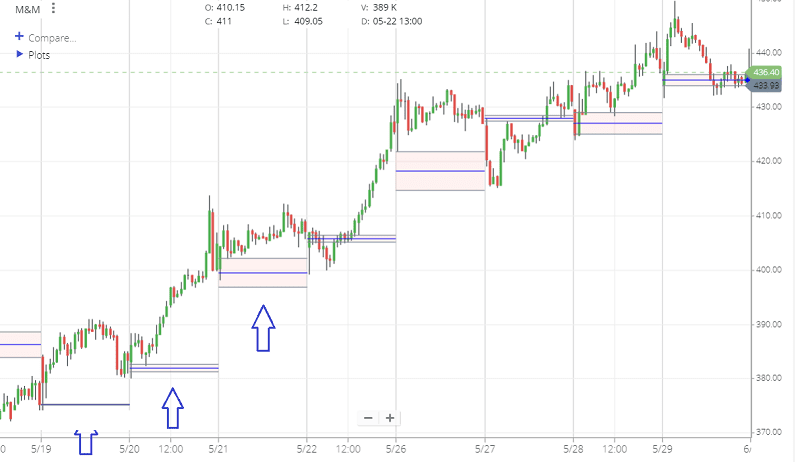

Today traders can use charts to continue with their trading. Charts adequately describe the critical price points including their breakout points based on which the traders can decide their trades.

The candlestick pattern is a convenient pattern for traders, it helps in a better understanding of technical indicators like the CPR.

Traders can plot CPR for a full day’s candle, for 30-60 minutes candles, and 1,3,5,10, and 15 minutes candles, for which one has to refer to the OHLC (Opening, High, Low and Closing prices) of the previous month, the previous week and previous day respectively.

Support and Resistance

The concept of support and resistance is a significant factor in understanding the versatile pivot point indicators, especially the CPR.

The support level identifies the lowest price range that stock might reach over time. It is an important element in a falling market condition since the price of reaching the support level would start showing an increasing trend.

The resistance, on the other hand, is the highest price level that stock rises to. On reaching the resistance level the stock price may fall.

The resistance range provides the trader with a maximum profit through selling. It happens while the support level increases the demand for the stock.

Learn everything about Technical Analysis & make for money in stock market

How Central Pivotal Range CPR) works?

CPR or Central Pivot Range is the technical analysis indicator that we can interpret in the following ways for trading.

Overall trend

The CPR lines indicate a bullish outlook if they constantly move upward and the price remains higher than the TC value.

Whereas, if the CPR lines depict an overall downward movement and the price remain lower than the BC value, then it refers to the bearish nature of the trade.

Width – The width of CPR, in which the distance between the TC and BC line in the chart, is significant. It helps in predicting price movements.

The larger CPR width is the result of the previous trending market. It usually indicates a sideways trend for the next day.

Similarly, a narrow trend of the previous day makes the CPR width narrower, which would further indicate a trending market.

Support and Resistance

The central pivotal ranges help the trader to act either as a support or as a resistance depending upon the market trend.

All the 3 levels have the potential to indicate the price movements and act as the support or resistance levels in trade.

The traders can calculate the resistance and support using the following formula,

- Ist R (R1)- (2*P) – Low

- Ist S (S1)- (2*P) – High

- IInd R (R2)- P + (R1 – S1)

- IInd S (S2)- P – (R1 – S1)

Breakout

Breakouts refer to the points when the stock price moves beyond the support or resistance level. In CPR it refers to the points when the price moves beyond the TC or BC level.

CPR breakouts are helpful in trading as it indicates the chance of continuing with the existing movements.

In a candlestick pattern chart, the bigger breakout candles provide additional assurance for the continuing trend.

Experts in this field suggest that this additional volume assurance provided by the CPR breakout can increase the success rate to approximately 70%.

Virgin CPR

When the price movements do not touch any of the CPR levels in a particular schedule, then that particular CPR the virgin CPR.

Traders can take the virgin CPR of the previous schedule to act as the support or resistance of the next day, as the prices may dramatically move in the opposite direction on touching these support and resistance levels.

How to trade with CPR or Central Pivotal Range?

A trader can trade when the stock has a bullish outlook that is when the market price of the stock remains higher than the TC level in CPR.

In this case, the trader has to look for opportunities to buy, and the TC level functions as a support line.

Similarly, the trader has to go with selling opportunities when the current market price goes less than the BC.

CPR provides the traders with the necessary advantage of predicting the trend, to make the profiting move.

Trading is also possible when the stock price remains within the central pivotal range. However, this is rarely used by traders. Traders can keep the TC as the objective and choose to buy options at BC.

Similarly, traders can opt for selling when the stocks are at TC, targeting BC. Moreover, one of the most important factors to be noted while trading based on CPR is using a stop loss.

The three different levels within the CPR can be used effectively as the stop loss.

Central Pivotal Range – Conclusion

The central pivotal range is one of the efficient indicators of technical analysis in trade. It helps the traders in identifying significant price points and the possible price movements of the stock.

The CPR indicator comprising of 3 different levels – the pivot point, top central pivot, and bottom center, predicts the movements in stock price based on the calculations using previous prices.

The 3 levels of CPR are calculated based on the prices of the preceding period. It is to help the traders foresee the movements in stock price and invest accordingly to gain profits.

Support and resistance levels have a major role in safeguarding the trader from losses. CPR marks these two levels and assists the traders.

Moreover, CPR indicators are largely useful for intraday trading. A CPR chart allows traders to technically analyze the market in different ways.

It happens according to its width, breakouts, support and resistance levels, virgin CPR, overall trend, etc. to study the price movements and continue the trade.

The overall market trend can be bullish or bearish. It depends on the market price going above the TC level or below the BC value.

There are automated spreadsheets and charts available. They help the traders in calculating the CPR value.

Open Demat Account in 10 Min & Start Trading Now!

Most Read Articles