Strip Straddle – A Simple Volatile Trading Strategy Suitable For Beginners

Last Updated Date: Aug 30, 2023Strip Straddle is an options trading strategy used in volatile market conditions. This is simple option trading strategy & can be used by beginners aswell.

Know everything about Strip Straddle Options Trading Strategy here.

About Strip Straddle

Suitable for beginners, a Strip Straddle strategy is suitable for investors who want to aim for unlimited gains. The essence of this strategy emerges from the assumption that the price of a security may fall down.

An investor is assuming two separate positions when planning this strategy. This includes buying calls and puts to take a position at the time of implementing the strategy.

However, in comparison to many other options strategies, the number of calls and puts that the investor buys are not equal in the strategy.

For this reason, it often gets the name of a ratio straddle. Particularly for this strategy, the name, bearish ratio straddle, is also quite common.

Depending on the planning of the investor or their desire to earn a profit, the ratio between the calls and puts can be different.

At first sight, the strip straddle may appear an extension of the long straddle strategy. The element of the ratio between calls and puts and a bearish inclination, make it different from the latter.

In practice, the strip straddle strategy does not come without risks. To bring a positive impact on the action of the strategy, a strong move should take place on the price of the underlying security.

Unless that happens, the investor may not be in a position to make a genuine profit. Since a low trading level takes place, even a beginner can make use of this strategy and plan to take a position which yields positive returns.

Open a Demat Account Now! – Apply this Options Strategy

What is the right time to use a Strip Straddle strategy?

First and foremost, an investor must oversee the market sentiment and identify a stock which proposes a bearish inclination in its price movement.

It is possible that the investor may not have a definite idea about the possible direction in which the price may move.

However, an estimate that the price is more likely to move down than go up merits using the strip straddle strategy.

So, the realisation of profits will occur even if the price goes up or down. But, the quantum of the same will be higher if the price moves down south.

The implementation of the strip straddle strategy is same as long straddle in many respects. The investor will need to purchase both, calls and puts for an underlying security.

The point of difference between the long straddle and the strip straddle lies in the higher composition of put options in comparison to calls options.

The date of expiry for both the calls and puts will remain the same. On the forefront of implementing the strategy is the pivotal decision regarding the ratio in which the call and put options are bought by the investor.

What is the potential to make profit or incur loss under the Strip Straddle strategy?

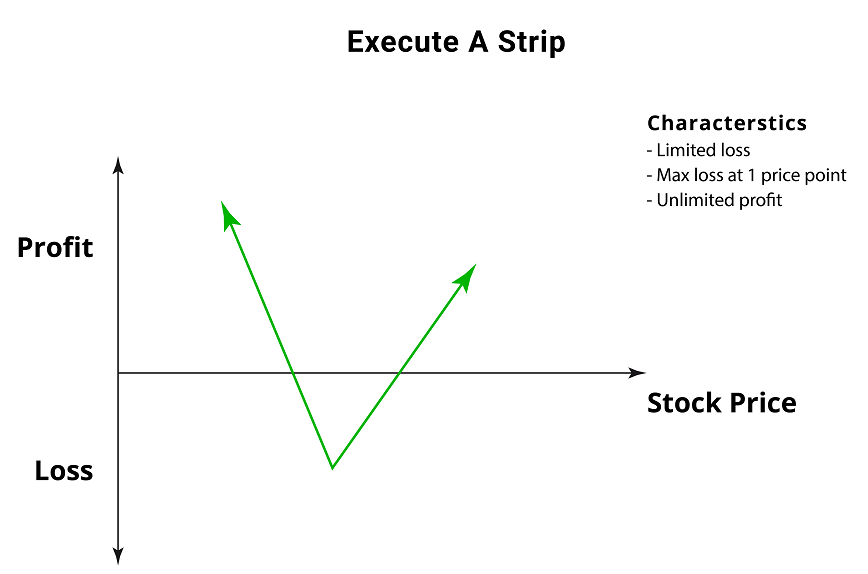

The quantum of maximum profit does not have a limit in this Strip Straddle strategy.

An investor will realize this level when the price of the underlying security moves such that it is either greater than or less than the strike price.

The level of maximum loss is restricted to the amount of initial investment made by the investor.

Find out other Volatile Option Trading Strategy here

| Reverse Iron Albatross Spread | Long Straddle | Short Calendar Put Spread |

| Long Strangle | Reverse Iron Butterfly Spread | Short Butterfly Spread |

| Long Gut | Reverse Iron Condor Spread | Short Condor Spread |

How to implement a Strip Straddle Options Strategy?

It is possible to understand the operation of Strip Straddle strategy with the help of an example.

So, let us assume that an investor has an optimistic outlook towards security. As per their prediction, the price of security is likely to fall in the days to come.

Let us say that the price of the security on this day is INR 50. A significant movement in the price is expected on the road going down.

To make a position in this strategy, the investor makes the following positions and enters into these trades:

- Buy at the money calls for a strike price of INR 50. These options are trading at INR 2 each. The investor purchases one contract with 100 options each. The total cost of the contract amounts to INR 200.

- Buy at the money puts for a strike price of INR 50. These options are trading at INR 2 each. The investor purchases two contracts with 100 options each. The total cost of the contract amounts to INR 400.

Further illustration of Strip Straddle Strategy

As a result of these positions, the total net debit spread will amount to INR 600. Now, at the date of expiry, the following circumstances could occur:

- The stock could continue to trade at INR 50. Then, the options in both the contracts 1 and 2 above will expire and become worthless. Due to this, the initial net debit spread of INR 600 will be lost and unrecoverable.

- The stock price could be trading at INR 53. Then, the calls in contract 1 above will be worth INR 3 each. This will amount to a total value of INR 300. The options in contract 2 above will expire and become worthless. Reduced by the total debit spread of INR 600, the total amount of loss will reduce to INR 300.

- The stock price could be trading at INR 57. The calls in contract 1 above will then be worth INR 7 each. The options in contract 2 above will expire and become worthless. After reducing the net debit spread of INR 600, the total profit will remain at INR 100.

- The stock could trade at INR 47. The calls in contract 1 above will expire and become worthless. The options in contract 2 above will be worth INR 3 each. The INR 600 value of the puts will be offset by the INR 600 spent on the net debit spread and the net position will be NIL.

- The stock could be trading at INR 43. The calls in contract 1 above will expire and become worthless. The options in contract 2 above will be worth INR 7 each. Reduced by the debit spread of INR 600, the total amount of profit will tank at INR 800.

Final Phase of Strip Straddle Strategy Example

Thus, it is evident why the investor will benefit the most with a downfall in the price of the underlying security.

A small margin of profit can still accrue to the investor if the price of the security takes a major swing upwards.

But, the quantum of it will not be the same as the situation in which the price drops down significantly.

In any circumstance, the loss of the investor is limited to the amount of net debit spread which he pays to take the relevant positions in the market.

I hope this detailed example on Strip Straddle Strategy clears all your doubt.

Find out more relevant Volatile Option Trading Strategy below

To Conclude Strip Straddle Strategy

The strip straddle strategy is a useful strategy for a beginner who does not have a thorough knowledge of the stocks markets.

It may appear slightly more comprehensive to an investor. But it is an excellent alternative to a long straddle strategy.

The best time to use the strategy is when the investor expects a breakthrough in the price of the security on the lower ranks.

As such, rates of commission are low in this strategy since the investor enters into only two transactions. The restriction on the amount of maximum loss is a boon for the investor who may be attracted to the simple element of the strategy.

Open a Demat Account Now! – Apply this Options Strategy

Similar Topics on Options Trading