Short Butterfly Spread – A Complicated Volatile Trading Strategy

Last Updated Date: Aug 30, 2023Short Butterfly Spread is a complicated options trading strategy. This strategy is mainly used in volatile market conditions.

Know everything about Short Butterfly Options Trading Strategy now.

About Short Butterfly Spread

The Short Butterfly Spread is a neutral trading strategy. Under this strategy, the investor bets on the volatility of the market to make returns. The strategy involves placing three separate trades to make a profit.

However, the scope to make a return is limited but so is the possibility to incur a loss. Owing to the construction of the strategy, it is an advanced and complex one to plan and execute.

Hence, it is best to use by experienced investors, who understand the market run and its volatile component.

So, an investor will make use of this strategy when they expect the price of an underlying security to move significantly. But when they cannot predict the swing of this direction, that is when this strategy can perform well.

It is notable that at the time of creating this strategy, the investor receives an upfront credit for the transactions.

Hence, the three trades involved in this strategy create a net credit spread at the beginning.

Open a Demat Account Now! – Apply this Options Strategy

What is the right time to use Short Butterfly Spread?

A volatile outlook on the market is a good time to design and implement a short butterfly spread strategy.

As long as you expect the prices of an underlying security to move by enough margin, you can go ahead with it.

It is worthy to note that you need not be absolutely confident about the direction in which the prices will move.

The beneficial aspect of this strategy is that it is quite flexible and it allows the investor to plan their profits.

This is why it is possible to employ this strategy even when a moderate shift in security price is seen. However, this factor makes it all the more difficult for a beginner to succeed in this strategy.

Find out other Volatile Option Trading Strategy here

| Reverse Iron Albatross Spread | Long Straddle | Short Calendar Put Spread |

| Long Strangle | Reverse Iron Butterfly Spread | Short Condor Spread |

| Long Gut | Reverse Iron Condor Spread |

Planning a Short Butterfly Spread Strategy

An investor needs to enter into three separate transactions. This will involve a combination of call and put options and will result in a net credit spread.

The investor has the choice to enter into all three transactions at the same time or not. The transactions carried out will be as follows:

- Sell an in the money call

- Buy two at the money calls

- Sell one out the money call

The expiration date for each of these transactions shall be the same. The strike prices for each such option shall be equidistant.

The incidence to earn the maximum profit will arise when the stock price remains above or below the highest and lowest strike prices, respectively. In these cases, the net credit minus the commission will mark the amount of return earned.

The chances of incurring maximum loss establish itself at the difference between the middle and lowest strike prices.

A short butterfly spread strategy which uses put options can realize maximum gain for an investor. This will happen when the stock price of a security moves higher than the strike price or below it.

Thus, on the day of expiry of the options, the investor must be able to bet on the high volatility of the market.

It is in the nature of butterfly spreads to react strongly to market movements. If the level of volatility rises, the net cost of a butterfly spread will fall. But if the level of volatility falls, then the price of the spread will rise.

Thus, an investor must exercise patience and discipline when implementing the short butterfly spread strategy.

With the expiry date approaching, there can be plenty of unrest between the prices of the security and the strike prices.

Find out more relevant Volatile Option Trading Strategy below

| Short Calendar Call Spread | Strip Straddle | Strap Strangle |

| Short Albatross Spread | Strap Straddle | Strip Strangle |

Potential to earn Profit or incur Loss using Short Butterfly Spread Options Strategy

Let us take an example to illustrate the impact of a short butterfly spread strategy.

Let us assume that the trading price of a security at present is INR 50. At this time, you expect that the security will take a major turn in its prices but you are unsure which of north or south it will be.

You decide to enter into the following contracts to build a short butterfly spread strategy:

- Write a contract with 100 options for INR 4 each. The strike price is INR 47 for in the money calls for a total credit of INR 400.

- Write a contract with 100 options for INR 0.5 each. The strike price is INR 53 for out the money calls for a total credit of INR 50.

- Buy two contracts with 200 options for INR 2 each. The money calls are at a strike price of INR 50 for a total cost of INR 400.

As a result of these transactions, a short butterfly spread is created with a total credit of INR 50. At the date of expiry, the following events could occur:

- The price of the security may continue to drive around INR 50. As a result, the options in contract 1 above would materialise for a value of INR 300. But the options in contract 2 and 3 above will expire. Subtracted by the initial credit of INR 50, your final liability will stand at INR 250.

- The price of the security can rise to, let’s say, INR 54. The options in contract 1 would materialise for a value of INR 700 and contract 2 will be INR 100. The total liability will stand at INR 800 at this point. But the options in contract 3 above will materialise for a value of INR 4 each, which is INR 800 in total. Thus, after the two are offset with each other, the final profit will be the initial credit spread of INR 50.

- The price of the security could go down to, let’s say, INR 46. In this case, all the options in the three contracts above will expire. The only amount retained will be INR 50 spent on the initial net credit spread.

To Conclude Short Butterfly Spread

It will not be wrong to call a short butterfly spread strategy as a combination of a bear and bull put spread.

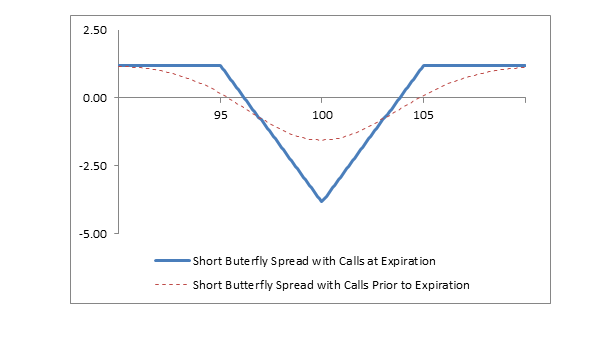

The strategy gets its name from the profit loss diagram which emerges from the placement of various strike and stock prices.

In comparison, the short butterfly, short condor and reverse iron condor strategies are similar to this one.

An investor will realize the maximum loss on this strategy at a point when the price of the security does not change.

This is because, at this point, the calls for the lower strike price will have to be exercised at their intrinsic price.

As can be seen, the strategy is not without a fair share of complications. Thus, it will not be wrong to conclude that a beginner in the options market must not experiment with this strategy. The investor will really have to put some thought into the options to choose.

There is a limit on the maximum potential profit and the maximum potential loss. Moreover, they are fairly determinable at the time of planning the strategy.

This makes it possible for the trader to manage the extent of trade and limit the risk. Thus, in the right circumstances, this strategy will prove to be a beneficial trade for the learned investor.

Open a Demat Account Now! – Apply this Options Strategy

Similar Topics on Options Trading