Reverse Iron Butterfly Spread – A Complicated Volatile Trading Strategy

Last Updated Date: May 12, 2022Reverse Iron Butterfly Spread is a complicated option trading strategy used in Volatile Market conditions. Understand everything about this amazing options strategy here.

About Reverse Iron Butterfly Spread

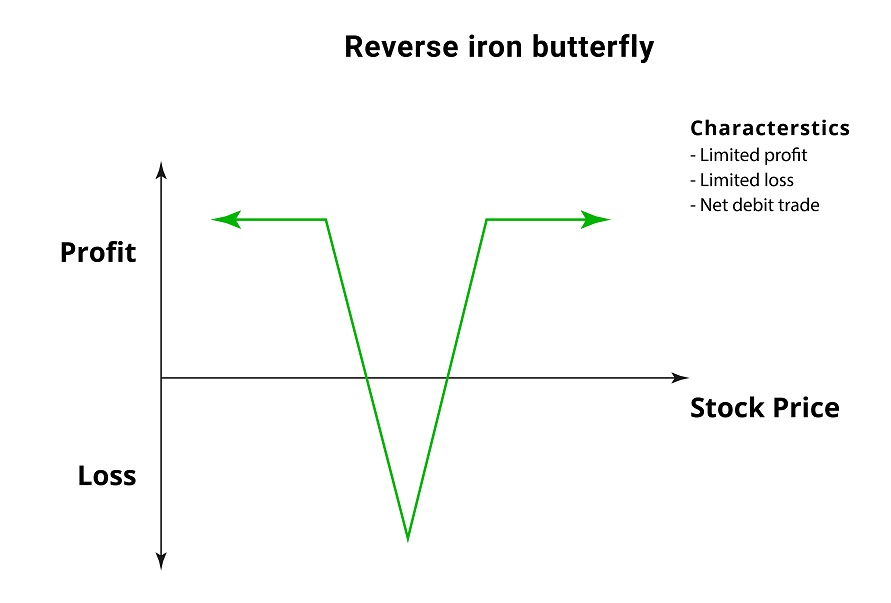

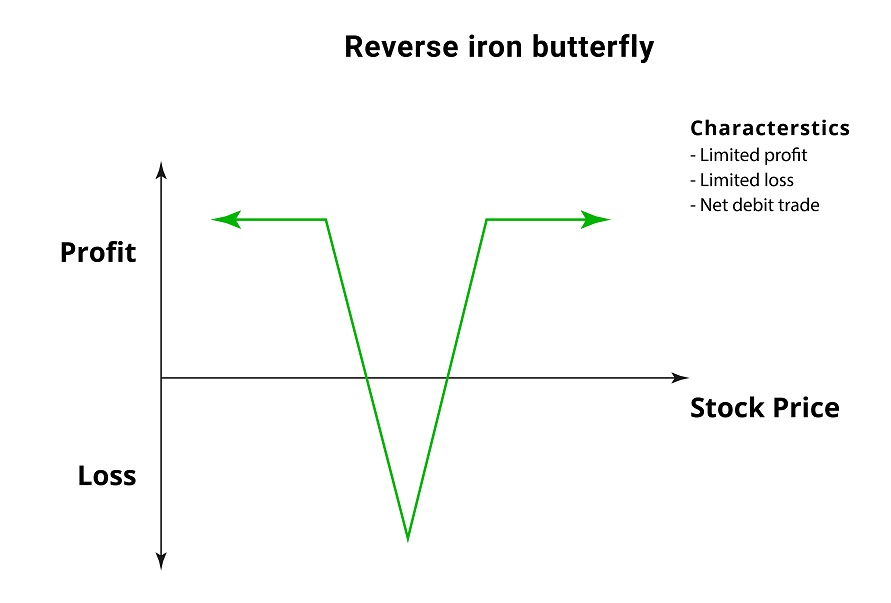

The Reverse Iron Butterfly Strategy is an options strategy and it yields limited profit as the risk of a limited nature.

Market bet rests on the price movement of an underlying stock, which will need to move by a sharp margin. Thus, it is a strategy that can be played in volatile market conditions.

Talking of options market strategies, this is among the most advanced and should suit experienced traders.

Unlike simpler strategies like long straddle and long strangle, an investor knows the potential to make profits or incur losses beforehand.

Thus, it is easier to know where a trader stands at the time of entering into the strategy.

Open a Demat Account Now! – Apply this Options Strategy

What is the right time to use a Reverse Iron Butterfly Strategy?

An investor can plan this strategy in expectation of market volatility. This means that the prices of underlying security can move significantly. The catch here lies in the fact that the investor cannot be sure of the direction in which this movement will take place.

So, as long as the price of such security moves by enough margin, there is scope to make a profit on the strategy.

However, as compared to some other advanced strategies, the potential to make profits is small. At the same time, the possibility to incur a loss is maximum which does not justify the profit potential.

Thus, this strategy is not the most efficient among options strategies. The only point of difference between them and this strategy is that the reverse iron butterfly has a debit spread.

How to plan a Reverse Iron Butterfly Strategy?

To implement the strategy, an investor will have to enter into four different trades, which are mentioned below:

- Sell out of the money call options

- Buy at the money call options

- Sell out of the money put options

- Buy at the money put options

Trade will be done for the same number of options in each of these contracts. Also, the date of expiry for each such contract will be the same.

The strike price for the short options will have the same distance from the current trading price of the underlying security.

The investor can certainly plan how far out this distance would be but it should be the same for both the contracts.

If the investor chooses a strike price which is closer to the current trading price of the security, it will be higher in cost.

The potential to earn profit from such trade will reduce. The maximum gain on the strategy will accrue to the investor under two conditions:

- If the stock price drops down below the strike price of short put options.

- If the stock price rises above the strike price of short call options.

Maximum profit will always be equal to the difference in strike price of puts and calls reduced by the net debit spread.

The extent of loss will manifest only when the price of the security on the date of expiry is equal to the strike price of the long call and long put.

If it is so, the options will expire and the total loss to the trader will be equivalent to the amount of net debit spread.

Find out other Volatile Option Trading Strategy here

| Reverse Iron Albatross Spread | Long Straddle | Short Calendar Put Spread |

| Long Strangle | Short Condor Spread | Short Butterfly Spread |

| Long Gut | Reverse Iron Condor Spread |

Potential to earn a profit or incur a loss

Let us take an Reverse Iron Butterfly Strategy example of security on which an investor plans to use the Reverse Iron Butterfly Strategy. On the date of planning the strategy, the price of the security is INR 50.

Now, you expect that the volatile movement of the market will shift the price of this security by a considerable margin. But at this point, you are unsure about whether it will be an upside move or a downside move.

On this date, you purchase the following options trades:

- One contract of 100 options for out of the money calls for a strike price at INR 52. The cost is INR 1.5 per options so the total credit is INR 150.

- One contract of 100 options for at the money calls for a strike price at INR 50. The cost is INR 2 per options so the total cost is INR 200.

- One contract of 100 options for out of the money puts for a strike price at INR 48. The cost is INR 1.5 per options so the total credit is INR 150.

- One contract of 100 options for at the money puts for a strike price at INR 50. The cost is INR 2 per options so the total cost is INR 200.

So, overall, you have spent INR 400 to buy options. At the same time, you have received a credit of INR 300. The total debit spread resulting from this transaction is INR 100.

Example on Reverse Iron Butterfly Spead Option Strategy – Continues

You have hence created a successful Reverse Iron Butterfly Strategy. Here is what might happen at the date of expiry:

- The price of the security might remain INR 50. All the options which the investor enters into, as mentioned above will expire and no return will be earned. The net debit spread of INR 100 will be lost.

- The price of the security may rise to, lets say, INR 52. In this case, the options in contract 1, 3 and 4 above will expire. Only options in contract 2 will realise and yield a total value of INR 200. Subtract it by the INR 100 of the debit spread, you will earn INR 100 as final profit.

- The price of the security could go down to INR 47, let’s say. This would make the contract 1 and 2 worthless and they will expire. The options in contract 3 will realise and you will incur a liability of INR 100. The options in contract 4 will also realise and yield INR 300. So, finally, after the settlement of the liability and reduction of net debit, the profit amount will be INR 100.

So, as can be seen from the above points, there is a restriction on the amount of net debit. Profit potential exists but is limited.

Find out more relevant Volatile Option Trading Strategy below

| Short Calendar Call Spread | Strip Straddle | Strap Strangle |

| Short Albatross Spread | Strap Straddle | Strip Strangle |

What are the benefits of choosing the Reverse Iron Butterfly Spread?

There are benefits in opting for this strategy. With a narrow breakeven range, it is better as compared to a straddle or strangle strategy.

The investor can easily predict the losses and profits. Due to market volatility, there is a chance to make a profit whether the security moves up or down.

Due to account restrictions, some traders cannot make use of credit spread. So for them, this strategy is highly suitable.

However, there are disadvantages in using this strategy as well. As compared to the potential to make a profit, the amount of maximum loss is quite high.

It is higher when compared to alternative strategies like short butterfly spread and short condor spread.

To conclude Reverse Iron Butterfly Spread

As can be seen, the strategy is quite complex and not meant for a beginner.

The complexity in the trade does not come from the presence of four separate transactions. The combination of limited profit and loss and the spread makes it so.

The complexity in the trade does not come from the presence of four separate transactions. The combination of limited profit and loss and the spread makes it so.

This strategy is perfect for those who can trade with a debit spread only with their account. The limit on profit and loss is important to plan this strategy.

Open a Demat Account Now! – Apply this Options Strategy

Similar Topics on Options Trading