Strap Straddle – A Simple Volatile Trading Strategy Suitable For Beginners

Last Updated Date: Aug 30, 2023Strap Straddle Options Trading Strategy is used in volatile market conditions. This is a simple strategy which can be used by beginners of options trading.

Know everything about strap straddle options strategy here.

About Strap Straddle

The Strap Straddle strategy is meant for investors who have a high inclination towards a bullish market.

Similar to most options strategies, the strap straddle is meant to be used in a volatile market condition but more specifically when the investor expects a major upswing in the prices of the underlying security.

Also commonly known by the name of straps, it is a modified form of long straddle strategy.

The other point of difference between this strategy and most other options strategy is that the number of call options purchased by the investor is far more than the number of put options.

To understand this strategy, it is imperative to have some knowledge of the long straddle strategy.

Hence, it is also suitable for beginners and involves the use of two transactions to generate profits. The low level of trading generates a debit spread which is paid up front.

Open a Demat Account Now! – Apply this Options Strategy

What is the right time to implement the Strap Straddle?

As compared to a long straddle strategy, a strap saddle involves buying more call options. It is possible that the investor may not find the appropriate at the money option at a given time.

The best time to use a strap saddle is when the investor expects that the price of a certain stock price may go up.

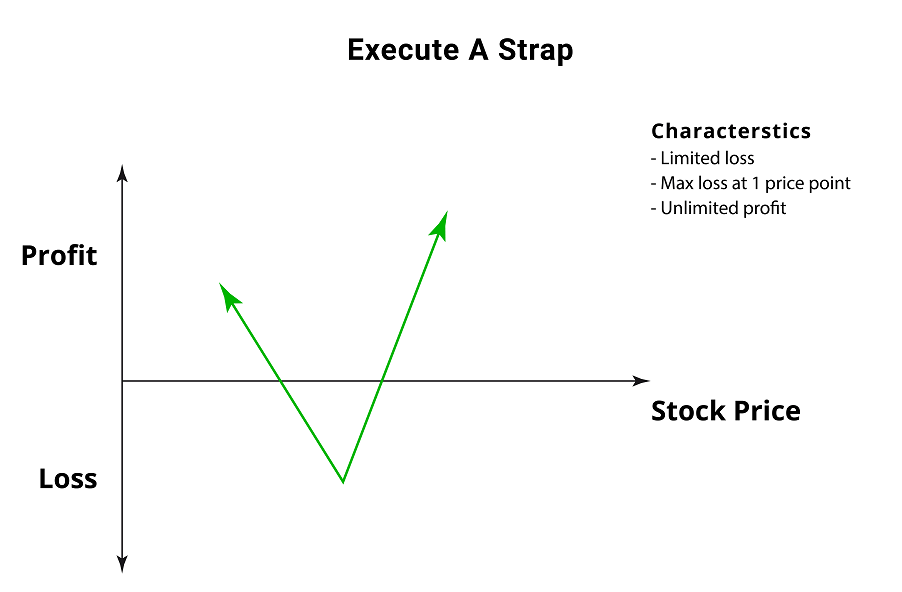

If there is indeed an upside movement in the stock prices of an underlying security, there is an endless profit potential awaiting the investor.

If the price takes a downward path, there might be a reduction in the earning potential but there is always a limit on the total outgo.

So, the profits will accrue to the investor no matter which direction the price of the security moves. But the quantum of such profits will be more if the security takes a northward route.

The date of expiry for both the call and put options remains the same in this strategy. The difference arises in the number of calls and puts which the investor purchases.

Usually, a ratio of 2:1 is the recommended balance when placing calls and puts in this strategy. However, the investor is free to make his own call and decide how he would like to benefit from the strategy.

Find out other Volatile Option Trading Strategy here

| Reverse Iron Albatross Spread | Long Straddle | Short Calendar Put Spread |

| Long Strangle | Reverse Iron Butterfly Spread | Short Butterfly Spread |

| Long Gut | Reverse Iron Condor Spread | Short Condor Spread |

What is the potential to earn a profit or incur a loss on the Strap Straddle strategy?

The investor stands to make a huge gain with this strategy. This will happen if the price of the underlying stock moves either up or down.

However, the investor places his bets on an upward move in the stock price with this strategy. So, there is a higher potential to gain if the stock price moves up, rather than going down.

Thus, it will not be wrong to say that the profit potential is unlimited in this strategy.

There is a chance that the investor may incur some loss on the underlying security as well. This will happen if the stock price continues to trade at the same price on the date of expiry. In a situation such as this, every option will expire and become worthless.

Hence, there will be a complete loss of the amount of debit spread paid at the time of entering the strategy.

Thus, the maximum loss has a capping on the amount of net premium paid to take the call and put positions.

Find out more relevant Volatile Option Trading Strategy below

How to plan a Strap Straddle strategy to earn a profit?

To understand how the strap straddle strategy works, here is an example to highlight the movement of stock prices and the resulting outcome.

Let us assume that the price of the underlying security is INR 50. According to your market study and expectations, you expect a rise in the price of the security in the days to come.

You take the following positions in the market to benefit from the strap straddle strategy.

- You buy at the money calls at a strike price of INR 50. These calls are trading at INR 2 each so you buy 2 contracts with 100 options in it. The total cost to you in INR 400.

- You write at the money puts at a strike price of INR 50. These calls are trading at INR 2 each so, you write a contract with 100 options in it. The total cost to you is INR 200.

Accordingly, the total debit spread which results from these positions will amount to INR 600.

Now, at the date of expiration, here are the possibilities which could occur:

- The stock price of the company could be trading at INR 53. Now, the calls in contract 1 above will trade at INR 3. The total value of the contract will be INR 600 while the options on contract 2 above will expire. The resulting profit from the transactions is equal to the amount spent on buying the trades so in this case, there will be no profit to the investor.

- If the stock price rises to INR 57, the calls in contract 1 above will realise for INR 1400. Options in contract 2 above will expire and after deduction of the amount of initial investment, a total profit of INR 800 will remain for the investor.

- If the price of the stock falls down to INR 47, the options in contract 1 will become worthless. But the options in contract 2 above will amount to INR 300. After deducting it from the amount of debit spread you will be left with a loss of INR 300.

- If the price of the security falls down to INR 43, the options in contract 1 will expire. But the options in contract 2 will realise INR 700 and after deducting the amount of the debit spread, you will be left with a profit of INR 100.

Further illustration of Strap Straddle

The upside of this strategy is the potential to earn maximum gains. At the same time, the losses have a cap on their extent.

As compared to a regular straddle, the potential to earn profits is quite high. The higher the stock price breaks out and attains a higher space, the better it is for the strategy.

At the same time, there is a small disadvantage in using this strategy. The initial debit spread turns out to be quite high so the investor requires a generous amount of cash to meet the outlay.

As compared to a regular straddle strategy, the quantum of losses is also quite high.

To Conclude Strap Straddle Strategy

The strap straddle strategy is a powerful play option for investors who seek a high trading profit from the market.

However, the strategy is not good for a long term options trader. This is because they will end up incurring a high premium cost.

It is advisable for a trader to set a target for profits in mind. As soon as that profit level accrues to the investor, they must exit the position and limit the possibility of incurring losses.

The strategy is not quite as complex as some other options strategies. However, if the investor is absolutely confident about the upward movement of the stock price, they can definitely go for this strategy and take the relevant positions to earn a handsome return.

Open a Demat Account Now! – Apply this Options Strategy

Similar Topics on Options Trading