Reverse Iron Condor Spread – An Advanced Volatile Trading Strategy

Last Updated Date: May 12, 2022Reverse Iron Condor Spread is an advanced Option Strategy. This trading strategy is mainly used in volatile market conditions.

Know everything about Reverse Iron Condor Spread Option Trading Strategy here.

About Reverse Iron Condor Spread

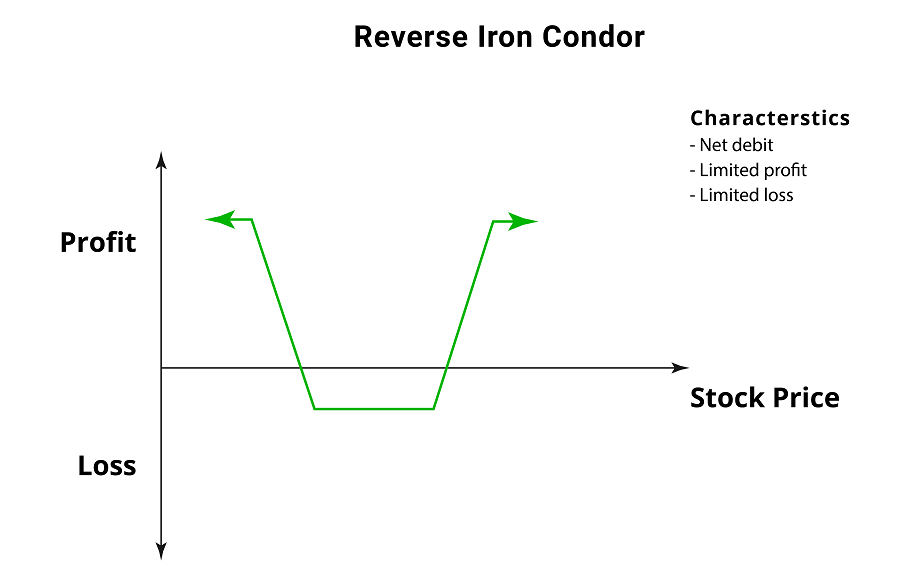

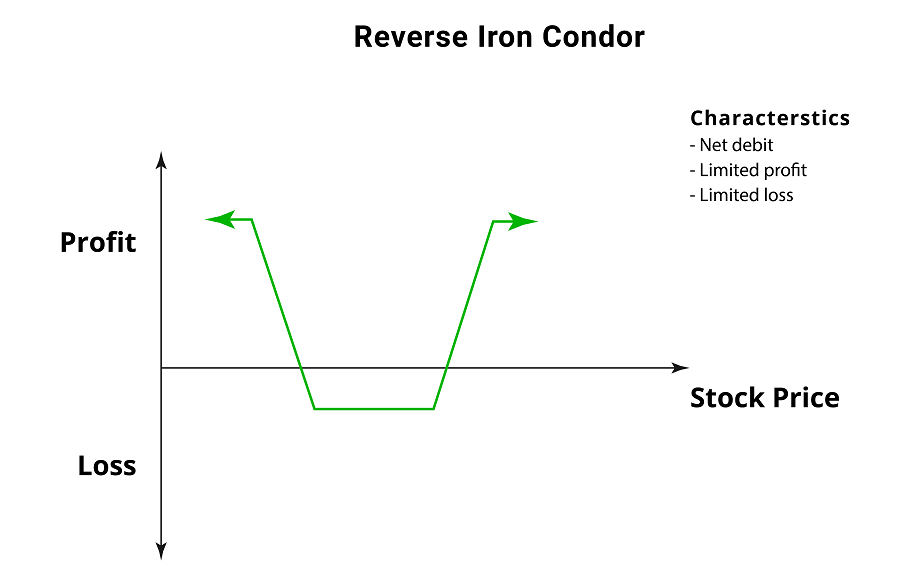

The reverse iron condor is an advanced options strategy. Yet, the potential to make profits by implementing the strategy is small.

The limited scope of profits is complimented by a matching limit on the possibility to incur a loss. Thus, this strategy appeals to the intellect of most advanced options traders to invest and make a viable return.

The basic assumption pertaining to the strategy relates to the volatile movement of the stock markets.

If the investor expects a sharp movement in the prices of an underlying security, they might seek to implement the Reverse Iron Condor Strategy for maximum return.

The strategy involves entering into four different transactions in both, call and put options. Even though the investor may not be sure of the direction in which the price of the security may move.

Yet, at the time of planning this strategy, they will be able to make a reliable estimate of the profit or loss potential resulting from the strategy.

Open a Demat Account Now! – Apply this Options Strategy

What is the right time to use the Reverse Iron Condor Strategy?

The investor will find himself in a tube with closed caps on either end with the Reverse Iron Condor Strategy. This is because there is a defined limit to the quantum of profit and loss that the strategy could yield.

Hence, at most, they could swing between either end of the tube by carrying out the strategy in real. But the chances of falling out from either end are non-existent in this strategy.

The investor will realize the maximum gain on the strategy if the price of a stock drops below the strike price of the short put option.

Or else, the profit will also accrue if the price of the stock rises above the strike price of the short call option.

Thus, the quantum of maximum profit is derivable by finding the difference between the strike prices of the calls and puts and the net debit spread, which the investor will have to incur at the time of entering the transaction.

The maximum loss will occur if the price of the security does not move significantly and remains the same.

The strategy does not compare well to alternatives like straddles, strangles and guts. This is because it has a limit on its profit potential and is quite advanced for a beginner to understand or implement.

A close look at the design of the strategy will reveal that it is basically a combination of two spreads. These are bull call debit and bear put debit spreads.

An investor can use out of the money options to enhance their position in the strategy. This, however, will limit the probability of making a profit at all.

Find out other Volatile Option Trading Strategy here

| Reverse Iron Albatross Spread | Long Straddle | Short Calendar Put Spread |

| Long Strangle | Reverse Iron Butterfly Spread | Short Butterfly Spread |

| Long Gut | Short Condor Spread |

How to construct a Reverse Iron Condor Strategy?

To design and implement this strategy, the investor will trade in four different contracts. Whether to carry out all the trades at the same time or not, is a decision that can be made by the investor.

Here are the four trading contracts that need action:

- Buying a contract for out the money put option

- Selling a contract for out the money put option at a lower strike price

- Buying a contract for out the money call option

- Selling a contract for out the money call option

To execute the strategy, the number of contracts which are bought and sold should be the same. The expiry date of each contract has to be the same.

Buying of contract 1 and 3 as states above are ideally done at a strike price which is equidistant from the out of the money price. The wider the difference between the strike prices, the lower is the scope to incur a loss.

While selling the contracts, the distance between them and the out the money buy options should be further away but by the same distance.

This will bring down the scope of maximum potential loss and increase the chances to earn a greater profit.

Find out more relevant Volatile Option Trading Strategy below

| Short Calendar Call Spread | Strip Straddle | Strap Strangle |

| Short Albatross Spread | Strap Straddle | Strip Strangle |

Potential to earn a profit or incur a loss using Reverse Iron Condor Strategy

Let us take an example to illustrate the impact of the strategy on profit-earning potential.

Suppose, the price of security is INR 50, and you expect that the price of this security will move either up or down, by a significant margin.

Thus, you execute the following contracts to build the Reverse Iron Condor Strategy:

- Purchase put contract with 100 options for INR1, at a strike price of INR48 for a total cost of INR100.

- Sell put contract with 100 options for INR0.5, at a strike price of INR46 for a total credit of INR50.

- Purchase call contract with 100 options for INR1, at a strike price of INR52 for a total cost of INR100.

- Sell call contract with 100 options for INR0.5, at a strike price of INR54 for a total credit of INR50.

As a result of these transactions, you will incur a total cost of INR 200 and receive a credit for INR 100. The total debit spread created will be INR 100.

Example of Reverse Iron Condor Spread Option Strategy – Continues

Now, at the date of expiry, here are the possible outcomes from the price movements in the market:

- If the price of the security continues to stay at INR 50, all the options will expire. There will be no realisation and no liability to pay anything. The final loss to the investor will be INR 100, which results from the net debit spread.

- The price of the security could move up, let’s say, to INR 56. In this case, the options in contract 1 and 2 above will expire. Only options 3 and 4 will materialise. As a result, the calls in option 3 would be worth INR 400. And the calls in option 4 will be around INR 200, for which you will incur liability. So, the final profit resulting from the transaction will be INR 100. Reduce it by the initial debit spread of INR 100 and you will be left will a total profit of INR 100.

- The price of the security could go down by to INR 44. Hence, the puts in option 1 above will materialise for INR 400 and similarly, the puts in option 2 above will also materialise with a liability of INR 200. The options in contracts 3 and 4 will expire and be worthless. As a result, you will incur a liability of INR 200 and earn a profit of INR 400. After deducting the amount of initial net debit spread, the final return from the transaction will be INR 100.

To Conclude Reverse Iron Condor Spread

There are other viable strategies as well which are similar to the Reverse Iron Condor Strategy. These are short put butterfly, short condor and short butterfly options.

There are plenty of reasons why this is a good strategy to formulate if you expect the price of a security to move significantly but aren’t sure of the direction itself.

For one, the investor knows very well of his potential to make a profit or incur a loss. So, they can easily adjust the strike prices of the options contracts.

Thus, these strike prices will reflect the expectation of the investor and the quantum by which they expect the price of a security to move.

Perhaps the only downside of this strategy is that it is quite complicated and advanced. Since there are four different contracts which build this strategy, the rates of commissions will also be significant.

Open a Demat Account Now! – Apply this Options Strategy

Similar Topics on Options Trading