Long Straddle – Volatile Options Trading Strategy suitable for Beginners

Last Updated Date: Aug 31, 2023Know everything about Log Straddle Options Trading Strategy here. This strategy can be easily used by the beginners & can be implemented during Volatile Market conditions.

About Long Straddle Options Trading Strategy

Long Straddle is yet another feasible options strategy for those who are beginning to ramble the markets.

The basic plot of the strategy remains akin to most other option strategies. The ultimate goal resulting from the strategy must bring benefit to the investor in terms of profits.

These usually result from volatility in the market. Under this strategy, a trader will place his bets on both, call options as well as put options.

Such a strategy can undergo implementation for underlying security with the same date of expiration and strike price.

The prices of security need a significant move in either one direction. Then, the investor of options stands to make a definite gain resulting from the volatility. Usually, a long straddle strategy is beneficial for an investor in many instances.

One of them is when the expected price surge or fall is expected from a massive unpredictable event. The strategy involves making a bet on only two transactions.

This includes buying a call option and a put option. Since, the scope of incurring losses is not undefined; this strategy is by far, the simplest one to implement for beginners.

Open a Demat Account Now! – Apply this Options Strategy

What is the right time to apply a Long Straddle Strategy?

The success of a long straddle strategy rests on the occurrence of volatility in the market. Hence, when an investor expects a major swing in the prices of a security, it might be a good time to exercise the long straddle strategy.

The long straddle strategy implies that the investor expects the price of the security to move in any one direction with a huge swing.

But, he is unsure about the direction in which it may happen. So, this underlying presumption makes the strategy limited in terms of risk.

But, it is also heavily potential in terms of gains which it can accrue to the investor. This is why a trader need not be a skilled jack of trade at the options market.

He can still utilize this basic knowledge and plan this strategy.

Find out other Volatile Option Trading Strategy here

| Reverse Iron Albatross Spread | Short Condor Spread | Short Calendar Put Spread |

| Long Strangle | Reverse Iron Butterfly Spread | Short Butterfly Spread |

| Long Gut | Reverse Iron Condor Spread |

Building a Long Straddle Strategy for maximum Profit

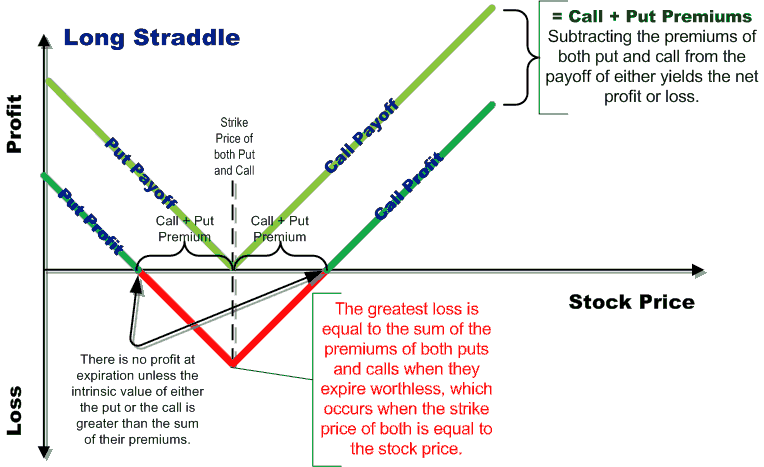

The maximum risk associated with a long straddle strategy lies within the ambit of the cost of premium paid to purchase the call and put options. A price swing, either up or down, will result in the realization

Find out more relevant Volatile Option Trading Strategy below

of mammoth profits.

It will be right to say that the associated risk with the strategy is quite low. The potential to make profits though remains top notch. To implement this strategy, the investor must purchase an equal number of call and put options.

Also, the options are meant for purchase for the same date of expiration. It may even come to impact the success of the strategy. The longer the date of expiration, more is the scope for the investor to realize greater profits.

This can happen since the stock prices have a greater chance to move in any direction during this time. A shorter expiration date will not give enough time to the investor to wait for their strategy to play out.

It is worth to note that, options for a closer expiry date will always cost you less in terms of premium to be paid. While the opposite of it is also true.

At the time of purchasing the call and put options, the investor will need to make payment of an upfront premium.

So, they will be able to purchase the option contracts. Thus, it will result in the creation of a net debit at the time.

The maximum loss involved in this strategy amounts to the net premium paid to purchase the options plus, any commissions.

If at the date of expiry, the strike price of the options equals the price of the security on that day; this event can become a reality.

Find out more relevant Volatile Option Trading Strategy below

| Short Calendar Call Spread | Strip Straddle | Strap Strangle |

| Short Albatross Spread | Strap Straddle | Strip Strangle |

Scope of Earning Profits in Long Straddle Options Strategy

To explain this strategy clearly, let us take an example.

Let us say that, the price of a stock on a given day is INR 50. On this day, a call option for the security at a strike price of INR 50 is at a price of INR 3. Also, a put option for the security at the same strike price is kept at INR 3.

Now suppose that an investor plans to implement a long straddle strategy. He purchases one each of both, call and put options.

It is now implied that the investor expects a major movement in the prices of the security. This move is expected by an additional margin of INR 6 in either direction.

Now, as per the data, it can be clearly outlined that the profits will accrue to the investor only if, at the date of the expiration, the price of the underlying security is either above INR 56 or below INR 44. It does not matter what the initial price of the security was.

The maximum loss that can occur to the investor is for an amount of INR 6. This will happen only if the price of the security on the date of expiry is exactly INR 50.

If however, the price of the security happens to lie anywhere between INR 44 and INR 56, the resulting loss from the transaction will be comparatively less.

Example on Long Straddle Options Strategy Continues

An estimation of potential profits can be made by estimating the price of the security at INR 65. Here, the investor will benefit from an upward swing by INR 15. It will come to reduce by INR 6 to arrive at a net profit of INR 9.

Thus, it can be concluded that unless there is a massive swing in the price of a security, a long straddle will fail to reap the expected returns. However, there is solace for the investor in the fact that the cost of such losses is under a limit.

This is mainly due to the net amount of premiums paid to purchase the options. At the same time, the potential to make gains is not limited.

As long as the security moves by enough momentum in any one direction, the investor stands to gain a significant profit.

Long Straddle Options Strategy – Conclusion

An investor need not wait for the date of expiry to sell their options. If at any time during the implementation of the long straddle strategy, the investor feels that he desires to exit from the strategy, he need only sell his options to do so.

This could happen if the impending expectation in the movement of prices fails to manifest, or there are looming events which signal that the price of the security might remain relatively stagnant in the days to come.

Also, the investor could sell his options in advance, if they have already accrued a reasonable level of profit on their trade and are happy to exit with it.

Thus, the long straddle strategy is a good one to utilize and employ if you are confident that there is a likely swing possible in the prices of a security.

The sheer simplicity of this strategy lies in the fact that it involves merely two trades, even when the investor is unsure of the direction in which the price of the security may move.

There are limited calculations involved in implementing this strategy and this is why it is quite easy to understand.

The scope for unlimited profits and limited losses makes it an attractive strategy in the options segment.

Open a Demat Account Now! – Apply this Options Strategy

Similar Topics on Options Trading