Short Condor Spread – An Advanced Volatile Trading Strategy

Last Updated Date: Nov 19, 2022Short Condor Spread is an option trading strategy which is used by advanced traders. This strategy is mainly used in volatile market condition.

Know everything about this another interesting Options Trading Strategy now.

About Short Condor Spread

An investor has the option to choose from among a variety of options trading strategies in a volatile market.

The short condor spread happens to be among the most advanced and typical among these strategies.

The reason why it is recommended for experienced traders is that there are four separate trading transactions involved.

Plus, it is quite flexible and amenable to market conditions. Together, these factors make the strategy unsuitable for a beginner, who may still be learning about the options market.

The strategy parts ways in two different variations. These are the short call condor spread and the short put condor spread.

Open a Demat Account Now! – Apply this Options Strategy

What is the right time to use the Short Condor Spread?

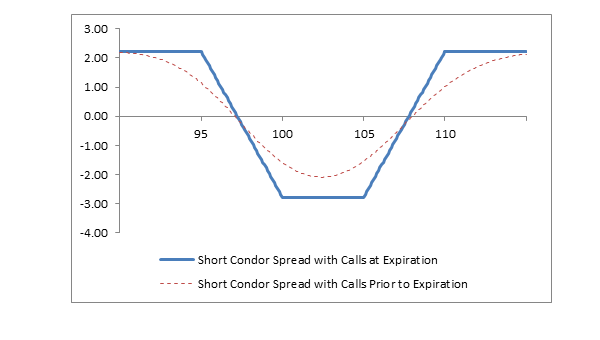

Essentially, the short condor spread strategy is a neutral and limited risk strategy. But at the same time, there is also a limit on the profit earning potential.

If an investor expects the prices of security to move with a significant margin, this strategy can return exponential profits to the investor, if they execute the calls and puts at the right time.

The short condor spread is a reliable alternative to the short butterfly spread strategy. The flexibility of the strategy emerges from the fact that the investor can adjust the strategy and tune the options depending on their strike prices.

This will also bear an impact on the break even points of the strategy but also holds the potential to return better gains.

The mammoth amount of knowledge needed to execute this strategy makes it viable only for advance traders.

Find out other Volatile Option Trading Strategy here

| Reverse Iron Albatross Spread | Long Straddle | Short Calendar Put Spread |

| Long Strangle | Reverse Iron Butterfly Spread | Short Butterfly Spread |

| Long Gut | Reverse Iron Condor Spread |

How to Plan a Short Condor Strategy to make maximum Profit?

To enter into a short condor spread strategy, an investor will have to execute four separate transactions. These could be a combination of call and put options but that is not central to the success of the strategy.

However, most investors prefer to make use of calls to implement the strategy. Effectively it is fine as long as the characteristics of the options are the same.

In detail here is a break down of the four transactions which the investor will have to choose:

- Buy one in the money call

- Sell one in the money call for a lower strike price than before

- Buy one out of the money call

- Sell one out of the money call for a higher strike price than before

It is up to the investor if they wish to execute each of these transactions on the same day or not. It is important that each of these contracts should contain the same number of options. Also, the date of expiry for each of these options should be the same.

It is important to determine the strike prices for which the investor will trade. The short contracts should be at an equal distance from the trading price of the security at present.

Similarly, the strike prices of the long contracts will remain at an equal distance from the price of the security at present.

What remains to decide is the distance between the two strike prices, which is the pillar on which the success of this strategy rests.

Find out more relevant Volatile Option Trading Strategy below

| Short Calendar Call Spread | Strip Straddle | Strap Strangle |

| Short Albatross Spread | Strap Straddle | Strip Strangle |

Potential to earn a profit or incur a loss using the short condor strategy

To understand the extent of profit which an investor can earn or incur a loss, let us take an example.

Let us assume that the price of the underlying security is INR 50. As an investor, you expect that the price of the security will move by a substantial gap in the days to come.

However, you are not sure of the direction in which the stock will move. This is when you can plan and implement the short condor strategy.

Here are the possible positions that you can take in the market to implement the strategy:

- You can write one contract with 100 options at a price of INR 4 each at a strike price of INR 47. In all, the credit value will amount to INR 400.

- You can buy a contract with 100 options at a price of INR 2.5 each at a strike price of INR 49. In all, the contract will cost you INR 250.

- You can write one contract with 100 options at a price of INR 0.50 each at a strike price of INR 53. In all, the contract will amount to a credit of INR 50.

- You can buy one contract with 100 options at a price of INR 1.50 each at a strike price of INR 51. In all, the contract will cost you INR 150.

As a result of these transactions, you will make a total spend of INR 400. In return, you will receive a value of INR 450 for the options written by you. Thus, the complete strategy will result in a net credit spread of INR 50.

Further Illustration of Short Condor Spread

On the date of expiry, the following outcomes are possible:

- The price of the security can hover over INR 50 only. Then, the options in the contract will be worth INR 3 each. This will charge liability on you for INR 300. The options in contract 2 above will be worth INR 1. Options in contract 3 and 4 above will expire and your liability of INR 300 will be partly offset by the INR 100 earned from the contract and the net credit spread of INR 50. Hence, the total loss will stand at INR 150.

- The price of the security can go up to, let’s say, INR 55. In this case, the options in contract 1 would be worth around INR 8. This will build a liability of INR 800 for you. The options in contract 2 will cost around INR 6 for a total value of INR 600. The options in contract 3 would stand at INR 2 and create a liability of INR 200. Lastly, the options in contract 4 above would be around INR 4 for a total value of INR 400. Hence, the total liability will stand at INR 1000 and the value of the options which you own will stand at INR 1000. Thus, the totals will offset one another. The initial net credit spread of INR 50 will be the final profit of the investor.

- The price of the security may go down to INR 45, let’s say. Thus, all the options will expire eventually. The only profit will be for the amount of INR 50 which was the net credit spread.

The extent of maximum profit is limited to the amount of net credit spread.

To Conclude the Strategy – Short Condor Spread

The design of the strategy makes it obvious why a beginner cannot trade in a strategy such as this one.

Even though it is complicated by many scores, there is immense potential for the investor to make a profit. At the same time, there is a limit on the extent of maximum loss which the investor can incur.

So, an investor has a vague idea about the extent of profit and loss on the transaction from the start.

However, since there are four separate transactions involved in the strategy, the costs of commissions may be quite high. Even then, there is a viable scope to make attractive returns on this strategy.

Open a Demat Account Now! – Apply this Options Strategy

Similar Topics on Options Trading