Short Calendar Put Spread – A Complex Volatile Trading Strategy

Last Updated Date: Nov 19, 2022The Short Calendar Put Spread is a complex options trading strategy. This strategy is mainly used in Volatile Market Conditions.

Know everything about this Options Trading Strategy now.

About Short Calendar Put Spread

A volatile outlook towards the stock market opens up the opportunity to trade in securities with multiple options strategies.

One of these is the Short Calendar Put Spread, which investors use to draw profits from movement in stock prices.

The best time to implement this strategy is when the investor expects a sharp movement in the price of the underlying security.

The direction of such price movement may not be clear or ascertainable at that point. But as long as it moves with enough margin in either direction, the investor stands to make a gain.

Due to the complex nature of this strategy, it is not suitable for beginners. The investor will most likely enter into two separate transactions while plotting this strategy. As a result of this, a net credit spread will accrue to the investor upfront.

If an investor buys a put option and sells a second put option for a longer date of expiry, a short calendar put strategy falls into place.

The strike prices used to complete the strategy will be the same but, in the case of a diagonal spread, different strikes prices are also an option for the investor.

Open a Demat Account Now! – Apply this Options Strategy

What is the right time to use a Short Calendar Put Strategy?

If an investor estimates that the price of an underlying security will move by a sharp margin, this strategy is a vehicle to gain profits. It is not necessary to estimate clearly as to which direction it will move in.

Examples of conditions where the strategy can benefit an investor the most are earnings announcement, new product launch etc.

For an experienced investor, it is not new to know that such events can cause a breakthrough in the prices of securities.

At the same time, they understand that it could be in either direction, up or down. The point to note here is that the investor will profit nonetheless, no matter which direction the movement is in.

Find out other Volatile Option Trading Strategy here

| Reverse Iron Albatross Spread | Long Straddle | Short Condor Spread |

| Long Strangle | Reverse Iron Butterfly Spread | Short Butterfly Spread |

| Long Gut | Reverse Iron Condor Spread |

How to Implement a Short Calendar Put Strategy?

To put this strategy in place, the investor need only enter into two trades. These include buying and selling at the money put options.

Since this strategy bets on a calendar spread, the date of expiry for both the options will be different. So, the investor will end up executing the following two trades:

- Buy contracts for a shorter expiry date

- Sell contracts for a longer expiry date

Since the value of the contracts with the longer expiration date will be more, as compared to the one’s with the shorter expiry date, the investor receives more amount at the time of taking the positions.

Hence, a net credit spread opens up for the investor at the start of this strategy.

Interestingly, the investor understands that at the time of taking the strategy, his maximum profit is equal to the amount of net premium which he receives.

And the amount of maximum loss stands at the strike price reduced by the amount of net premium received. There is a limit on the extent of the maximum profit that the investor can earn.

Furthermore, it will materialize only when the options with the shorter expiry date either gain more quickly or fall down more slowly in comparison to the options taken for the longer date of expiration.

The potential loss bears the impact of market volatility and if there is a sharp spike in the price on the upside, the strategy could result in a loss for the investor.

Find out more relevant Volatile Option Trading Strategy below

| Short Calendar Call Spread | Strip Straddle | Strap Strangle |

| Short Albatross Spread | Strap Straddle | Strip Strangle |

Potential to make Profits or incur a Loss

The best way to understand how a short calendar put strategy yields profits for the investor is through an example.

Let us assume that the price of the underlying security is INR 100. You expect a major shift in the price of this security due to prevailing market conditions. However, you are not sure if the price will go up or fall down.

You decide to take the following positions:

- Buy a contract for 100 options at a strike price of INR 3.25. Expiry is at 28 days

- Sell a contract for 100 options at a strike price of INR 4.60. Expiry is at 56 days.

As a result of these two transactions, a credit spread of 1.35 will materialise for the investor.

Now, on the day of expiry of 28 days, the following events could take place:

- The price of the security could remain at INR 100. Let us assume that the strike price of the contracts in option 2 is trading at INR 1.35 on that day. In this case, INR 3.25 will be spent per option and INR 1.35 will realise from contract 2 above. The net loss will be INR 1.90 for every single option.

- The price of the security could rise up to INR 115. Let us assume that the options in contract 2 above are trading at INR 4.45 on that day. In this case, INR 3.35 will be spent per option but INR 4.45 will accrue as credit. The total profit on each option of the contract will be INR 1.20.

- The price of the security could fall down to INR 85. Let us assume that on this day the options in contract 1 are trading at INR 11.75 and options in contract 2 are trading at INR 10.40. In this case, the total profit realised on the transactions will be INR 1.35 per option.

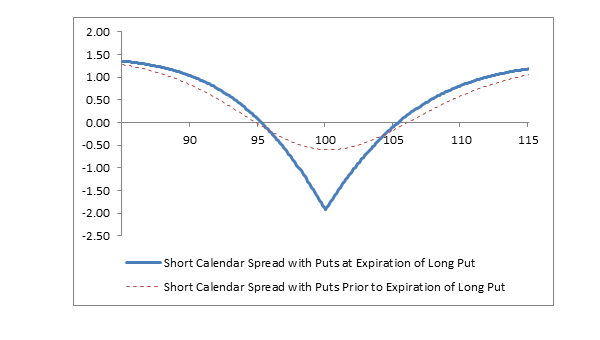

Further illustration of Short Calendar Put Spread

As such, calculating the exact amount of profit on the date of expiry is difficult at the time of planning and implementing this strategy. This is because the trading prices of each option could be different on the date of expiry.

Even market volatility has a role to play on the trading price of the stock options. This is the reason why the short calendar put strategy is largely difficult for the investor to study and implement.

The impact of time decay and market volatility is an impediment on the trading prices of the stock options.

So for examples, if the trading price of the security on the date of expiry were to shoot up, both the options will expire worthlessly. In such a case, only the amount received on the put spread will remain with the investor.

It can also happen that the price of security dramatically falls down and this will open a possibility for the investor where they can buy and sell their options. A profit could still accrue to the investor in this situation.

To avoid a situation of unending losses, it is absolutely vital that the options which are written by the investor are bought back.

Otherwise, only a position of a short put will remain and this can cause virtually endless losses for the investor.

To Conclude Short Calendar Put Spread

It is in the nature of this strategy to obtain benefit from the results of time lapse and market volatility. However, to dictate the exact quantum of profits and losses on the date of expiry is a tough call.

This is why it is absolutely pertinent that the investor uses this strategy only when they are confident and experienced enough to plan it.

One of the major advantages of this strategy is that the extent of maximum losses is far lower as compared to the scope of maximum profits.

Open a Demat Account Now! – Apply this Options Strategy

Similar Topics on Options Trading