Short Calendar Call Spread – An Advanced Volatile Trading Strategy

Last Updated Date: Nov 19, 2022Short Calendar Call Spread is an advanced options strategy used by traders during volatile market conditions.

Know everything related to Short Calendar Call Options Strategy here.

About Short Calendar Call Spread

A Short Calendar Call Spread Strategy is a rewarding strategy for an experienced options market trader. Fueled by the sharp movements in the prices of a security, the strategy can yield remarkable returns.

So, when an investor expects the price of an underlying security to move by a significant margin, they can choose this strategy for investment.

It is worthy to note that at the time of planning this strategy, the investor may not be sure of the direction in which the strategy may move.

The reason why this strategy is relatively complex and advance emerges from its variations. There are two of them:

- The short horizontal calendar call

- The short diagonal calendar call

Among these, investors mostly make use of the short horizontal calendar call option. Beginners must stay away from this strategy as it involves major understanding, in spite of the fact that the investor makes use of only two transactions in this strategy.

The resultant spread from this strategy creates a credit spread, due to which the investor receives an upfront credit for the trades.

The strategy also goes by other names such as short call calendar spread and a short time call spread.

Open a Demat Account Now! – Apply this Options Strategy

What is the right time to use a Short Calendar Call Spread?

The reason why an investor may want to trade in this strategy is that it offers a chance to make hefty returns.

At a time when a thoughtful estimate about the direction of the price movement cannot be made, this strategy is a useful move to make.

In the stock markets, conditions can often arise, which indicate that a strong swing in the movement of the prices is imminent. However, making an estimation of its direction becomes a task!

In this situation, the investor can still make a bet on a return, even when they are unsure of the quantum or direction of the price movement.

So, a short calendar call spread will still yield a return to the investor, in spite of this contingency.

Find out more relevant Volatile Option Trading Strategy below

| Reverse Iron Albatross Spread | Long Straddle | Short Calendar Put Spread |

| Long Strangle | Reverse Iron Butterfly Spread | Short Butterfly Spread |

| Long Gut | Reverse Iron Condor Spread | Short Condor Spread |

Planning and Implementing a Short Calendar Call Spread in the Stock Market.

The strategy involves entering two different trades, which are as follows:

- Sell one longer term call

- Buy one shorter term call

The two trades are carried out at the same strike price and as it results in a net credit. Due to the structure of the strategy, there is a limit on the profit potential and the risk.

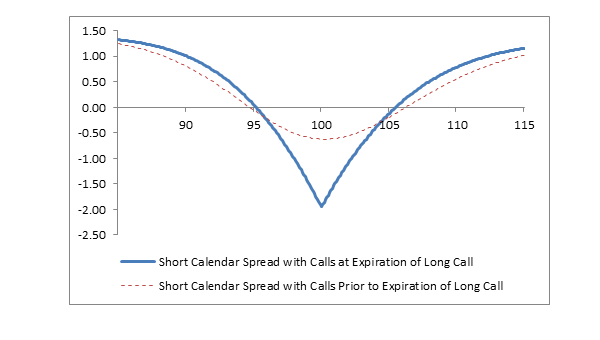

The investor will realise the maximum profit on this strategy when the stock price will either move above or below the strike price of the spread on the date of expiry.

A sharp rise or fall in the price of the security will close the difference between the two calls. Thus, the complete amount received on the strategy will be tagged as the income of the investor.

The investor undertakes the maximum risk which is unlimited. This will happen if the long call expires and the short call remains open. With the approach of the expiry date of the long call, the investor must monitor the spread.

The maximum loss from this strategy cannot be defined completely. This is because it is highly dependent on the prices of the short call and since it bears the impact of volatility, anything is possible.

To make the strategy successful, the investor must buy options with a short term perspective.

On the other hand, the investor can choose a greater expiration date to sell the contracts. The number of contracts bought and sold must be the same and for the same underlying security.

A net credit results from the difference in the date of expiry between the two options. Since the amount paid to purchase the calls is less than the amount received to write the calls. Thus, net credit forms.

Find out other Volatile Option Trading Strategy here

Potential to earn a profit or incur a loss in a Short Calendar Call Spread Strategy

Let us take the example of a stock price and check how an investor can plan the strategy and the resulting outcomes from it.

Let us assume that the price of security is INR 50. As an investor, you expect a sharp move in the prices of this security either up or down.

To build a position with the help of a short calendar call strategy, you decide to enter into the following transactions:

- You buy at the money call options at a strike price of INR 50. For the near term expiry, they cost INR 2 each and you buy 100 such options for INR 200.

- You write at the money call options. These are trading at INR 4 and you sell 100 such options for a total value of INR 400.

As a result of these positions, you will successfully create a short calendar call spread. The net credit spread resulting from these will be INR 200.

More on Profit Potential of Short Calendar Call Options Strategy

The impact of market volatility has a major role to play in the success of this strategy. Without it, the strategy may not work out as expected and fail to yield the expected results.

It may be difficult for the investor to predict the exact gain or loss that they stand to make, at the time of planning this strategy, especially in monetary terms.

If a significant change in the price of the underlying security occurs, then the values of the options will change as well. They are expected to fall drastically and more so, in the case of the longer term options.

The risk of playing this strategy emerges from the fact the price of the security may not move at all. As a result, both the options above will expire and become worthless.

An increase in implied volatility will increase the risk of the strategy. It might not be wrong to say that the decision to make a profit out of this strategy is highly subjective.

The investor needs to enter and exit at the right time to make a significant profit out of this strategy.

To Conclude Short Calendar Call Spread

The strategy creates a limited risk for the investor on the upside. At the same time, on the downside, the potential to make a profit is substantial. A bearish forecast is a right time to maintain a position in this strategy.

The investor can obviously close his position anytime by exercising the call option or by making a purchase of the stock and selling his call options.

Since there is a credit spread involved in the strategy, there is no upfront cost to the investor. As compared to the maximum loss, the potential for maximum profit is significant and high.

However, not every type of account can trade in a credit spread.

Open a Demat Account Now! – Apply this Options Strategy

Similar Topics on Options Trading