Long Strangle: A simple Volatile Trading Strategy Suitable for Beginners

Last Updated Date: Aug 30, 2023The Long Strangle is an options strategy which is also known by the name of Buy Strangle or Option Strangle.

About Long Strangle Options Trading Strategy

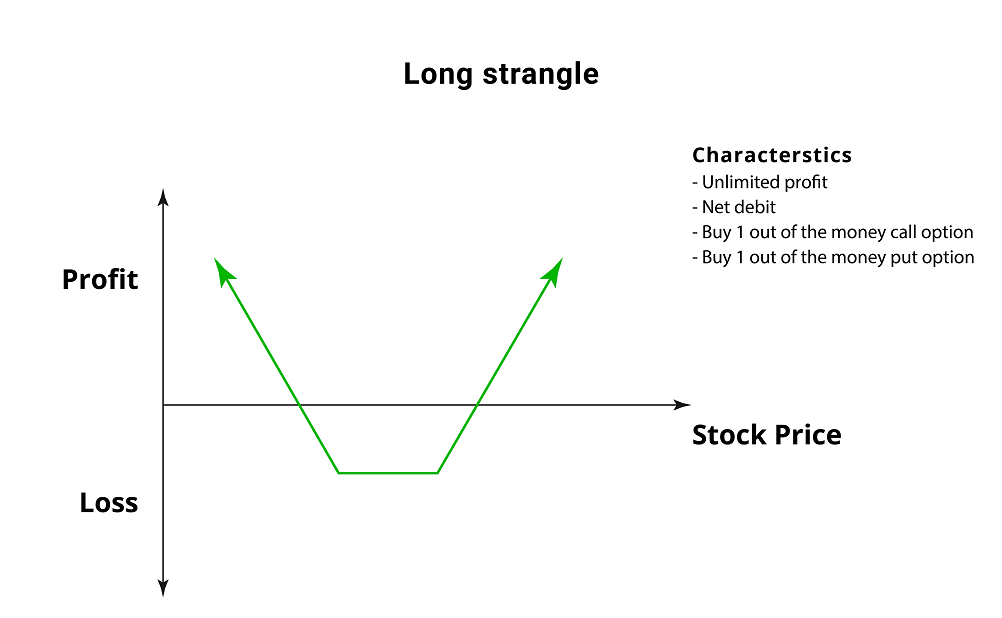

Long Strangle is a neutral trading strategy, which bets on the volatility of the market to make returns. To implement this strategy, an investor will enter two transactions broadly.

First, they will need to buy a call option at a higher strike price. And second, will be a put option at a lower strike price.

Both of the transactions concur over the same underlying security and the same date of expiry. However, the strike price for both the transactions will be different from each other.

In this strategy, the potential to earn profits is significant. If only, the price of the security rises by a massive margin.

On the downside, there is a limit on profit potential but it is existential. The scope for losses remains limited to the premium paid to purchase the calls plus commission.

Open a Demat Account Now! – Apply this Options Strategy

What is the right time to use a long strangle strategy?

The Long Strangle strategy will yield benefit for the investor, irrespective of the direction in which the stock price moves.

The strategy is a profitable bet for an investor! That is, if they can confidently claim that the price of a security will move substantially in one direction.

It is not necessary to be confident about the direction in which the movement will be in. For a new investor, the perk is that, it is easy to understand this strategy so it is a good way to go ahead for them.

At the same time, it is also easy to implement and poses minimal risk to the investor. Therefore, an investor who is not well – versed with the metrics of the market can still make a bet with this options strategy.

Since the price of the security can rise up to an indefinite limit, there is no cap on the potential to earn profits.

The potential loss arises from the payment of the premium amount on buying the calls plus commission.

This will happen if the investor continues to hold the options till the date of expiry but the options fail to exercise.

If the stock price continues to stick around the strike price or between the two strike prices, the options will still expire.

Find out other Volatile Option Trading Strategy here

| Reverse Iron Albatross Spread | Long Straddle | Short Calendar Put Spread |

| Short Condor Spread | Reverse Iron Butterfly Spread | Short Butterfly Spread |

| Long Gut | Reverse Iron Condor Spread |

Planning an effective long strangle strategy

A long strangle is the strategy of choice when a big market move can be seen on the horizon, for an underlying stock.

However, the direction of such change may not be predictable. This strategy is typically profitable to use when good news could send the price of a security sky high.

It could also happen that a piece of bad news can plummet the same in the earth. The element of risk exists because it is possible that the impact of such news may not create a viable shift in the market, to be profitable for the option strategy holder.

The investor will need to purchase the same number of call and put options on the security. The options contracts purchased under this strategy must be out the money contracts.

Like long straddle and long gut strategy, there is an upfront cost to enter this strategy. So the investor will have to enter into a net debit spread at the time of planning and implementing this strategy.

If the investor wants to minimise the quantum of this debit spread, they will need to buy the contracts close to the date of expiry. If an investor purchases an option close to the date of expiry, there is a small scope for market movement.

There is a greater chance that the price of the underlying security will move by a substantial mark if the involved expiration date is for a longer duration. Thus, there is obvious scope to make better profits with that approach.

Nevertheless, an investor can still opt for a shorter expiration date. This can be done if they do not want to create a big debit spread.

Otherwise, if they are confident that the price of the security will certainly move in the expected direction within such period.

Find out more relevant Volatile Option Trading Strategy below

| Short Calendar Call Spread | Strip Straddle | Strap Strangle |

| Short Albatross Spread | Strap Straddle | Strip Strangle |

Calculating the potential to make a profit or suffer a loss

Since the potential to make profits is unlimited, the investor can plan the strategy with relative confidence. Let us take an example to understand the impact of the price movements for an underlying security.

Let us assume that the cost of a stock price is INR 50. At this stage, you estimate that the price of the security will move with a massive margin. But at the same time, you aren’t sure of the direction in which the movement will be.

At present, the call options for this security, at a strike price of INR 51 are trading for INR 1.5. You can buy a single contract for this call, which consists of 100 options. Thus, you will spend INR 150 to purchase the net call options.

Similarly, the out of the money put options for a strike price of INR 49 are trading at INR 1.5 at present.

Long Strangle Option Trading Strategy – Example Continues

You buy a single contract for this put option, which consists of 100 options. Thus, you will spend a total of INR 150 to purchase the put options.

By completing these two transactions, you have entered into a long strangle strategy. Immediately, a net debit spread of INR 300 is created.

This includes INR 150 spent on purchasing the call options and INR 150 spent on purchasing the put options.

It is possible that at the date of expiry, the security continues to trade at INR 50. In this case, both options will expire and your total loss will be INR 300. This was incurred on purchasing the options.

At the date of expiration, the security trades at, let’s say, INR 56. Then you will be able to exercise your call options for a net profit of INR 100.

But if the same was to plummet down to INR 42, then you will be able to sell your options for INR 700. It will yield a total profit of INR 400 at the end.

Thus, it can be seen that there is no limit on the potential to make a profit. Also, there is a fixation on the amount of maximum loss.

If the investor desires, they can exit or close the long strangle position at any time, before the date of expiry. This is possible if the investor has already realised profit on the trade.

It could happen due to unexpected movement in the prices beforehand. Or it could be possible that the investor feels the strategy may not play out by the date of expiry and they might incur a loss.

Long Strangle Strategy – Conclusion

The strategy is quite simple and effective at what it promises. If there is scope for volatility in the market, there is also a chance for the investor to make a huge profit.

Since, there are only two transactions involved in the trade, there is little outflow in terms of commission to the broker.

Also, the adjoining calculation and risk assessment are small. Traders can certainly make use of this strategy to make the desired profit from the market run, in a short span of time.

This is the reason why this strategy is competent for beginners in the options market.

Open a Demat Account Now! – Apply this Options Strategy

Similar Topics on Options Trading