Long Gut – Volatile Options Trading Strategy suitable for beginners

Last Updated Date: Nov 17, 2022A long gut is an optimum strategy for an investor when they expect a significant movement in the prices of the underlying security.

But at the same time, the movement of the price in either direction cannot be established with certainty.

About Long Gut Options Trading Strategy

Long Gut Options Trading Strategy involves the execution of two different trades. It involves buying a put option and a call option for the same date of expiry. The borderline benefit of this strategy lies in the fact that there is scope to make unending profits.

However, there is a limit to the possibility to incur a loss. As long as an investor has the risk-taking capacity to bear this loss, a long gut strategy is a suitable road to walk on.

Since, the trader has to purchase two options to pursue this strategy; initially a net debit will result in the account.

Open a Demat Account Now! – Apply this Options Strategy

What is right time to use a Long Gut Strategy?

When a trader studies the movement of stock prices in the market and anticipates huge volatility in their movement, it might be the right time to plan the long gut strategic move.

The trader only needs to establish with certainty that the price of the underlying stock will move with a major margin.

Which direction the movement will actually occur is not the point of deliberation at the time of planning the strategy. It is worth noting that the resulting net debit due to the purchase of the options is high.

However, the resulting risk from the transaction is quite low in comparison to most other options strategies.

For this reason, a long gut happens to be a suitable strategy for an investor who is new to the options segment.

Find out other Volatile Option Trading Strategy here

| Reverse Iron Albatross Spread | Long Straddle | Short Calendar Put Spread |

| Long Strangle | Reverse Iron Butterfly Spread | Short Butterfly Spread |

| Reverse Iron Condor Spread | Short Condor Spread |

How to build a Long Gut Strategy in the Options Market?

The investor must begin with a preliminary examination of the market. And, they must conduct an economic, fundamental and technical check on the security, which is the subject of the long gut strategy.

As already mentioned, the long gut strategy aims to place a bet on high-grade movement in the stock price.

Thus, the neutral trading strategy should undergo planning and then implemented before the actual breakout in the price occurs.

Larger volatility increases the incidence of making a profit and the reverse might result in losses. Since, an equal portion of the call and put options are purchased, the trader must decide the strike price and expiration date to give effect to the strategy.

To construct the long gut strategy, it is recommended that a strike price, close to the current trading price of the security is chosen.

This is because the resulting net debit from the purchase of options will be limited in such a case. However, this does not mean that the date of expiration will not affect the resulting net debit.

The impact of time value is a relevant concept in the calculation of the net debit such case. Closer the expiration date to the current date, cheaper would be the cost of options you purchase.

Long Gut Option Trading Strategy process continues

Similarly, if the date of expiration is far ahead of the current date, the increased time value will certainly inflate the cost of options.

Consequently, a new investor might always feel drawn to choose a closer expiry date. This is mainly in appreciation of the low cost of options.

However, the downside of this choice would mean a smaller potential for the long gut strategy to work out.

This is because, in the time frame chosen by you, it is highly likely that the security might not drift by enough momentum in either direction.

The best action here is to estimate how quickly the price movement might occur. If it is expected to be a rapid one, then choosing a close expiry date might be meritorious. If not, it is best to forgo the instant savings in net debit and opt for a longer expiration date.

After conducting a break-even analysis, calculating profit and loss and establishing the risk ratio, the investor may be ready to set up their trade strategy.

To do so, they will have to purchase one money put option and one money call option. In each of these options, derivation of prices will result from the same underlying security.

The date of expiration of both options will also be the same. Essentially, the trader must implement a 1:1 ratio of call and put options to design a long gut strategy.

Find out more relevant Volatile Option Trading Strategy below

| Short Calendar Call Spread | Strip Straddle | Strap Strangle |

| Short Albatross Spread | Strap Straddle | Strip Strangle |

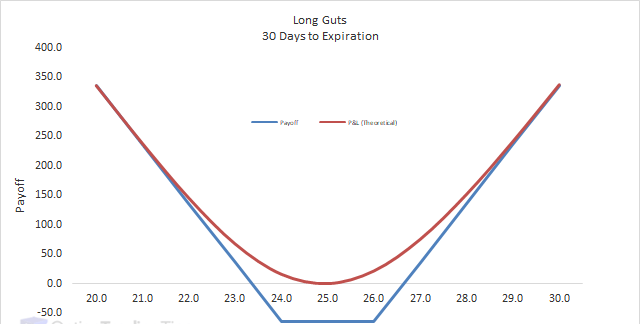

What is the potential to make Profit Or Loss?

Once a long gut strategy has been designed and initiated by the investor, the potential to make profits is nearly unlimited. The security on bet must move by enough pace in one particular direction.

The investor has the option to book a bounty of profits on such price movement. The only loss to the investor in this situation would be on the amount of net debit. It is an intrinsic amount to purchase the opposite option.

The amount to purchase the favorable option will be recovered in the number of profits. The possibility of incurring a loss arises when the price movement is insignificant or non-existent.

Even then, there is a cap on the only amount lost to the investor. And this is at the net debit outflow to purchase the options.

Example of Long Gut Options Trading Strategy

Let us take an example to demonstrate the concept. Suppose the price of the underlying security is INR 100. The strike price for a call at INR 99 is worth INR 2.50 and for a put at INR 101 is INR 2.50.

If you purchase 1 contract of each, consisting of 100 options, you will be spending

INR 250 to purchase one leg of call options and INR 250 to purchase one leg of put options. The total spend would amount to INR 500.

Now, consider that on the date of expiry, the stock is trading at INR 100. You will realise INR 1 on each option, which will amount to a final loss of INR 300.

Let us say that the trading price on the date of expiry is INR 107. Now, the call option will realise INR 8 for each option, for a total profit of INR 800. The put option will expire and your net profit, after covering INR 500 will be INR 300.

However, if the same price was to go down to INR 93 on the date of expiry, the put option will realise INR 800. The call option will expire and yield a final profit of INR 300.

The quantum of this profit will increase by as much margin as the price of the stock moves in either direction.

As you can see, the potential to make a profit is vast and the maximum loss that can occur is INR 500, spent on purchasing the options.

If at any point, after implementing the long gut strategy, the investor believes that significant volatility in the stock price may not happen, they have the option to exit the strategy by simply selling their options at the available strike price.

The same can be done if there is an instance of early realization of profits.

To Sum Up the Strategy of Long Gut

This is a simple strategy, most suitable for beginners, who want to explore the options segment. Since only two transactions are involved, it is relatively easy to implement and execute.

An alternative to long gut strategy is long straddle and long strangle, which are very similar in nature.

Open a Demat Account Now! – Apply this Options Strategy

Similar Topics on Options Trading