Bear Put Ladder Spread – An advanced Options Trading Strategy

Last Updated Date: Nov 16, 2022Bear Put Ladder Spread is an options trading strategy used by advanced traders. This strategy is mainly used in Bear market conditions.

Know everything about Bear Put Ladder Options Trading Strategy.

About Bear Put Ladder Spread

The Bear Put Ladder Spread strategy is an options trading strategy which is ideal in a bearish market condition.

It is essentially an extension of the bear put strategy, which is also ideal for use in bearish market conditions.

As the name suggests, an investor can use this strategy when they have a bearish outlook at security. However, in contrast to the bear put strategy, it involves an additional transaction.

Due to this, the upfront cost involved in entering this strategy comes down. It is the point of difference between this strategy and others.

The right time to use this strategy is when the investor expects the price of a security to fall. But, the expectations pertain to a small drop in the price of the security.

If against the expectation of the investor, the price of the security slips beyond a certain point, there are major losses waiting to happen for the investor then.

Due to this, the strategy is not optimal for beginners and rests best under the knowledge of experienced investors. The other name of the strategy is long put ladder spread.

Open a Demat Account Now! – Apply this Options Strategy

Why should an investor use the Bear Put Ladder Spread option trading strategy?

The right time to use the bear put ladder spread strategy is when the investor expects a moderate fall in the price of a security.

Thus, the investor should not apply it in a condition where a major fall in the price of the security may occur.

Motivated by the reduced price of taking positions in this strategy, the investor may use it as an alternative to bear put spread strategy.

Accordingly, whether the positions result in a net debit or a net credit, it can be limited using this strategy. If the design of the strategy fails, the investor can find themselves in major losses.

In case, there is a chance that market conditions might induce the security to fall unending, this strategy is best avoided.

What is the potential to make a profit with the Bear Put Ladder Spread option trading strategy?

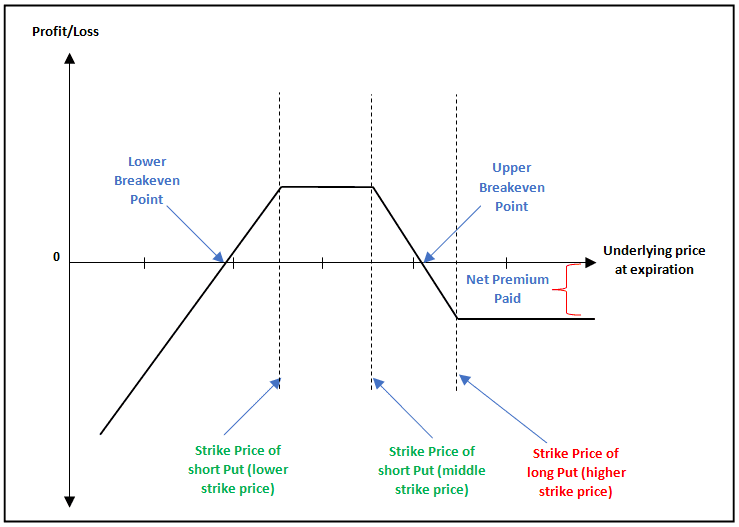

Since there are up to three transactions involved in the application of Bear Put Ladder Spread Strategy, it can be quite complicated to apply it.

The use of put options makes it possible to earn a profit if the price of the security falls. The next two put options are for lower strike prices but for an equal amount.

The purpose of writing put options is to erase the value of the cost involved in buying the options.

Ideally, the three transactions must be carried out at the same time. Before implementing the strategy, it is vital to decide the strike prices which the investor plans to use.

As a rule of thumb, the options which the investor buys should be at the money. The put options which should be close to the expected price after falling. The next options which the investor writes must be for an even lower strike price.

The lower the investor choose the strike prices to be, the less will be the credit that they receive for writing the options.

But there is a scope to make larger profits with this approach too. The investor must choose the same date of expiry for all the options.

There is a capping on the extent of maximum profits which the investor can make.

However, if the security falls any lower than the lowest strike price applied by the investor, there will be no end to the losses which they must incur.

Find out more relevant Bear Option Trading Strategy below

| Long Put | Bear Call Spread | Bear Butterfly Spread |

| Bear Ratio Spread | Short Bear Ratio Spread | Bear Put Spread |

| Short Call |

How to execute a Bear Put Ladder Spread option trading strategy?

In order to understand the method with which Bear Put Ladder Spread operates, let us take an example

Let us assume that the price of a security at present is INR 50. As an investor you expect the price of the security to fall at INR 45.

It will be ideal to take the following positions to implement the strategy:

- Buy put options at a strike price of INR 50.

- Sell out of the money put options for a strike price of INR 45.

- Sell out of the money put options for a strike price of INR 44.

Each contract for a strike price of INR 50 contains 100 options. These options are trading for INR 2 each so the total cost is INR 200.

The puts for a strike price of INR 45 are trading for INR 0.4 each. For every single contract with 100 options, you receive a credit of INR 40.

The puts for a strike price of INR 44 are trading for INR 0.3 each. For every single contract with 100 options, you will receive a credit of INR 30.

So in the end, the cost of the debit spread is offset by the credit received by writing the put options. Hence, the total debit spread incurred by you in INR 130.

Now, on the day of expiry of the options, the following situations may occur:

- The price of the security may remain INR 50. Since the options bought are at the money, they will expire and become worthless. The options are out of the money and hence, of no value. The investor will lose the amount of INR 130 spent to take the relevant positions.

- The price of the security may fall down to INR 47. The options bought will have a value of INR 3 each and yield a total of INR 300. The written options will be worthless since they are out of the money options. After reducing the value of debit spread, the remaining profit for the investor will be INR 170.

- The price of the security may fall down to INR 45. The put options bought by the investor will be worth INR 5 each for a total of INR 500. The written options will be worthless since they are out of the money. After reducing the initial debit spread, the remaining profit will be INR 370. This is in fact the maximum amount of profit that an investor can make. This will happen only when the strike price remains between INR 44 and INR 45 in this example.

- The stock may fall to INR 40. The options bought by the investor will be worth INR 10 and offer a total of INR 1000 to the investor. However, the options written at INR 45 will give rise to a liability of INR 500 and the options are written at INR 44 will contribute INR 400 towards the liabilities of the investor. Combining the liabilities of INR 900 and reducing it by the value of INR 1000 received and INR 130 of debit spread, the final loss to the investor will be INR 30.

If the price of the security keeps falling, the extent of losses for the investor will keep rising.

What are the benefits and drawbacks of Bear Put Ladder Spread option trading strategy?

The reduction in the upfront costs involved in taking the options is one of the most lucrative features of this strategy. So, the investor can gain a significant amount in profits even when the price of the security drops.

Due to the flexibility with which they can take positions in this strategy, there is abundant potential to make significant gains.

The investor can easily adjust the strike price of the security to make the desirable gains as per their estimate and knowledge.

Talking of its drawbacks, the biggest one pertains to the limitless loss which the investor will have to bear if the strategy does not work out as expected. If the price of the security falls by too large a margin, the losses to the investor will be massive.

Plus, the use of three transactions also raises the amount that will go in the form of commissions to the broker.

Thus, this is not a strategy that is ideal for beginners. Only experienced investors, who have the provision to tie up margin in their account can use this strategy.

To Conclude the Bear Put Ladder Spread

If an investor is confident about the quantum by which security may fall, they can certainly opt for this strategy and make good on the capital invested by them.

This strategy is definitely an advanced one but promises to reward the investors by a huge margin if they are willing to undertake the risk and invest the amount.

Open a Demat Account Now! – Apply this Options Strategy

Similar Topics on Options Trading